Dynamic Positioning Systems Market Size, Share, Trends, Industry Analysis Report

By Equipment Class, By System, By Fit, By Ship Type, and By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM6312

- Base Year: 2024

- Historical Data: 2020-2023

Overview

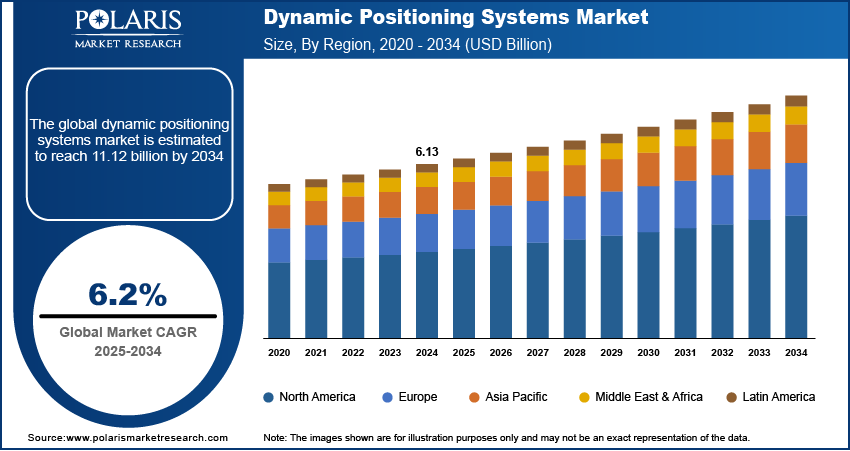

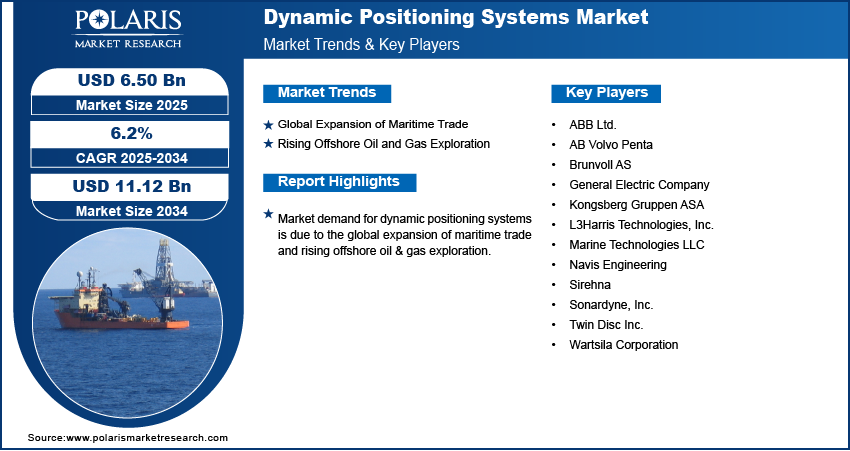

The dynamic positioning systems market size was valued at USD 6.13 billion in 2024, growing at a CAGR of 6.2% from 2025 to 2034. The market is driven by offshore energy growth, autonomous vessel demand, strict safety norms, and advancements in AI, IoT and propulsion.

Key Insights

- Thruster & propulsion systems led the market in 2024.

- Defense vessels segment to grow rapidly with rising naval modernization.

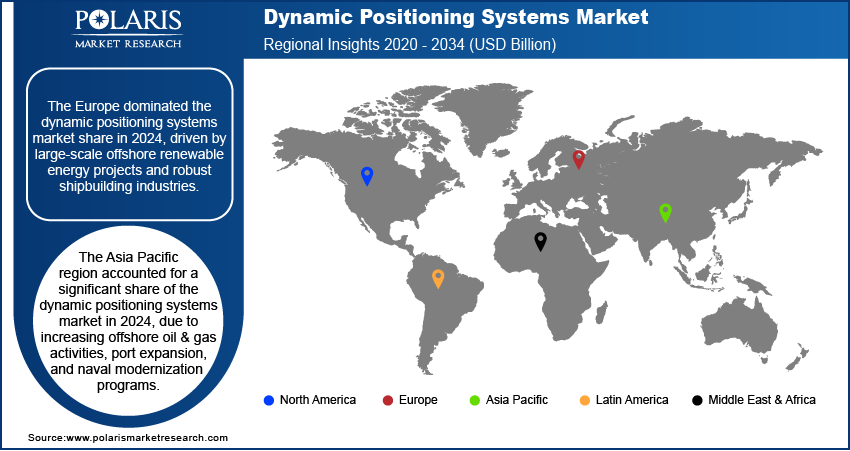

- Europe dominated the dynamic positioning systems market in 2024.

- Germany market rising with offshore renewable investments and shipbuilding strength.

- Asia Pacific to grow at fastest rate, driven by offshore oil & gas and deep-sea projects.

- China and Japan fueling growth through shipbuilding, tech adoption, and offshore energy.

Industry Dynamics

- Expansion of maritime trade worldwide is fueling the market growth due to the increasing need for reliable vessel navigation, safe cargo transportation, and efficient port operations.

- Rising exploration of oil and gas worldwide is fueling the market growth due to high demand for offshore drilling rigs, floating production units, and support vessels equipped with advanced dynamic positioning systems.

- The shift toward autonomous and highly automated vessels such as artificial intelligence integration is expected to create lucrative opportunities during the forecast period.

- The high upfront cost of dynamic positioning systems is hindering the market growth.

Market Statistics

- 2024 Market Size: USD 6.13 Billion

- 2034 Projected Market Size: USD 11.12 Billion

- CAGR (2025–2034): 6.2%

- Europe: Largest Market Share

Dynamic positioning systems (DPS) are computer-regulated systems that maintain vessels in position with propellers and thrusters. They play a critical role in offshore drilling, subsea construction, and cargo handling for cases where anchoring is not feasible. DPS find extensive application in oil and gas platforms, wind farms, research ships, and warships, providing secure and efficient maritime operations. Demand is increasing due to increased offshore exploration, renewable projects, and maritime trade growth requiring accurate positioning.

Increasing defense expenditure is also increasing demand for DPS in naval operations and fleet modernization. Warships, carriers, and support ships rely on these systems for navigation, surveillance, and operations in challenging waters. SIPRI reports that worldwide military expenditure was USD 2,718 billion in 2024, up 9.4% from 2023. Higher defense budgets are stimulating purchases of advanced maritime technologies, promoting uptake of DPS across naval forces around the world.

The need for dynamic positioning systems is growing on account of ships having to precisely navigate deep waters during offshore wind farm expansion. They allow for turbine installation, cable laying and maintenance operations. New offshore wind capacity of 10.8 GW in 2023 was reported by GWEC, raising the total global installations to 75.2 GW-a 24% increase from the corresponding period a year earlier.

Drivers & Opportunities

Global Expansion of Maritime Trade: International maritime commerce growth is accelerating adoption of dynamic positioning technology by cargo vessels, supply boats in the offshore sector, and oil tankers. The technology ensures safe navigation and precise maneuverability in poor water conditions. UNCTAD indicated that shipping trade rose 2.4% in 2023 compared to 1.4% in 2022, hence demand for advanced positioning solutions rose accordingly.

Rising Offshore Oil and Gas Exploration: Growing offshore oil and gas exploration is driving the need for dynamic positioning systems to provide safety and precision of deep-water drilling. Ships and rigs depend on accurate station-keeping without anchors to minimize risks. IEA documented that global oil demand increased by 700 kb/d in 2025 and is set to increase by 720 kb/d in 2026, fueling broader DPS adoption.

Segmental Insights

Equipment Class Analysis

Based on equipment class, the market is segmented into Class 1, Class 2, and Class 3. The Class 2 segment held the largest share of the market during 2024 with the backing of extensive application in offshore supply vessels, shuttle tankers, and diving support ships. Redundancy functionalities provide the stability of the vessel during drilling, cargo operations, and upkeep. Due to its capacity to offer safety under circumstances of moderate risk, it is the preferred option for commercial operators.

The Class 3 segment is expected to expand at the fastest pace up to 2034 based on enhanced fault tolerance and higher redundancy. These systems are crucial in high-hazard offshore platforms, floating production facilities, and naval fleets. Increases in deepwater expenditures and growing defense uses are fueling segment expansion.

System Analysis

By system, the market is divided into position reference & tracking systems, thruster & propulsion systems, power monitoring systems, DP control systems, and motion & environment sensors. The thruster and propulsion systems segment dominated the market in 2024, with core maneuverability and station-keeping features. They offer thrust for offshore oil stability, subsea construction, and wind farms. Hybrid propulsion and fuel-efficient thruster technologies further enhance dominance.

The position reference and tracking systems segment is likely to grow most rapidly, driven by offshore project demand for high-precision navigation. Precision in poor conditions is made possible by GPS, lasers, and acoustic sensors. Offshore wind, subsea mining, and exploration are driving adoption.

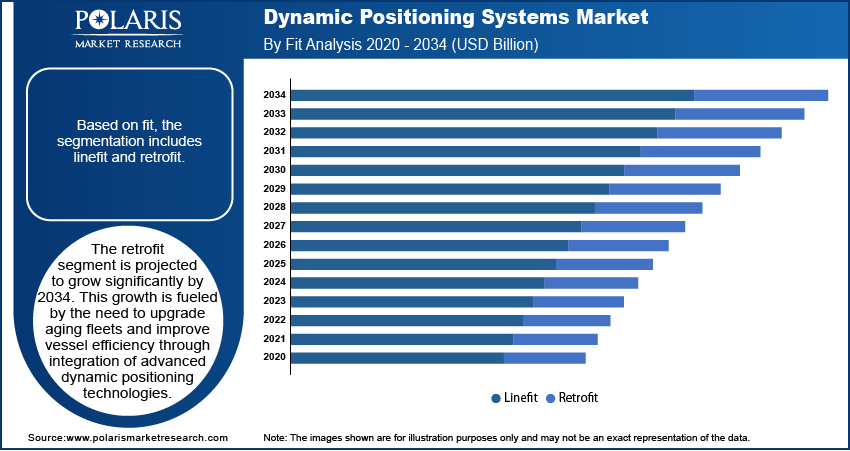

Fit Analysis

On the basis of fit segment, it comprises of linefit and retrofit. The linefit segment held the highest market share in 2024, as shipbuilders incorporate DPS into new ships to satisfy safety requirements. Offshore support ships and drilling vessels more frequently utilize linefit systems. This is necessary for compliance as well as enhancing efficiency in contemporary fleets.

The retrofiting segment is expected to see the highest growth, driven by replacement of aging fleets with new DPS technologies. Retrofit lengthens ship life and maintains regulatory requirements. Demand for retrofit is increasing with aged ships in offshore wind and naval services.

Ship Type Analysis

By ship type, the market is segmented into commercial vessels and defense vessels. The commercial vessels segment accounted for the largest market share in 2024, driven by the rising integration of dynamic positioning systems into offshore support ships, ferries, and research vessels. Expanding offshore oil and gas projects, together with the growth of offshore wind capacity, continue to elevate demand for DPS in commercial operations. Vessel operators are adopting dynamic positioning to improve safety, reduce downtime, and achieve higher operational efficiency.

The defense ships segment is expanding rapidly due to naval modernization and increasing defense expenditure. DPS enhances mission accuracy and security and U.S. defense spending reached USD 916.01 billion in 2023 which marked a 24.7% increase from 2019.

Regional Analysis

Europe held the largest market share for DPS in 2024 owing to a robust shipbuilding industry and stringent maritime regulations. Top shipbuilders are adopting DPS on cargo vessels as well as offshore vessels to increase efficiency. EU regulatory frameworks also require adoption of advanced navigation to ensure offshore safety.

Germany Dynamic Positioning Systems Market Overview

Support from governments for offshore facilities is driving DPS demand for advanced vessels in energy prospecting, space launch, and sea transportation. Germany spent USD 905 thousand in 2025 to upgrade the North Sea offshore launch platform by GOSA. Such projects put DPS at center stage as important for precision, security, and efficiency in future maritime projects.

North America Dynamic Positioning Systems Market Trends

North America is expected to command a significant revenue share by 2034, led by naval modernization and offshore oil development. Huge defense budgets spur DPS integration into naval fleets for enhancing navigation safety. Drilling in the Gulf of Mexico further propels constant demand for dependable positioning systems.

Asia Pacific Dynamic Positioning Systems Market Assessments

Asia Pacific is growing at highest CAGR, driven by offshore wind farms and increasing sea-borne trade. Japan, South Korea, and China are making massive investments in renewables, driving demand for DPS in installation vessels. Offshore hydrocarbon exploration also increases adoption throughout the region's maritime economy.

India Dynamic Positioning Systems Market Insights

India's offshore wind goals are driving DPS demand for turbine installation and service ships. India has set targets of 5 GW by 2022 and 30 GW by 2030 to increase renewable capacity. Supported by pilot projects in Gujarat and Tamil Nadu and surveys, these initiatives push DPS deployment in clean energy activities.

Key Players & Competitive Analysis

The dynamic positioning systems (DPS) market is moderately concentrated with key players including Kongsberg Gruppen ASA, Wartsila, ABB, GE and Marine Technologies focusing on advanced sensor fusion, thruster control and energy-efficient designs for offshore oil and gas, defense and wind projects. Strategic partnerships and acquisitions further strengthen their foothold in the future offshore markets.

Major players in the DPS market are Kongsberg Gruppen ASA, Wartsila Corporation, ABB Ltd., General Electric Company, Marine Technologies LLC, Navis Engineering, Brunvoll AS, L3Harris Technologies, Inc., AB Volvo Penta, Twin Disc Inc., Sonardyne, Inc., and Sirehna.

Key Players

- ABB Ltd.

- AB Volvo Penta

- Brunvoll AS

- General Electric Company

- Kongsberg Gruppen ASA

- L3Harris Technologies, Inc.

- Marine Technologies LLC

- Navis Engineering

- Sirehna

- Sonardyne, Inc.

- Twin Disc Inc.

- Wartsila Corporation

Dynamic Positioning Systems Industry Developments

June 2025: Kongsberg Maritime and partners tested remote DP operations from shore bases, improving safety, flexibility, and manning recruitment for sustainable offshore operations.

February 2025: Sonardyne introduced SPRINT-Nav DP for shallow water, improving accuracy using advanced acoustic positioning and minimizing dependency on GNSS signals.

April 2024: Wartsila launched a new thruster and propulsion control bundle, making DP operations more straightforward with enhanced situational awareness and reduced installation complexity.

Dynamic Positioning Systems Market Segmentation

By Equipment Class Outlook (Revenue, USD Billion, 2020–2034)

- Class 1

- Class 2

- Class 3

By System Outlook (Revenue, USD Billion, 2020–2034)

- Position Reference & Tracking Systems

- Thruster & Propulsion Systems

- Power Management Systems

- DP Control Systems

- Motion & Environment Sensors

By Fit Outlook (Revenue, USD Billion, 2020–2034)

- Linefit

- Retrofit

By Ship Type Outlook (Revenue, USD Billion, 2020–2034)

- Commercial Vessels

- Defense Vessels

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Dynamic Positioning Systems Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 6.13 Billion |

|

Market Size in 2025 |

USD 6.50 Billion |

|

Revenue Forecast by 2034 |

USD 11.12 Billion |

|

CAGR |

6.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The dynamic positioning systems market size was valued at USD 6.13 billion in 2024 and is projected to grow to USD 11.12 billion by 2034.

The dynamic positioning systems market is projected to register a CAGR of 6.2% during the forecast period.

Europe dominated the market in 2024 due to strong offshore wind energy development, advanced shipbuilding capabilities, and stringent maritime safety regulations.

A few of the key players in the market are Kongsberg Gruppen ASA, Wartsila Corporation, ABB Ltd., General Electric Company, Marine Technologies LLC, Navis Engineering, L3Harris Technologies, Inc., AB Volvo Penta, Brunvoll AS, Twin Disc Inc., Sonardyne, Inc., and Sirehna.

The class 2 segment dominated the market revenue share in 2024 due to its extensive adoption in offshore support vessels, drilling rigs, and subsea construction, offering redundancy and enhanced safety at a cost-effective level.

The position reference & tracking systems segment is projected to witness the fastest growth during the forecast period due to rising demand for precise vessel positioning, increasing deep-water exploration, and integration of advanced sensor technologies.