Drone Warfare Market Share, Size, Trends, Industry Analysis Report

By Capability; By Mode of Operation (Autonomous and Semi-autonomous); By Application; By Region; Segment Forecast, 2024 - 2032

- Published Date:Apr-2024

- Pages: 117

- Format: PDF

- Report ID: PM4832

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

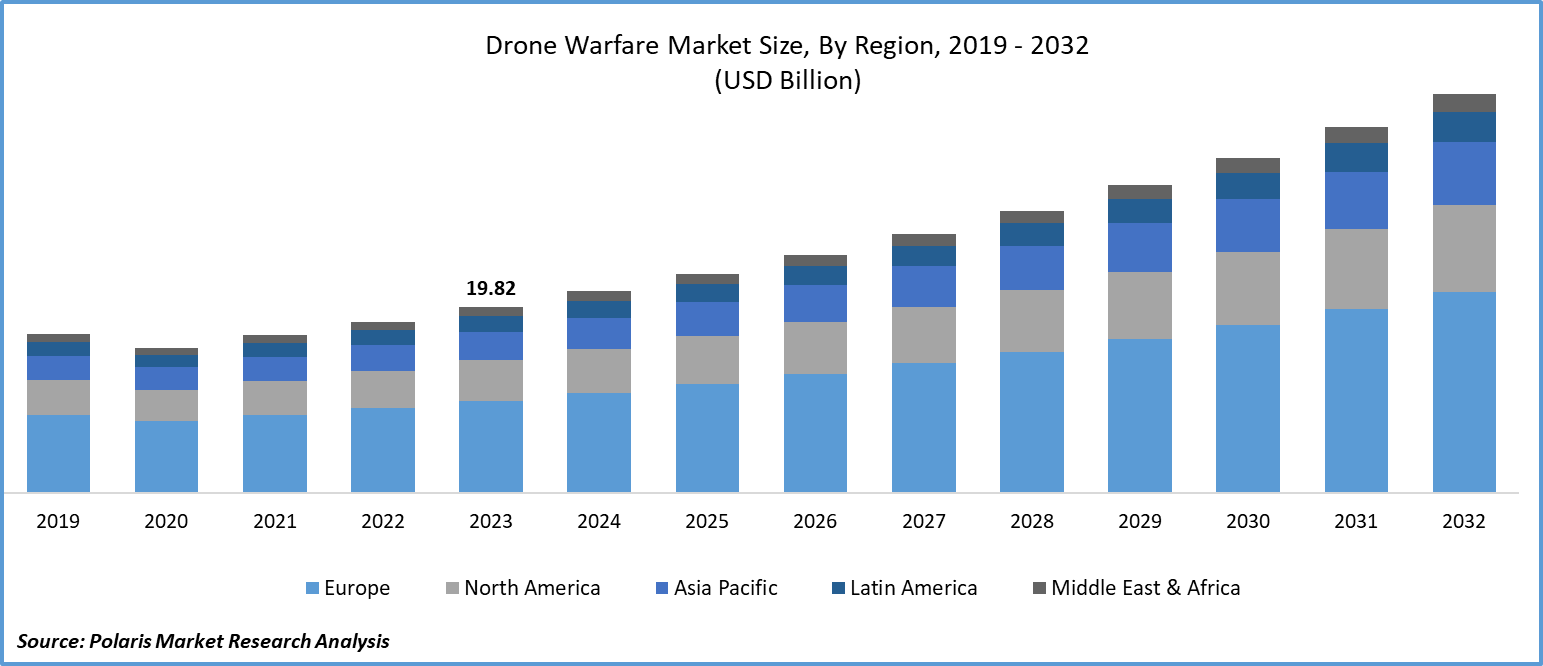

- Global drone warfare market size was valued at USD 19.82 billion in 2023.

- The market is anticipated to grow from USD 21.53 billion in 2024 to USD 42.52 billion by 2032, exhibiting the CAGR of 8.9% during the forecast period.

Market Introduction

Drones offer military forces real-time intelligence, surveillance, and reconnaissance capabilities, significantly improving their ability to gather information and monitor activities in diverse environments. Providing an aerial perspective, drones enable safer assessment and analysis of complex situations, enhancing decision-making and operational planning. With advancements like improved sensors and longer flight times, drones offer enhanced effectiveness in providing actionable intelligence to military commanders. As military operations become increasingly dynamic, the demand for drones to enhance situational awareness continues to rise, fueling further innovation and investment in the market.

In addition, several countries are investing in drone warfare owing to military modernization and rising incidences of terrorism.

To Understand More About this Research:Request a Free Sample Report

- For instance, in February 2024, the UK initiated its military drone strategy, supported by $5.7 billion in funding. Over the next ten years, the UK plans to allocate these funds to the acquisition of new military drones, aiming to equip its armed forces with cutting-edge unmanned systems for air, land, and sea operations.

Technological advancements are driving significant transformations in the market, reshaping military operations worldwide. Breakthroughs in unmanned aerial vehicle technology have led to the development of highly advanced drones with superior capabilities. Progress in propulsion systems, materials, and miniaturization has resulted in smaller, faster, and more agile drones. Moreover, advancements in sensor technology, artificial intelligence, and communication systems enable drones to gather and process vast amounts of data in real time, enhancing situational awareness. Additionally, developments in autonomy and swarm intelligence have facilitated the coordination of complex missions by drone swarms.

Industry Growth Drivers

Increasing military expenditure is projected to spur product demand.

The surge in global military spending is a significant driver of the market. Nations are increasingly investing in advanced defense technologies, with drones playing a pivotal role in modern warfare strategies. Drones offer advantages in surveillance, reconnaissance, and targeted strikes while minimizing risks to soldiers. As military forces aim to maintain dominance in contested areas and counter evolving threats, there's a growing demand for sophisticated drone systems with advanced sensors and autonomous capabilities. With escalating geopolitical tensions, governments are allocating substantial budgets to develop and procure drone systems, fueling growth in the drone warfare market.

Growing demand for counterterrorism operations is expected to drive drone warfare market growth.

The rise in demand for counterterrorism operations is propelling the expansion of the drone warfare market. Drones offer advantages, including risk-free intelligence gathering in hostile areas and precise strikes with minimal collateral damage. Technological advancements such as improved autonomy and longer flight times enhance their effectiveness in counterterrorism efforts. Governments and defense agencies worldwide are investing heavily in drone development to maintain strategic superiority against emerging threats.

Industry Challenges

Cybersecurity risks are likely to impede drone warfare market growth.

Cybersecurity risks present a significant constraint on the expansion of the drone warfare market. As drones become more integrated with digital networks, they become susceptible to cyberattacks and hacking attempts. Malicious actors can exploit vulnerabilities in drone software and communication systems to gain unauthorized access or disrupt operations. The use of drones for critical military missions necessitates robust cybersecurity measures to safeguard sensitive data and prevent breaches.

Report Segmentation

The drone warfare market analysis is primarily segmented based on capability, mode of operation, application, and region.

|

By Capability |

By Mode of Operation |

By Application |

By Region |

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Mode of Operation Analysis

The semi-autonomous segment held a significant drone warfare market share in 2023

The semi-autonomous segment held a significant drone warfare market share in 2023. It provides enhanced control, blending manual oversight with automated functions for improved mission execution. Its operational flexibility enables it to perform a wide array of tasks, from reconnaissance to targeted strikes, meeting diverse mission requirements. Semi-autonomous features enhance safety by reducing human error and ensuring precise mission execution. Moreover, it enhances efficiency by automating routine tasks, allowing operators to focus on higher-level decision-making. Additionally, its scalability enables deployment in various operational scenarios, while its cost-effectiveness optimizes resource utilization, reducing operational expenses for military forces.

By Application Analysis

The intelligence, surveillance, and reconnaissance segment held a significant drone warfare market share in 2023

The intelligence, surveillance, and reconnaissance (ISR) segment held a significant drone warfare market share in 2023. ISR capabilities are strategically important for military operations, driving demand for drones equipped with advanced sensors and cameras. These drones provide real-time intelligence, offering commanders critical information for informed decision-making and mission planning. With applications including border security, counterterrorism, and reconnaissance, ISR drones see widespread adoption. They streamline surveillance processes, improving operational efficiency and reducing reliance on manned missions.

Regional Insights

Europe is expected to experience significant growth during the drone warfare market forecast period.

Europe is expected to experience growth during the drone warfare market forecast period. Increasing defense budgets enable investment in advanced military technologies such as drones. Rising security threats drive European nations to bolster their military capabilities, leading to greater adoption of drones for surveillance and reconnaissance. The region's strong focus on technological innovation fosters development and competitiveness in drone technology. Moreover, collaboration among European countries on defense projects and modernization efforts further stimulates market expansion in the region.

In 2023, the North American region accounted for a significant drone warfare market share. With leading drone manufacturers and technological innovators, the region maintains a competitive edge. Its substantial defense budget allows for investment in drone technology development and deployment. The presence of research institutions and academic centers dedicated to drone technology in the region drives innovation. Moreover, strategic alliances between North American companies and government agencies or defense contractors further solidify the region's dominance in the drone warfare market.

Key Market Players & Competitive Insights

The drone warfare market involves diverse players, and the expected surge of newcomers is poised to intensify rivalry. Dominant market players continuously enhance their technologies to maintain a competitive advantage, emphasizing efficacy, reliability, and security. These firms prioritize strategic actions like establishing alliances, improving product portfolios, and participating in collaborative endeavors. They aim to outperform competitors within the industry and secure a significant drone warfare market share.

Some of the major players operating in the global drone warfare market include:

- Airbus SE

- BAE Systems plc

- Boeing Company

- Elbit Systems Ltd.

- FLIR Systems, Inc.

- General Atomics Aeronautical Systems, Inc.

- General Dynamics Corporation

- Israel Aerospace Industries (IAI)

- Kratos Defense & Security Solutions, Inc.

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Raytheon Technologies Corporation

- Textron Inc.

- Thales Group

Recent Developments

- In November 2023, Mac Jee unveiled a prototype drone named Anshar. Referred to as loitering munitions, these drones can linger in the air until a remote operator commands them to collide with a target.

- In February 2024, the sale of 31 MQ-9B Sea Guardian drones to India was sanctioned by the US State Department. This acquisition will enhance India's capacity to address present and future challenges by facilitating unmanned surveillance and reconnaissance missions in maritime operational zones.

- In December 2023, Johnnette Technologies was awarded a contract to deliver their premier tactical fixed-wing drone, the Johnnette JF-2, to the Indian Army for conducting border surveillance.

Report Coverage

The drone warfare market report emphasizes key regions across the globe to help users better understand the product. It also provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis of various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, capability, modes of operation, applications, and their futuristic growth opportunities.

Drone Warfare Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 21.53 billion |

|

Revenue Forecast in 2032 |

USD 42.52 billion |

|

CAGR |

8.9% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global drone warfare market size is expected to reach USD 42.52 billion by 2032

Key players in the market are Airbus SE, BAE Systems plc, Boeing Company, Elbit Systems Ltd., FLIR Systems, Inc

Europe contribute notably towards the global Drone Warfare Market

Global drone warfare market exhibiting the CAGR of 8.9% during the forecast period.

The Drone Warfare Market report covering key segments are capability, mode of operation, application, and region.