Drag Reducing Agent Market Share, Size, Trends, Industry Analysis Report

By Product Type (Polymer, Surfactant, Suspension); By Application; By End Use; By Region; Segment Forecast, 2023 - 2032

- Published Date:Oct-2023

- Pages: 118

- Format: PDF

- Report ID: PM3860

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

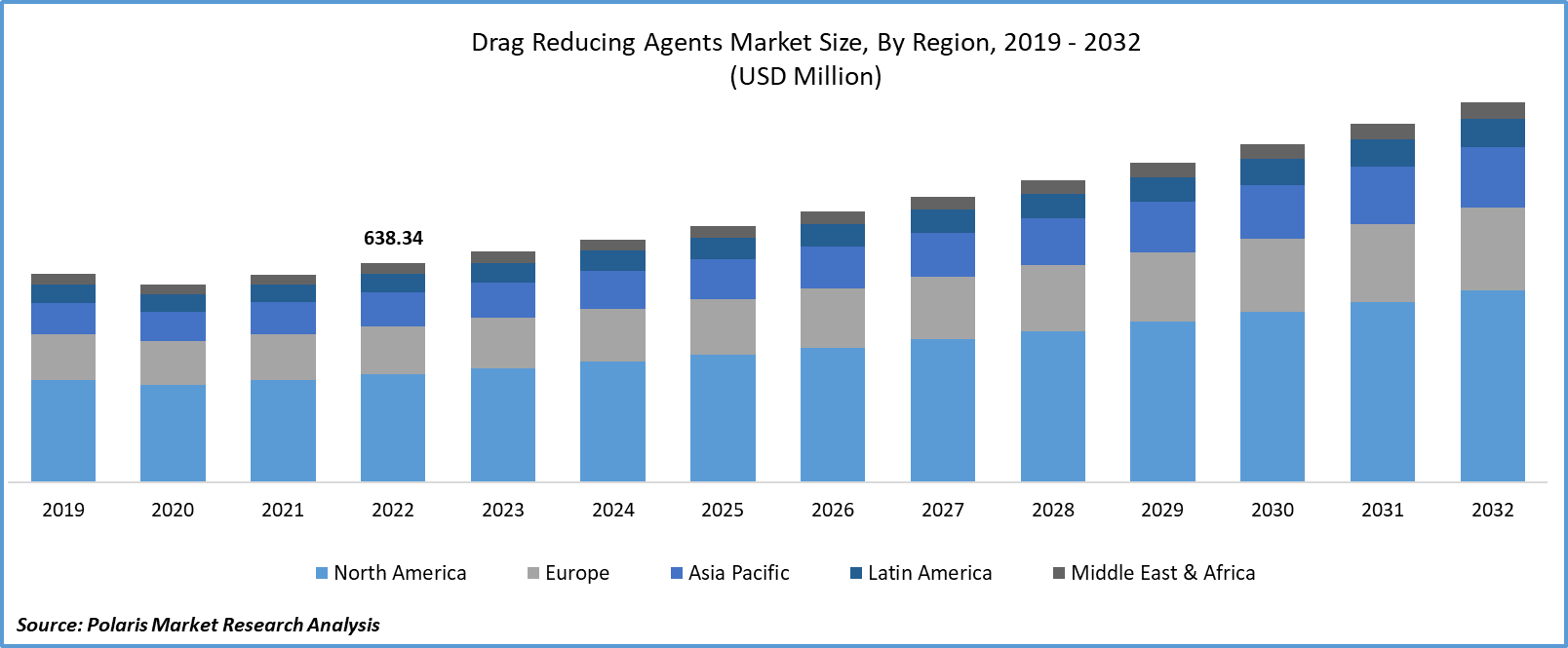

The global drag reducing agent market was valued at USD 638.34 million in 2022 and is expected to grow at a CAGR of 5.7% during the forecast period.

Drag-reducing agents (DRA), also known as Drug-reducing polymers. They are used in pipeline operations as they reduce turbulence in a pipe. Mostly, they are used in petroleum pipelines due to their ability to increase pipeline capacity by increasing laminar flow and reducing turbulence. Petrochemicals are quickly overtaking transportation as the main source of world oil demand.

To Understand More About this Research: Request a Free Sample Report

According to the International Energy Agency, the industrial sector will need more oil demand by 2030, ahead of the transportation sector. This is enhancing the government's initiatives to promote efficiency in the transportation of fluids to fulfill demand, driving the need for drag-reducing agents. Furthermore, the requirement for effective feedstock transportation becomes crucial as the demand for petrochemical products such as plastics, chemicals, and fertilizers rises. DRAs maximize fluid flow in pipelines, ensuring that raw materials obtained from oil effectively reach petrochemical industrial facilities.

For Specific Research Requirements: Request for Customized Report

Industry Dynamics

Growth Drivers

The rising need for efficient transportation of petrochemicals

Drag-reducing agent reduces frictional pressure loss during fluid flow in a conduit or pipeline. Reducing the amount of turbulent motion in the flow reduces pressure loss. By employing DRA, it is possible to increase flow and use the same amount of energy or to lower pressure drop while maintaining the same rate of fluid flow in pipes. In petroleum production systems, increasing flow capacity and pumping rates is difficult because of drag or frictional losses. In order to reduce drag and enhance the fluid's capacity to flow or pump at the rates needed to reach the desired flow rate or improve transportation efficiency, drag-reducing agents are typically added to the fluid. Recent advancements in nanotechnology have widened the use of DRA in oil field systems. The rising need for efficient transportation of petrochemicals is creating new growth opportunities for drag-reducing agents in the forecast period.

Report Segmentation

The market is primarily segmented based on product type, application, end use, and region.

|

By Product Type |

By Application |

By End Use |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Type Analysis

Polymer segment is expected to witness the fastest growth over the estimated period

The polymer segment is expected to have faster growth in the drag reducing agent market. The efficient reduction of friction and turbulence in pipelines is a property of polymers. The change in the liquid flow is making it possible for the fuels to travel more smoothly and effectively. DRAs are very sought-after for fluid transportation because of the energy savings and greater throughput that result from the decrease in resistance.

Furthermore, polymers can be designed to accommodate different fluid types and pipeline conditions. They can be customized to handle issues in several sectors, including chemical processing, water transportation, and the oil and gas industry. Due to their adaptability, polymer-based DRAs are useful in a variety of fields. Moreover, the effectiveness of pipeline operations can be greatly increased by the employment of polymer-based DRAs. These agents assist in maintaining a constant flow rate even over long distances by lowering the pressure drop brought on by friction, which leads to a decrease in energy consumption and general operating expenses. These factors are collectively driving the demand for drag-reducing agents in the future.

By Application Analysis

Crude Oil segment registered the largest market share during the forecast period

Crude Oil segment held the largest market share for the market in the study period. Pipelines are frequently used to move crude oil over long distances from extraction locations to refineries or distribution centers. By lowering friction and turbulence, DRAs improve the flow of crude oil, ensuring that it gets to its destination more quickly. Additionally, DRAs reduce the amount of energy needed to transport crude oil through pipelines. They allow oil to flow more smoothly by reducing frictional resistance, which lowers the energy requirement for fluid transmission.

In addition, DRAs allow pipelines to carry more crude oil per unit of space. This is especially crucial in areas where meeting demand may be constrained by pipeline capacity. DRAs enable pipelines to move more crude oil while minimizing the need for costly infrastructure alterations. Moreover, DRAs aid in preserving a steady flow of crude oil. This is necessary to keep refinery operations running smoothly and to provide a consistent flow of crude oil to subsequent processes. These factors are fuelling the demand for drag-reducing agents in the coming years.

By End Use Analysis

Oil & Gas segment is expected to hold the larger revenue share over the forecasted years

The oil & gas segment is projected to witness a larger revenue share in the coming years. Liquids like crude oil and processed products must be transported over great distances through pipelines for the oil and gas industry to function effectively. By minimizing turbulence and friction, DRAs increase flow efficiency, ensuring that these fluids move easily and more effectively to their destinations.

Furthermore, these agents assist in reducing the amount of energy needed to pump fluids. DRAs let fluids move more freely by reducing resistance, which leads to less energy being used during transportation. In addition, DRAs protect pipeline integrity by minimizing friction and turbulence-related wear and tear. This drives an increase in pipeline lifespan and lower maintenance costs, fuelling the demand for drag-reducing agents in the oil and gas sector in the future.

By Regional Analysis

APAC witnessed the highest growth rate in the study period

APAC is projected to experience a higher growth rate for the market. The presence of developing countries in this region is expanding the drag-reducing agent market. Countries like India are focusing more on self-reliance. Initiatives in India, primarily Atma Nirbhar Bharat, fueled the production process to meet the demand for goods in the country. Indian Oil Corporation has partnered with Dorf Ketal Chemicals to meet the demand for energy in the country by utilizing drag-reducing agents produced by Dorf Ketal Chemicals. These are specifically formulated polymers that improve pipelines' capacity to transport hydrocarbons (crude oil and finished fuels), helping the nation better fulfill its rising energy needs.

When used, it helps the operator of the hydrocarbon pipeline carry more than 30% of the intended capacity while minimizing the expenses of establishing new pipes, which causes delays, expensive land acquisition, and an increase in the overall cost of installing pumping stations. As the demand for energy increases in the country, there will be an increase in the need for drag-reducing agents for oil pipelines in this region.

North America is expected to have a larger revenue share of the market in the forecast period. Growing natural gas production in this region is driving the demand for drag-reducing agents. According to the Canada Energy Regulator, with an average daily production of 17.9 billion cubic feet (Bcf/d) in November 2022, western Canadian natural gas production reached an all-time high. This demonstrates the rising need for natural gas globally. To meet this demand, countries are showing interest in adopting drag-reducing agents, which reduce friction and turbulence in pipelines. It increases the flow of gas, ensuring smooth and secure natural gas transportation. As countries realize the potential benefits of drag-reducing agents, there will be a rise in the demand for drag-reducing agents in the market.

Competitive Insight

The Drag Reducing Agent Market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include

- Lubrizol Specialty

- Baker Hughes

- Oil Flux Americas Flowchem

- Innospec

- NuGenTec

- Sino Oil King Shine Chemical

Recent Developments

- In October 2022, Infinum & Entegris agreed to acquire the pipeline and industrial materials division of Infinum by Entegris. It is part of specialty chemicals and engineered materials that include a wide range of drag-reducing agents for pipeline operations.

- In January 2022, Innospec Oil-field Services introduced a water-based friction reducer, “AquaBourne.” It is for FR polymers that are purposefully devoid of any oil or surfactants.

Drag Reducing Agent Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 672.30 million |

|

Revenue forecast in 2032 |

USD 1,109.10 million |

|

CAGR |

5.7% from 2023 - 2032 |

|

Base year |

2022 |

|

Historical data |

2019 - 2021 |

|

Forecast period |

2023 - 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments covered |

By Product Type, By Application, By End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |