DPU SmartNIC Market Size, Share, Trends, & Industry Analysis Report

By Type (Programmable SmartNICs, Fixed-Function SmartNICs), By Architecture, By Application, By End-User Industry, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5801

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

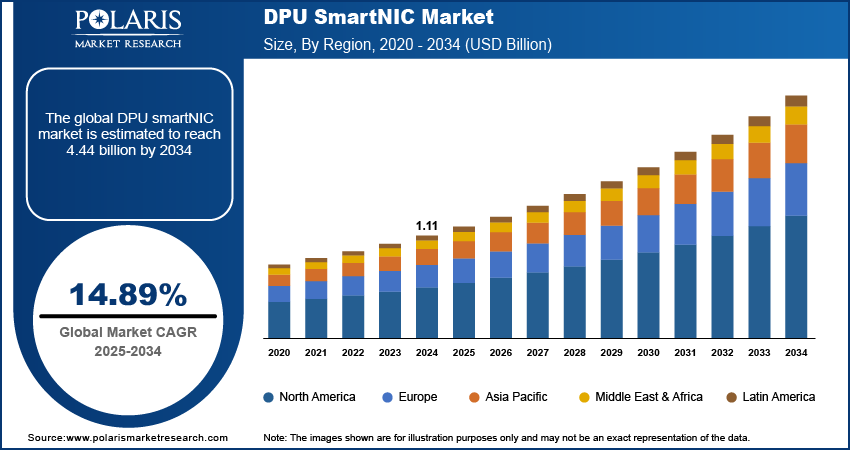

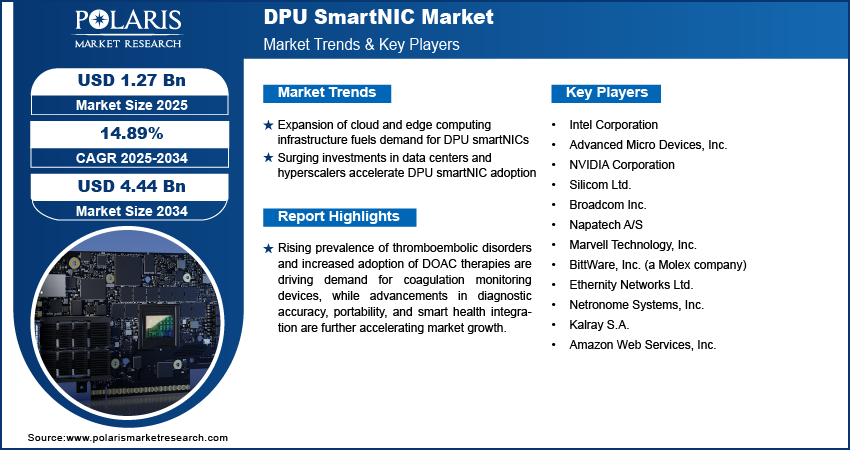

The global DPU smartNIC market size was valued at USD 1.11 billion in 2024, growing at a CAGR of 14.89% during 2025–2034. The growth is driven by, expansion of cloud and edge computing infrastructure and Surging Investments in Data Centers and Hyperscalers Accelerate DPU smartNIC Adoption.

DPU smartNIC is a programmable data processing unit integrated into a smart network interface card, designed to offload and accelerate complex networking, security, and storage tasks from the CPU. It serves as a shared resource for managing high-speed data traffic across cloud data centers, edge environments, and enterprise networks. It is a collaborative hardware-software platform that involves the execution, management, and exchange of virtualized functions and telemetry data throughout a network’s lifecycle from data ingress and processing to routing, security enforcement, and storage management. DPU smartNIC integrates packet processing, encryption, compression, and virtualization capabilities, enabling enterprises and service providers to reduce latency, optimize CPU usage, and enhance overall network performance.

DPU smartNIC is most extensively used in large-scale cloud data centers, telecom environments, and enterprise IT infrastructure, including hyperscale platforms, AI/ML workloads, and content delivery networks. This is due to their complex traffic patterns, massive data throughput, and stringent performance requirements, making DPU smartNIC’s offloading, workload isolation, and hardware-level acceleration capabilities essential.

To Understand More About this Research: Request a Free Sample Report

The DPU smartNIC market is witnessing significant growth, primarily driven by advancements in networking technologies such as 5G, Software-Defined Networking (SDN), and network functions virtualization (NFV). DPU smartNICs are reshaping network architecture by enabling inline encryption, packet inspection, load balancing, and virtualization offloading tasks from CPUs to energy-efficient, programmable hardware for faster, more dynamic network performance. For instance, in April 2025, the European Telecommunications Standards Institute (ETSI) unveiled a new NFV architecture, moving away from the traditional MANO framework to a platform-centric Telco Cloud structure optimized for cloud-native, modular, and scalable 6G telecom environments. Additionally, in September 2024, Somfy North America introduced SDN Connect, a digital network solution integrating RS485 motors, data hubs, PowerConnect panels, and Set Pro commissioning software demonstrating the growing commercial adoption of SDN in smart building infrastructure. These developments emphasize the need for DPU smartNIC solutions to support increasingly complex and automated network ecosystems.

Additionally, the rising demand for high-performance computing (HPC) is accelerating DPU smartNIC adoption, as these devices offload networking, storage, and security tasks from CPUs to boost system performance. Rapid growth in AI, data analytics, and simulation workloads is accelerating the adoption of DPU smartNICs to reduce latency and enhance efficiency across high-performance computing environments and modern data centers.

Industry Dynamics

Expansion of Cloud and Edge Computing Infrastructure Fuels Demand for DPU SmartNICs

The DPU smartNIC market is experiencing strong momentum due to the rapid expansion of cloud and edge computing infrastructure security solutions across the globe. For instance, in June 2024, Microsoft announced a USD 3.21 billion investment to scale its cloud and artificial intelligence infrastructure in Sweden over a two-year span. This strategic initiative underscores the accelerating demand for high-performance, scalable infrastructure to support growing workloads in Europe and beyond. Such developments highlights the role of DPU smartNICs in optimizing networking performance as hyperscalers and enterprises expand their digital infrastructure footprints globally.

DPU smartNICs address the growing need for low-latency, scalable networking by offloading traffic management, load balancing, and security processes from host CPUs to programmable, energy-efficient hardware. These capabilities are vital in managing the complex demands of real-time data processing, AI inference at the edge, and containerized workloads in cloud-native environments. The widespread adoption of hybrid and multi-cloud architectures is driving the demand for DPU smartNICs, which are becoming essential technologies for enhancing operational efficiency, scalable performance, and agile infrastructure in next-generation computing environments.

Surging Investments in Data Centers and Hyperscalers Accelerate DPU SmartNIC Adoption

The growth of data centers and hyperscalers is further propelling the DPU smartNIC market, as these environments require enhanced performance, greater power efficiency, and effective data flow management to operate at scale. For instance, in May 2025, Meta announced its intention to invest nearly USD 1 billion in developing a new data center as part of its long-term infrastructure expansion strategy. Earlier in the same year, the state government had approved an incentive deal with an unidentified company later linked to Meta for a data center project involving a cumulative investment of approximately USD 837 million. Also, in January 2025, NTT DATA’s Global Data Centers division committed over USD 10 billion toward expanding its data center operations worldwide by 2027, targeting over 370 MW of added capacity across ten new facilities. These large-scale capital investments reflect a rising global need for agile and energy-efficient data center operations, highlighting the critical role of DPU SmartNICs in enabling such efficiencies.

DPU SmartNICs are increasingly being deployed by cloud giants such as Amazon Web Services (AWS), Microsoft, and Google to improve network throughput, enable storage disaggregation, and shift processing loads from general-purpose CPUs. Offloading complex networking and security tasks, these devices reduce server load and improve efficiency in large-scale data centers handling huge amounts of data and many users at the same time. The integration of DPU smartNICs is increasing as data volumes surge and performance expectations rise, making them essential for maintaining scalability, responsiveness, and overall infrastructure optimization across global data center networks.

Segmental Insights

By Type Analysis

The global segmentation includes, programmable smartNIC and fixed-function smartNIC. The programmable smartNIC segment held the largest share of the market in 2024 due to their high flexibility offering, enabling developers to program or reprogram network functions based on dynamic workloads and evolving data center requirements. Growing network complexity is pushing hyperscale data centers and telecom providers to adopt programmable solutions that efficiently support diverse applications including software-defined anything (SDx), deep packet inspection (DPI), and traffic steering. The compatibility with containerized and microservices-based environments further enhances their appeal, propelling the dominant market position.

The fixed-function smartNICs segment is projected to grow at a robust pace in the coming years, owing to its cost-effectiveness, lower power consumption, and optimized design for specific networking tasks such as packet filtering, load balancing, and data encryption. These smartNICs come with pre-configured functionalities that eliminate the need for complex programmability, making them particularly attractive for enterprises seeking easy-to-deploy solutions with predictable performance. The simplicity and efficiency are specifically beneficial in edge computing environments, where limited space, power constraints, and the need for fast deployment make fixed-function devices a practical choice.

By Architecture Analysis

The global segmentation includes, arm-based DPUs, x86-based DPUs, and FPGA-based DPUs. The arm-based DPUs segment accounted for substantial market share in 2024, driven by a combination of energy-efficient processing, broad scalability, and optimized support for cloud-native environments. The rapid expansion of hyperscale cloud data centers, where operators prioritize performance-per-watt and high-density computing to reduce operational costs is further driving the growth. According to data from the Institute of Electrical and Electronics Engineers and Synergy Research Group, As of 2026, the US led globally in hyperscale data centers, hosting nearly 40% of operational sites and contributing around 50% of worldwide capacity. Also, in India, the data center capacity stood at 637 MW in 2022. By the end of 2025, the country is projected to witness the addition of 45 new data centers spanning 13 million square feet, contributing to a capacity increase of 1,015 MW. Additionally, the growing demand for virtualized network functions (VNFs), containerized workloads, and edge computing applications is further fueling the adoption of Arm-based DPUs across both centralized and distributed computing environments.

The FPGA-based DPU segment is projected to grow at a significant pace during the assessment phase, due to the increasing enterprise demand for ultra-low-latency networking, workload acceleration, and real-time analytics. The escalating complexity of cybersecurity threats and the need for real-time mitigation solutions, is significantly accelerating the growth. Cybersecurity Ventures projected that global cybercrime costs would increase by 15% annually over the next five years, reaching approximately USD 10.5 trillion per year by the end of 2025. Also, the deployment of 5G networks and edge computing, where network slicing and packet processing must be dynamically optimized at the hardware level.

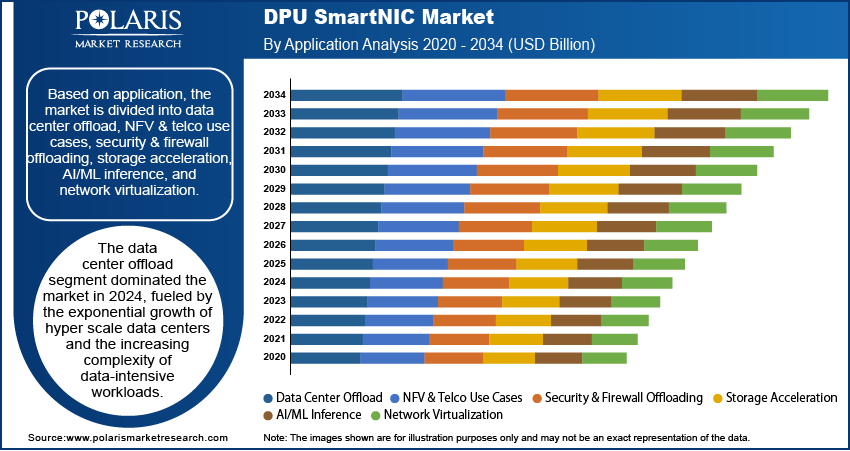

By Application Analysis

The global segmentation includes, data center offload, NFV & telco use cases, security & firewall offloading, storage acceleration, AI/ML inference, and network virtualization. The data center offload segment dominated the market in 2024, fueled by the exponential growth of hyperscale data centers and the increasing complexity of data-intensive workloads. Modern data centers are under pressure to deliver higher performance while optimizing power and operational efficiency. This has driven strong adoption of DPUs to offload networking, storage, and security-related tasks such as deep packet inspection, encryption, flow control, and protocol processing from host CPUs.

The AI/ML inference segment is estimated to hold a substantial market share in 2034 driven by the increasing deployment of real-time, edge-level AI processing. As organizations shift AI workloads closer to the data source, particularly in applications such as autonomous driving, smart surveillance, IoT analytics, and predictive maintenance, the need for localized, low-latency inference is intensifying. DPU smartNICs provide built-in acceleration and can process AI inference workloads directly on the network interface, minimizing reliance on central CPUs or GPUs and reducing decision latency. These trends, coupled with ongoing advancements in silicon acceleration and AI model optimization, are driving rapid growth in this segment. For instance, in June, 2025, AMD unveiled its comprehensive “Open AI Ecosystem” vision at the Advancing AI event, introducing the high-performance Instinct MI350 Series GPUs, next-gen MI400 chip roadmap, Helios rack-scale AI infrastructure, and ROCm 7 open-source software stack.

By End-User Industry Analysis

The global segmentation includes, IT & telecom, cloud service providers, financial services, healthcare, and government & defense The cloud service providers segment is projected to grow at highest CAGR during the forecast period driven by the growing reliance on hyperscale cloud infrastructures and the continued surge in demand for compute-heavy applications such as AI/ML workloads, real-time analytics, and high-speed virtualization. Industry leaders such as Amazon Web Services, Microsoft Azure, and Google Cloud are increasingly integrating DPU SmartNICs into their data center architecture to streamline packet processing, enforce zero-trust security policies, and manage massive volumes of network traffic across distributed environments. For instance, in March 2022, NVIDIA launched its Spectrum‑4 high‑performance Ethernet platform for data centers, combining the Spectrum‑4 switch, ConnectX‑7 smartNIC, BlueField‑3 DPU, and DOCA software to deliver end‑to‑end 400 Gbps networking and nanosecond‑level timing precision.

The financial services segment is estimated to hold a significant market share in 2034, driven by the industry’s demand for ultra-low latency and secure, high-performance data handling. Financial institutions rely heavily on real-time data processing for algorithmic trading, risk assessment, and regulatory compliance, where even microsecond-level latency can put financial implications. Also, the rise of digital banking, real-time payment systems, and fintech innovations including blockchain-based platforms further accelerating the need for secure, scalable, and latency-optimized network infrastructure. According to the Australian Banking Association, a new report highlights the ongoing digital transformation in the country's banking sector, with 99.1% of all transactions now being conducted through digital channels. As per the India Brand Equity Foundation, as of July 2024, a total of 602 banks in India were actively utilizing the Unified Payments Interface (UPI). During this period, digital transactions reached 15.08 billion in volume, amounting to a total value of approximately USD 25.27 billion.

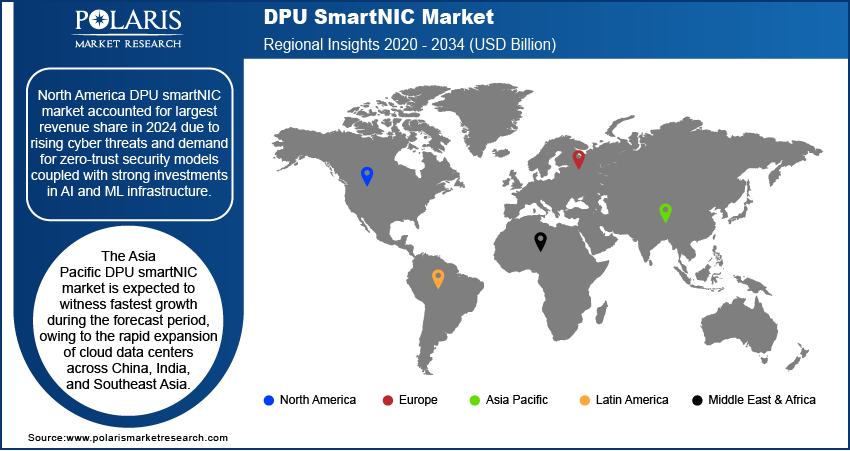

Regional Analysis

North America DPU smartNIC market accounted for largest revenue share in 2024 due to rising cyber threats and demand for zero-trust security models coupled with strong investments in AI and ML infrastructure. Enterprises across the US and Canada are modernizing data centers to meet escalating workloads, as cyber threats become more complex. DPU smartNICs enable offloading of security, networking, and storage tasks, helping hyperscale operators enhance server efficiency while securing data flows across hybrid and multi-cloud environments. Furthermore, increasing AI/ML training and inferencing workloads require high-performance, low-latency interconnects, boosting DPU smartNICs adoption as critical accelerators for next-generation compute environments.

US DPU SmartNIC Market Insight

The US, in particular, dominated the regional market due the country’s high concentration of hyperscale data centers. Major cloud providers such as Amazon Web Services, Microsoft Azure, and Google Cloud are at the forefront of smartNIC deployment, aiming to improve network performance, reduce CPU overhead, and scale security operations. As of 2024, the US hosts over 5,000 data centers across all 51 states, making it the largest data center market globally, accounting for approximately 45% of the world’s operational data centers. This vast infrastructure base, coupled with rising enterprise cloud adoption, continues to fuel significant demand for DPU smartNIC in the country.

Europe DPU SmartNIC Market

The Europe DPU smartNIC market is projected to grow significantly. This growth is driven by increasing demand for secure, high-speed network infrastructure and the rise of sovereign cloud initiatives across the region. Countries such as Germany, France, and the Netherlands are taking strategic steps to boost their digital sovereignty, pushing organizations to adopt DPU-enabled smartNICs that support localized data processing and reinforce compliance with regional data protection regulations such as the General Data Protection Regulation (GDPR). This has led to growing smartNIC deployment in public and private cloud infrastructures where data residency, processing speed, and advanced workload isolation are critical.

Moreover, the region’s broader digital transformation, particularly across key sectors such as manufacturing, finance, and healthcare, is significantly accelerating the market growth. Enterprises in Western and Northern Europe are integrating smartNICs into their data centers to support low-latency operations, accelerate virtual machine and container workloads, and optimize resource utilization. Additionally, the push for green data centers and energy-efficient processing solutions is also fueling the adoption of DPU smartNIC, as operators seek to meet Europe’s ambitious sustainability and digital decarbonization goals.

Asia Pacific DPU SmartNIC Market Overview

The Asia Pacific DPU smartNIC market is expected to witness fastest growth during the forecast period, owing to the rapid expansion of cloud data centers across China, India, and Southeast Asia. Regional hyperscalers such as Alibaba Cloud, Tencent Cloud, and Reliance Jio are scaling their infrastructure aggressively, deploying smartNICs to manage soaring workloads, reduce latency, and improve throughput. According to India Brand Equity Foundation, India’s data center capacity is projected to exceed 4,500 megawatts (MW) by 2030, driven by investments totaling USD 25 billion.

Moreover, the proliferation of 5G networks and edge computing deployments is accelerating smartNIC demand across Asia Pacific. Countries such as South Korea and Japan are leading large-scale 5G rollouts, creating the need for DPUs to enable efficient network slicing, packet processing, and edge workload acceleration. For example, in April 2022, the Japanese government announced that 99% of the population is expected to be covered by 5G services by fiscal year 2030. These regional developments highlight the urgency for scalable and secure network infrastructure in the region, thus driving the growth of the market.

Key Players & Competitive Analysis Report

The DPU smartNIC market is highly competitive, marked by aggressive innovation and strategic initiatives undertaken by leading players to gain a technological edge and strengthen their market presence. Companies are consistently investing in expanding their product lines, enhancing processing performance, and delivering scalable solutions that meet the growing demand for virtualization, network acceleration, and workload offloading. Strategic partnerships, mergers and acquisitions (M&A), and collaborations with hyperscalers and telecom providers are prevalent across the industry as firms seek to diversify applications across cloud, edge, and enterprise environments. Additionally, the integration of emerging technologies such as artificial intelligence (AI), deep learning, hardware-level encryption, and dynamic telemetry features is intensifying competition, enabling vendors to deliver intelligent, programmable, and secure smartNIC platforms tailored for next-generation data center needs.

Prominent companies in the DPU smartNIC market include Intel Corporation, Advanced Micro Devices, Inc. (AMD), NVIDIA Corporation, Silicom Ltd., Broadcom Inc., Napatech A/S, Marvell Technology, Inc., BittWare, Inc. (a Molex company), Ethernity Networks Ltd., Netronome Systems, Inc., Kalray S.A., and Amazon Web Services, Inc.

Key Players

- Intel Corporation

- Advanced Micro Devices, Inc.

- NVIDIA Corporation

- Silicom Ltd.

- Broadcom Inc.

- Napatech A/S

- Marvell Technology, Inc.

- BittWare, Inc. (a Molex company)

- Ethernity Networks Ltd.

- Netronome Systems, Inc.

- Kalray S.A.

- Amazon Web Services, Inc.

Industry Developments

December 2024: Lanner Electronics launched N2S-MBF301 smartNIC, powered by NVIDIA BlueField‑3 DPU and Mellanox ConnectX‑7 chipset, at RSA Conference 2025.

June 2022: The Linux Foundation launched the Open Programmable Infrastructure (OPI) project to standardize DPU/SmartNIC APIs and software stacks, aiming to simplify integration of DPUs across data centers.

October 2020: Intel unveiled its next-generation FPGA-based smartNIC platforms including the smartNIC C5000X and Silicom N5010 to enhance networking and storage acceleration for cloud and 5G applications.

DPU SmartNIC Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Programmable SmartNIC

- Fixed-Function SmartNIC

By Architecture Outlook (Revenue, USD Billion, 2020–2034)

- Arm-based DPUs

- x86-based DPUs

- FPGA-based DPUs

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Data Center Offload

- NFV & Telco Use Cases

- Security & Firewall Offloading

- Storage Acceleration

- AI/ML Inference

- Network Virtualization

By End-User Industry Outlook (Revenue, USD Billion, 2020–2034)

- IT & Telecom

- Cloud Service Providers

- Financial Services

- Healthcare

- Government & Defense

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

DPU SmartNIC Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.11 Billion |

|

Market Size in 2025 |

USD 1.27 Billion |

|

Revenue Forecast by 2034 |

USD 4.44 Billion |

|

CAGR |

14.89% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1.11 billion in 2024 and is projected to grow to USD 4.44 billion by 2034.

The global market is projected to register a CAGR of 14.89% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are Intel Corporation, Advanced Micro Devices, Inc. (AMD), NVIDIA Corporation, Silicom Ltd., Broadcom Inc., Napatech A/S, Marvell Technology, Inc.

The programmable smartNIC segment dominated the market share in 2024.

The arm-based DPUs segment accounted for substantial market share in 2024.