Earthmoving Equipment Market Size, Share, Trends, Industry Analysis Report

: By Product (Dozer, Excavator, Loader, Motor Grader, Dump Truck, Backhoe, Compaction Equipment, and Others), Propulsion, Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM5586

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

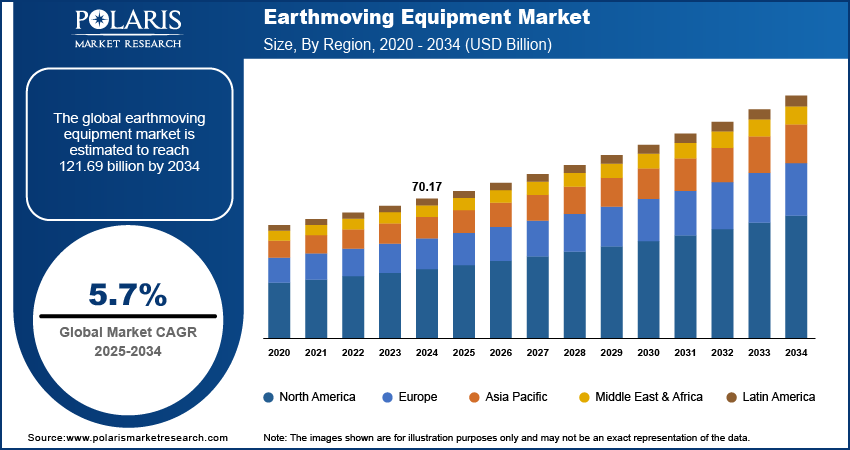

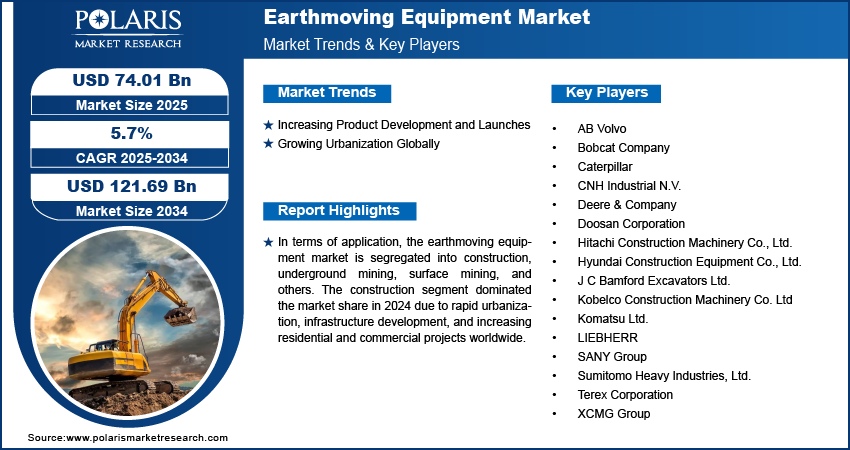

The global earthmoving equipment market size was valued at USD 70.17 billion in 2024, exhibiting a CAGR of 5.7 % during 2025–2034. Rising global industrialization, infrastructure investments, rapid urbanization, and continuous product innovations are collectively fueling the growing demand for earthmoving equipment across the construction and mining sectors.

Key Insights

- The loader segment led the market in 2024 due to its versatility, widespread usage, and integration of advanced automation technologies.

- Surface mining is the fastest-growing application due to increased mineral demand and the adoption of high-capacity, energy-efficient earthmoving machinery.

- Asia Pacific held the largest market share in 2024 owing to rapid urban growth, infrastructure investments, and strong government support for construction.

- The Middle East and Africa region is set for strong growth due to megaprojects, mining expansion, and demand for durable, high-performance equipment.

Industry Dynamics

- Rising global industrialization drives demand for earthmoving equipment by increasing construction, mining, and infrastructure development activities.

- Expansion of smart cities and urban transit systems increases demand for advanced earthmoving equipment with automation and GPS technologies.

- Rapid urbanization globally fuels construction projects requiring earthmoving machines for land clearing, excavation, and complex site preparation tasks.

- Integration of IoT and telematics systems in earthmoving equipment offers opportunities to improve operational efficiency and predictive maintenance.

- Fluctuating raw material prices and supply chain disruptions increase production costs and cause delays in equipment manufacturing.

Market Statistics

2024 Market Size: USD 70.17 billion

2034 Projected Market Size: USD 121.69 billion

CAGR (2025–2034): 5.7%

Asia Pacific: Largest market in 2024

AI Impact on Earthmoving Equipment Market

- AI integration in earthmoving equipment enables autonomous operation, improving precision and reducing human error on construction sites.

- Predictive maintenance powered by AI minimizes downtime by identifying potential equipment failures before they occur, lowering repair costs.

- AI-driven real-time data analytics optimize fuel consumption and operational efficiency, reducing overall project expenses and environmental impact.

- Machine learning algorithms enhance equipment performance by adapting to varying terrain and workload conditions for better productivity.

To Understand More About this Research: Request a Free Sample Report

Earthmoving equipment refers to heavy-duty machines designed to excavate, transport, and shape large quantities of soil, rock, or other materials in construction, lithium mining, and landscaping projects. These machines are essential for tasks such as digging foundations, leveling terrain, clearing land, and constructing roads or dams. A few common types of earthmoving equipment are excavators, bulldozers, backhoe loaders, graders, and dump trucks. These machines enhance productivity, reduce manual labor, and ensure precision in construction and mining operations. They are crucial in infrastructure development, enabling the creation of buildings, highways, and other critical structures that support modern society.

The rising industrialization across the globe is propelling the earthmoving equipment market growth. According to the Economic Survey 2023-24, India witnessed 9.5% industrial growth. Industrialization leads to the development of new factories, warehouses, roads, and utility systems to support production and secure logistics. These projects demand extensive site preparation, excavation, grading, and material handling tasks that rely heavily on earthmoving machines such as excavators, loaders, and motor graders. Additionally, industrial growth increases the mining operations to source raw materials such as minerals, metals, and aggregates. This increase in mining operations fuels the demand for earthmoving equipment, such as dump trucks and bulldozers, to streamline the processes. Therefore, the adoption of earthmoving equipment is rising with the growing industrialization across the globe.

The earthmoving equipment market demand is driven by the increasing investments in infrastructural development. Governments and private developers across the globe are investing heavily in constructing roads, bridges, airports, railways, and urban transit systems. These projects require extensive groundwork, including excavation, grading, soil compaction, and material transportation. Earthmoving equipment such as excavators, loaders, backhoes, and motor graders perform these essential tasks efficiently, allowing contractors to meet project deadlines and cost targets. Additionally, governments worldwide are investing in smart city development, which is propelling the demand for earthmoving equipment.

Market Dynamics

Increasing Product Development and Launches

Earthmoving equipment manufacturers are continuously investing in research and innovation to introduce equipment that delivers higher productivity, lower fuel consumption, and enhanced operator comfort. These improvements attract construction and mining companies looking to improve performance and reduce operational costs. Frequent product launches also allow manufacturers to address niche requirements in sectors such as urban construction, road maintenance, and mining, thereby expanding market presence. For instance, LiuGong showcased its full-line earthmoving products at the M&T Expo 2024. Hence, the earthmoving equipment market revenue is increasing with the rising product development and launches.

Growing Urbanization Globally

The need for housing, roads, sewage systems, and public transit is rising sharply with the growing urbanization globally. This drives construction companies to complete large-scale earthworks such as land clearing, excavation, grading, and trenching to prepare urban areas for development. Earthmoving machines such as loaders, backhoes, and excavators become essential tools to manage these intensive groundwork requirements efficiently. Furthermore, urban development usually involves high-density and vertical construction, requiring deeper foundations and more complex site preparation. Earthmoving equipment equipped with GPS, automation, and real-time monitoring systems allows operators to meet these challenges with greater accuracy and safety. According to the World Bank collection of development indicators, the urban population in the world was reported at 57.25 % in 2023 and is expected to increase in the coming years. Thus, as urbanization increases worldwide, the demand for earthmoving equipment also spurs.

Market Assessment by Segment

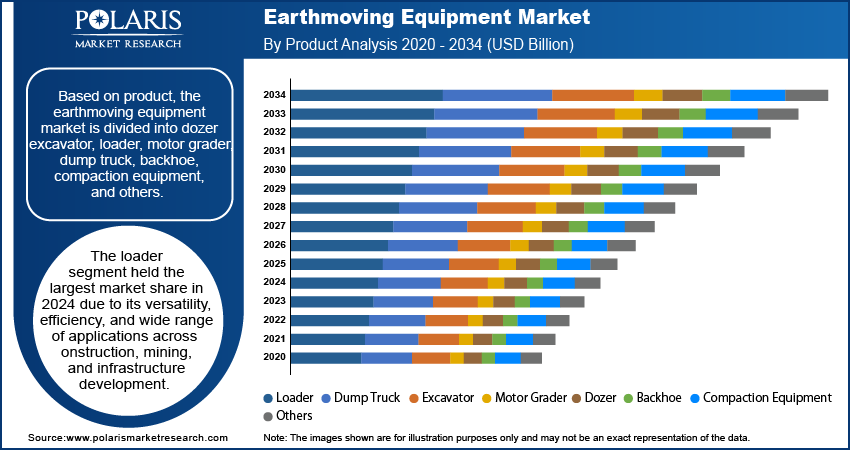

Market Evaluation by Product

Based on product, the earthmoving equipment market is divided into dozer, excavator, loader, motor grader, dump truck, backhoe, compaction equipment, and others. The loader segment held the largest earthmoving equipment market share in 2024 due to its versatility, efficiency, and wide range of applications across construction, mining, and infrastructure development. Loaders offer unmatched flexibility in material handling, site preparation, and debris removal, making them essential for large-scale projects. The increasing investments in urban infrastructure, particularly in rapidly developing economies across Asia Pacific and the Middle East, further fueled demand for loaders. Additionally, technological advancements such as GPS-integrated systems and automated control features enhanced the productivity and fuel efficiency of modern loaders, prompting contractors and fleet operators to upgrade their equipment.

The dump truck segment is projected to grow at a robust pace in the coming years, owing to a surge in large-scale mining activities, road construction projects, and the expansion of logistics infrastructure worldwide. Governments and private entities continue to invest in transport connectivity, leading to higher demand for reliable haulage solutions. Modern dump trucks now incorporate telematics, real-time diagnostics, and energy-efficient drivetrains, making them increasingly attractive to operators seeking to lower operational costs while maximizing output. Furthermore, the growing focus on electric and hybrid dump trucks reflects the broader shift toward sustainability, which is expected to boost the adoption of dump trucks across both emerging and developed regions.

Market Outlook by Application

In terms of application, the earthmoving equipment market is segregated into construction, underground mining, surface mining, and others. According to the earthmoving equipment market statistics, the construction segment dominated the market share in 2024 due to rapid urbanization, infrastructure development, and increasing residential and commercial projects worldwide. Countries such as China, India, and the US prioritized large-scale construction initiatives, including smart cities, highway expansions, and urban transit systems. These developments created sustained demand for high-performance earthmoving equipment, such as loaders, which offer superior material handling, site clearing, and road-building capabilities. Contractors preferred earthmoving equipment equipped with telematics and automation features to improve operational efficiency and meet tight construction project timelines, further contributing to the dominance of the segment.

The surface mining segment is expected to grow at the fastest during the forecast period, owing to rising global demand for minerals, coal, and metals used in manufacturing, energy production, and electric vehicle batteries. Mining companies are scaling up their operations in regions such as Australia, South America, and Africa, which require robust and high-capacity earthmoving machinery. Dump trucks, in particular, have become increasingly critical in transporting large volumes of overburdened and mined materials efficiently across rugged terrains. Innovations in fuel efficiency, load monitoring systems, and hybrid powertrains have made these machines more cost-effective and environmentally compliant, accelerating their adoption in surface mining projects.

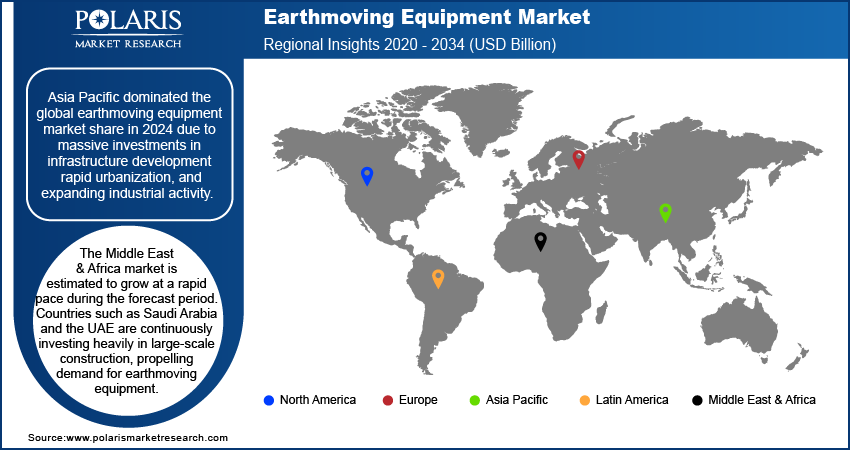

Regional Analysis

By region, the report provides earthmoving equipment market insight into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific held the largest share of the earthmoving equipment market revenue in 2024 due to massive investments in infrastructure development, rapid urbanization, and expanding industrial activity. The urban population in Asia is expected to grow by 50% by 2050. China’s aggressive Belt and Road Initiative, along with domestic mega projects such as high-speed rail lines, urban transit systems, and housing developments, fueled earthmoving equipment market expansion in the region. Additionally, government-backed packages supported public infrastructure spending, which encouraged contractors in the region to upgrade their fleets with advanced earthmoving machines. The availability of cost-effective labor and the growing adoption of automation and telematics in construction practices further strengthened the region’s dominance.

The Middle East & Africa earthmoving equipment market is estimated to grow at a rapid pace during the forecast period. Countries such as Saudi Arabia and the UAE are continuously investing heavily in large-scale construction and mining projects, thereby propelling demand for earthmoving equipment. Government initiatives such as Saudi Vision 2030 and the development of NEOM city have created sustained demand for durable, high-capacity earthmoving machines capable of operating in harsh environmental conditions. Moreover, increasing exploration of natural resources and rising government spending on infrastructure modernization are fueling the Middle East & Africa earthmoving equipment market expansion. Strategic partnerships with global manufacturers and an increasing focus on technology integration also position the Middle East & Africa as a key region in the market.

Earthmoving Equipment Key Market Players & Competitive Analysis Report

The earthmoving equipment market is highly competitive, driven by strategic mergers and acquisitions, partnerships, and collaborations that enhance market presence and technological capabilities. Major players such as Caterpillar, Komatsu, and Volvo frequently engage in mergers and acquisitions to expand their geographic reach and product portfolios. Additionally, companies are expanding their product portfolios to cater to diverse applications, from mining to urban construction. This dynamic landscape compels companies to continuously innovate and adapt, ensuring they offer advanced solutions that address evolving customer needs and regulatory requirements.

The earthmoving equipment market is fragmented, with the presence of numerous global and regional market players. A few major players in the market are AB Volvo; Bobcat Company; Caterpillar; CNH Industrial N.V.; Deere & Company; Doosan Corporation; Hitachi Construction Machinery Co., Ltd.; Hyundai Construction Equipment Co., Ltd.; J C Bamford Excavators Ltd.; Kobelco Construction Machinery Co. Ltd; Komatsu Ltd.; LIEBHERR; SANY Group; Sumitomo Heavy Industries, Ltd.; Terex Corporation; and XCMG Group.

AB Volvo, commonly known as the Volvo Group, is a multinational corporation that provides a wide range of commercial transport solutions. The company is headquartered in Gothenburg, Sweden, and operates globally, offering products such as trucks, buses, construction equipment, and power solutions for marine and industrial applications through its subsidiary Volvo CE. Volvo CE produces a comprehensive range of earthmoving equipment, including wheel loaders, hydraulic excavators, articulated haulers, motor graders, soil and asphalt compactors, pavers, backhoe loaders, skid steers, and milling machines. These products are designed to meet the diverse needs of construction and infrastructure projects worldwide. Volvo CE has production facilities in several countries, including the US, Brazil, Scotland, Sweden, France, Germany, Poland, India, China, Russia, and South Korea. This global presence allows the company to serve markets across every major region efficiently. Volvo CE also sells machines under two brands, Volvo and SDLG, catering to different market segments and customer preferences.

XCMG Group is a major global manufacturer of construction and earthmoving equipment. Founded in 1943, XCMG has grown to become one of the world's top construction machinery companies. The company offers a wide range of earthmoving equipment designed to meet the diverse needs of construction, mining, and infrastructure projects worldwide. XCMG's earthmoving equipment lineup includes excavators, loaders, graders, and rollers, all of which are known for their reliability, performance, and competitive pricing. The company's excavators, ranging from mini excavators as small as 0.8 tons to larger models, are particularly notable for their excellent power, strong lifting capability, and extended reach. These machines are versatile enough to handle various attachments, including those requiring high flow, such as mulchers and augers. XCMG has also made significant strides in remote-controlled excavators, such as the XE215GA. This 22.5-ton machine is equipped with a six-cylinder customized high-power engine, offering strong performance under heavy loads while reducing fuel consumption by 5%.

List of Key Companies

- AB Volvo

- Bobcat Company

- Caterpillar

- CNH Industrial N.V.

- Deere & Company

- Doosan Corporation

- Hitachi Construction Machinery Co., Ltd.

- Hyundai Construction Equipment Co., Ltd.

- J C Bamford Excavators Ltd.

- Kobelco Construction Machinery Co. Ltd

- Komatsu Ltd.

- LIEBHERR

- SANY Group

- Sumitomo Heavy Industries, Ltd.

- Terex Corporation

- XCMG Group

Earthmoving Equipment Industry Developments

January 2025: Volvo, a major player in the mining industry offering a wide range of equipment and solutions, unveiled its biggest and boldest articulated hauler to meet the modern-day need for connected solutions, productivity performance, and emission reduction.

October 2023: HD Hyundai Construction Equipment announced the launch of the HX Series 50ton class excavator, a smart plus series of excavators in 8ton, 14ton, 15ton, and electric forklifts in 2.5ton and 3.0ton for heavy-duty mining and material handling applications.

July 2022: Volvo Construction Equipment introduced an EC550E crawler excavator in India to boost productivity by up to 35%. EC550E crawler excavator can save up to 22% more fuel with independent metering valve technology.

Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Dozer

- Excavator

- Loader

- Motor Grader

- Dump Truck

- Backhoe

- Compaction Equipment

- Others

By Propulsion Outlook (Revenue, USD Billion, 2020–2034)

- ICE

- Electric

- Hybrid

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Construction

- Underground Mining

- Surface Mining

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Report Scope

|

Report Attributes |

Details |

|

Market Value in 2024 |

USD 70.17 Billion |

|

Market Forecast in 2025 |

USD 74.01 Billion |

|

Revenue Forecast by 2034 |

USD 121.69 Billion |

|

CAGR |

5.7 % from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global earthmoving equipment market size was valued at USD 70.17 billion in 2024 and is projected to grow to USD 121.69 billion by 2034

The global market is projected to register a CAGR of 5.7 % during the forecast period.

Asia Pacific held the largest share of the global market in 2024

A few of the key players in the market are AB Volvo; Bobcat Company; Caterpillar; CNH Industrial N.V.; Deere & Company; Doosan Corporation; Hitachi Construction Machinery Co., Ltd.; Hyundai Construction Equipment Co., Ltd.; J C Bamford Excavators Ltd.; Kobelco Construction Machinery Co. Ltd; Komatsu Ltd.; LIEBHERR; SANY Group; Sumitomo Heavy Industries, Ltd.; Terex Corporation; and XCMG Group.

The loader segment dominated the market revenue share in 2024.

The surface mining segment is expected to grow at the fastest pace in the coming years.