Earplugs Market Size, Share, Trends, Industry Analysis Report

By Material (Foam, Silicone, Wax, Others), By Technology, By Type, By Noise Reduction Rating, By Application, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM6302

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

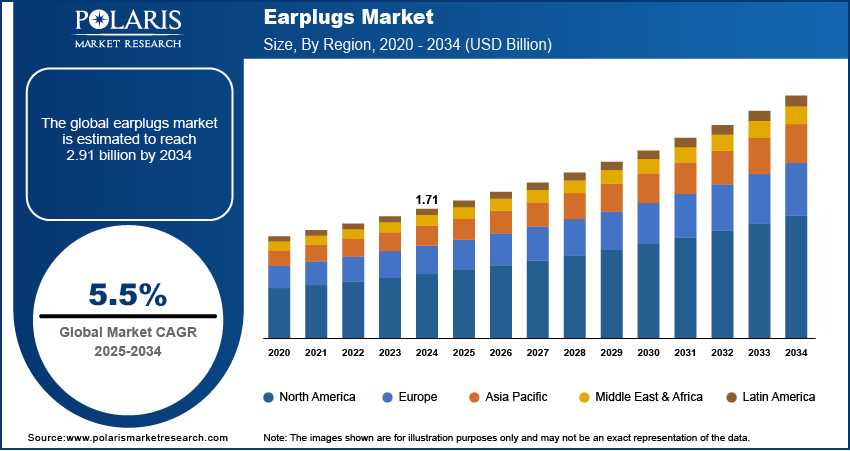

The global earplugs market size was valued at USD 1.71 billion in 2024 and is anticipated to register a CAGR of 5.5% from 2025 to 2034. Stricter workplace safety rules and a rise in health issues from noise exposure are major drivers. People are also using earplugs in their daily lives while sleeping, traveling, and in concerts, which further increases the demand.

Key Insights

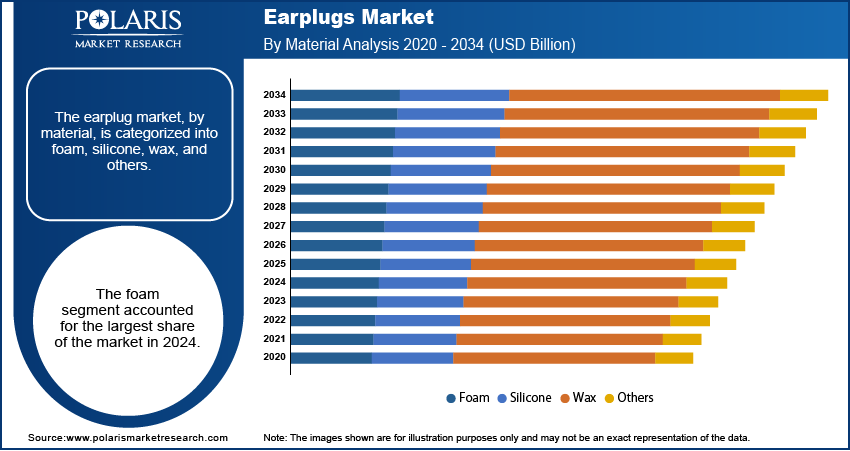

- By material, the foam segment held the largest share in 2024 due to its high effectiveness at blocking noise.

- Based on technology, the passive earplugs segment held the largest share in 2024 due it their simplicity, low cost, and wide range of applications.

- By type, the disposable segment held the largest share in 2024 because of its affordability and widespread use.

- In terms of noise reduction rating, the 26-29 dB range segment held the largest share in 2024 because it provides a good balance of protection.

- By application, the industrial and occupational segment held the largest share due to strict government safety regulations.

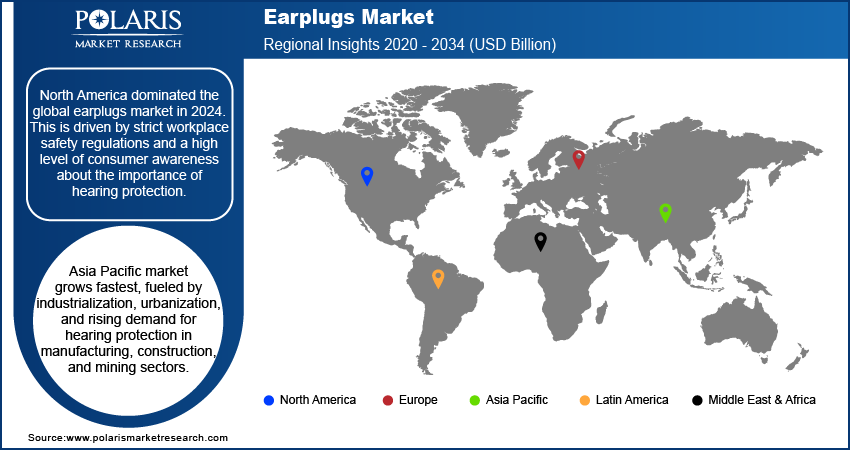

- By region, North America is the leading region, driven by strict workplace safety regulations and a high level of consumer awareness.

Industry Dynamics

- Strict safety regulations in workplaces, especially in industries such as manufacturing and construction, are a key driver. These rules require employers to provide hearing protection, which boosts the demand for earplugs to prevent noise-induced hearing loss among workers. The growing awareness of hearing damage from loud noises in these settings also plays a big part in the increased use of these products.

- The increased demand for personal use is another big growth factor. Many people are using earplugs to protect their hearing in everyday situations. This includes situations such as concerts and sporting events, as well as for improving sleep quality and concentration by blocking out noise from traffic or loud neighbors.

- Technological advances also drives the industry expansion. Companies are making earplugs that are more comfortable and effective, with new materials and designs. This includes custom-fit options and electronic earplugs that can filter out certain frequencies while allowing others to pass through, which appeals to a broader group of consumers.

Market Statistics

- 2024 Market Size: USD 1.71 billion

- 2034 Projected Market Size: USD 2.91 billion

- CAGR (2025–2034): 5.5%

- North America: Largest market in 2024

AI Impact on Earplugs Market

- AI-enables intelligent earplugs adapt to environmental noise levels. These devices can enhance specific sounds (such as speech) and actively cancel noise. These properties make them ideal for industrial and consumer use.

- Manufacturers use AI-powered 3D scanning and modeling to create custom-molded earplugs tailored to individual ear shapes and sizes. It helps improve comfort and acoustic performance.

- AI-integrated earplugs monitor usage patterns and alert users when replacements are needed, enhancing safety compliance.

Earplugs are small devices that are used to protect against loud noises, water, and other things. They are widely used for hearing protection to prevent conditions such as tinnitus and hearing loss. These products are available in many types, including electronic and non-electronic, and are made from materials such as foam, silicone, and custom-molded plastics.

The rising number of recreational activities and events with high noise levels drives the market growth. People are more frequently attending concerts, music festivals, and sporting events where loud sounds can cause hearing damage. This has led to a greater demand for earplugs that can reduce noise while still allowing for clear sound quality, which is especially important for musicians and event-goers.

Another growth factor is the increasing focus on personal wellness and the demand for better sleep quality. In today's busy world, many people deal with noise from their surroundings, such as traffic, loud neighbors, or snoring partners, which can disrupt their sleep. This has led to more people using earplugs to create a quieter environment for sleeping. For instance, the World Health Organization (WHO) has noted the negative health impacts of noise pollution on sleep, which highlights the need for effective solutions such as earplugs.

Drivers and Trends

Strict Workplace Safety Regulations: A major driver for the earplugs market is the rise of strict safety regulations in workplaces around the world. Industries such as construction, manufacturing, and mining have historically exposed workers to high levels of noise from machinery and other equipment. Government agencies are now putting more emphasis on protecting workers from noise-induced hearing loss, which is a serious and irreversible condition. These regulations often require employers to provide proper hearing protection, which directly increases the demand for various types of earplugs.

The growing awareness of the negative health effects of noise in the workplace is also a key part of this driver. The Occupational Safety and Health Administration (OSHA) states that employers are required to have a hearing conservation program for employees with noise exposures equal to or exceeding 85 decibels. Also, a hearing conservation program is needed to prevent hearing loss and protect a worker's remaining hearing and also to seek hearing loss disease treatment. This highlights the ongoing need for hearing protection in workplaces to comply with regulations. These safety measures are driving a steady and consistent increase in the demand for earplugs.

Growing Use in Recreational and Everyday Activities: Another significant driver is the increasing use of earplugs for recreational and everyday activities. People are becoming more aware of the risk of hearing damage from loud sounds not just at work but also in their personal lives. This includes attending concerts, music festivals, sporting events, and even using personal audio devices. The demand for earplugs that are both effective and comfortable for these specific situations has grown.

The World Health Organization (WHO) states that more than 1 billion young people are at risk of permanent hearing aid and loss from prolonged exposure to loud sounds during recreational pastimes such as listening to music and video games. This highlights the widespread nature of the problem and the need for protective measures. The increasing focus on personal health and wellness in these noisy environments is driving the demand for earplugs.

Segmental Insights

Material Analysis

Based on material, the segmentation includes foam, silicone, wax, and others. The foam segment held the largest share in 2024. This is mainly because of its affordability, wide availability, and ability to block out noise very well. The soft, expandable nature of foam allows it to fit snugly and comfortably in most ear canals, making it a popular choice for both industrial and personal use. These earplugs are especially favored in workplaces such as manufacturing and construction, where they are often provided to workers as a simple and cost-effective way to meet safety standards. Their disposable nature also makes them a hygienic option for one-time or short-term use in these settings.

The silicone segment is anticipated to register the highest growth rate during the forecast period. This is because consumers are increasingly looking for reusable and durable options for their hearing protection needs. Silicone earplugs are easy to clean and can be used many times, making them a more sustainable choice. They are popular for recreational uses such as swimming, concerts, and travel, as they provide a good seal against both noise and water. Additionally, advances in technology are leading to new types of silicone earplugs that offer a better fit and improved sound quality, which appeals to a broader group of people.

Technology Analysis

Based on technology, the segmentation includes active earplugs and passive earplugs. The passive earplugs segment held the largest share in 2024. This is because these earplugs are simple, affordable, and highly effective at blocking noise through physical barriers alone. Their widespread use in industrial and occupational settings, such as manufacturing and construction, is a key reason for their dominance. They are a cost-effective solution for companies that must comply with safety regulations requiring hearing protection. Additionally, passive earplugs are commonly used for everyday activities like sleeping, studying, and traveling, where a simple and reliable noise-blocking solution is all that is needed. Their accessibility and ease of use make them a popular choice for a wide range of consumers.

The active earplugs segment is anticipated to register the highest growth rate during the forecast period. These devices use electronic components to reduce or cancel out noise, offering more advanced features than traditional earplugs. This includes the ability to filter specific sounds, allowing users to hear speech or important alerts while still protecting their ears from harmful noise. This technology is especially useful for professionals in jobs such as the military, aviation, and live entertainment, where situational awareness is important. The growth is also being fueled by the increasing popularity of "smart" earplugs, which can connect to devices via Bluetooth and offer features like music streaming and phone calls.

Type Analysis

Based on type, the segmentation includes disposable and reusable. The disposable segment held the largest share in 2024. This is mainly due to their low cost and wide use in industrial settings. In sectors such as construction and manufacturing, where earplugs are used daily by many employees, the single-use nature of disposable earplugs makes them a hygienic and practical option. Companies can easily provide a new pair to each worker, which helps with hygiene and reduces the risk of ear infections. The convenience of not having to clean or maintain them also adds to their appeal for both businesses and consumers who need a simple, one-time solution for hearing protection in loud environments. Their widespread availability in retail stores and online further supports their dominance.

The reusable earplugs segment is anticipated to register the highest growth rate during the forecast period. This is because more consumers and companies are focusing on sustainability and long-term value. Reusable earplugs, which are often made from durable materials such as silicone, can be washed and worn multiple times. This reduces waste and makes them a more environmentally friendly choice compared to disposable ones. For consumers, reusable earplugs offer better comfort and a more custom fit, which is ideal for activities such as live concerts, travel, and getting a better night's sleep. While their initial cost may be higher, their durability and repeated use make them more cost-effective over time. The growing consumer interest in products that are both eco-friendly and long-lasting is a key factor in this segment's rapid expansion.

Noise Reduction Rating Analysis

Based on noise reduction rating, the segmentation includes 10 - 20 dB, 21 - 25 dB, 26 - 29 dB, and 30 - 33 dB. The 26 - 29 dB segment held the largest share in 2024. These earplugs offer a high level of protection, which is required for many industrial and occupational settings where noise exposure is a significant concern. The widespread use of these earplugs in industries such as construction, manufacturing, and mining, where noise levels often exceed safety limits, is a key reason for their dominance. Their effectiveness in meeting strict workplace safety standards makes them the most common choice for employers and employees needing reliable hearing protection.

The 21-25 dB segment is anticipated to register the highest growth rate during the forecast period. The growth in this segment is being driven by the increasing use of earplugs in everyday and recreational settings. Consumers are becoming more aware of the need to protect their hearing in situations such as attending concerts, flying on airplanes, or simply trying to get better sleep. This range of noise reduction is often seen as a good balance, as it lowers harmful noise levels without completely isolating the user from their surroundings. This makes them a popular choice for people who want to protect their hearing but still need to be aware of what is happening around them.

Regional Analysis

The North America earplugs market accounted for the largest share in 2024, driven by a strong focus on worker safety and high consumer awareness. The presence of strict regulations from government bodies such as the Occupational Safety and Health Administration (OSHA) in the U.S. mandates the use of hearing protection in many noisy workplaces. This has created a steady demand for earplugs in industries such as manufacturing, construction, and aviation. The North America hearing aid consumers are also very proactive about personal wellness, leading to greater use of earplugs for activities outside of work.

U.S. Earplugs Market Insights

The U.S. is the largest market in North America, because of its extensive industrial sector and strong emphasis on occupational health. The high demand for earplugs from sectors like manufacturing and construction is a major factor. In addition to industrial use, consumer demand for earplugs is also high for things like improving sleep quality, reducing noise while traveling, and attending live events. This dual-market demand, both from industries and individuals, makes the U.S. a significant part.

Europe Earplugs Market Trends

Europe is a major region for the earplugs market, fueled by strong industrial bases and a growing awareness of noise pollution's health effects. The region has well-established safety regulations that require employers to provide hearing protection in noisy work environments. Countries across Europe have a high number of manufacturing and construction activities, which creates a large and consistent demand for earplugs. Furthermore, the region's focus on personal health and environmental concerns is leading to increased interest in reusable and sustainable earplug options.

The Germany earplugs market stands out as a key country in Europe. The country's robust manufacturing sector, particularly in the automotive and machinery industries, generates a significant demand for earplugs to protect workers. German companies are known for their high standards in quality and safety, which often leads to the adoption of advanced and effective hearing protection products.

Asia Pacific Earplugs Market Overview

The Asia Pacific market is witnessing the fastest growth, driven by rapid industrialization and urbanization in many countries. The expansion of manufacturing, construction, and mining industries across the region is increasing the number of workers who need hearing protection. While awareness of hearing safety has been lower in the past, it is now on the rise due to a mix of government initiatives and companies adopting global safety standards. This is creating a large, new base of customers for earplugs.

China Earplugs Market Outlook

China is a major country in Asia Pacific. The country's massive manufacturing and construction sectors are a significant source of demand for earplugs. With a large workforce in these industries, there is a constant need for protective equipment. As the country's economy and living standards improve, there is also a growing consumer interest in earplugs for personal use, such as for sleep and noise reduction in busy urban areas. This makes China a key country to watch in the regional growth.

Key Players and Competitive Insights

The earplugs landscape has a diverse competitive landscape with a mix of large, multinational companies and smaller, specialized firms. Major players often compete on factors like brand reputation, product quality, and distribution networks, especially in the industrial safety segment. In the consumer space, competition is focused on product innovation, design, and user comfort, leading to a wide variety of earplugs for different activities like sleeping, music, and swimming. Smaller, innovative companies often focus on niche areas with specialized products like high-fidelity or custom-molded earplugs, which helps them create a strong presence. The sector is also seeing a trend toward mergers and acquisitions, as bigger companies look to expand their product portfolios and gain a stronger foothold in new areas.

A few prominent companies in the industry include 3M; Honeywell International Inc.; Moldex-Metric; Radians, Inc.; Alpine Hearing Protection; Loop Earplugs; Eargasm; Magid Glove & Safety Manufacturing Company LLC; and Lucid Hearing Holding Company, LLC.

Key Players

- 3M

- Alpine Hearing Protection

- Eargasm

- Honeywell International Inc.

- Loop Earplugs

- Lucid Hearing Holding Company

- Mack's

- Magid Glove & Safety Manufacturing Company LLC

- Moldex-Metric

- Radians, Inc.

- UVEX SAFETY GROUP

Earplugs Industry Developments

May 2025: PIP acquired Honeywell’s PPE business, expanding its portfolio with established brands such as Howard Leight and Fibre-Metal.

January 2025: Sennheiser introduced its SoundProtex earplugs, engineered to deliver safe listening while preserving audio clarity. Featuring a two-stage acoustic filter, they balance sound frequencies and lower volume levels.

Earplugs Market Segmentation

By Material Outlook (Revenue – USD Billion, 2020–2034)

- Foam

- Silicone

- Wax

- Others

By Technology Outlook (Revenue – USD Billion, 2020–2034)

- Active Earplugs

- Passive Earplugs

By Type Outlook (Revenue – USD Billion, 2020–2034)

- Disposable

- Reusable

By Noise Reduction Rating Outlook (Revenue – USD Billion, 2020–2034)

- 10 - 20 dB

- 21 - 25 dB

- 26 - 29 dB

- 30 - 33 dB

By Application Outlook (Revenue-USD Billion, 2020-2034)

- Industrial & Occupational

- Consumer Applications

By Regional Outlook (Revenue-USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Earplugs Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.71 billion |

|

Market Size in 2025 |

USD 1.80 billion |

|

Revenue Forecast by 2034 |

USD 2.91 billion |

|

CAGR |

5.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1.71 billion in 2024 and is projected to grow to USD 2.91 billion by 2034.

The global market is projected to register a CAGR of 5.5% during the forecast period.

North America dominated the share in 2024.

A few key players in the market include 3M; Honeywell International Inc.; Moldex-Metric; Radians, Inc.; Alpine Hearing Protection; Loop Earplugs; Eargasm; Magid Glove & Safety Manufacturing Company LLC; and Lucid Hearing Holding Company, LLC.

The foam segment accounted for the largest share of the market in 2024.

The active earplugs segment is expected to witness the fastest growth during the forecast period.