Mainframe Modernization Market Size, Share, Trends, Industry Analysis Report

By Offering (Software, Service), By Deployment Mode, By Organization Size, By Industry Vertical, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM6382

- Base Year: 2024

- Historical Data: 2020-2023

Overview

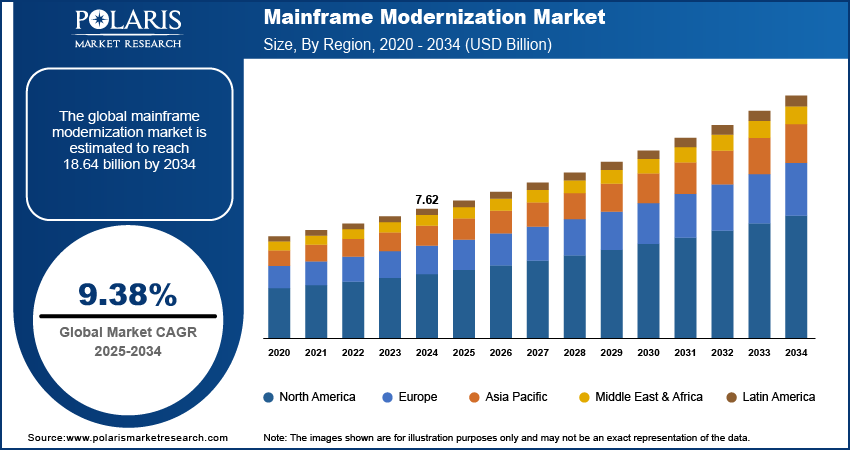

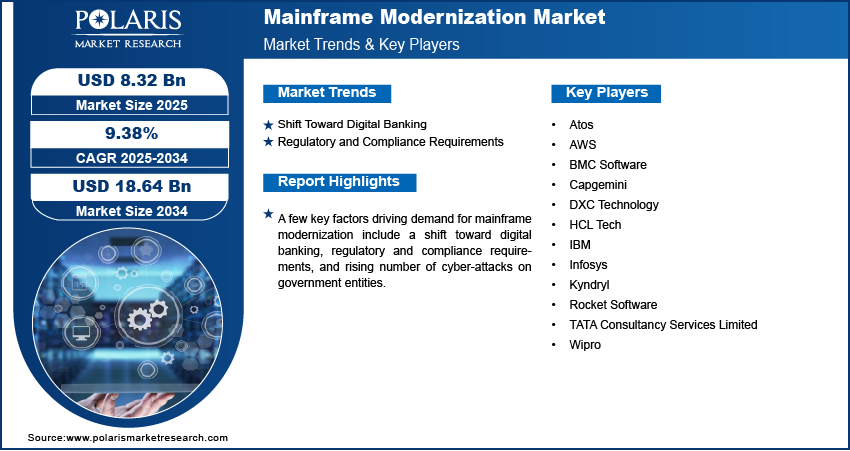

The global mainframe modernization market size was valued at USD 7.62 billion in 2024, growing at a CAGR of 9.38 % from 2025 to 2034. Key factors driving demand for mainframe modernization include the shift toward digital banking, regulatory and compliance requirements, and rising number of cyber-attacks on government entities.

Key Insights

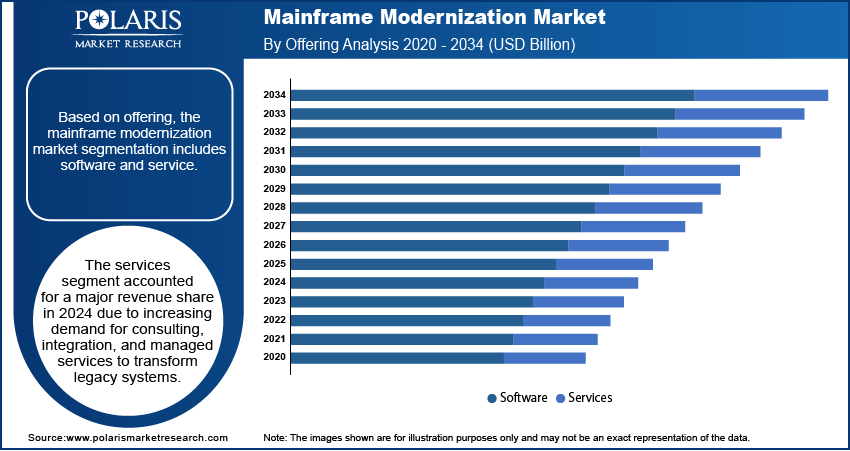

- The services segment accounted for a major revenue share in 2024, due to increasing demand for managed services to transform traditional mainframe systems.

- The cloud-based modernization segment held the largest revenue share in 2024, due to its ability to offer cost efficiency and agility.

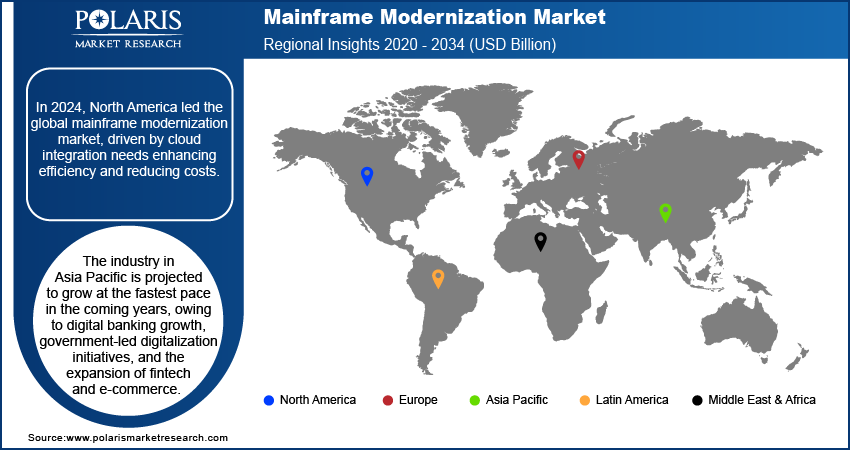

- The North America mainframe modernization market accounted for the largest revenue share in 2024, due to the rising need to integrate traditional mainframe systems with cloud-based technologies.

- The U.S. held the largest revenue share in the North America mainframe modernization landscape in 2024, due to rising number of cyber-attacks.

- The industry in Asia Pacific is projected to grow at the fastest pace in the coming years, owing to the expansion of fintech and e-commerce.

Industry Dynamics

- The shift toward digital banking is fueling the demand for mainframe modernization as digital banking generates vast amounts of data from online transactions, customer interactions, and fraud detection systems, requiring modernized mainframes.

- The regulatory and compliance requirements, such as GDPR, PSD2, and Basel III, are forcing financial institutions to enhance data security, creating a demand for mainframe modernization, as outdated mainframes often fall short.

- The expanding IT & e-commerce sector in emerging countries such as India and Brazil is expected to create a lucrative market opportunity during the forecast period.

- Integration complexity and risk of downtime hinder the market growth.

Artificial Intelligence (AI) Impact on Mainframe Modernization Market

- AI enhances mainframe modernization by automating legacy code conversion, reducing manual effort, and accelerating migration to cloud or hybrid environments.

- AI-driven analytics predict system failures, optimize performance, and minimize downtime, ensuring smoother modernization processes.

- AI streamlines operations, cuts labor costs, and improves resource allocation, making modernization more affordable for enterprises.

- AI analyzes vast mainframe data to guide modernization strategies, ensuring alignment with business goals.

Market Statistics

- 2024 Market Size: USD 7.62 Billion

- 2034 Projected Market Size: USD 18.64 Billion

- CAGR (2025–2034): 9.38 %

- North America: Largest Market Share

Mainframe modernization refers to the process of updating and transforming legacy mainframe systems to enhance performance, scalability, and integration with modern technologies such as cloud computing, AI, and microservices. It involves strategies such as rehosting, refactoring, or replacing legacy components with modern solutions. This modernization helps organizations reduce operational costs, improve agility, and leverage advanced analytics while maintaining the reliability of mainframes.

Mainframe modernization is crucial for industries such as banking, healthcare, and government, where legacy systems handle critical transactions but face challenges such as high maintenance costs and skill shortages. Modernization helps businesses integrate mainframes with DevOps, AI-driven automation, and hybrid cloud environments, enabling faster innovation, better security, and improved user experiences. It ensures that old systems remain competitive in the digital landscape without compromising their core functionalities.

The global demand for mainframe modernization is driven by the rising number of cyber-attacks on government entities. Cyberattacks on Indian government entities increased by 138% between 2019 and 2023, rising from 85,797 incidents in 2019 to 204,844 in 2023. This drove government agencies to prioritize robust security solutions, including mainframe modernization, as it offers advanced encryption, real-time threat detection, and secure data processing, which traditional systems often lack. Therefore, as cyber-attacks on government entities increase, government agencies invest heavily in upgrading mainframes to enhance security and improve operational efficiency.

Drivers & Opportunities

Shift Toward Digital Banking: The shift toward digital banking is increasing customer expectations for seamless, real-time transactions and robust security, which legacy mainframes struggle to support efficiently. This is driving banks to modernize their mainframes, which integrate with new technologies such as mobile apps, cloud services, and AI-driven analytics, to handle larger transaction volumes and enhance cybersecurity. As of 2024, a staggering 86% of UK adults, or roughly 46 million people, use online or digital banking in the country. Additionally, digital banking generates vast amounts of data from online transactions, customer interactions, and fraud detection systems, requiring modernized mainframes to process and analyze this data at high speeds. Modernizing mainframes with advanced analytics, AI capabilities, and hybrid cloud integration allows banks to extract real-time insights, personalize services, and detect anomalies faster. Hence, the growing shift toward digital banking is fueling the demand for mainframe modernization.

Regulatory and Compliance Requirements: Strict regulatory and compliance requirements, such as GDPR, PSD2, and Basel III, are forcing financial institutions to enhance data security, reporting accuracy, and audit capabilities. As outdated mainframes often fall short, the demand for mainframe modernization increase. Modernization equips legacy systems with encryption, real-time monitoring, and automated compliance checks, ensuring banks meet evolving legal standards without sacrificing performance. Regulators are also increasingly demanding seamless data transparency and fraud prevention, pushing firms to upgrade mainframes with advanced analytics and integration tools. Failure to modernize risks hefty fines, operational inefficiencies, and reputational damage, making modernization a necessity rather than an option for compliance-driven industries such as banking, IT, telecom, and others.

Segmental Insights

Offering Analysis

Based on offering, the segmentation includes software and service. The services segment accounted for a major revenue share in 2024 due to increasing demand for consulting, integration, and managed services to transform legacy systems. Enterprises prioritized expert guidance to navigate the complexities of migrating from outdated infrastructure to agile, cloud-based solutions. The shortage of in-house expertise and the need for risk mitigation further fueled reliance on service providers, as businesses sought end-to-end support for assessment, planning, and execution. Additionally, the rise of hybrid cloud environments and the integration of AI-driven automation tools into modernization projects amplified the need for specialized services, contributing to the segment’s dominance.

Deployment Mode Analysis

In terms of deployment mode, the segmentation includes cloud-based modernization, hybrid modernization, and on-premises modernization. The cloud-based modernization segment held the largest revenue share in 2024 as enterprises increasingly prioritized scalability, cost efficiency, and agility in their IT transformation strategies. Cloud platforms, such as AWS and IBM Cloud, offered robust tools for rehosting, refactoring, and rearchitecting legacy systems, reducing reliance on expensive on-premises infrastructure. The growing adoption of DevOps practices, coupled with advancements in containerization and microservices, further accelerated cloud migration, enabling businesses to achieve faster deployment and improved operational resilience. Additionally, stringent data security measures and compliance certifications from major cloud providers relieved concerns over regulatory risks, strengthening cloud-based deployment as the preferred choice.

The hybrid modernization segment is expected to grow at a robust pace in the coming years as organizations are seeking a balance between cloud innovation and legacy system stability. Many enterprises, particularly in highly regulated industries such as banking and healthcare, require seamless integration between modern cloud environments and existing on-premises systems to maintain data sovereignty and compliance. Hybrid solutions provide the flexibility to transition workloads while leveraging cloud-native capabilities for critical applications gradually. The rise of edge computing and 5G networks is further projected to drive demand for hybrid modernization, enabling real-time data processing across distributed architectures.

Organization Size Analysis

In terms of organization size, the segmentation includes large enterprises and small & medium enterprises (SMEs). The large enterprises segment dominated the revenue share in 2024 due to their extensive reliance on traditional systems and the rising need to integrate advanced technologies such as cloud computing, artificial intelligence, and automation. These organizations invested heavily in comprehensive modernization initiatives, which enable them to enhance operational efficiency, reduce maintenance costs, and improve scalability. Industries such as banking, healthcare, and insurance drove demand for mainframe modernization, as they handle massive volumes of transactional data and require robust, secure systems to maintain compliance and competitiveness. Additionally, the complexity of large enterprises' IT infrastructures necessitated mainframe modernization.

Industry Vertical Analysis

In terms of industry vertical, the segmentation includes BFSI, healthcare, retail & E-commerce, government & public sector, manufacturing, telecom & IT, and others. The BFSI segment accounted for a major revenue share in 2024 due to its heavy dependence on mainframes for high-volume transaction processing, regulatory compliance, and data security. BFSI institutions prioritized upgrading their mainframe systems to incorporate cloud integration, AI-driven analytics, and real-time fraud detection, ensuring faster and more secure operations. The sector's stringent data governance requirements and the need for seamless digital banking experiences further fueled demand, as traditional infrastructures struggled to keep pace with fintech innovations and customer expectations. Additionally, mergers and acquisitions in the BFSI space necessitated system consolidation, driving further investments in modernization efforts.

The healthcare segment is estimated to grow at a rapid pace in the coming years, owing to the ongoing digital transformation to manage electronic health records (EHRs), telemedicine platforms, and AI-powered diagnostics. Regulatory mandates, such as interoperability standards and data privacy laws, are pushing healthcare providers to replace outdated systems with agile, scalable solutions. The rise of personalized medicine and big data analytics also demands high-performance computing capabilities, which traditional mainframe systems cannot efficiently support. Furthermore, increasing cybersecurity threats and the need for real-time patient data access make modernization a critical priority, positioning healthcare as the fastest-growing segment.

Regional Analysis

The North America mainframe modernization market accounted for the largest revenue share in 2024. This dominance is attributed to the rising need to integrate traditional mainframe systems with cloud-based technologies to improve operational efficiency and reduce costs. Digital transformation initiatives, regulatory compliance requirements such as GDPR and CCPA, and the need for real-time data processing also pushed organizations in the region to modernize their mainframes. Additionally, the shortage of skilled COBOL programmers in the region and the rise of DevOps accelerated the shift toward modernized mainframes.

U.S. Mainframe Modernization Market Insights

The U.S. held the largest revenue share in the North America mainframe modernization landscape in 2024, due to increasing cybersecurity threats, the need for better customer experiences, and competitive pressures. The U.S. government has also emphasized modernizing federal IT systems, including mainframes, to enhance security and interoperability. Cloud adoption, AI/ML integration, and the demand for API-driven ecosystems further propelled market growth in the region. Companies in the U.S. also leveraged modernization to move from traditional mainframe applications to microservices and cloud-native solutions while maintaining compliance with strict data protection laws.

Europe Mainframe Modernization Market Trends

The market in Europe is projected to hold a substantial revenue share in 2034 due to stringent data privacy regulations such as GDPR and the push for digital sovereignty. Financial institutions and public sector entities in the region are under pressure to improve system agility, reduce technical debt, and enhance cybersecurity, which is encouraging them to modernize their mainframes through mainframe modernization services and software. The rise of open banking (PSD2) in the EU is also driving modernization to enable seamless API integrations.

Germany Mainframe Modernization Market Overview

The demand for mainframe modernization in Germany is being driven by the need for Industry 4.0, smart manufacturing, and IoT integration in the industrial and financial sectors. German enterprises are adopting cloud strategies, containerization, and DevOps to enhance scalability and innovation. Compliance with EU regulations, along with a shortage of mainframe system expertise, is pushing companies toward automated mainframe modernization tools.

Asia Pacific Mainframe Modernization Market Outlook

The industry in Asia Pacific is projected to grow at the fastest pace in the coming years, owing to digital banking growth, government-led digitalization initiatives, and the expansion of fintech and e-commerce. Countries such as Australia, Japan, and India are investing in hybrid cloud solutions to modernize legacy mainframes while ensuring regulatory compliance. Cost efficiency and the need for real-time analytics are driving organizations in the region to adopt mainframe modernization services. Additionally, enterprises are adopting AI and automation to streamline mainframe operations and integrate them with modern applications.

Key Players & Competitive Analysis

The mainframe modernization market is highly competitive, with key players such as IBM, TCS, Infosys, and DXC Technology dominating the space. IBM dominates with its deep expertise in mainframe systems and hybrid cloud solutions, while Indian IT giants such as TCS, Infosys, HCL Tech, and Wipro leverage cost-effective modernization services, including application refactoring and cloud migration. Capgemini and Atos provide strong European market presence with legacy transformation expertise. AWS is emerging as a major force by offering cloud-native modernization tools, competing with Kyndryl in hybrid infrastructure solutions. BMC Software and Rocket Software specialize in automation and DevOps for mainframe environments. The market remains dynamic, with partnerships and acquisitions shaping competitive positioning.

A few major companies operating in the mainframe modernization market include Atos, AWS, BMC Software, Capgemini, DXC Technology, HCL Tech, IBM, Infosys, Kyndryl, Rocket Software, TATA Consultancy Services Limited, and Wipro.

Key Companies

- Atos

- AWS

- BMC Software

- Capgemini

- DXC Technology

- HCL Tech

- IBM

- Infosys

- Kyndryl

- Rocket Software

- TATA Consultancy Services Limited

- Wipro

Mainframe Modernization Industry Developments

In January 2025, Kyndryl unveiled new advisory and implementation mainframe modernization services to accelerate the modernization of mainframe applications and data for Amazon Web Services (AWS).

In May 2024, Rocket Software closed a USD 2.275B acquisition of OpenText’s application modernization and connectivity business.

In January 2024, Atos, a global company in digital transformation, announced that it had been selected by global telecommunications company Lumen to modernize its mainframe services in a multi-year deal.

Mainframe Modernization Market Segmentation

By Offering Outlook (Revenue, USD Billion, 2020–2034)

- Software

- Services

- Application Modernization

- Infrastructure Modernization

- Data Modernization

- Cloud Migration Services

- Consulting & Assessment Services

By Deployment Mode Outlook (Revenue, USD Billion, 2020–2034)

- Cloud-based Modernization

- Hybrid Modernization

- On-premises Modernization

By Organization Size Outlook (Revenue, USD Billion, 2020–2034)

- Large Enterprises

- Small & Medium Enterprises (SMEs)

By Industry Vertical Outlook (Revenue, USD Billion, 2020–2034)

- BFSI

- Healthcare

- Retail & E-commerce

- Government & Public Sector

- Manufacturing

- Telecom & IT

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Mainframe Modernization Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 7.62 Billion |

|

Market Size in 2025 |

USD 8.32 Billion |

|

Revenue Forecast by 2034 |

USD 18.64 Billion |

|

CAGR |

9.38% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 7.62 billion in 2024 and is projected to grow to USD 18.64 billion by 2034.

The global market is projected to register a CAGR of 9.38% during the forecast period.

North America dominated the market in 2024

A few of the key players in the market are Atos, AWS, BMC Software, Capgemini, DXC Technology, HCL Tech, IBM, Infosys, Kyndryl, Rocket Software, TATA Consultancy Services Limited, and Wipro.

The services segment dominated the market revenue share in 2024.

The healthcare segment is projected to witness the fastest growth during the forecast period.