Elderly Nutrition Market Share, Size, Trends & Industry Analysis Report

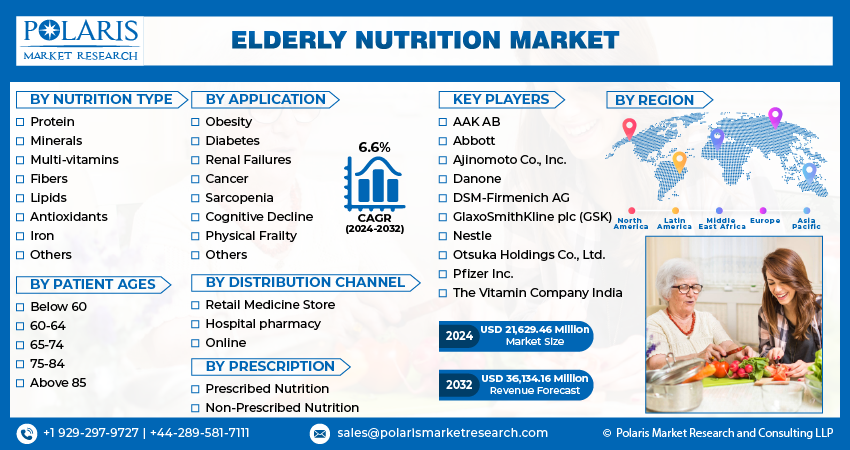

By Nutrition Type (Protein, Minerals, Multi-vitamins, Fibers, Lipids, Antioxidants, Iron, Others); By Application; By Distribution Channel; By Patient Ages; By Prescription; By Region; Segment Forecast, 2025 - 2034

- Published Date:Jun-2025

- Pages: 113

- Format: PDF

- Report ID: PM2918

- Base Year: 2024

- Historical Data: 2020-2023

Elderly Nutrition Market Overview

The global Elderly Nutrition Market was valued at USD 24.7 billion in 2024 and is projected to grow at a CAGR of 6.90% from 2025 to 2034. An aging global population and rising awareness of age-related dietary needs are driving market expansion.

The elderly nutrition is an essential part of the health and wellness industry, focusing on the dietary needs of older adults. The elderly nutrition market demand has grown significantly in recent years, driven by improved healthcare and increased life expectancy. Seniors are becoming aware of how nutrition affects their overall health. Thus, there is an increasing demand for specialized nutrition products. With aging, elderly dietary changes; they eat less, lose muscle, or have problems absorbing nutrients. Because of this, there is a growing need for nutritious and easy-to-consume foods designed specifically for seniors.

Consumer preferences shifting toward healthier lifestyles and preventive healthcare measures have contributed to the elderly nutrition market expansion. Older adults are increasingly prioritizing staying active, due to which they are seeking out nutritional products that sustain healthy aging and promote energy. This shift in consumer preference has encouraged manufacturers to diversify their product offerings and tailor marketing strategies to resonate with older consumers, highlighting the benefits of proper nutrition for maintaining physical function, cognitive health, and overall quality of life.

To Understand More About this Research: Request a Free Sample Report

The rising prevalence of chronic diseases such as osteoporosis, heart disease, and diabetes drive the demand for elderly nutrition products. According to the International Osteoporosis Foundation, osteoporosis is estimated to impact approximately 200 Billion women globally, affecting about one-tenth of those aged 60, one-fifth of those aged 70, two-fifths of those aged 80, and up to two-thirds of women aged 90. This high prevalence has raised awareness about chronic diseases, due to which older adults are shifting toward preventive measures, thereby driving the elderly nutrition market growth.

Elderly Nutrition Market Dynamics

Increasing Use of Nutraceuticals and Dietary Supplements

The elderly nutrition market is growing rapidly, driven by the increasing elderly population and a rising need for better health support among older adults. According to the India Ageing Report 2023, India’s elderly population is projected to double from 149 Billion in 2022 to 347 Billion by 2050, comprising over 20% of the total population amid rising age-related socio-economic challenges. This increase in population is a major factor contributing to the demand for elderly nutrition products. Many seniors struggle to get adequate nutrition from their daily diet alone due to reduced appetite, changes in metabolism, and difficulties in food digestion. Therefore, they rely on supplements to meet their daily nutritional needs. The preference for easy-to-use products makes nutraceuticals and dietary supplements more attractive to consumers. Additionally, old people are turning to preventative health and wellness, showing greater interest in natural and plant-based options such as natural, plant-based options, including herbal supplements, probiotics, and vitamins. These are often seen as safer and more effective for long-term health. Overall, the increasing use of nutraceuticals and dietary supplements in the diet of elderly people is driving the market growth.

Rising Prevalence of Chronic Diseases Worldwide

The prevalence of chronic conditions such as diabetes, cardiovascular diseases, osteoporosis, and hypertension rises as the population ages, demanding a greater focus on dietary interventions tailored to meet the unique needs of older adults. According to the 2022 National Diabetes Statistics Report by the Centers for Disease Control and Prevention (CDC), over 130 Billion adults in the US are affected by diabetes or prediabetes. These health concerns are closely linked to lifestyle changes seen in aging populations, such as less physical activity and unhealthy eating habits. Nutrition products are used in the diet of the elderly population to help manage these conditions. Thus, the increasing prevalence of chronic diseases among geriatric patients has significantly influenced the elderly nutrition market opportunities in recent years.

Elderly Nutrition Market Segment Insights

Elderly Nutrition Market Outlook by Nutrition Type Insights

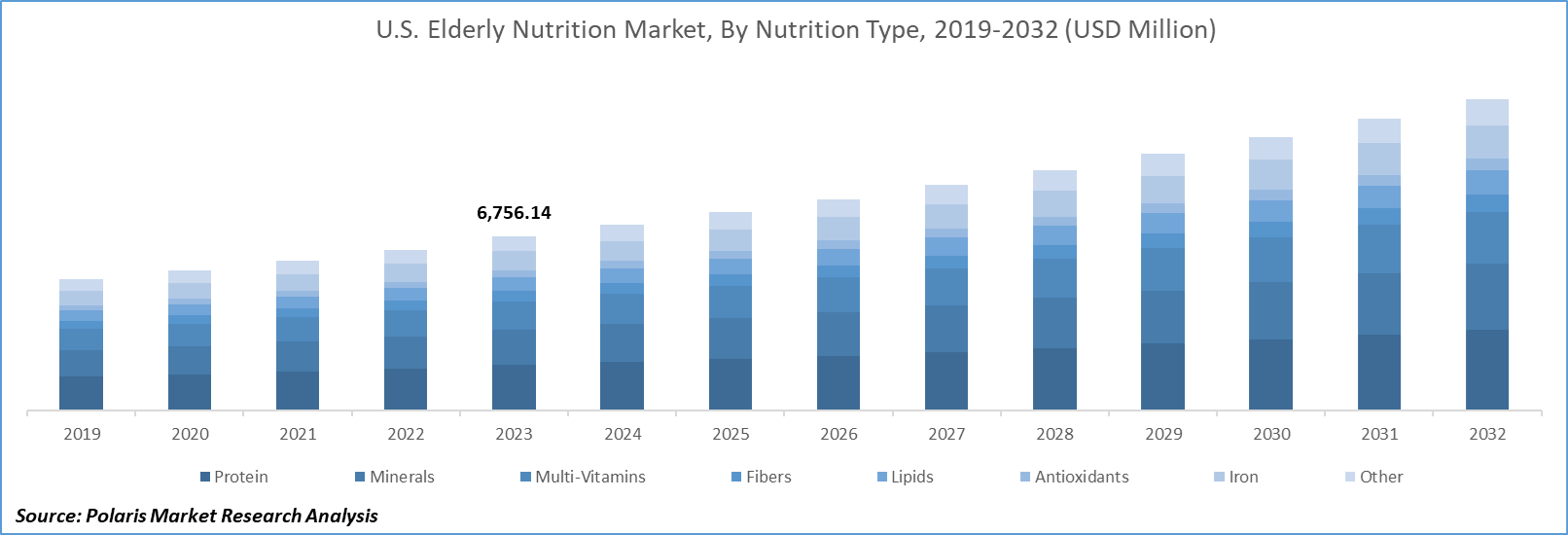

On the basis of nutrition type, the elderly nutrition market is segmented into protein, minerals, multi-vitamins, fibers, lipids, antioxidants, iron, and other. In 2024, the protein segment dominated the elderly nutrition market share, accounting for 25.8% of market revenue. This dominance is mainly attributed to growing awareness about the importance of protein in maintaining health as people age. Protein is a vital macronutrient essential for maintaining normal bodily functions, such as muscle repair, immune system support, and hormone regulation. As awareness increases, so does the demand for high-quality protein sources suited to the needs of the elderly. Elderly nutrition market analysis highlights the advancements in research and development that have led to innovative protein-based products specifically designed for seniors, helping them manage age-related muscle loss and overall physical decline. According to a 2024 study published by Stanford Lifestyle Medicine, research suggests a daily protein intake of 1.2–1.6 grams per kilogram of body weight or 0.54–0.72 grams per pound. For example, a 165-pound (75 kg) adult would need approximately 90–120 grams of protein daily to support health. This research highlights the role of protein in addressing age-related muscle loss, thereby emphasizing its importance in elderly nutrition. Therefore, protein remains a central component of the elderly nutrition market trends.

Elderly Nutrition Market Assessment by Application Insights

By application, the elderly nutrition market is divided into obesity, diabetes, renal failures, cancer, sarcopenia, cognitive decline, physical frailty, and others. The diabetes segment accounted for the largest share in 2024 and is expected to register the highest CAGR of 7.0% during the forecast period. Elderly individuals suffering from diabetes need carefully planned nutrition to manage their condition and support overall well-being. Within the elderly nutrition market, there is a growing focus on low-sugar, low-carbohydrate products that help regulate blood sugar levels without compromising essential nutrient intake. For instance, in December 2021, Danone India launched Protinex Diabetes Care to meet the nutritional needs of Indians affected by diabetes, offering a scientifically developed product rich in protein, fiber, and low Glycemic Index aimed at managing blood sugar levels effectively. Such launches also highlight a key elderly nutrition market opportunity, addressing the nutritional gaps and limited awareness around diabetes-friendly diets.

Elderly Nutrition Market Regional Analysis

By region, the study provides elderly nutrition market insights into North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. The North America market size reached USD 9.83 billion in 2024 and is estimated to register a CAGR of 6.6% during the forecast period. The regional market growth is driven by the rising prevalence of chronic diseases, increasing health awareness, and advancements in nutritional science. The aging population has become more vulnerable to conditions such as diabetes, heart disease, and osteoporosis; therefore, there is a stronger focus on using nutrition to support better health outcomes. Elderly individuals and their families are now more informed and actively looking for foods and supplements that help manage these health issues. Nutrition is no longer seen as just a basic need but as a key part of staying independent and healthy in later years. For example, the increased consumption of protein supplements and vitamin D-fortified products among seniors reflects a deliberate effort to preserve muscle mass and bone health, which are critical concerns for aging individuals. As awareness of personalized dietary needs increases, the elderly nutrition market is experiencing steady growth in demand for age-specific products designed to support senior health and wellness.

The Asia Pacifici elderly nutrition market is expected to register a significant CAGR from 2025 to 2034 due to the growing elderly population and rising demand for nutrient-rich products. For instance, according to the National Institutes of Health, by 2050, a quarter of Asia's population will be ≥60 years old, leading to more elderly with chronic diseases and disability, affecting health, healthcare systems, the workforce, and budgets in many Asian countries. Elderly individuals often face health challenges such as malnutrition, reduced appetite, chronic conditions, and age-related deficiencies. This drives the demand for nutritional supplements, functional foods, and specialized diets designed to support healthy aging and manage these health issues.

Various companies in Asia Pacific have launched nutrition for adults and a mobile app to raise awareness of the nutritional value, driving the elderly nutrition market expansion. For instance, in February 2024, Otsuka Pharmaceutical introduced "Mogumogu Town," an AR-based nutrition education game app. This initiative aligns with the Japanese Government's food education efforts and incorporates AI technology for interactive learning. This approach boosts nutritional awareness diversely and expansively, driving the elderly nutrition market in Asia Pacific.

Elderly Nutrition Market – Key Players & Competitive Insights

The competitive landscape includes a wide range of products, including nutritional supplements, meal replacements, fortified foods and beverages, dietary fibers, vitamins, and minerals. Companies differentiate themselves based on the formulation, bioavailability, taste, convenience, and targeted health benefits of their products. Continuous research and development efforts drive innovation in the elderly nutrition market. Companies invest in developing products with enhanced nutrient absorption, reduced allergens, better taste and texture, and improved shelf stability. For example, there is a growing interest in plant-based and functional ingredients that offer health benefits beyond basic nutrition.

A few key players in the elderly nutrition market include Nestle Health Science; Danone; Abbott; AAK AB; The Vitamin Company India; Ajinomoto Co., Inc.; DSM-Firmenich AG; Otsuka Holdings Co., Ltd; Synlait Ltd.; and Nutreat Australia.

Nestlé Health Science is a globally recognized subsidiary of Nestlé, a leading multinational food and beverage company. As part of Nestlé’s broader vision of enhancing nutrition and health, Nestlé Health Science was established in 2011 to focus on medical nutrition, consumer health, and pharmaceutical solutions. The company operates at the intersection of food, healthcare, and science, aiming to improve people’s quality of life through targeted nutritional products. Nestlé Health Science develops and markets a wide range of specialized nutritional solutions, including dietary supplements, medical foods, and functional beverages. Its portfolio includes well-known brands such as BOOST, Garden of Life, Vital Proteins, and Pure Encapsulations, catering to consumers with varying health and dietary needs. The company also provides medical nutrition products for individuals with specific conditions such as malnutrition, metabolic disorders, and digestive health issues. The company operates globally, with manufacturing sites and research facilities dedicated to developing science-backed products. By leveraging Nestlé’s expertise in nutrition and science, Nestlé Health Science continues to expand its footprint in the growing health and wellness.

Danone is a multinational food and beverage company headquartered in Paris, France. It is one of the world’s leading companies in the dairy foods, plant-based meat, and specialized nutrition sectors. Founded in 1919, Danone has grown into a global powerhouse with a strong commitment to health-focused and sustainable food solutions. The company operates through three main business segments: Essential Dairy & Plant-Based Products, Specialized Nutrition, and Waters. Its well-known brands include Activia, Actimel, Alpro, Evian, Nutricia, and Aptamil, catering to diverse consumer needs, from dairy alternatives to infant nutrition and bottled water. Danone's Specialized Nutrition division focuses on early-life nutrition and medical nutrition, addressing dietary needs for infants, the elderly, and individuals with medical conditions. Sustainability is a core part of Danone’s mission. The company is committed to reducing its carbon footprint, promoting regenerative agriculture, and ensuring sustainable water management. It has also embraced a B Corp certification strategy, reinforcing its commitment to social and environmental responsibility. With operations in over 120 countries, Danone continues to expand its presence in health-driven food categories, leveraging science, innovation, and consumer insights to shape the future of nutrition.

List of Key Companies in Elderly Nutrition Market

- AAK AB

- Abbott

- Ajinomoto Co., Inc.

- Danone

- DSM-Firmenich AG

- Nestle Health Science

- Nutreat Australia

- Otsuka Holdings Co., Ltd

- Synlait Ltd.

- The Vitamin Company India

Elderly Nutrition Industry Developments

In April 2025, Horlicks launched Strength PLUS, a sugar-free nutritional supplement for seniors, targeting India’s growing elderly population. It supports muscle, bone, and digestive health, with diagnostic partnerships to promote proactive senior wellness.

April 2025: Danone India announced the launch of Zero Added Sugar variants of Protinex in Vanilla Delight flavors and Tasty Chocolate.

January 2024: Abbott launched its new PROTALITY brand to support adults on their weight loss journey.

December 2023: Ajinomoto introduced AminoMOF, a new amino acid dietary supplement with collagen, which targets Thailand's thriving elderly dietary supplement market.

Elderly Nutrition Market Segmentation

By Nutrition Type Outlook (Revenue, USD Billion, 2020–2034)

- Protein

- Minerals

- Multi-Vitamins

- Fibers

- Lipids

- Antioxidants

- Iron

- Other

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Obesity

- Diabetes

- Renal Failures

- Cancer

- Sarcopenia

- Cognitive Decline

- Physical Frailty

By Distribution Channel Outlook (Revenue, USD Billion, 2020–2034)

- Retail Medicine Store

- Hospital Pharmacy

- Others

By Patient Ages Outlook (Revenue, USD Billion, 2020–2034)

- Below 60

- 60–64

- 65–74

- 75–84

- Above 85

By Prescription Outlook (Revenue, USD Billion, 2020–2034)

- Prescribed

- Non-Prescribed

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Austria

- Italy

- Spain

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- South Africa

- Israel

- UAE

- Rest of Middle East & Africa

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

Elderly Nutrition Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 24.7 Billion |

|

Market Size Value in 2025 |

USD 26.4 Billion |

|

Revenue Forecast by 2034 |

USD 45.2 Billion |

|

CAGR |

6.90% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 24.7 billion in 2024 and is projected to grow to USD 45.2 billion by 2034.

The global market is expected to register a CAGR of 6.90% during the forecast period.

North America held the largest share of the global market in 2024.

A few key players in the market are Nestle Health Science; Danone; Abbott; AAK AB; The Vitamin Company India; Ajinomoto Co., Inc.; DSM-Firmenich AG; Otsuka Holdings Co., Ltd; Synlait Ltd.; and Nutreat Australia.

The protein segment dominated the market in 2024.

The diabetes segment held the largest share of the global market in 2024.