Electric Golf Carts Market Size, Share, Trends, Industry Analysis Report

: By Application, By Seating Capacity (2, 3, 4, 6, and 8), and By Region– Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM5628

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

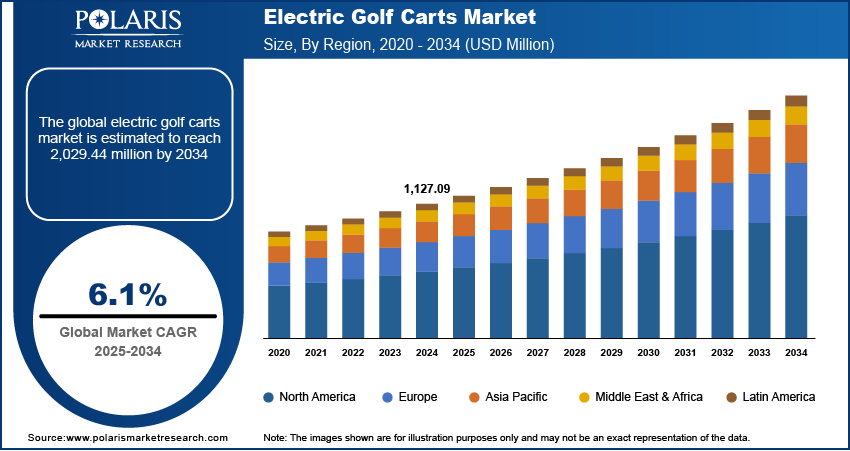

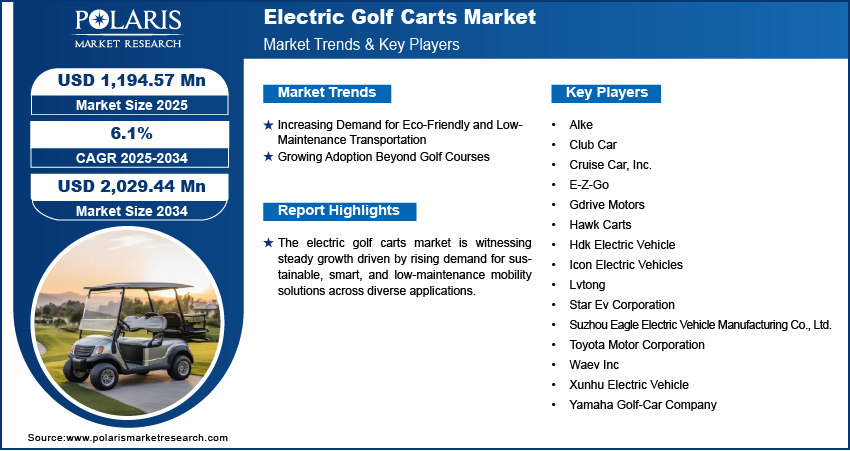

The global electric golf carts market size was valued at USD 1,127.09 million in 2024, at a CAGR of 6.1% during 2025–2034. Advancements in battery technology, decreasing costs, and growing demand for eco-friendly, low-maintenance transport are collectively driving the market, expanding its application from golf courses to sectors such as hospitality, urban mobility, and industrial logistics.

Key Insights

- Golf courses continue to dominate application usage due to demand for quiet, efficient, and low-emission transport within large green spaces.

- The 4-seating segment is gaining popularity as it offers a balance of size and utility for resorts, gated communities, and families.

- North America leads the market due to an established golf culture, strong infrastructure, and widespread adoption of electric mobility in leisure and housing.

- Asia Pacific is growing fastest with rising urbanization, expanding tourism, and supportive policies driving electric cart use in diverse non-golf settings.

Industry Dynamics

- Advancements in battery technology, especially lithium-ion, are improving performance, charging efficiency, and range of electric golf carts.

- Declining battery costs and manufacturing efficiencies are making electric golf carts more affordable for broader commercial and residential use.

- Rising demand for eco-friendly, low-maintenance vehicles is driving adoption in environmentally sensitive and urban areas.

- Increasing use beyond golf courses in resorts, airports, campuses, and gated communities is diversifying market applications.

- Range limitations, low speed, and suitability for only short-distance travel continue to restrict broader utility in certain transport scenarios.

Market Statistics

2024 Market Size: USD 1,127.09 million

2034 Projected Market Size: USD 2,029.44 million

CAGR (2025–2034): 6.1%

North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

An electric golf cart is a battery-powered vehicle primarily used to transport golfers and their equipment across a golf course, with expanding use in resorts, gated communities, and short-distance transportation. The market growth is driven largely by technological advancements in electrification. Innovations in battery technology, particularly lithium-ion batteries, have significantly improved the performance, range, and charging efficiency of electric golf carts. A 2023 report by the IEA stated that automotive lithium-ion (Li-ion) battery demand increased by about 65%, reaching 550 GWh in 2022, up from around 330 GWh in 2021. Additionally, enhanced motor control systems and integration of smart features such as GPS tracking, digital dashboards, vehicle tracking systems, and regenerative braking are elevating the overall user experience. These advancements are improving energy efficiency and also aligning electric golf carts with modern sustainability and automation trends, thereby boosting their adoption across a range of non-golf applications.

The demand for electric golf carts is rising due to decreasing costs, making them more accessible to a wider consumer base. For instance, a 2024 IEA report showed EV battery demand reached 18% of total sales, up from 17% in 2021 and one-quarter (25%) in 2022. Reductions in the cost of battery components, improved manufacturing efficiencies, and scaled production have contributed to the overall affordability of electric models. This cost-effectiveness is attracting new buyers from sectors such as hospitality, urban mobility, and industrial logistics. More institutions and individuals are making the shift from traditional golf carts to electric alternatives as initial investment barriers lower. These changes in the market are reinforcing the transition toward sustainable and economically viable mobility solutions in both recreational and utility-driven environments.

Market Dynamics

Increasing Demand for Eco-Friendly and Low-Maintenance Transportation

The increasing demand for eco-friendly and low-maintenance transportation is driving the market development, aligning closely with global sustainability goals. A November 2024 IBEF report valued the global EV market at 255.54 million, projecting growth to 2,108.80 million by 2033 at a 23.42% CAGR. The EV sector is expected to expand rapidly over the next decade. Electric golf carts operate on battery power, producing zero tailpipe emissions, making them a clean alternative to traditional gasoline-powered vehicles. Their quiet operation and reduced environmental footprint make them particularly attractive for use in environmentally sensitive areas such as parks, campuses, and residential communities. Additionally, these vehicles offer lower maintenance requirements due to fewer moving parts and the absence of an internal combustion engine, which translates into cost savings for users. This combination of environmental and operational advantages is fostering increased adoption across various end-user segments.

Growing Adoption Beyond Golf Courses

Electric golf carts are increasingly being utilized in settings such as airports, resorts, industrial facilities, and urban neighborhoods for short-distance travel. Their compact size, energy efficiency, and ease of use make them well-suited for a wide range of utility and personal transport needs. A notable example is Massimo Group’s December 2024 launch of its MVR HVAC Golf Cart and Utility Cart, featuring enclosed cabs with heating/cooling, a 48V motor, a 45-mile range, and all-terrain capability. Designed for golf, recreation, and light work, they prioritize comfort and quiet operation. This diversification in the adoption of electric golf carts beyond golf courses reflects a broader shift toward flexible, low-speed electric mobility solutions and is expanding the market application scope across both commercial and private sectors.

Segment Insights

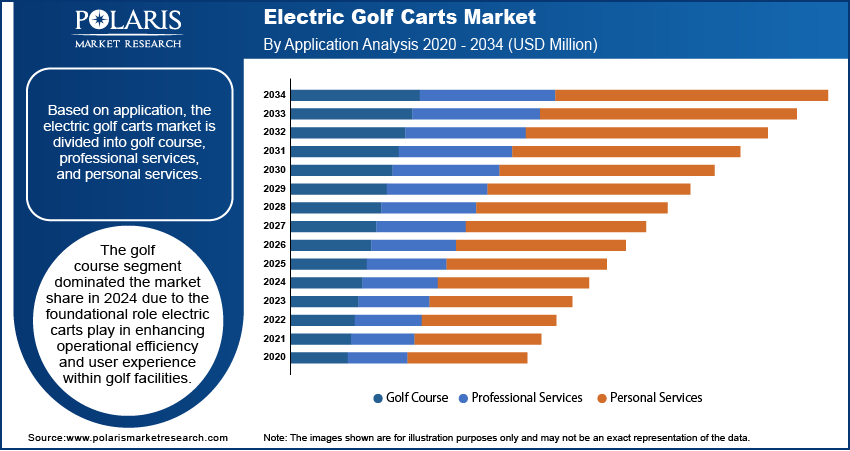

Electric Golf Carts Market Assessment by Application

The segmentation based on application, includes golf course, professional services, and personal services. The golf course segment dominated the electric golf carts market share in 2024 due to the foundational role electric carts play in enhancing operational efficiency and user experience within golf facilities. Golf courses require reliable, quiet, and emission-free transportation solutions to maintain the tranquility and environmental integrity of their landscapes. Electric golf carts fulfill these needs while offering lower operational costs compared to gas-powered alternatives. Their ease of use and minimal maintenance further make them the preferred choice for both public and private golf courses globally. Additionally, many golf clubs continue to replace older fleets with newer, technologically advanced electric models, reinforcing the dominance of this segment.

Electric Golf Carts Market Evaluation by Seating Capacity

The segmentation based on seating capacity, includes 2, 4, 6, and 8. The 4 seating segment is expected to witness the fastest growth during the forecast period as it strikes an ideal balance between passenger capacity and vehicle size, catering to a wide variety of users. This configuration is particularly preferred in non-golf uses such as resort shuttles, residential communities, and industrial areas, where efficient transport of small groups is essential. The increased adoption of electric carts for family and commercial use has driven demand for mid-sized vehicles that offer both comfort and utility. 4-seater models are becoming more versatile and appealing for both personal and institutional buyers, leading to strong growth potential with advancements in battery life and design.

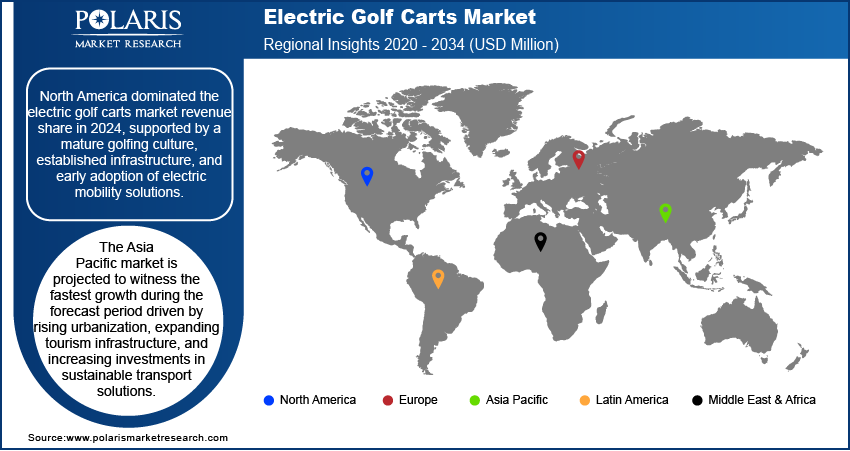

Electric Golf Carts Market Regional Analysis

By region, the report provides insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the market revenue share in 2024, supported by a mature golfing culture, established infrastructure, and early adoption of electric mobility solutions. The presence of a large number of golf courses across the US and Canada continues to generate consistent demand for electric carts. According to a July 2022 Pfeiffer University report, quality golf clubs cost at least USD 500, green fees start at USD 50, and private lessons range from USD 80 to USD 100. Weeklong camps cost USD 250–USD 400, while overnight camps reach USD 1,200–USD 2,000, further boosting the growth opportunities. Furthermore, regional consumer preference for sustainable transport options in residential communities, resorts, and recreational facilities has reinforced market growth. Supportive regulatory frameworks, high disposable incomes, and a strong network of manufacturers and distributors also contribute to North America's leadership in this sector.

The Asia Pacific market is projected to witness the fastest growth during the forecast period driven by rising urbanization, expanding tourism infrastructure, and increasing investments in sustainable transport solutions. Countries in the region are increasingly deploying electric carts in airports, resorts, and gated communities as part of broader eco-friendly mobility initiatives. Additionally, growing awareness of the environmental benefits of electric vehicles and government emphasis on reducing carbon emissions are creating favorable market conditions. Demand for electric golf carts in Asia Pacific is expected to rise rapidly across both commercial and personal segments as affordability improves and applications diversify.

Electric Golf Carts Market – Key Players & Competitive Analysis Report

The electric golf cart industry is experiencing substantial growth driven by disruptive technologies in battery efficiency and sustainable value chains. Established players such as Club Car, Yamaha, and E-Z-GO dominate with an extensive regional footprint and diverse product offerings while facing competition from emerging Asian manufacturers. Strategic investments in lithium-ion battery technology and solar integration are reshaping competitive positioning, with industry leaders focusing on expansion opportunities beyond traditional golf courses into planned communities, tourism, and commercial applications. Economic and geopolitical shifts, particularly related to battery material sourcing, have created supply chain disruptions that manufacturers address through strategic alliances with battery producers. Revenue growth analysis indicates that premium-segment products with extended range and smart connectivity features command higher profit margins. Technology advancements in autonomous capabilities and digitalization of fleet management systems represent key R&D focus areas, while international collaboration on battery recycling initiatives strengthens sustainability credentials. Competitive benchmarking reveals successful vendors leveraging partnerships with resort developers and municipalities. Future development strategies emphasize modular designs, increased customization options, and integrated solar charging solutions, with experts projecting a continued industry-wide transition toward fully electric fleets across all business segments. A few key major players are Alke; Club Car; Cruise Car, Inc.; E-Z-Go; Gdrive Motors; Hawk Carts; Hdk Electric Vehicle; Icon Electric Vehicles; Lvtong; Star Ev Corporation; Suzhou Eagle Electric Vehicle Manufacturing Co., Ltd.; Toyota Motor Corporation; Waev Inc; Xunhu Electric Vehicle; and Yamaha Golf-Car Company.

Toyota Motor Corporation, founded in 1937 and headquartered in Toyota City, Japan, is one of the world’s leading automotive manufacturers known for its innovation and sustainability. Toyota also produces electric golf carts designed to meet the growing demand for eco-friendly and efficient short-distance transportation. Toyota’s electric golf carts are engineered with advanced technologies to ensure smooth, quiet operation and high performance. These vehicles cater to various applications, such as golf courses, resorts, gated communities, and industrial complexes. Toyota’s electric golf carts are equipped with powerful motors and long-lasting lithium-ion batteries that provide extended range and fast charging capabilities. These carts align with the company’s commitment to environmental sustainability with zero emissions. The ergonomic designs prioritize passenger comfort, featuring spacious seating, adjustable steering wheels, and smooth suspension systems for a pleasant ride across diverse terrains. Safety features such as regenerative braking, LED headlights, and digital dashboards enhance usability and reliability. Toyota’s electric golf carts also offer customization options, allowing businesses to personalize them with specific colors, logos, or accessories. Toyota continues to innovate in the electric golf cart segment by leveraging its expertise in electric vehicle technology, providing sustainable mobility solutions for leisure and commercial purposes.

Yamaha Golf-Car Company is a well-known manufacturer of golf carts and vehicles. It is a subsidiary of Yamaha Motor Company and has built a strong reputation for producing high-quality, reliable, and innovative electric and gas-powered golf cars. The company focuses on providing vehicles that offer comfort, performance, and durability, making them suitable for golf courses, resorts, personal use, and commercial applications. Yamaha's golf carts are widely used around the world and are appreciated for their smooth ride and user-friendly features. The product portfolio of Yamaha Golf-Car Company includes a range of electric and gas-powered golf carts, utility vehicles, and personal vehicle options. Some of their key models include the Drive2 series, which is available in both electric and gas versions, known for its advanced technology, quiet performance, and ergonomic design. They also offer utility vehicles such as the UMAX series, built for heavy-duty tasks in various environments such as campuses, resorts, and industrial sites.

List of Key Companies in Electric Golf Carts Market

- Alke

- Club Car

- Cruise Car, Inc.

- E-Z-Go

- Gdrive Motors

- Hawk Carts

- Hdk Electric Vehicle

- Icon Electric Vehicles

- Lvtong

- Star Ev Corporation

- Suzhou Eagle Electric Vehicle Manufacturing Co., Ltd.

- Toyota Motor Corporation

- Waev Inc

- Xunhu Electric Vehicle

- Yamaha Golf-Car Company

Electric Golf Carts Industry Developments

April 2025: Motocaddy expanded its remote-controlled electric golf cart lineup with the budget-friendly ME Remote model. Designed as an entry-level option, it offers hands-free operation, making automated golf carts more accessible to a wider market.

March 2025: Yamaha launched its new five-seater electric golf carts, the G30Es (self-guided) and G31EPs (manual), in Japan and later in Taiwan. Both feature lithium-ion batteries, high-performance AC motors, and improved ride stability.

Electric Golf Carts Market Segmentation

By Application Outlook (Revenue, USD Million, 2020–2034)

- Golf Course

- Professional Services

- Personal Services

By Seating Capacity Outlook (Revenue, USD Million, 2020–2034)

- 2

- 4

- 6

- 8

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Electric Golf Carts Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1,127.09 million |

|

Market Size Value in 2025 |

USD 1,194.57 million |

|

Revenue Forecast in 2034 |

USD 2,029.44 million |

|

CAGR |

6.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1,127.09 million in 2024 and is projected to grow to USD 2,029.44 million by 2034.

The global market is projected to register a CAGR of 6.1% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are Alke; Club Car; Cruise Car, Inc.; E-Z-Go; Gdrive Motors; Hawk Carts; Hdk Electric Vehicle; Icon Electric Vehicles; Lvtong; Star Ev Corporation; Suzhou Eagle Electric Vehicle Manufacturing Co., Ltd.; Toyota Motor Corporation; Waev Inc; Xunhu Electric Vehicle; and Yamaha Golf-Car Company.

The golf course segment dominated the market share in 2024.

The 4 seating segment is expected to witness the fastest growth during the forecast period.