Digital Workplace Market Size, Share, Trends, & Industry Analysis Report

By Component (Solution, Services), By Solution, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 117

- Format: PDF

- Report ID: PM2697

- Base Year: 2024

- Historical Data: 2020-2023

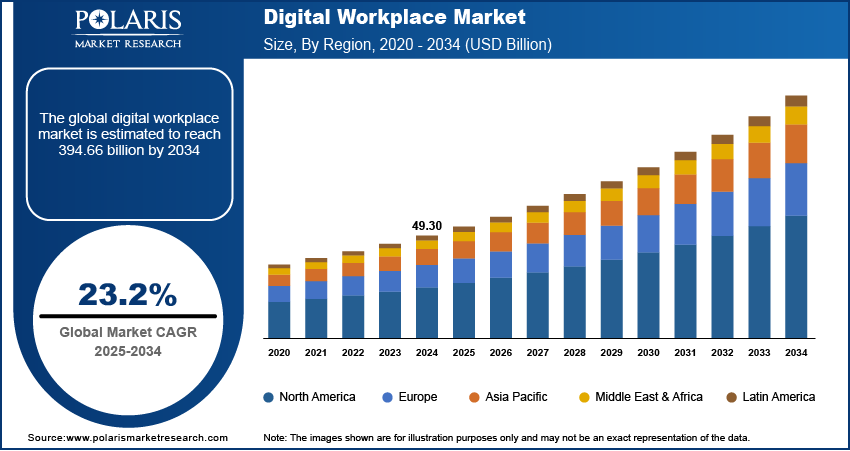

The global digital workplace market is valued at USD 49.30 billion in 2024 and is projected to grow at a CAGR of 23.2% during the forecast period. The growing adoption of cloud-based applications in many sectors, along with the higher flexibility of employees concerning work-life balance is driving the market growth. In addition, rising trend of BYOD (bring your own device) technology and business mobility by organizations further contribute to market growth.

Key Insights

- The BFSI is expected to witness significant growth during the forecast period due to increasing application of digital workplace services and solutions in the BFSI industry.

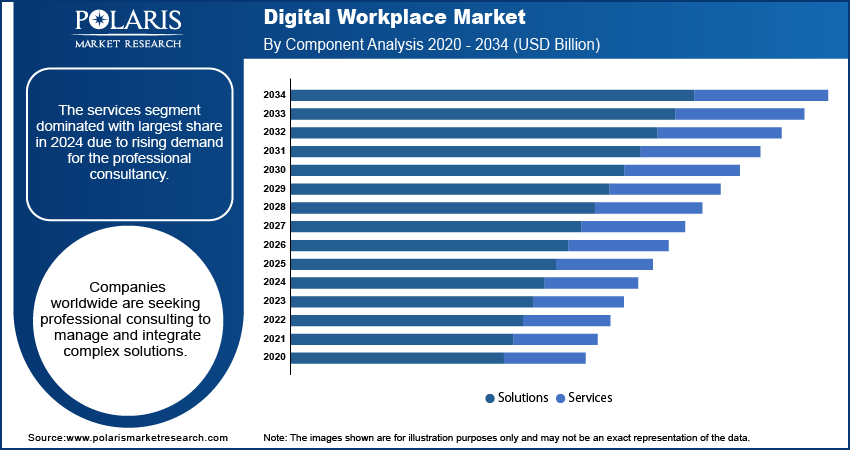

- The service segment accounted for the largest share in 2024 driven by rising need for professional consulting for complex solution integration.

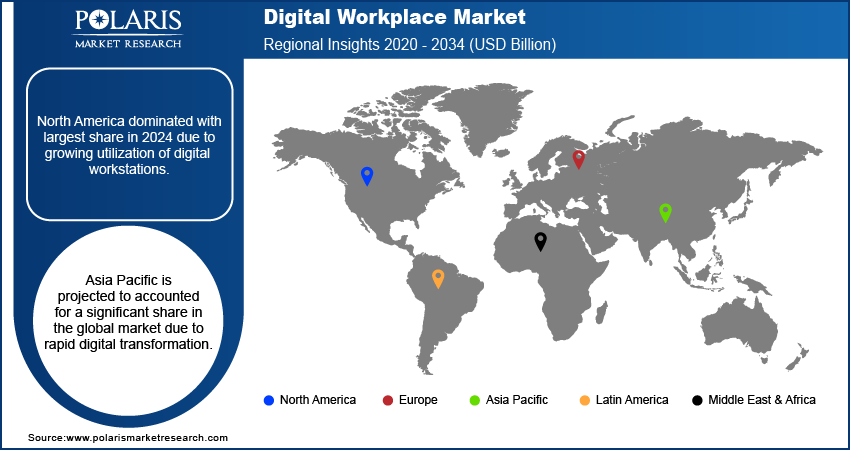

- North America dominated with largest share in 2024 due to growing utilization of digital workstations.

- Asia Pacific is projected to accounted for a significant share in the global market due to rapid digital transformation.

Industry Dynamics

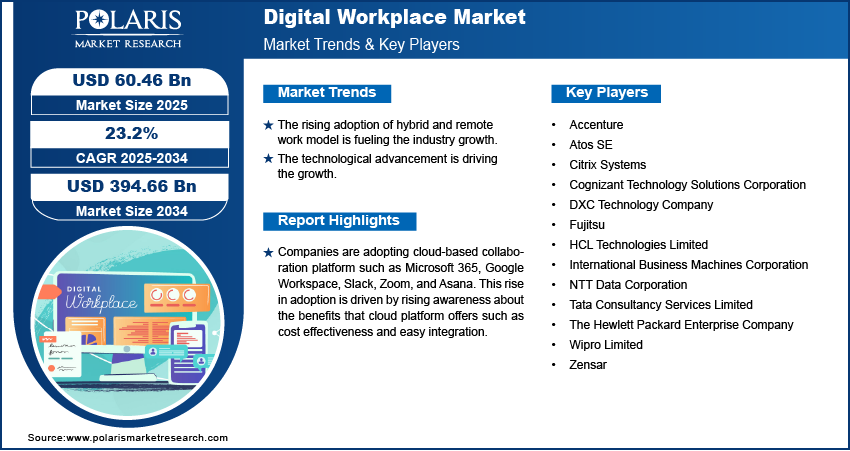

- The rising adoption of hybrid and remote work model is fueling the industry growth.

- The growing adoption of cloud-based collaboration model is boosting the industry growth.

- The technological advancement is driving the growth.

- High implementation costs and integration challenges with existing legacy systems is limiting the growth.

Market Statistics

- 2024 Market Size: USD 49.30 Billion

- 2034 Projected Market Size: USD 394.66 Billion

- CAGR (2025-2034): 23.2%

- Largest Market: North America

To Understand More About this Research: Request a Free Sample Report

Impact of AI on Industry

- Improves productivity through automation in repetitive task such as scheduling, data entry, and ticketing.

- Improve collaboration through intelligent virtual assistants such as Microsoft Copilot.

- Enables advance cybersecurity and threat detection by identifying and responding to anomalies.

Companies are adopting cloud-based collaboration platform such as Microsoft 365, Google Workspace, Slack, Zoom, and Asana. This rise in adoption is driven by rising awareness about the benefits that cloud platform offers such as cost effectiveness and easy integration. This cloud-based platform cuts operational cost as companies avoid investing in physical infrastructure and offers a subscription model, which makes them scalable and affordable. This flexibility and ease of use are driving more companies to adopt digital workplace solutions, thereby driving the growth of the industry.

Industry Dynamics

Growth Drivers

Companies worldwide are shifting to the remote of hybrid model. This rise in the remote work model is fueled after the covid-19 emergence when companies had to shut the workplace in order to curb disease infection. Currently companies have realized the advantages of remote work place model such as less operational expenditure and improved work efficiency. This rise in the remote and hybrid workplace model is driving the demand for the efficient tools that enables collaboration between employees. This has led to rise in adoption of Microsoft Teams, Zoom, Google Workspace, and Slack to facilitate real-time communication, project management, and team collaboration across locations. This has further fueled the demand for the unified platform to access files and manage workflow, which drives the demand, thereby driving the industry growth.

Report Segmentation

The market is primarily segmented by component, type, application, and region.

|

By Component |

By Solution |

By End User |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Service Segment Accounted for the Largest Share in 2024

The services segment dominated with largest share in 2024 due to rising demand for the professional consultancy. Companies worldwide are seeking professional consulting to manage and integrate complex solutions. Moreover, the demand for the customization in the complex tools is rising. This rise in demand for the customization is prompting companies to seek professional consulting and implementation. Services like consulting, integration, training, and managed support help businesses transition smoothly to cloud-based tools and hybrid work environments, thereby driving the growth in the segment.

The BFSI segment is Expected to Witness Significant Growth

The BFSI is expected to witness signifiucant growth duriung the forecast period due to the increasing application of digital workplace services and solutions in the BFSI Industry. Mass deployment of digital workstations supports lowering office expenses and other associated functional expenditures are driving the adoption in the BFSI sector. Digital workplace certifies administrative regulations, and improves operative capability in the BFSI industry, which further drives the adoption, thereby driving the growth in the segment.

North America Accounted for Largest Share in 2024

North America dominated with largest share in 2024 due to the increasing utilization of digital workstations across SMEs and big enterprises in the region. North America is the global hub for many startup companies, medium-level companies, and large organizations. The growing evolution of social connections from trade, along with the surge in the shift towards IoT, cloud computing, and the application of vital technology such as big data, AI, and automation techniques, is propelling regional growth.

The Asia Pacific region is expected to witness significant growth during the forecast period due to the growing adoption of working from home and remote working culture. The region is home of large number of cmpanies operating in retail, IT and banking sector. This large number of companies in the region is driving the demand for the digital workplace tools. Moreover, rising investment in the end use industries is supporting companies to spend on advance digital workplace tools. This in turn drives the demand and thereby fuels the industry growth in the region.

Competitive Insight

Some of the key players operating in the global market include Fujitsu, Citrix Systems, Atos SE, Fujitsu Limited, Inc, IBM, Accenture, NTT Data Corporation, Zensar, The Hewlett Packard Enterprise Company, HCL Technologies Limited, Tata Consultancy Services Limited, DXC Technology Company, International Business Machines Corporation, Cognizant Technology Solutions Corporation, Wipro Limited, and Others.

Recent Developments

- May 2025, TeamViewer launched TeamViewer ONE, a unified digital workplace platform combining endpoint management, remote connectivity, AI, and digital employee experience (DEX). The platform helps organizations streamline IT operations, enhance support, and boost employee productivity in hybrid work environments.

- In February 2021, Accenture declared the accretion of Imaginea, a source provider of a cloud-oriented platform. The acquirement will assist Accenture in improving the proposition of cloud-based ministrations for digital solutions and services.

Digital Workplace Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 49.30 billion |

| Market size value in 2025 | USD 60.46 billion |

|

Revenue forecast in 2034 |

USD 394.66 billion |

|

CAGR |

23.2% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

Component, Solution, End User, and Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Fujitsu, Citrix Systems, Atos SE, Fujitsu Limited, Inc, IBM, Accenture, NTT Data Corporation, Zensar, The Hewlett Packard Enterprise Company, HCL Technologies Limited, Tata Consultancy Services Limited, DXC Technology Company, International Business Machines Corporation, Cognizant Technology Solutions Corporation, and Wipro Limited. |

FAQ's

• The market size was valued at USD 49.30 Billion in 2024 and is projected to grow to USD 394.66 Billion by 2034.

• The market is projected to register a CAGR of 23.2% during the forecast period.

• A few of the key players in the market are Citrix Systems, Atos SE, Fujitsu Limited, Inc, IBM, Accenture, NTT Data Corporation, Zensar, The Hewlett Packard Enterprise Company, HCL Technologies Limited, Tata Consultancy Services Limited, DXC Technology Company, International Business Machines Corporation, Cognizant Technology Solutions Corporation, and Wipro Limited.

• The service accounted for the largest market share in 2024.

• The BFSI segment is expected to record significant growth.