Direct Oral Anticoagulants (DOACs) Device Market Size, Share, Trends, & Industry Analysis Report

By Product Type, By Disease Indication, By Application, By Patient Demographic, By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 130

- Format: PDF

- Report ID: PM5800

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

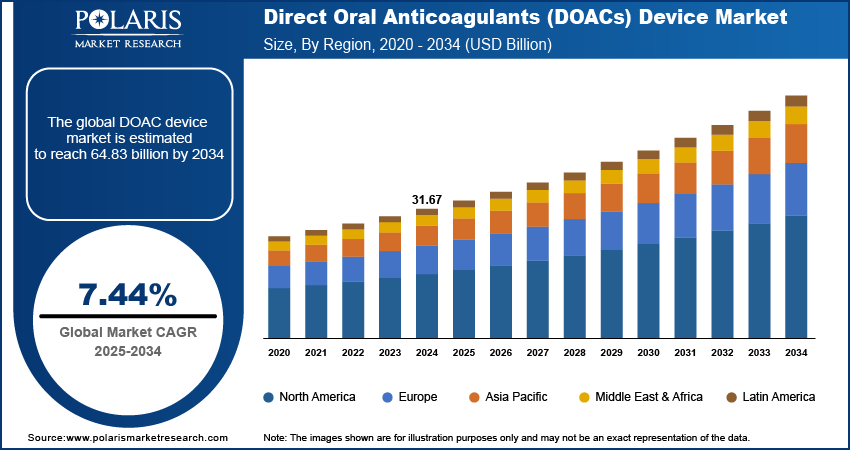

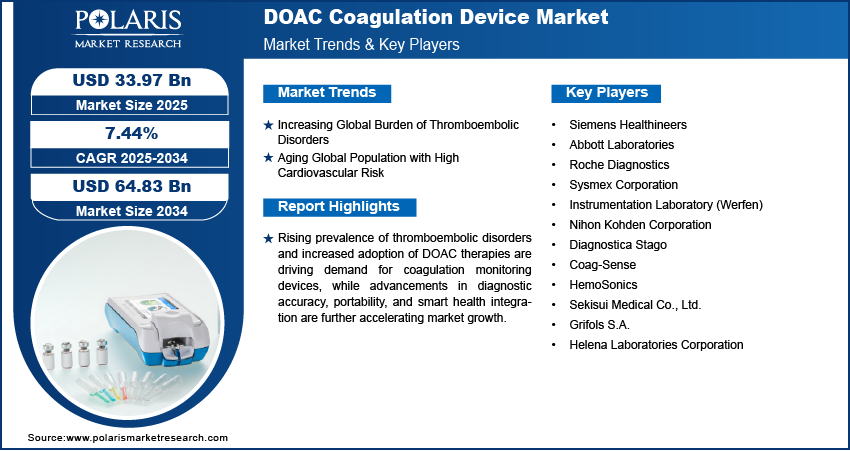

The global Direct Oral Anticoagulants (DOACs) device market size was valued at USD 31.67 billion in 2024, growing at a CAGR of 7.44% during 2025–2034. The rising incidence of thromboembolic conditions is accelerating the adoption of DOAC instruments, enabling data-driven, outcome-oriented clinical management across healthcare settings.

DOAC devices serve an important function in monitoring clotting activity in patients undergoing anticoagulant therapy. These devices are designed to deliver precise results with minimal turnaround time, thereby enabling timely clinical decision-making. Their application extends across emergency care, surgical risk assessment, and chronic disease management. Technological advancements in sensor technology, assay specificity, and point-of-care capabilities are enhancing device reliability and diagnostic efficiency, making them increasingly essential for both routine and high-acuity scenarios.

The market is also benefiting from the growing focus on remote monitoring and digital health integration. Manufacturers are investing in smart, connected devices that facilitate real-time data sharing and personalized treatment adjustments. Furthermore, strategic partnerships between device developers and healthcare providers are accelerating the deployment of patient-centric solutions. As regulatory frameworks evolve to support innovation in diagnostic technologies, this sector is positioned for sustained growth and greater clinical relevance.

To Understand More About this Research: Request a Free Sample Report

The global direct oral anticoagulants device industry is driven by improvements in diagnostic accuracy, smaller device designs, and better integration with healthcare IT systems.. Manufacturers are prioritizing the development of compact, user-friendly platforms that operates seamlessly within decentralized care environments, including ambulatory care service centers and home healthcare settings. This is enabling broader deployment of coagulation monitoring, particularly in regions adopting telehealth and remote patient management frameworks.

Additionally, regulatory bodies are streamlining approval pathways for innovative diagnostic technologies, encouraging faster market entry and broader clinical adoption. Strategic collaborations between device developers, hospitals, and data analytics firms are further enhancing device functionality through real-time data capture and analysis. For instance, in August 2024, Perosphere Technologies partnered with CoRRect Medical to exclusively distribute its reagent‑free point‑of‑care coagulometer across Germany, addressing rising anticoagulant usage and bolstering rapid coagulation diagnostics in hospitals and clinics. These partnerships help improve clinical decisions and support the role of coagulation diagnostics in care models focused on safety, efficiency, and cost control over time.

Industry Dynamics

Increasing Global Burden of Thromboembolic Disorders

The rising global prevalence of thromboembolic disorders such as deep vein thrombosis (DVT), pulmonary embolism (PE), and atrial fibrillation (AF) drives the demand for DOAC devices. According to the Centers for Disease Control and Prevention (CDC), venous thromboembolism affects up to 900,000 people annually in the United States, causing an estimated 60,000 to 100,000 deaths and leading to long-term complications for many patients. These conditions are associated with considerable morbidity and mortality, often requiring long-term anticoagulation therapy. As a result, healthcare providers are under pressure to adopt accurate, real-time monitoring tools to assess coagulation status and ensure therapeutic effectiveness. The increasing clinical reliance on direct oral anticoagulants, which require tailored monitoring in high-risk or complex patient populations, further necessitates the integration of advanced coagulation diagnostics into standard care protocols.

In addition, changing lifestyles, rising obesity rates, sedentary behavior, and growing cases of chronic diseases such as cancer and diabetes are contributing to higher thrombotic risks globally. This epidemiological shift is particularly evident in both developed and emerging economies, placing additional demands on healthcare systems to adopt proactive, preventive, and patient-specific management strategies. These devices provide timely, actionable insights and are becoming vital for efficient management of thromboembolic conditions. Growing awareness of early diagnosis and continuous monitoring is driving their adoption across both hospital and decentralized care settings.

Aging Global Population with High Cardiovascular Risk

The ongoing demographic shift toward an aging global population is significantly contributing to the growth of this industry. Elderly individuals are more prone to cardiovascular diseases, including atrial fibrillation, which is a leading cause of ischemic stroke and often requires long-term anticoagulation therapy. According to the WHO, the global population aged 60 and above is expected to grow from 1.4 billion in 2030 to 2.1 billion by 2050. The rapid growth of the geriatric population in regions such as Europe, North America, and Japan is driving demand for reliable and easy-to-use coagulation monitoring devices. Older adults often have multiple health conditions and take several medications, making real-time coagulation monitoring important to help prevent issues such as bleeding or blood clots.

Furthermore, the elderly people require continuous healthcare management across various care settings, including hospitals, rehabilitation centers, and home care environments. This is driving the demand for portable, easy-to-use direct oral anticoagulants devices that can be deployed outside traditional laboratories. The healthcare sector is increasingly investing in diagnostic tools that support personalized care and clinical decision-making tailored to older patients’ unique physiological needs. As the aging trend continues, the role of coagulation monitoring is expected to become more central in ensuring therapeutic safety and improving the quality of life for senior patients undergoing anticoagulation therapy.

Segmental Insights

By Product Type Analysis

The global segmentation based on product type includes, factor Xa inhibitors and direct thrombin inhibitors. The factor Xa inhibitors segment dominated the market in 2024. This growth is attributed to due to their broad clinical applicability, favorable safety profile, and consistent demand in both preventive and therapeutic anticoagulation. These agents, including rivaroxaban and apixaban become the preferred option in stroke prevention and venous thromboembolism treatment, particularly among patients with atrial fibrillation. According to the National Library of Medicine, nearly 12 million new stroke cases occur annually, with one in four individuals over the age of 25 projected to experience a stroke in their lifetime, and approximately 15% of cases affecting individuals aged 15 to 49. Their predictable pharmacokinetics and minimal dietary restrictions contribute to reduced monitoring requirements. However, in specific clinical scenarios such as renal impairment or perioperative management, targeted coagulation assessment is still necessary. This growing need is driving the adoption of supportive diagnostic tools in hospitals and specialty care centers, thereby reinforcing the dominance of factor Xa inhibitor-related monitoring solutions.

The direct thrombin inhibitors segment is projected to grow at a robust pace in the coming years, as they gain traction in patients requiring alternative anticoagulation therapy, particularly those with contraindications to factor Xa inhibitors. Dabigatran, a key drug in this category is increasingly used in acute stroke prevention and post-operative care. Demand for coagulation monitoring devices specific to thrombin inhibition is rising in response to complex dosing considerations and patient-specific safety concerns. Continued advancements in diagnostics designed to assess thrombin activity, along with expanded clinical acceptance of direct thrombin inhibitors are expected to drive robust market growth over the coming years

By Disease Indication Analysis

The global segmentation, based on disease indication includes, atrial fibrillation, deep vein thrombosis (DVT), pulmonary embolism (PE), heart attacks, post-surgical thromboprophylaxis, and others. The atrial fibrillation segment accounted for substantial market share in 2024. It is one of the most common arrhythmias globally and presents a major risk for thromboembolic events such as ischemic stroke. Long-term anticoagulation therapy with DOACs become standard practice in managing atrial fibrillation. This trend is resulting in a growing demand for precision coagulation monitoring to ensure therapeutic safety, particularly among older adults and patients with comorbidities. As the incidence of atrial fibrillation continues to rise worldwide, hospitals and cardiology clinics are integrating more advanced and responsive diagnostic tools to support continuous patient care. According to a 2025 Frontiers report, Atrial Fibrillation and Atrial Flutter (AF/AFL) accounted for 4.48 million new cases globally in 2021, with an ASIR of 52.1 per 100,000, bringing total prevalence to 52.55 million cases and resulting in 338,947 deaths.

The post-surgical thromboprophylaxis segment is projected to grow at a significant pace during the assessment phase, due to the increasing use of direct oral anticoagulants in preventing venous thromboembolic complications following orthopedic, abdominal, and cardiovascular surgeries. Enhanced recovery protocols and the need for continuity of care after discharge are accelerating demand for portable monitoring solutions. In addition, hospitals are emphasizing real-time coagulation assessment to reduce readmission rates and postoperative complications. The growing adoption of evidence-based thromboprophylaxis strategies is expected to support the rapid expansion of this sub-segment across both inpatient and outpatient settings.

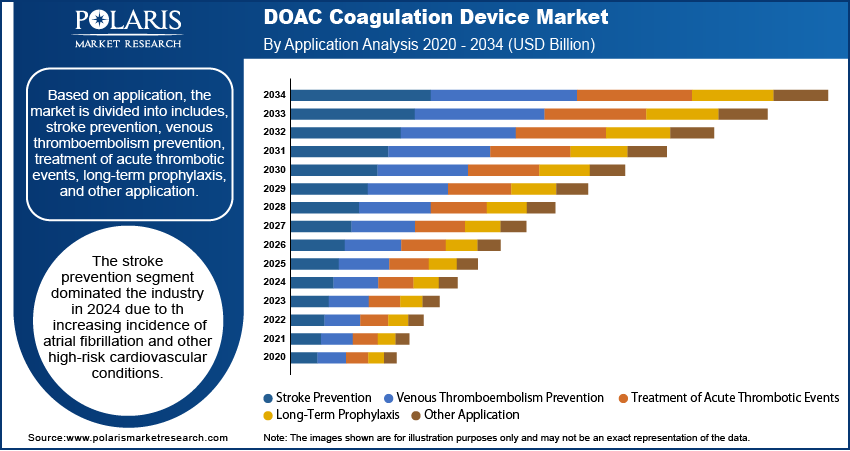

By Application Analysis

The global segmentation, based on application includes, stroke prevention, venous thromboembolism prevention, treatment of acute thrombotic events, long-term prophylaxis, and other application. The stroke prevention segment dominated the industry in 2024 due to the increasing incidence of atrial fibrillation and other high-risk cardiovascular conditions. The effectiveness of DOACs in reducing the risk of cardioembolic stroke led to their widespread use across multiple care settings. This resulted in strong demand for diagnostic systems that supports personalized therapy and minimize the risk of adverse events. Hospitals and specialized stroke units are prioritizing coagulation monitoring as part of comprehensive stroke prevention programs, contributing to consistent segment growth.

The treatment of acute thrombotic events segment is estimated to hold a substantial market share in 2034, reflecting the growing clinical need for immediate therapeutic intervention in emergency settings. Conditions such as deep vein thrombosis and pulmonary embolism require accurate and timely coagulation assessment to guide treatment decisions. As hospitals enhance their capabilities in emergency care and adopt advanced triage systems, there is increasing demand for rapid diagnostic platforms that can provide real-time coagulation status. The rising prevalence of these acute conditions and growing awareness of the need for early intervention are key factors driving segment growth.

By Patient Demographic Analysis

The global segmentation, based on patient demographics includes, pediatric, adult, geriatric The adult segment is projected to grow with a substantial CAGR during the forecast period. This is supported by the high incidence of lifestyle-related disorders including hypertension, diabetes, and obesity. Adults represent the largest consumer base for DOAC therapy across both prophylactic and treatment use cases. The demand for continuous and accurate monitoring of anticoagulation is expanding, with rising awareness about cardiovascular health and increased access to specialized care. Hospitals and ambulatory clinics are investing in diagnostic platforms that offer reliable data for adults requiring long-term therapy, contributing to this segment's sustained market leadership.

The geriatric segment is estimated to hold a significant industry share in 2034, due to the increasing global elderly population and their heightened risk of thromboembolic complications. Older adults frequently require individualized therapy adjustments and are more vulnerable to adverse events, necessitating regular coagulation assessment. The expansion of home-based care services and greater reliance on remote monitoring are encouraging the adoption of portable and user-friendly diagnostic tools. Healthcare systems are placing a stronger focus on patient safety and care quality for the aging population that is expected to drive accelerated growth in this segment.

By End User Analysis

The global segmentation, based on end user includes, hospitals, ambulatory surgical centers, specialty clinics, homecare settings, and others. The hospitals segment is projected to grow with a fastest CAGR during the forecast period due to their primary setting for managing both acute and chronic anticoagulation needs. These institutions generally handle a high volume of direct oral anticoagulants prescriptions, particularly for patients undergoing surgery, stroke prevention therapy, or emergency thrombotic care. Hospitals are equipped with comprehensive laboratory and point-of-care diagnostic infrastructure, enabling efficient monitoring of coagulation parameters. The presence of trained personnel and structured clinical pathways further supports the integration of DOAC monitoring systems in hospital workflows, reinforcing their position as the largest consumer base.

The homecare settings segment is estimated to hold a significant market share in 2034, driven by the growing emphasis on decentralized healthcare and chronic disease management outside traditional clinical environments. Advances in compact diagnostic technologies and improved connectivity with healthcare providers are enabling safer and more effective monitoring of anticoagulation therapy at home. This trend aligns with the broader shift toward patient-centered care, reduced hospital readmissions, and enhanced treatment compliance. As healthcare systems and insurers increasingly support remote monitoring models, the homecare segment is anticipated to expand rapidly.

Regional Analysis

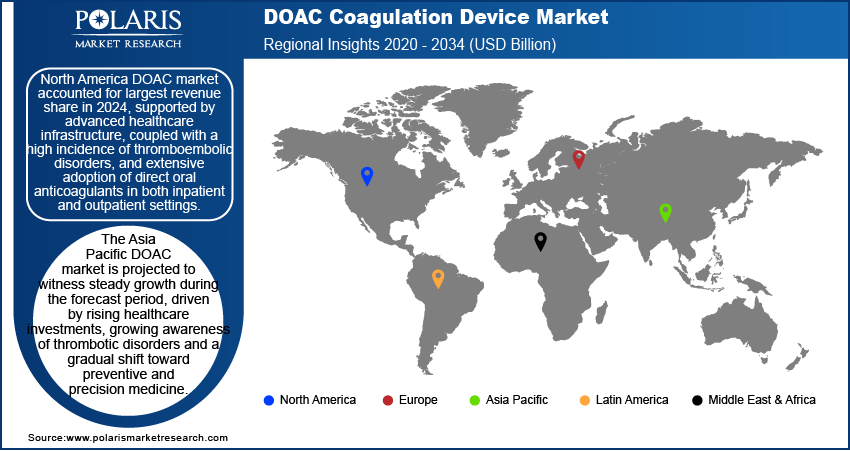

North America direct oral anticoagulants device market accounted for largest revenue share in 2024, supported by advanced healthcare infrastructure, coupled with a high incidence of thromboembolic disorders, and extensive adoption of direct oral anticoagulants in both inpatient and outpatient settings. The region’s focus on patient safety, clinical efficiency, and early diagnosis resulted in significant investments in diagnostic technologies, particularly those that align with personalized medicine and point-of-care testing. Furthermore, the presence of leading device manufacturers, favorable reimbursement policies, and a well-established regulatory environment are contributing to consistent market expansion. Clinical guidelines from institutions such as the American Heart Association and the American College of Cardiology further standardize DOAC usage and the associated monitoring needs.

United States Direct Oral Anticoagulants (DOACs) Device Market Insight

The United States direct oral anticoagulants market dominated the regional market in 2024. This is driven due to its widespread use of DOACs for conditions such as atrial fibrillation and deep vein thrombosis is fueling demand for specialized coagulation monitoring devices. In October 2023, FloBio secured FDA Breakthrough Device designation for its point-of-care diagnostic test designed to rapidly assess bleeding risk and detect oral anticoagulants, aiming to enhance clinical decision-making in emergency care settings. Growing geriatric population, high healthcare awareness, and increased preference for data-driven anticoagulation management are accelerating the deployment of portable and connected diagnostic systems across hospitals, outpatient centers, and homecare settings. Strategic collaborations between healthcare providers and diagnostic firms, along with rising adoption of telehealth platforms are enhancing access to real-time coagulation data, supporting both clinical decision-making and long-term therapy compliance.

Asia Pacific Direct Oral Anticoagulants (DOACs) Device Market

The Asia Pacific direct oral anticoagulants device market is projected to witness steady growth during the forecast period, driven by rising healthcare investments, growing awareness of thrombotic disorders and a gradual shift toward preventive and precision medicine. The region is experiencing an epidemiological shift due to aging populations in countries such as Japan, South Korea, and China, where the burden of cardiovascular conditions is steadily increasing. Government initiatives to strengthen diagnostic capacity, expand rural healthcare access, and digitize hospital infrastructure are also fueling demand for modern coagulation monitoring systems. As clinical use of DOACs rises across primary care and specialty practices, Asia Pacific is becoming a key growth frontier for global diagnostic device manufacturers.

Japan direct oral anticoagulants device market plays an important role in the Asia Pacific industry, owing to its highly structured healthcare system and rapidly aging population. According to Nipino, over 30% of Japan's population is aged 65 or older as of 2025, driven by high life expectancy and a declining birthrate. Japanese clinicians embraced DOACs for stroke prevention and post-surgical thromboprophylaxis, creating a sustained need for accurate monitoring tools. The country’s proactive regulatory stance on device approval and adoption, along with its robust outpatient care network, supports the seamless integration of advanced coagulation testing systems into standard practice. Moreover, Japan’s investment in smart healthcare technologies and home-based diagnostic solutions is expected to further accelerate the adoption of portable, user-friendly DOAC monitoring devices across the elderly demographic.

Europe Direct Oral Anticoagulants (DOACs) Device Market Overview

The market in Europe direct oral anticoagulants device market is expected to witness substantial growth, driven by its mature healthcare infrastructure, widespread clinical use of direct oral anticoagulants, and the implementation of structured anticoagulation management protocols across member states. According to the Germany’s Federal Statistical Office report 2025, Germany recorded the highest health expenditure among EU Member States, allocating 12.6% of its GDP to healthcare. However, the EU average stood at 10.4%, reflecting varying national priorities and investment levels across the region. The region places strong emphasis on individualized, evidence-based care, resulting in growing demand for high-precision diagnostic tools that support therapeutic optimization and risk reduction. Additionally, the shift toward outpatient and home-based treatment models is encouraging broader adoption of portable and real-time coagulation monitoring devices. Germany leads the regional market, supported by its large aging population, comprehensive cardiovascular care framework, and early adoption of innovative medical technologies. The country's dual-payer system ensures consistent reimbursement for advanced diagnostics that is increasing digitalization in healthcare and expanding remote care services. It helps to reinforce the need for efficient, interoperable, and patient-friendly testing solutions across hospitals, specialty centers, and homecare environments.

Key Players & Competitive Analysis Report

The direct oral anticoagulants device industry is moderately fragmented, with key players competing on diagnostic precision, turnaround time, device portability, and integration with digital health ecosystems. Market participants are focusing on innovation in point-of-care technologies, miniaturized testing platforms, and real-time analytics to address the increasing clinical demand for timely and accurate anticoagulation monitoring. Strategic partnerships with hospitals, diagnostic networks, and research institutes are enabling broader product adoption and improving clinical decision-making outcomes. Rising demand for remote patient monitoring devices solutions, driven by home-based care models and aging patient populations further pushing companies to invest in sensor-enabled, interoperable, and user-friendly diagnostic systems. Research and development efforts are increasingly directed toward enhancing assay sensitivity, expanding test menus, and ensuring regulatory compliance across global markets.

Key companies operating in the global DOAC device market include Siemens Healthineers, Abbott Laboratories, Roche Diagnostics, Sysmex Corporation, Instrumentation Laboratory (Werfen), Nihon Kohden Corporation, Diagnostica Stago, Coag-Sense, HemoSonics, Sekisui Medical Co., Ltd., Grifols S.A., and Helena Laboratories Corporation.

Key Players

- Siemens Healthineers

- Abbott Laboratories

- Roche Diagnostics

- Sysmex Corporation

- Instrumentation Laboratory (Werfen)

- Nihon Kohden Corporation

- Diagnostica Stago

- Coag-Sense

- HemoSonics

- Sekisui Medical Co., Ltd.

- Grifols S.A.

- Helena Laboratories Corporation

Industry Developments

July 2024: Perosphere Technologies signed an exclusive agreement with CoRRect Medical to introduce its reagent-free, point-of-care coagulometer in German hospitals and clinics, addressing the rising demand for advanced bedside coagulation testing.

February 2024: Roche launched three CE-marked coagulation tests for the Factor Xa inhibitors apixaban, edoxaban, and rivaroxaban that features automated reagent cassettes to streamline high-quality results and support clinical decisions in stroke prevention and thromboembolism treatment.

October 2023: FloBio received FDA breakthrough device designation for its rapid point‑of‑care test that assesses bleeding risk and detects direct oral anticoagulants to support emergency treatment decisions.

Direct Oral Anticoagulants (DOACs) Device Market Segmentation

By Product Type Outlook (Revenue, USD Billion, 2020–2034)

- Factor Xa Inhibitors

- Direct Thrombin Inhibitors

By Disease Indication Outlook (Revenue, USD Billion, 2020–2034)

- Atrial Fibrillation

- Deep Vein Thrombosis (DVT)

- Pulmonary Embolism (PE)

- Heart Attacks

- Post-Surgical Thromboprophylaxis

- Others

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Stroke Prevention

- Venous Thromboembolism Prevention

- Treatment of Acute Thrombotic Events

- Long-Term Prophylaxis

- Other Application

By Patient Demographic Outlook (Revenue, USD Billion, 2020–2034)

- Pediatric

- Adult

- Geriatric

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Hospitals

- Ambulatory Surgical Centers

- Specialty Clinics

- Homecare Settings

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

DOAC Coagulation Device Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 31.67 Billion |

|

Market Size in 2025 |

USD 33.97 Billion |

|

Revenue Forecast by 2034 |

USD 64.83 Billion |

|

CAGR |

7.44% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 31.67 billion in 2024 and is projected to grow to USD 64.83 billion by 2034.

The global market is projected to register a CAGR of 7.44% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are Siemens Healthineers, Abbott Laboratories, Roche Diagnostics, Sysmex Corporation, Instrumentation Laboratory (Werfen), Nihon Kohden Corporation, Diagnostica Stago, Coag-Sense, HemoSonics, Sekisui Medical Co., Ltd., Grifols S.A., and Helena Laboratories Corporation.

The stroke prevention segment dominated the market share in 2024.

The hospitals segment is projected to grow with a fastest CAGR during the forecast period.