Digital Rights Management Market Size, Share, Trends, Industry Analysis Report

By Enterprise Size (Large Enterprise, Small & Medium Enterprise), By Application, By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 125

- Format: PDF

- Report ID: PM6195

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

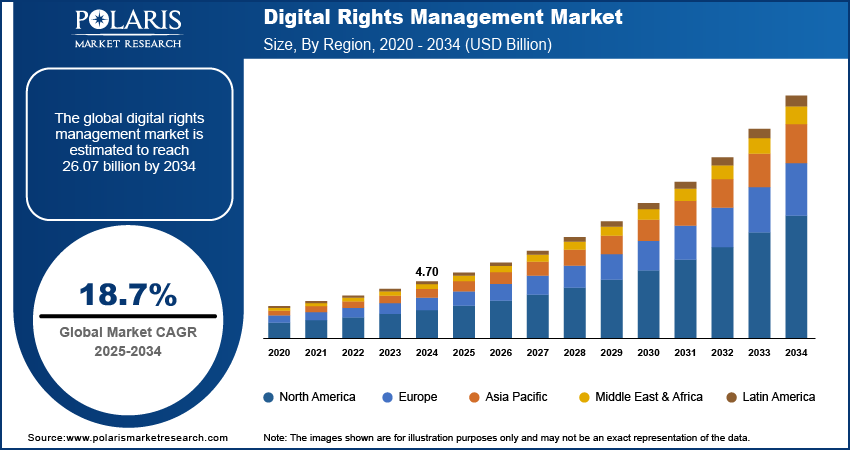

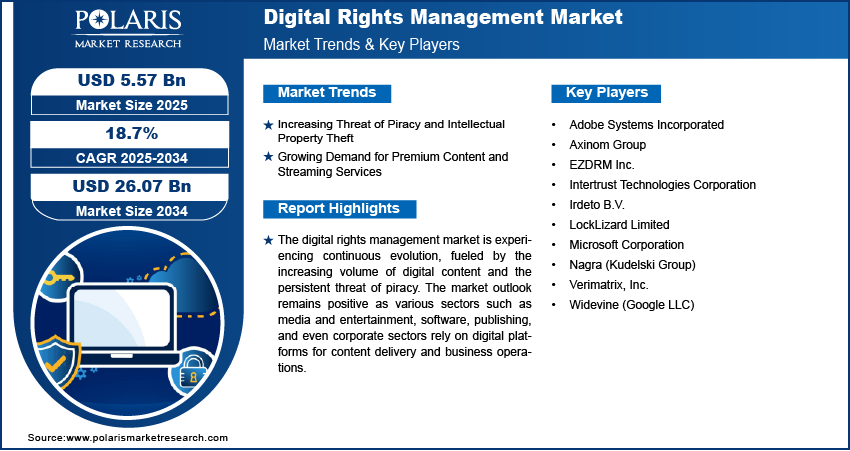

The global digital rights management market size was valued at USD 4.70 billion in 2024 and is anticipated to register a CAGR of 18.7% from 2025 to 2034. The market growth is mainly driven by the growing need to protect digital content from piracy and unauthorized sharing. There is also an increasing demand for premium content and streaming services across different platforms. Furthermore, strict rules and laws about data protection and intellectual property rights encourage companies to adopt DRM solutions.

Key Insights

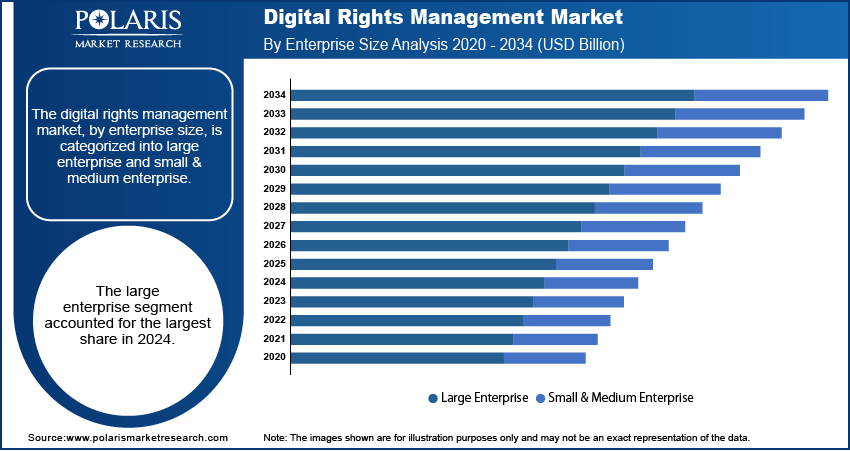

- By enterprise size, the large enterprises segment held the largest share in 2024. This dominance is attributed to their extensive digital content portfolios, significant financial capacity to invest in robust security solutions, and their heightened risk exposure to intellectual property theft.

- In terms of application, the video on demand (VOD) application segment held the largest share in 2024. This is driven by the massive global consumption of streaming video content and the critical need for content providers to protect high-value assets from piracy and ensure secure monetization across numerous platforms.

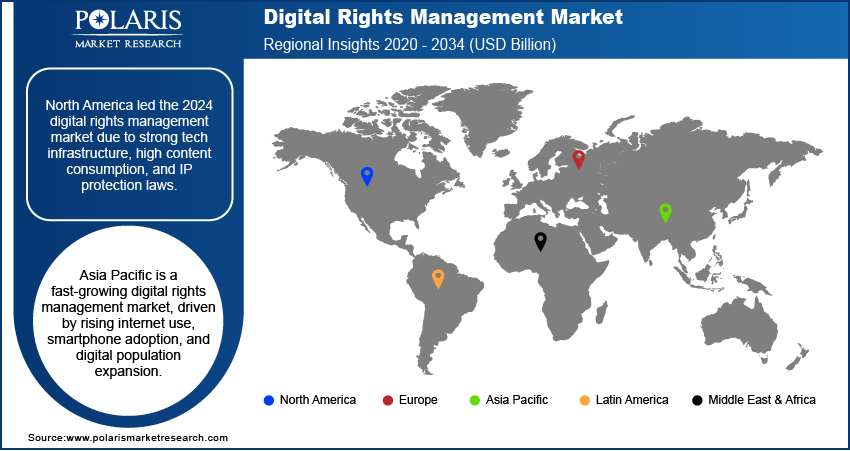

- By region, North America dominated digital rights management industry in 2024. This is attributed to the region's advanced technological infrastructure, high digital content consumption rates, and the strong presence of major media, entertainment, and software companies, all operating within a robust intellectual property legal framework.

Industry Dynamics

- The rapid expansion of online streaming platforms for movies, music, and educational materials has created a significant need for effective protection measures. As more users access digital content, securing it from unauthorized sharing and intellectual property theft becomes crucial for content creators and distributors to maintain their revenue streams and encourage investments in new productions.

- The ease of digital copying and global distribution via the internet has led to a widespread challenge of piracy. This unauthorized reproduction and sharing of copyrighted works cause substantial financial losses for industries and creators. Robust protection solutions are essential to combat this ongoing threat, safeguarding the value of digital assets and supporting creative industries.

- Governments and international bodies are increasingly implementing and enforcing intellectual property (IP) laws to combat digital piracy. These regulations aim to protect the rights of content owners and ensure fair compensation for their work. Compliance with these evolving legal frameworks drives the adoption of advanced protection technologies to avoid legal repercussions and maintain integrity.

Market Statistics

- 2024 Market Size: USD 4.70 billion

- 2034 Projected Market Size: USD 26.07 billion

- CAGR (2025–2034): 18.7%

- North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

AI Impact on Digital Rights Management Market

- AI tools enhance piracy detection by analyzing large datasets to identify and predict unauthorized content piracy and distribution in real time.

- The technology automates the DRM application to new content, including fingerprinting and watermarking, which reduces manual effort and improves efficiency.

- In DRM, AI tools are used to analyze user behavior to predict and prevent potential security threats.

- Many companies and academic institutions are using AI tools for content creation, which raises new challenges for DRM. AI-powered DRM is evolving to combat new forms of infringement, including the unauthorized use of copyrighted content to create pirated content using AI and train AI models.

Digital Rights Management (DRM) refers to a set of technologies used to control and manage access to and usage of copyrighted digital content. These systems help content creators and owners protect their intellectual property by preventing unauthorized distribution, modification, and access to their 2D and 3D digital assets, such as movies, music, e-books, and software.

The increasing adoption of cloud-based DRM solutions and the growing need for content monetization strategies boost the industry growth. Cloud-based solutions offer greater flexibility, scalability, and cost-effectiveness for businesses, making DRM more accessible to a wider range of content creators and distributors. This shift reduces the need for extensive on-premise infrastructure, lowering entry barriers for many companies.

The rising emphasis on content monetization strategies acts as a driver. As more businesses, from educational institutions to corporate training platforms, create and distribute their digital content, they seek effective ways to control its usage and generate revenue. For example, universities use DRM to protect their online course materials, ensuring that only enrolled students can access them, or to limit the number of downloads to prevent widespread unauthorized sharing. This allows them to secure their educational assets and maintain the value of their offerings.

Drivers and Trends

Increasing Threat of Piracy and Intellectual Property Theft: The issue of digital piracy and the theft of intellectual property continues to be a primary driver for the adoption of digital rights management solutions. With the widespread availability of high-speed internet and sophisticated tools, unauthorized copying and distribution of digital content, including movies, music, software, and e-books, have become increasingly easy. This poses a significant financial threat to content creators, distributors, and industries relying on intellectual property for revenue. The global nature of the internet means that content stolen in one region can be quickly distributed worldwide, making effective protection more challenging.

The financial losses due to piracy are substantial, compelling businesses to invest in technologies that can deter or prevent such activities. For example, the World Intellectual Property Organization (WIPO) highlighted in its "New WIPO Report on Digital Copyright- and Content-related Disputes" in 2021 that over 60% of businesses surveyed had been involved in B2B digital copyright- and content-related disputes over the past five years, with software and musical works being common types of disputes. Such figures underscore the ongoing and significant threat that intellectual property theft poses to businesses. This persistent threat directly drives the demand for robust digital rights management systems and threat hunting to safeguard valuable digital assets.

Growing Demand for Premium Content and Streaming Services: The rapid growth of online streaming platforms and the increasing consumer appetite for premium digital content are significant drivers for digital rights management. As consumers shift from traditional media consumption to on-demand streaming services for entertainment, education, and other content, the need for secure delivery and monetization becomes paramount. Content providers are continually investing in high-quality, exclusive content to attract and retain subscribers, and DRM is essential to protect these investments from being illegally accessed or redistributed.

The expansion of streaming ecosystems across various devices, including smart TVs, mobile phones, and tablets, further complicates content protection, making DRM solutions indispensable. For instance, a report on "An Analysis of Intellectual Property Rights Challenges in the Over-the-Top (OTT) Media Landscape," published in 2025 in the International Journal of Law Management & Humanities (IJLMH), emphasizes that intellectual property plays a crucial role in the OTT media ecosystem, safeguarding content creators' rights and encouraging creativity. It notes that platforms face complex issues in navigating global regulations and ensuring compliance to combat piracy, which highlights the critical role DRM plays. This strong demand for protected content across diverse platforms is a key factor driving the growth of the digital rights management (DRM) market.

Segmental Insights

Enterprise Size Analysis

Based on enterprise size, the segmentation includes large enterprise and small & medium enterprise. The large enterprise segment held the largest share in 2024. These organizations, which include major media and entertainment conglomerates, large software companies, and vast corporate entities, possess extensive libraries of high-value digital content that necessitate sophisticated protection. Their substantial financial resources and complex operational structures allow them to invest in robust, enterprise-grade digital rights management solutions, often customized to their specific needs. Large enterprises also face more stringent regulatory compliance requirements and are at a higher risk of significant financial losses from piracy and data breaches, compelling them to adopt comprehensive security measures. Their existing IT infrastructure and well-defined security protocols also make the integration of these advanced systems more feasible, cementing their dominant position in the market. This segment's consistent demand for high-level content security significantly contributes to the overall revenue.

The small and medium enterprises (SMEs) segment is anticipated to register the highest growth rate during the forecast period. This accelerated growth is primarily driven by the increasing digitalization of business operations across SMEs, leading to a greater creation and reliance on digital content. As these businesses increasingly adopt cloud-based services and expand their online presence, they face similar, albeit scaled, threats of intellectual property theft and unauthorized content use. The availability of more affordable, flexible, and scalable cloud-based digital rights management solutions has lowered the entry barrier for SMEs, enabling them to protect their digital assets without the need for significant upfront investment in infrastructure. Furthermore, as SMEs become more aware of the importance of content monetization and brand protection, their adoption of these solutions is set to grow considerably, driving future expansion.

Application Analysis

Based on application, the segmentation includes mobile content, video on demand (VOD), mobile gaming & apps, ebook, and others. The video on demand (VOD) segment held the largest share in 2024. This dominance is driven by the immense global consumption of streaming movies, TV shows, and other video content across various online platforms. With the proliferation of subscription-based and ad-supported VOD services, content providers are constantly investing heavily in acquiring and producing high-value, exclusive content. Protecting this valuable intellectual property from unauthorized access, piracy, and redistribution is paramount to maintaining revenue streams and business models. The sheer volume and value of video content, combined with its widespread availability across devices, necessitate robust digital rights management solutions to enforce licensing agreements, geo-restrictions, and subscription policies, solidifying VOD's leading position.

The mobile gaming and apps segment is anticipated to register the highest growth rate during the forecast period. The burgeoning global smartphone user base, coupled with advancements in mobile technology and network infrastructure, has fueled an unprecedented surge in mobile gaming and app usage. As developers introduce more sophisticated and feature-rich games and applications, often incorporating in-app purchases and subscription models, the need for effective content protection intensifies. Safeguarding against cheating, unauthorized modifications, intellectual property theft, and revenue loss from pirated apps is critical for developers and publishers in this highly competitive space. The dynamic nature of mobile app development, rapid content updates, and the continuous introduction of new titles contribute significantly to this segment's accelerated adoption of digital rights management technologies.

Regional Analysis

The North America digital rights management market accounted for the largest share in 2024, due to the region's highly developed digital infrastructure, early adoption of advanced technologies, and a robust legal framework for intellectual property protection. The widespread consumption of digital media, especially through streaming services for video and music, as well as a large software and gaming sector, fuels the continuous demand for strong content security. Major content creators, technology innovators, and media distributors are headquartered in this region, leading to significant investments in sophisticated digital rights management solutions to combat piracy and manage content rights effectively. The presence of a mature market with high internet penetration further emphasizes the need for comprehensive protection against unauthorized access and distribution.

U.S. Digital Rights Management Market Insights

In North America, the U.S. stands out as a key contributor to the digital rights management market. The U.S. is home to many of the world's leading media and entertainment companies, software developers, and cloud service providers, all of whom have a critical need to protect their digital assets. The country's strong copyright laws, such as the Digital Millennium Copyright Act (DMCA), provide a legal backbone that encourages the adoption and enforcement of digital rights management technologies. Furthermore, the high rates of digital content consumption, including an extensive use of streaming platforms and online gaming, mean that protecting intellectual property from piracy is a constant concern. This active environment of content creation, distribution, and consumption, coupled with ongoing cybersecurity investments, drives innovation and adoption of advanced digital rights management solutions in the U.S.

Europe Digital Rights Management Market Trends

Europe represents a significant and evolving landscape for digital rights management. The region is characterized by a high level of digital content consumption across diverse languages and cultures, alongside a strong emphasis on data privacy and copyright protection. European intellectual property laws and regulations, such as the General Data Protection Regulation (GDPR), indirectly influence the demand for secure content handling and access control. The growth of online streaming services, digital publishing, and e-learning platforms throughout the continent necessitates robust digital rights management solutions to ensure compliance with regional licensing agreements and to combat piracy effectively across national borders. European media companies and publishers are increasingly investing in these technologies to secure their digital offerings and monetize content across various distribution channels.

In Europe, the Germany digital rights management market stands as a prominent country in the adoption of advanced technologies. Germany has a strong media and entertainment sector, a vibrant software industry, and a high level of digital content consumption, all of which contribute to the demand for effective content protection. The country's strict intellectual property laws and a cultural emphasis on copyright compliance drive businesses to implement comprehensive digital rights management strategies. As digital transformation continues across various industries, including publishing and automotive (for in-car infotainment systems), German enterprises are increasingly integrating these solutions to secure proprietary data, software, and premium digital content creation. This commitment to intellectual property rights and digital security positions Germany as a key player in the European digital rights management landscape.

Asia Pacific Digital Rights Management Market Overview

Asia Pacific is rapidly emerging as a high-growth region for the digital rights management industry. This growth is fueled by a burgeoning digital population, increasing internet penetration, and the widespread adoption of smartphones and digital devices. The region is witnessing an explosive growth in online streaming services, mobile gaming, and e-commerce, leading to a massive demand for localized digital content. Rising content creation and consumption increases the risk of piracy and intellectual property infringement, making digital rights management solutions increasingly critical. Governments across the region are also strengthening intellectual property laws, further encouraging businesses to invest in technologies that protect their digital assets and revenue streams.

China Digital Rights Management Market Insights

China dominates the digital rights management market in Asia Pacific. With its immense internet user base, rapid expansion of online entertainment platforms, and a booming mobile gaming sector, the need for robust content protection is substantial. The Chinese government has been increasingly focused on strengthening intellectual property rights enforcement to foster innovation and protect domestic industries, which boosts the demand for digital rights management solutions. Local content creators and international companies operating in China are actively implementing these technologies to combat widespread piracy and manage the distribution and monetization of their digital content in this highly dynamic and competitive environment.

Key Players and Competitive Insights

The digital rights management (DRM) landscape is highly competitive, featuring a diverse range of technology providers from large, diversified corporations to specialized DRM solution vendors. Competition is driven by the need for robust content protection against increasingly sophisticated piracy methods and the demand for seamless and flexible content delivery across a multitude of platforms and devices. Companies compete to gain a significant market share by offering superior encryption technologies, comprehensive anti-piracy services, strong integration capabilities with existing content ecosystems, and flexible business models that cater to various industries. Continuous innovation in areas such as forensic watermarking, real-time threat detection, and user authentication is key for companies to maintain and expand their market presence.

A few prominent companies in the industry include Adobe Systems Incorporated; Axinom Group; EZDRM Inc.; Intertrust Technologies Corporation; Irdeto B.V.; LockLizard Limited; Microsoft Corporation; Nagra (Kudelski Group); Verimatrix, Inc.; and Widevine (Google LLC).

Key Players

- Adobe Systems Incorporated

- Axinom Group

- EZDRM Inc.

- Intertrust Technologies Corporation

- Irdeto B.V.

- LockLizard Limited

- Microsoft Corporation

- Nagra (Kudelski Group)

- Verimatrix, Inc.

- Widevine (Google LLC)

Digital Rights Management Industry Developments

May 2025: Irdeto announced that its Irdeto Experience platform will power Astro's new Sooka streaming service. This collaboration provides a comprehensive streaming solution, ensuring secure content delivery for Astro's next-generation platform.

Digital Rights Management Market Segmentation

By Enterprise Size Outlook (Revenue – USD Billion, 2020–2034)

- Large Enterprise

- Small & Medium Enterprise

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Mobile Content

- Video on Demand (VOD)

- Mobile Gaming & Apps

- eBook

- Others

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Digital Rights Management Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 4.70 billion |

|

Market Size in 2025 |

USD 5.57 billion |

|

Revenue Forecast by 2034 |

USD 26.07 billion |

|

CAGR |

18.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 4.70 billion in 2024 and is projected to grow to USD 26.07 billion by 2034.

The global market is projected to register a CAGR of 18.7% during the forecast period.

North America dominated the share in 2024.

A few key players include Adobe Systems Incorporated; Axinom Group; EZDRM Inc.; Intertrust Technologies Corporation; Irdeto B.V.; LockLizard Limited; Microsoft Corporation; Nagra (Kudelski Group); Verimatrix, Inc.; and Widevine (Google LLC).

The large enterprise segment accounted for the largest share of the market in 2024.

The mobile gaming and apps segment is expected to witness the fastest growth during the forecast period.