Electric Utility Vehicle Market Share, Size, Trends, Industry Analysis Report

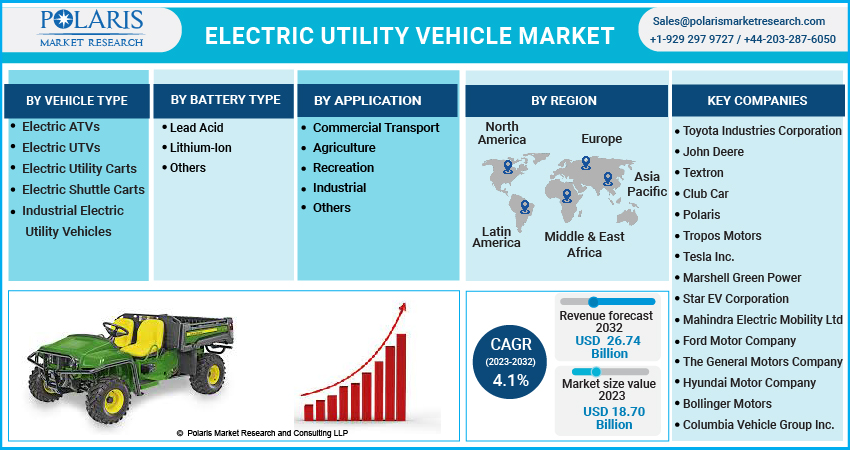

By Vehicle Type (Electric ATVs, Electric UTVs, Electric Utility Carts, Electric Shuttle Carts, and Industrial Electric Utility Vehicles); By Battery Type; By Application; By Region; Segment Forecast, 2023 - 2032

- Published Date:Apr-2023

- Pages: 118

- Format: PDF

- Report ID: PM3155

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

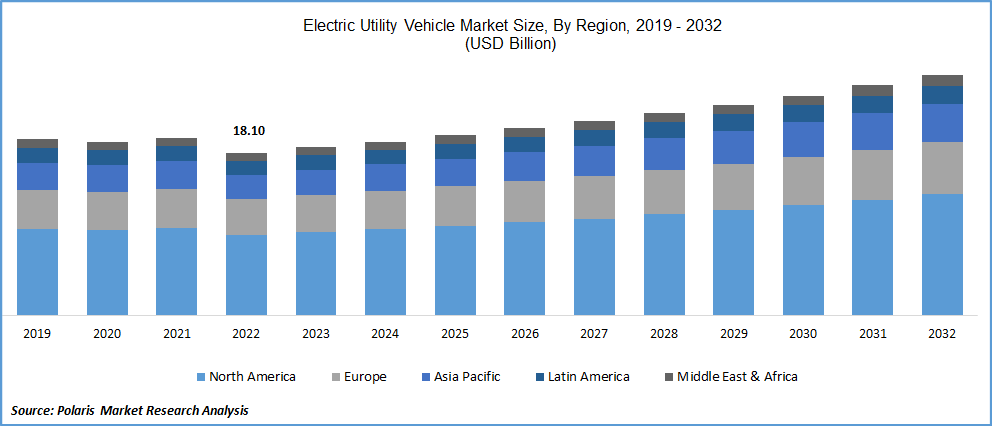

The global electric utility vehicle market was valued at USD 18.10 billion in 2022 and is expected to grow at a CAGR of 4.1% during the forecast period. The extensive rise in the investment from both private and government organizations to establish electric vehicle stations, increasing utilizations of electric utility vehicles in last mile delivery applications, and high focus on the reduction of carbon emissions, are primary factors projected to drive the revenue growth of the global market. Electric vehicles are being widely utilized globally for recreation activities like hunting, forest rides, and fishing and are also used for variety of agricultural purposes including cattle, towing, construction tasks, and feeding.

Know more about this report: Request for sample pages

At present, large number of utility vehicles are based on the internal combustion engines, that uses fossil fuels to operate the vehicles and create high emissions, however, electric utility vehicles completely run of clean energy and do not produce emissions and are low-maintenance requires as well. Thus, manufacturers around the world are focusing on the electrification of their vehicles and introducing new electric utility vehicles, which is likely to create to new lucrative growth opportunities for the electric utility vehicle market.

For instance, in May 2022, Alpha Motor Corporation, announced the launch of its new pure electric utility vehicles named REX in a collaboration with Iconic LA “Free & Easy” brand. It is a multi-faceted adventure-based vehicle, that is built for all-terrain ability, utility, & comes with a wide array of customization options and is powered with 85-KW hour-lithium-ion battery for a range of 275 miles.

COVID-19 pandemic has impacted the growth of the electric utility vehicle market. Deadly coronavirus has resulted in high disruptions in the global supply chain and temporary shutdown of manufacturing facilities and sales channels, that causing for low production and sales of vehicles around the globe. In addition, many manufacturers have faced the shortage of components including semiconductor chips and many others, which further hampered the vehicles production during the pandemic.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The exponential rise in the need and prevalence to support the hub and spoke model across numerous applications including e-commerce, automotive component, electronics, consumable goods, that results in increased number of warehouses worldwide, which is likely to heightened the demand for industrial electric utility vehicles and boost the global market growth over the study period. For instance, according to the India Brand Equity Foundation, the Indian e-commerce industry projected to reach USD 111 Bn, by 2024 & USD 200 Bn, by 2026. After China and US, India was the largest country in terms of online shopper with over 150 Mn in 2021 & is expected to grow to 350 Mn. by 2026.

Furthermore, with the rising environmental concerns, many governments and also environmental agencies globally are enacting several stringent emission norms and regulations to get control on the vehicle emission, as high amount of greenhouse gases such as carbon dioxide and nitrogen oxide are being emitted from vehicles and affecting the environment as well as human health. Thus, in turn, the demand and adoption of electric utility vehicles are expected to gain traction and grow significantly in the coming years.

Report Segmentation

The market is primarily segmented based on vehicle type, battery type, application, and region.

|

By Vehicle Type |

By Battery Type |

By Application |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Electric ATVs segment accounted for the largest market share in 2022

The electric ATVs segment accounted for largest global market share in 2022, and is projected to grow at considerable growth rate during the forecast period. The growth of the segment market can be attributed to growing popularity of various recreational and adventurous sports, very low noise emissions, low ownership cost, and expansion in the use for military purposes. Rapid increase in the use of autonomous ATVs for excavating land, reclaiming land, clearing mud, and maintaining reservoirs, ponds, riverbeds, and swamps would also favorably affect the segment growth.

Furthermore, the industrial electric utility vehicles are projected to grow at substantial growth rate over the study period, that is accelerated by the rise in the penetration of the AWD and 4WD vehicles around the world along with the surge in number of government initiatives to promote driving utility vehicles.

Lithium-ion segment is expected to witness fastest growth during forecast period

lithium-ion segment is anticipated to grow at fastest growth rate during the projected period, which is mainly driven growing utilization of these batteries in wide range of electric vehicles due to their high efficiency, faster charging time, low weight, and enhanced battery capacity. Additionally, most components used in the manufacturing of lithium-ion batteries can be easily recycled and thus have very low environmental impact during the disposal, which is further expected to boost the adoption in the near future.

However, the lead acid battery segment held the largest market share in 2022, on account of the wide usage of these batteries in automobiles applications including starting, lighting, and ignition purposes and further supplies voltage to the variety of vehicle accessories such as air conditioners, music players, radio, wipers, and charging plugs. The reliability and low cost of lead acid batteries as compared to the others available in the market make its highly suitable and preferable for numerous consumers and industrial applications in the electric automotive sector, that is likely to have a positive impact on the global market growth over the coming years.

Commercial segment is projected to hold significant market share in 2022

The commercial segment is likely to register significant growth and will account for significant market share throughout the forecast period. Growth in the logistics sector, waste collection, postal services, and municipality’s tasks across both developed and developing nations coupled with the high preference for last mile deliveries and use of electrified vehicles like vans and trucks are primary factors expected to drive the growth of the segment market.

Commercial transport is one of the leading applications of electric utility vehicles, with a huge demand and proliferation for electric shuttle carts for various applications especially in urban areas, as these types of vehicles are considered as low-speed logistics and cargo services. Hence, many industrial players have been looking to adopt these vehicles systems into their process, which is generating high growth opportunities for the segment.

The demand in North America is expected to witness significant growth during projected timeframe

The North America region is expected to be the largest market with a holding of healthy market share during the projected period, as North America is one of the leading and advanced ATV/UTV industries worldwide, and contributing around 50% of the global demand. The demand for electric utility vehicle has grown rapidly due to the presence of large e-commerce industry and a well-established ecosystem foe various industrial and manufacturing companies in the region, thereby propelling the demand and growth of the market.

The Asia Pacific region is also projected to account for substantial market share, which is mainly led by the countries like China, South Korea, Japan, and India. The government of these countries have taken several initiatives including initiatives for EV buyers, large support to the EV charging station installation, compulsory laws and regulations to manufacture EVs along with the introduction to new vehicles scrappage policy, in which old vehicles are change into new charging ones, are among the key factors driving the market growth exponentially.

Competitive Insight

Key players include Toyota Industries Corporation, John Deere, Textron, Club Car, Polaris, Cenntro Automotive Europe GmbH, Tesla., Marshell Green Power, Star EV, Mahindra Electric Mobility, Ford Motor Company, General Motors, Hyundai Motor, Bollinger Motors, Columbia Vehicle Group, Neuron EV, & Ligier Professional.

Recent Developments

- In January 2022, Toyota Handling, introduced its 22 latest EVs for the industrial utility across all the environments and applications. TMH’s new product range include 12 new truck models, 4 different operator compartments, a multidirectional model for long roads in the narrow aisles, & 3 mast reach truck models to fit in wide range of applications.

- In August 2022, Mahindra, a leading sports utility vehicle manufacturer, introduced its new EV architecture named “INGLO EV platform” & 5 new e-SUVs under tow different EV brands, with the vision of future of electric mobility. The new platform is mainly based on the modular electric skateboard, which will underpin the company’s new range of EVs, that is expected to arrive by the end of 2024.

Electric Utility Vehicle Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 18.70 billion |

|

Revenue forecast in 2032 |

USD 26.74 billion |

|

CAGR |

4.1% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Vehicle Type, By Battery Type, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Toyota Industries Corporation, John Deere, Textron, Club Car, Polaris, Cenntro Automotive Europe GmbH, Tesla Inc., Marshell Green Power, Star EV Corporation, Mahindra Electric Mobility Limited, Ford Motor Company, The General Motors Company, Hyundai Motor Company, Bollinger Motors, Columbia Vehicle Group Inc., Neuron EV, and Ligier Professional. |

FAQ's

The electric utility vehicle market report covering key segments are vehicle type, battery type, application, and region.

Electric Utility Vehicle Market Size Worth $26.74 Billion by 2032.

The global electric utility vehicle market expected to grow at a CAGR of 4.1% during the forecast period.

North America is leading the global market.

Key driving factors in electric utility vehicle market are increased demand for warehouses in the e-commerce and growing number of onsite storage facilities.