Healthcare IT Market Size, Share, & Industry Analysis Report

: By Product & Services, Components (Hardware, Software, and Service), End Use, and Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 128

- Format: PDF

- Report ID: PM1528

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

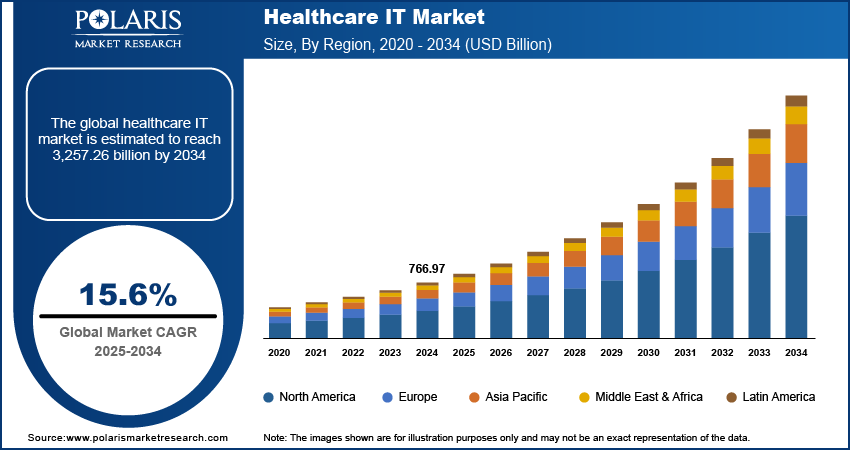

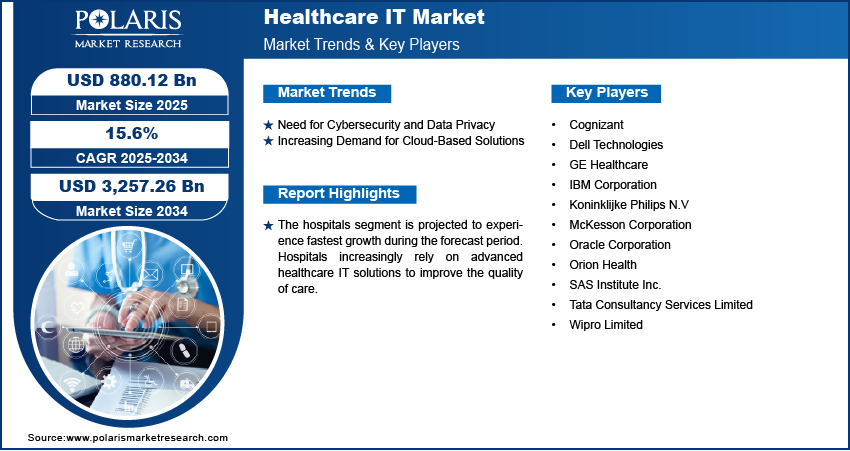

The healthcare IT market size was valued at USD 761.68 billion in 2024. The market is projected to grow from USD 880.12 billion in 2025 to USD 3,257.26 billion by 2034, exhibiting a CAGR of 15.6% during 2025–2034. The market is driven by the growing need for efficient patient data management, increasing adoption of electronic health records (EHR), rising demand for telemedicine, advancements in AI and IoT, government initiatives, and the need to improve healthcare outcomes and reduce costs.

Key Insights

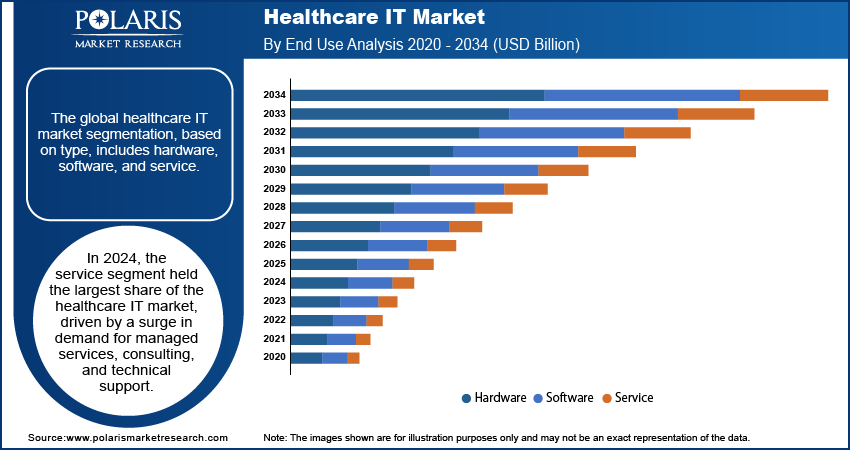

- In 2024, the service segment dominated the market revenue, driven by growing demand for managed services, consulting, and technical support to facilitate smooth integration and maintenance of complex digital health systems.

- The hospital segment is expected to grow the fastest, as healthcare providers adopt IT solutions to enhance care quality, operational efficiency, and patient outcomes amid expanding healthcare demands.

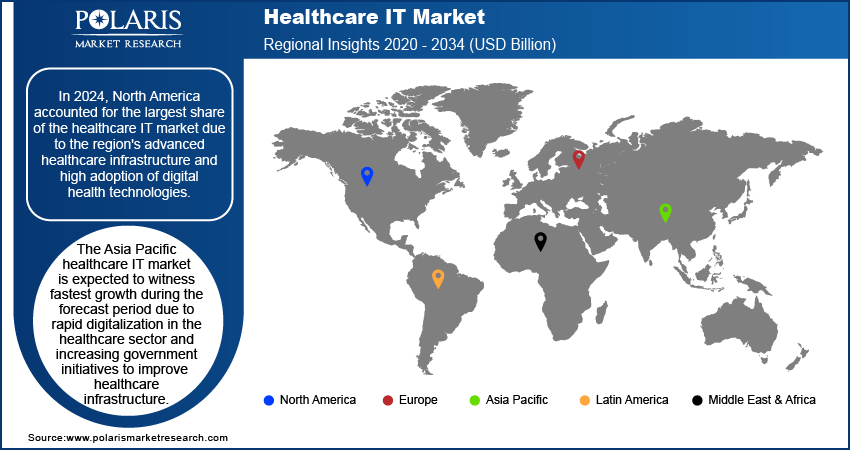

- North America led the global healthcare IT market in 2024, supported by a robust healthcare system and widespread adoption of digital technologies such as EHRs and telehealth.

- The Asia Pacific region is projected to experience the fastest growth, driven by the rapid digitalization of healthcare, supportive government policies, and an increasing adoption of telemedicine and electronic health records.

Industry Dynamics

- Growing demand for improved patient care and operational efficiency is encouraging healthcare providers to adopt digital solutions like EHRs, telemedicine, and health information exchanges.

- Rising government initiatives and investments in healthcare IT infrastructure are accelerating digital transformation across both developed and emerging markets.

- Data security concerns and interoperability issues among various healthcare IT systems are hindering seamless implementation.

- Advancements in AI, big data analytics, and cloud computing offer vast opportunities to enhance diagnostics, personalize treatments, and optimize healthcare delivery systems.

Market Statistics

- 2024 Market Size: USD 761.68 billion

- 2034 Projected Market Size: USD 3,257.26 billion

- CAGR (2025-2034): 15.6%

- North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

The healthcare IT market refers to the sector that encompasses the development, implementation, and management of information technology systems, software, and services designed to enhance healthcare delivery, efficiency, and patient outcomes. The market includes electronic health records (EHRs), telemedicine platforms, healthcare analytics, medical imaging solutions, revenue cycle management systems, and patient engagement tools.

Increasing emphasis on digital health records to streamline data management, improve patient care, and comply with government mandates is contributing to the healthcare IT market growth. Additionally, policies promoting healthcare IT adoption, such as funding programs and incentives for implementing EHRs and telemedicine solutions, significantly boost market expansion. Integration of an AI and ML enables advanced data analytics, personalized treatment plans, and predictive healthcare solutions, contributing to increasing healthcare IT market demand. Moreover, rising healthcare investments globally, particularly in developing economies, boost market expansion by enabling hospitals and clinics to adopt IT infrastructure.

Market Dynamics

Need for Cybersecurity and Data Privacy

The increasing digitization of healthcare systems creates vast amounts of sensitive patient data, including personal health information (PHI), diagnostic records, and treatment plans, which are stored and shared electronically. This transition has heightened the risk of data breaches, cyberattacks, and unauthorized access, necessitating robust cybersecurity measures. The healthcare industry is particularly vulnerable due to the high value of medical data on the black market and the reliance on interconnected devices, such as EHR systems, telemedicine platforms, and medical devices with IoT technologies. The rising frequency of cyber incidents has prompted healthcare organizations to adopt advanced IT solutions to secure their infrastructure and ensure data integrity. For instance, in June 2022, according to Identity Defined Security Alliance, 84% reported an identity-related breach, with 78% indicating direct business consequences such as recovery expenses and harm to reputation. Therefore, the growing need for cybersecurity and data privacy is a significant driver of the industry's development.

Increasing Demand for Cloud-Based Solutions

Cloud technology provides unparalleled scalability, enabling healthcare facilities to adapt and expand their IT infrastructure as needed without significant upfront investments. This flexibility is particularly beneficial for accommodating the growing volume of healthcare data generated by electronic health records (EHRs), telemedicine, remote patient monitoring devices, and other digital health applications. Additionally, cloud technology supports advanced data analytics and AI-driven insights, enabling healthcare providers to enhance patient outcomes and operational efficiency. In March 2024, NVIDIA launched around 20 new micro services personalized for healthcare enterprises worldwide, enabling them to leverage the latest advances in generative AI on any cloud platform. With robust security protocols and compliance measures in place, modern cloud platforms also address concerns related to data privacy and regulatory compliance, making them an increasingly integral component of healthcare IT strategies. The convergence of these benefits is driving the demand for cloud-based solutions in the healthcare sector, which propels the market demand.

Segment Insights

By Components Outlook

The global healthcare IT market segmentation, based on components, includes hardware, software, and service. In 2024, the service segment held the largest share of the healthcare IT market revenue, driven by a surge in demand for managed services, consulting, and technical support to ensure seamless implementation, integration, and maintenance of advanced digital solutions. Healthcare providers and institutions are increasingly relying on external expertise to address challenges associated with interoperability, data migration, and compliance with stringent regulations such as HIPAA and GDPR.

The rising adoption of cloud-based solutions has fueled the need for ongoing service support to optimize performance, ensure data security, and provide scalable solutions tailored to dynamic healthcare environments. The growing emphasis on patient-centric care and value-based healthcare models has highlighted the importance of professional services, enabling providers to enhance operational efficiency, reduce costs, and improve patient outcomes.

By End Use Outlook

The global healthcare IT market segmentation, based on end use, includes payer, public payers, private payers, providers, ambulatory care centers, hospitals, diagnostics and imaging centers, pharmacies, and others. The hospitals segment is projected to experience fastest growth during the forecast period. Hospitals increasingly rely on advanced healthcare IT solutions to improve the quality of care, streamline operations, and ensure better patient outcomes as healthcare systems continues to grow. Additionally, hospitals face a rising number of patient admissions and the growing need to manage vast amounts of clinical and administrative data efficiently.

Regional Analysis

By region, the study covers North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America accounted for the largest share of the global healthcare IT market revenue due to the region's advanced healthcare infrastructure and high adoption of digital health technologies. Moreover, strong government initiatives promote healthcare digitization, which propel the demand for efficient, secure, and cost-effective healthcare solutions. Additionally, the presence of major healthcare IT companies and continuous investments in healthcare IT innovation contribute to the market growth in North America. According to the American Hospital Association, in the last three years, over USD 30 billion has been invested in healthcare AI startups, totaling around USD 60 billion in the past decade.

The Asia Pacific healthcare IT market is expected to witness fastest growth during the forecast period due to rapid digitalization in the healthcare sector, increasing government initiatives to improve healthcare infrastructure, rising demand for advanced healthcare solutions, and growing awareness of the benefits of electronic health records and telemedicine. Additionally, the region's expanding healthcare needs, coupled with the increasing adoption of cloud-based solutions and mobile health technologies, are driving significant market growth.

Key Players and Competitive Analysis Report

The competitive landscape is characterized by the presence of both established players and emerging companies, all competing to provide innovative solutions across various segments, including electronic health records (EHR), telemedicine, healthcare analytics, and cloud-based solutions. Major companies such as Cerner Corporation, Allscripts Healthcare Solutions, and McKesson Corporation dominate the market, offering a wide range of healthcare IT solutions to streamline operations and improve patient care. These companies compete by focusing on technological advancements, customer service, and strategic acquisitions.

Emerging players are increasingly leveraging technologies such as artificial intelligence (AI), machine learning, and blockchain to enhance the efficiency and security of healthcare systems. The market is also witnessing growing collaboration between healthcare providers, IT companies, and governments to meet the rising demand for digitized healthcare solutions. Partnerships and acquisitions are common strategies for expanding product portfolios and geographic reach. Furthermore, the rising importance of data privacy and cybersecurity in healthcare IT solutions is fueling competition, with companies focusing on developing robust security features to ensure compliance with regulations such as HIPAA and GDPR. The competitive landscape is also shaped by the increasing shift toward value-based care models, driving demand for integrated healthcare IT systems that improve patient outcomes and reduce operational costs.

A few key major market players are Wipro Limited, Cognizant, Orion Health, SAS Institute Inc., GE Healthcare, Oracle Corporation, Tata Consultancy Services Limited, McKesson Corporation, Koninklijke Philips N.V, Dell Technologies, and IBM Corporation.

International Business Machines Corporation (IBM) is an American multinational technology company operating in over 75 countries. The company mainly sells software which generates 29% of its revenue. Infrastructure services hold 37%, the hardware segment has 8%, and IT services hold 23%. The organization has an extensive network of 80,000 business associates who help it handle 5,200 clients, including 95% of the Fortune 500. Although IBM is a B2B firm, it has a significant external influence. For instance, the company is responsible for 50% of all wireless and 90% of all credit card transactions.

The company provides healthcare and healthcare payer solutions through the IBM Watson Health business. However, as of 2022, the IBM Watson Healthcare business was purchased by Merative. IBM Watson started in 2010, is a supercomputer that uses Digital Workplace (AI) and advanced analytical tools to operate optimally as a "question-answering" machine. For businesses and organizations, IBM Watson uses Digital Workplace to optimize employees' time, automate complex processes, and predict future outcomes.

Oracle Corporation provides products and services that address enterprise information technology environments globally. Oracle Fusion cloud enterprise performance management, Oracle Fusion cloud supply chain, as well as manufacturing management, enterprise resource planning (ERP), Oracle Advertising, NetSuite applications suite, Oracle Fusion cloud human capital management, and Oracle Fusion Sales, Service, and Marketing are few of the cloud software programs included in the company's Oracle software as a service. The company provides its services to various industries such as automotive, communications, consumer goods, construction and engineering, energy and water, government and education, food and beverage, financial services, health, high technology, life sciences, hospitality, media and entertainment, industrial manufacturing, oil and gas, retail, public safety, wholesale distribution, travel and transportation, and professional services.

List of Key Companies

- Cognizant

- Dell Technologies

- GE Healthcare

- IBM Corporation

- Koninklijke Philips N.V

- McKesson Corporation

- Oracle Corporation

- Orion Health

- SAS Institute Inc.

- Tata Consultancy Services Limited

- Wipro Limited

Market Developments

In April 2023, Philips partnered with Northwell Health to help the health system standardize patient monitoring, enhance patient care, and improve patient outcomes while driving interoperability and data innovation.

In March 2023, GE HealthCare made an agreement with Advantus Health Partners to broadening the reach of healthcare technology management services.

In March 2023, Orion Health expanded its presence in North America by introducing Amadeus Unified Healthcare Platform; it marks a departure from conventional, fragmented healthcare systems, as it prioritizes the needs of patients by offering digital health solutions.

Market Segmentation

By Product & Services Outlook (Revenue, USD Billion, 2020–2034)

- Provider Solutions

- Clinical Solutions

- Non-Clinical Solutions

- Payer Solutions

- Patient Administration System (PAS)

- Facility Management services (FMS)

- Member Eligibility Management Solutions (MEMS)

- Billing Accounts and Management Solutions (BAMS)

- Customer Relationship Management solution (CRMS)

- Population Health Management Solutions (PHMS)

- Claim Management Solutions (CMS)

- Network Management Systems (NMS)

- Others

- Healthcare IT Outsourcing Services

- Payers IT

- Provider

- Operation

- IT Infrastructure Management Services

By Components Outlook (Revenue, USD Billion, 2020–2034)

- Hardware

- Software

- Service

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Payer

- Public Payers

- Private Payers

- Providers

- Ambulatory Care Centers

- Hospitals

- Diagnostics and Imaging Centers

- Pharmacies

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 761.68 billion |

|

Market Size Value in 2025 |

USD 880.12 billion |

|

Revenue Forecast by 2034 |

USD 3,257.26 billion |

|

CAGR |

15.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion; 2020–2034 and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global healthcare IT market size was valued at USD 761.68 billion in 2024 and is projected to grow to USD 3,257.26 billion by 2034.

The global market is projected to register a CAGR of 15.6% during the forecast period.

In 2024, North America accounted for the largest market share due to the region's advanced healthcare infrastructure and high adoption of digital health technologies.

A few key players in the market are Wipro Limited, Cognizant, Orion Health, SAS Institute Inc., GE Healthcare, Oracle Corporation, Tata Consultancy Services Limited, McKesson Corporation, Koninklijke Philips N.V, Dell Technologies, and IBM Corporation.

In 2024, the service segment held the largest market share, driven by a surge in demand for managed services, consulting, and technical support.

The hospitals segment is projected to experience fastest growth during the forecast period as hospitals increasingly rely on advanced healthcare IT solutions to improve the quality of care.