Disposable Medical Sensors Market Share, Size, Trends, Industry Analysis Report

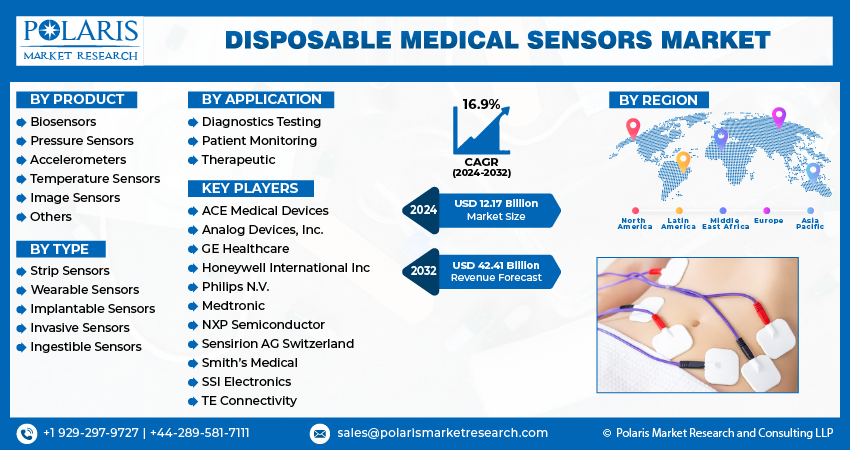

By Product (Biosensors, Pressure Sensors, Accelerometers, Temperature Sensors, Image Sensors, Others); By TYPE; By Application; By Region; Segment Forecast, 2024 - 2032

- Published Date:Dec-2023

- Pages: 115

- Format: PDF

- Report ID: PM4138

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

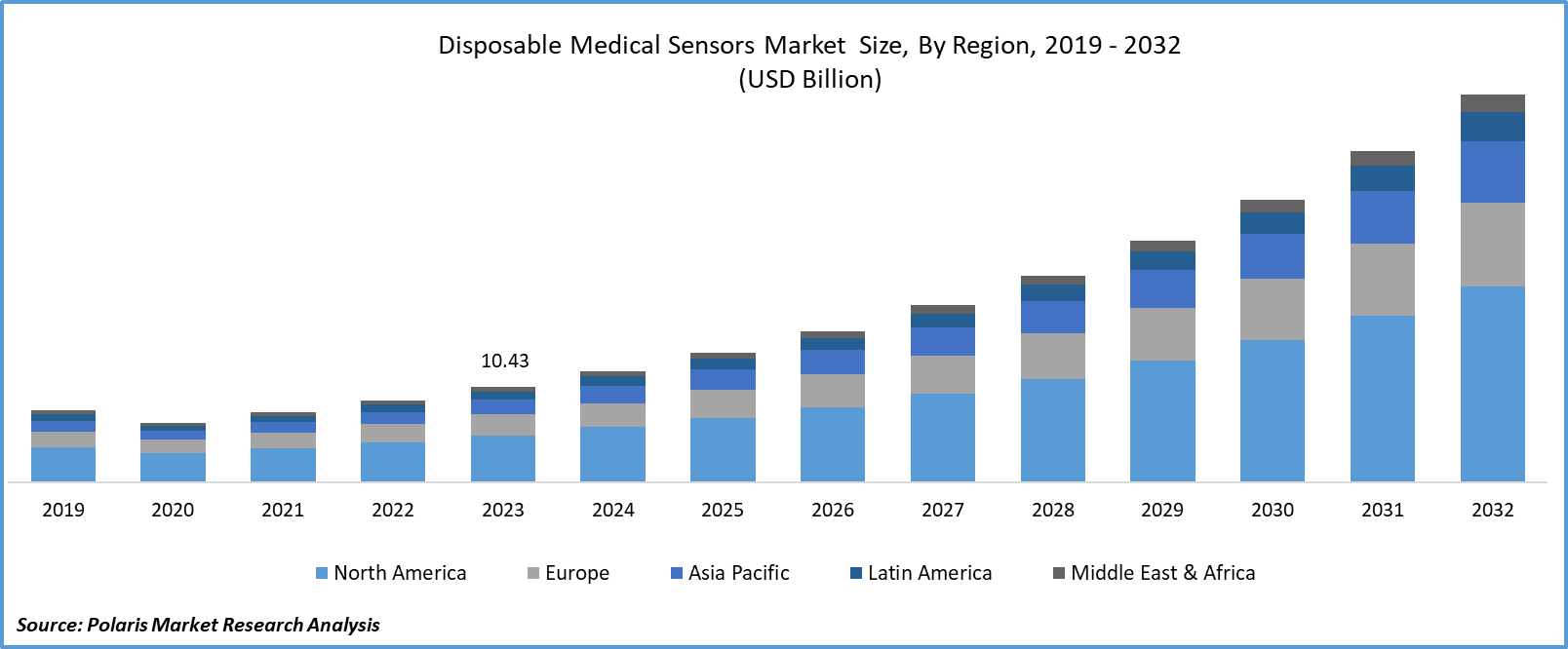

The global disposable medical sensors market was valued at USD 10.43 billion in 2023 and is expected to grow at a CAGR of 16.9% during the forecast period.

A disposable medical sensor is a specialized device used in the healthcare industry for monitoring, diagnosing, and managing various physiological parameters in patients. These sensors are designed for single-use applications and are typically discarded after use. They play a crucial role in collecting real-time data, enabling healthcare professionals to make informed decisions about patient care.

To Understand More About this Research: Request a Free Sample Report

The rising chronic disease prevalence around the world is expected to drive up the need for disposable medical sensors, according to Front. Public Health in 2020, NCDs (chronic non-communicable diseases) accounted for approximately 80% of deaths in China among adults aged 60, with the most common being ischemic heart disease, stroke, Chronic Obstructive Pulmonary Disease (COPD), and Type 2 diabetes.

Every year, the cost of health care rises. Factors contributing to this include increased demand for diagnostic devices, additional taxes on devices in certain regions, and increased regulations, all of which have an impact on the overall cost of production. The devices likely facilitate real-time monitoring of COVID-19 patients, allowing healthcare providers to track vital signs, respiratory parameters, and other relevant health metrics. It incorporates data analytics capabilities to analyze large sets of patient data, aiding in the identification of patterns, trends, and potential indicators of disease progression.

For instance, in April 2020, GE Healthcare unveiled a new software solution to assist physicians and healthcare organizations in the care of COVID-19 patients.

The company will bring its Virtual Care Mural Solution to the highly reputable and secure Microsoft Azure cloud platform, with the goal of providing hospitals with a thorough understanding of their ventilated patient population and assisting in the identification of patients in danger of deterioration. It is the most recent development in Microsoft and GE Healthcare's ongoing collaboration.

Furthermore, the small disposable sensor is a wearable patch for five days that can be connected to a scalable hub to survey multiple patients in different rooms. According to a study on coronavirus transmission in skilled nursing facilities, the asymptomatic rate of transmission was 56%, with 90% developing symptoms later. The symptom-based screening method may miss more than half of the people infected with a coronavirus. These obstacles can be overcome by the continuous data monitoring provided by disposable medical sensors.

The FDA granted Emergency Use Authorizations (EUAs) for a number of wearable and patient monitoring devices to improve patient monitoring and treatment options, as well as to reduce healthcare workers' exposure to SARS-CoV-2 during the pandemic. Wearable technology to help patients infected with the novel coronavirus (COVID-19) is expected to drive the disposable medical sensors market.

For Specific Research Requirements, Request for a Customized Research Report

Industry Dynamics

Growth Drivers

The Rise of Portable and Home-Based Healthcare Solutions

The trend toward delivery and portability of care at the patient's home or bedside is driving the development of next-generation diagnostic, therapeutic, display, and monitoring equipment that is more accurate, adaptable, and small. These platforms take a consumer-centric approach to healthcare, incorporating technological advancements such as electronic patient records, wireless internet-connected systems, and personalized wearables, all of which are expected to provide intelligent, convenient, and at-home healthcare.

The rapidly aging population, which is chronically ill and disabled, is the primary driver of the trend of portable, disposable medical sensor devices at home. As a result, manufacturers are likely to develop medical devices that patients can carry unobtrusively, even in public places. For example, Bio IntelliSense and Philips formed a strategic partnership in July 2020 to improve remote patient monitoring for at-risk patients. This made it easier for doctors to monitor patients who are being treated at home in hospitals, which resulted in demand for these sensors.

Report Segmentation

The market is primarily segmented based on product, type, application, and region.

|

By Product |

By Type |

By Application |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Analysis

The Biosensors Segment Accounted for the Largest Market Share in 2023

In 2023, the biosensors segment accounted for the largest disposable medical sensors market share. Biosensors, a type of sensor designed to detect analytes, utilize physiochemical detectors to collect biological components. These sensors detect and measure signals emitted by the analyte, and their connection to electronics allows the received signals to be displayed on the device. The market features a variety of biosensors, including electronic, amperometric, blood glucose, potentiometric, immune, conductometric, thermometric, fiber optic lactate, optical, and piezoelectric biosensors. Employed in both patient monitoring and diagnostics, biosensors are witnessing increased demand due to the growing need for rapid and accurate diagnostic kits. Ongoing innovations in the field are further fueling the demand for quicker diagnostic capabilities.

Furthermore, the image sensors segment is anticipated to exhibit a significant market share. Image sensors play a crucial role by converting light waves into signals to generate images, finding applications across a broad spectrum, particularly in the diagnostic sector. Medical imaging devices, such as endoscopy, and electronic imaging devices, like cameras, extensively utilize image sensors. Two common types of image sensors are charge-coupled devices (CCD) and complementary metal oxide semiconductors (CMOS). CMOS cameras are widely used in various medical applications, including minimally invasive surgery, X-ray imaging, endoscopy, and ocular surgery. Technological advancements and the increasing demand for higher resolution are expected to drive the growth of the image sensors market over the forecast period.

By Type Analysis

The Ingestible Sensors Segment Is Anticipated to Witness the Fastest CAGR During the Forecast Period

The ingestible sensors segment is anticipated to witness the fastest CAGR during the forecast period. Market growth is anticipated to be driven by increasing investments in Research and Development (R&D) and collaborative efforts among companies. In July 2021, Medtronic plc reported that the FDA had granted clearance for the use of two LINQ II insertable cardiac monitors featuring the AI AccuRhythm algorithms.

In the realm of medical technology, ingestible sensors play a pivotal role. These small chips, ingested in the form of capsules, detect any abnormalities in the body and transmit the data to an external device. Primarily, it is used in controlled drug delivery, endoscopy, and patient monitoring; ingestible sensors are gaining significance due to the rising prevalence of chronic diseases and the increasing demand for non-invasive diagnostic testing. Moreover, the results obtained through the use of ingestible sensors are noted for their enhanced accuracy, contributing to further market expansion.

Regional Analysis

North America Accounted for the Largest Revenue Share in 2023

In 2023, North America accounted for the largest revenue share due to a variety of factors, including its high healthcare spending, well-established healthcare infrastructure, the presence of monopolistic market players, and the rapid adoption of cutting-edge technologies. North America has the most developed disposable medical sensor industry in the world. The market is expected to be driven by the quick adoption of homecare devices and patient monitoring for ongoing, routine, and long-term patient monitoring, as well as the reduction in the frequency of hospital visits over the forecast period. Favorable reimbursement policies are expected to fuel further market growth in North America.

The rising prevalence of lifestyle-related health issues, accidents, and sports injuries are additional factors expected to drive market growth in North America. The rising demand for effective emergency care and the increasing use of mobile surgery centers are expected to drive the market during the forecast period.

The Asia-Pacific region is also poised to experience rapid growth in the disposable medical sensors market. The increased prevalence of cardiac disorders in APAC nations is driving the demand for disposable medical sensor equipment. Countries like China and India, facing high diabetes rates, are significantly impacted. In the South-East Asia (SEA) Region, an estimated 90 million people (20-79) had diabetes in 2021, projected to rise to 113 million and 152 million by 2030 and 2045, respectively. The burden of diabetes globally and in emerging nations, including India, is substantial and rising, primarily due to increasing rates of overweight/obesity and unhealthy lifestyles. In India, the number of people with diabetes is expected to increase from 77 million in 2019 to over 134 million by 2045. This surge in diabetes cases is driving the demand for home-based disposable medical sensors in the region, creating new market opportunities.

Key Market Players & Competitive Insight

The market is characterized by intense competition, with established players relying on advanced technology, high-quality products, and a strong brand image to drive revenue growth. These companies employ various strategies such as research and development, mergers and acquisitions, and technological innovations to expand their product portfolios and maintain a competitive edge in the market.

Some of the major players operating in the global market include:

- ACE Medical Devices

- Analog Devices, Inc.

- GE Healthcare

- Honeywell International Inc

- Philips N.V.

- Medtronic

- NXP Semiconductor

- Sensirion AG Switzerland

- Smith’s Medical

- SSI Electronics

- TE Connectivity

Recent Developments

- In June 2021, OMNIVISION Technologies, Inc. introduced the first 8-megapixel (MP) resolve sensors designed for both single-use and reusable Endoscopes. Furthermore, OmniVision has introduced groundbreaking imaging capabilities beyond the visible spectrum to the medical industry. This innovation is featured in the new OH08B medical-grade image sensor, marking a significant advancement that is expected to drive sales.

- In May 2021, Stryker acquired OrthoSensor, Inc., which is expected to support the company in gaining market share in musculoskeletal care and joint replacement sensor technology.

Disposable Medical Sensors Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 12.17 billion |

|

Revenue forecast in 2032 |

USD 42.41 billion |

|

CAGR |

16.9% from 2024 - 2032 |

|

Base year |

2023 |

|

Historical data |

2019 - 2022 |

|

Forecast period |

2024 - 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Product, By Type, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The global disposable medical sensors market size is expected to reach USD 42.41 billion by 2032

Key players in the market are SSI Electronics, ACE Medical Devices, Smith’s Medical, Koninklijke Philips N.V

North America contribute notably towards the global disposable medical sensors market

The global disposable medical sensors market is expected to grow at a CAGR of 16.9% during the forecast period.

The disposable medical sensors market report covering key segments are product, type, application and region.