Digital Freight Matching Market Share, Size, Trends, Industry Analysis Report

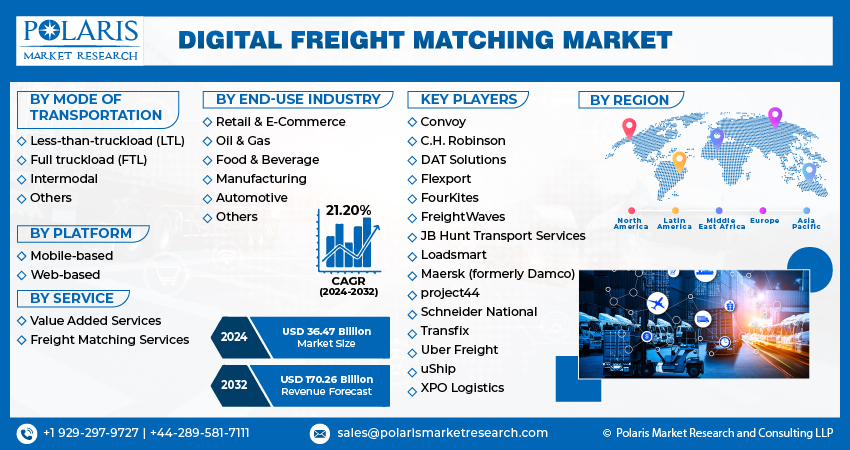

By Mode of Transportation (Less-than-truckload (LTL), Full truckload (FTL), Intermodal, Others); By Service; By Platform; By End-Use Industry; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 117

- Format: PDF

- Report ID: PM4044

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

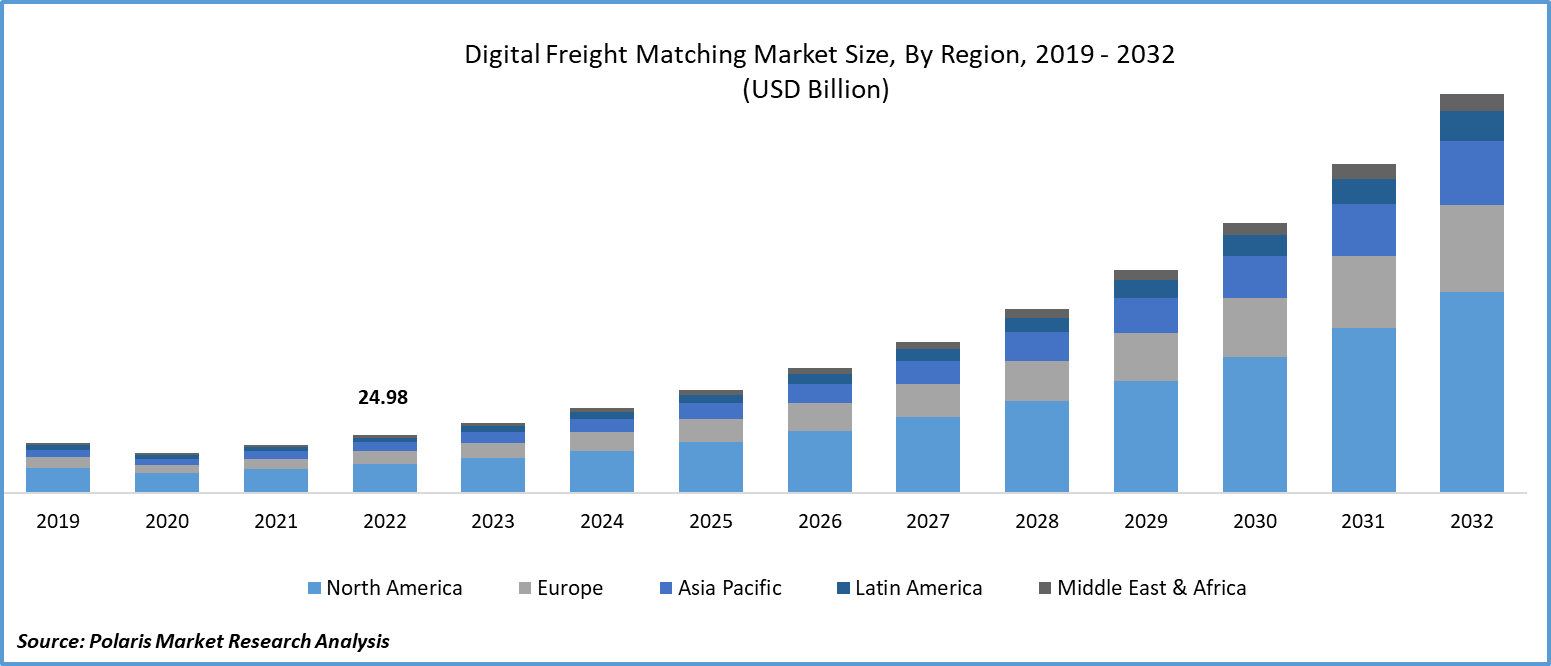

The global digital freight matching market was valued at USD 30.17 billion in 2023 and is expected to grow at a CAGR of 21.20% during the forecast period.

Digital freight matching, often referred to as DFM or digital load matching, employs web and mobile technology platforms to pair shippers' available freight (loads) with carriers' available capacity (trucks).

To Understand More About this Research: Request a Free Sample Report

Within these dynamic, real-time freight marketplaces, companies list shipments that require transportation. Trucking companies, armed with available drivers, then search for suitable freight and directly book it through the platform.

The most robust freight matching platforms leverage predictive analytics, underpinned by AI and machine learning, to enhance matches for service quality, operational efficiency, capacity utilization, and cost-effectiveness for all involved parties.

- For instance, in March 2023, Fr8Tech has introduced a digital freight-matching platform, Fr8Now, that provides less-than-truckload services (LTL) in Mexico. This platform employs advanced machine learning (ML) algorithms to connect shippers with carriers efficiently.

The digital freight matching market expansion is propelled by the increasing demand for automation and digitalization within supply chains. Digital freight matching platforms offer shippers and carriers real-time connectivity, presenting a relatively recent technological advancement. Through applications or platforms, these systems enable shippers to communicate their load requirements, aiding carriers in the efficient identification and booking of suitable loads. This technology surpasses traditional methods, as it streamlines arduous manual processes like load posting and booking, confirmation calls, and paperwork management.

However, the existing regulatory and compliance challenges within the transportation industry are one of the significant restraining factors for the digital freight matching Market. Navigating through complex and varying regulations across different regions or countries can be a cumbersome process for companies operating in this space. Adhering to compliance standards for various types of cargo, routes, and modes of transport can pose challenges and increase operational complexity for digital freight matching platforms. Moreover, regulatory changes or updates can require rapid adjustments to technology and operations, potentially leading to disruptions and increased costs for market participants.

Growth Drivers

- Seamless reach to logistics experts is projected to spur product demand.

While technology facilitates convenient booking and tracking, it's crucial to ensure that the DFM provider can readily connect one with a knowledgeable representative well-versed in logistics.

Freighting goods involves a level of complexity beyond simple tasks like arranging transportation after dinner. In situations like closed facilities or delayed drivers, one requires more than just an application.

A significant 71% of shippers express a preference for human interaction when addressing shipment or delivery issues. This underscores the importance of a personal touch in resolving unforeseen circumstances.

Report Segmentation

The market is primarily segmented based on mode of transportation, platform, service, end-use industry, and region.

|

By Mode of Transportation |

By Platform |

By Service |

By End-Use Industry |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Mode of Transportation Analysis

- The full truckload (FTL) segment is expected to witness the highest growth during the forecast period.

The full truckload segment is projected to grow at a CAGR during the projected period. Full Truckload (FTL) entails reserving the entire truck exclusively for your goods, ensuring a direct route from the origin to the destination without any interim stops for additional loading. This method is particularly suitable for transporting temperature-sensitive items that should not be mixed with other cargo. Additionally, FTL is an optimal choice for swift and uninterrupted transportation of goods. The versatility and expeditiousness of Full Truckload (FTL) transport are key factors propelling the growth of this segment.

However, the intermodal segment is projected to experience considerable growth over the forecast period. Intermodal shipping entails the transportation of goods via a combination of truckload and rail services. This mode of transportation proves advantageous when shipments need to cover extensive distances. It provides a more cost-effective and environmentally sustainable alternative to exclusive truckload services. Initiatives taken by countries in the Asia Pacific region to expand their rail networks further enhance the effectiveness of intermodal transportation. The cost-efficiency and eco-friendly nature of intermodal transportation are pivotal factors propelling the growth of this segment.

By Service Analysis

- Freight Matching Services segment accounted for the largest market share in 2022

The freight matching services segment accounted for the largest market share in 2022. Market participants offer an array of freight matching services, encompassing freight listing, brokerage, and online transaction services. These services form the core offerings of the platform, with market players entering into contracts with shippers and carriers for the utilization of brokerage services. The surge in technological innovation, particularly in fields like Artificial Intelligence (AI) and Machine Learning (ML), and their integration into digital freight matching platforms, is a pivotal driver of growth in this segment. Algorithms fueled by these technologies prove instrumental in various aspects of freight brokerage, including capacity management and dynamic pricing.

By Platform Analysis

- The mobile-based segment is expected to witness the highest growth during the forecast period.

The mobile-based segment is projected to grow at a CAGR during the projected period. Mobile-based platforms exhibit swifter performance compared to web-based apps and can function without an internet connection. Additionally, their security is bolstered by the requirement for approval on app stores. The increasing prevalence of smartphones and their user-friendly interfaces are key factors propelling the growth of this segment.

By End-Use Industry Analysis

- The food and beverage segment held a significant market revenue share in 2022

The food & beverage segment held a significant market share in revenue share in 2022. This industry deals with perishable and time-sensitive goods. These products are susceptible to degradation and necessitate precise handling throughout the supply chain. Therefore, swift and effective transportation solutions are imperative to preserve their quality. A digital freight matching platform serves to expedite freight brokerage operations by seamlessly linking shippers with carriers based on load specifications. The imperative to uphold food quality and meet regulatory standards is a significant driver of growth in this segment.

Regional Insights

- North America region dominated the global market in 2022

The North American region dominated the global market with the largest market share in 2022 and is expected to maintain its dominance over the anticipated period. This is due to the region's robust and complex logistics and transportation industry. North America boasts a vast network of highways, railways, ports, and airports, which creates a high demand for efficient freight-matching solutions. Additionally, the competitive nature of the industry and the need for cost-effective and streamlined transportation solutions further stimulate the adoption of digital freight matching platforms. Moreover, the region's inclination towards technological advancements and the widespread availability of internet connectivity contribute to the market's growth as companies seek to leverage digital solutions for optimizing their freight operations.

The Asia-Pacific region is expected to grow at the fastest CAGR during the projected period, owing to rapid economic growth and urbanization. This has led to an increase in trade and transportation activities, creating a high demand for efficient and technologically advanced freight-matching solutions. Additionally, the sheer size and diversity of the Asia-Pacific region present logistical challenges that can be addressed through digital freight matching platforms.

Key Market Players & Competitive Insights

The digital freight matching market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- Convoy

- C.H. Robinson

- DAT Solutions

- Flexport

- FourKites

- FreightWaves

- JB Hunt Transport Services

- Loadsmart

- Maersk (formerly Damco)

- project44

- Schneider National

- Transfix

- Uber Freight

- uShip

- XPO Logistics

Recent Developments

- In August 2023, Trucker Tools entered into a collaboration with BNSF Logistics to offer comprehensive freight tracking, matching, and automated booking services throughout North America.

- In June 2022, Uber Freight and Waymo Via entered into a long-term strategic collaboration aimed at integrating their technologies and rolling out autonomous trucks on a large scale within the Uber Freight network. This partnership leverages Waymo's advanced autonomous driving technology in tandem with Uber Freight's expansive network and cutting-edge marketplace technology.

Digital Freight Matching Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 36.47 billion |

|

Revenue Forecast in 2032 |

USD 170.26 billion |

|

CAGR |

21.20% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Mode of Transportation, By Platform, by Services, By End-Use Industry, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

Navigate through the intricacies of the 2024 Digital Freight Matching Market with precision, thanks to the comprehensive statistics on market share, size, and revenue growth rate assembled by Polaris Market Research Industry Reports. This thorough analysis not only provides a glimpse into the historical context but also extends its reach with a market forecast outlook until 2032. Immerse yourself in the richness of this industry analysis by securing a complimentary PDF download of the sample report.