Electronic Waste Management Market Size, Share, Trends, Industry Analysis Report

: By Material Recovery (Plastic, Glass, Metal, and Others), Recycler Type, Source Type, Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Jan-2024

- Pages: 129

- Format: PDF

- Report ID: PM3357

- Base Year: 2024

- Historical Data: 2020-2023

Report Outlook

Electronic Waste Management Market Overview

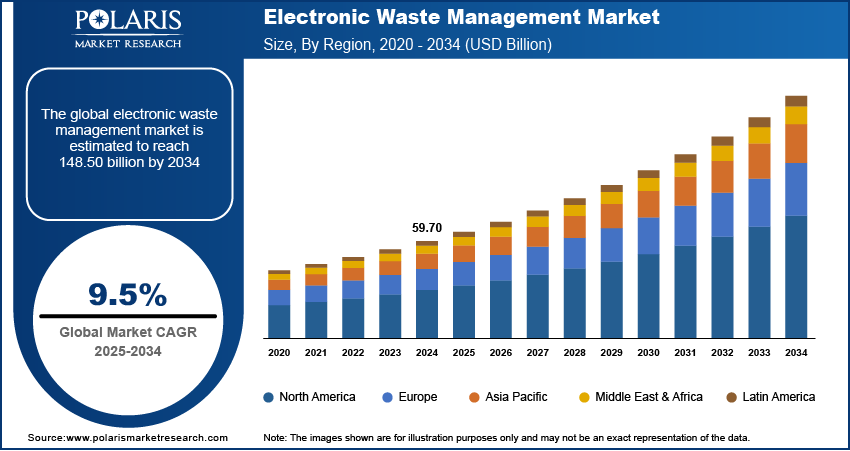

The global electronic waste management market size was valued at USD 59.70 billion in 2024 and is expected to reach USD 65.35 billion by 2025 and 148.50 billion by 2034, exhibiting a CAGR of 9.5% during 2025–2034.

Electronic waste management refers to the collection, recycling, disposal, and proper handling of discarded electronic devices such as computers, smartphones, TVs, and appliances. Electronic waste management aims to reduce environmental pollution, recover valuable materials, and ensure safe disposal of hazardous components. Governments across the world are enforcing laws for proper e-waste disposal and recycling, which is contributing to the electronic waste management market growth. Moreover, innovations in e-waste recycling processes boost efficiency and material recovery, further supporting market growth opportunities.

To Understand More About this Research: Request a Free Sample Report

Urbanization and industrialization are leading to the rise in disposable incomes and modern lifestyles of consumers, propelling the demand for new electronic devices. This growth is contributing to greater e-waste generation, which is further driving the electronic waste management market expansion. Furthermore, extended producer responsibility (EPR) programs are making manufacturers more accountable for e-waste disposal and recycling, driving the electronic waste management market demand.

Electronic Waste Management Market Dynamics

Rising Demand for Electronic Devices

The rising adoption of consumer electronics has led to an exceptional surge in e-waste generation. The increasing affordability, accessibility, and rapid technological advancements in electronic devices have significantly shortened product life cycles, convincing consumers to upgrade to newer models more frequently. This trend has resulted in the mass disposal of outdated smartphones, laptops, tablets, televisions, and household appliances, thereby intensifying the requirement for electronic waste management. Moreover, businesses and industries are continuously investing in advanced IT infrastructure, data centers, and industrial automation. For instance, BlackRock, Global Infrastructure Partners, Microsoft, and MGX have partnered to invest in data centers and power infrastructure, leveraging AI to enhance operational efficiency and energy management in response to increasing digital demands. Thus, the rising adoption of electronic devices and components propels the electronic waste management market development.

Growing Awareness & Sustainability Initiatives

Governments, corporations, and consumers are recognizing the hazardous impact of improper e-waste disposal, including toxin emissions, groundwater contamination, and resource depletion. Consequently, regulatory frameworks and voluntary corporate sustainability initiatives are reshaping electronic waste management market trends. For instance, the Cambridge City Council's Colourful Collections initiative utilizes bright pink bins specifically for collecting small discarded electrical appliances, aiming to reduce the e-waste that enters general recycling streams. Moreover, in Egypt, the E-Tadweer mobile application has been launched by policymakers to address the growing e-waste challenge through improved waste management and recycling practices. Companies are actively integrating circular economy principles by refurbishing and repurposing electronic components. Additionally, consumer preferences are shifting toward responsible disposal practices, leading to increased participation in recycling programs, trade-in schemes, and product take-back initiatives. The heightened focus on sustainability is accelerating market demand, increasing technological advancements in e-waste treatment, and boosting investment in automated material recovery solutions. Thus, as environmental awareness continues to grow, the industry is poised for sustained electronic waste management market growth. The market expansion is significantly driven by the increasing awareness of sustainability and environmental responsibility.

Electronic Waste Management Market Segment Insights

Electronic Waste Management Market Assessment by Material Recovery Outlook

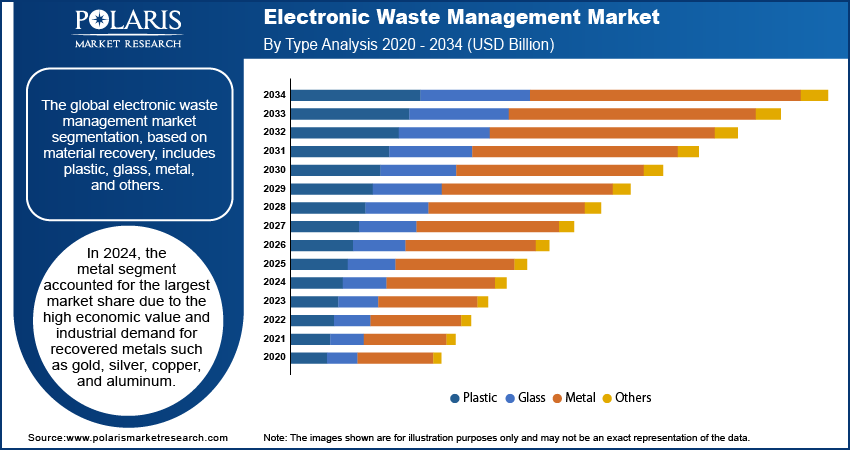

The global electronic waste management market segmentation, based on material recovery, includes plastic, glass, metal, and others. In 2024, the metal segment accounted for the largest market share due to the high economic value and industrial demand for recovered metals such as gold, silver, copper, and aluminum. Rising scarcity and high extraction costs of virgin metals have accelerated investments in advanced recycling technologies. Government regulations and extended producer responsibility (EPR) programs further support electronic waste management market expansion, ensuring efficient metal recovery. Additionally, the surge in electric vehicle (EV) production has increased demand for recycled metals, solidifying metal recovery as the leading segment in the market.

Electronic Waste Management Market Evaluation by Source Type Outlook

The global electronic waste management market segmentation, based on source type, includes communication and technology, consumer electronics, and others. In 2024, the consumer electronics segment accounted for the largest electronic waste management market share due to the high turnover rate of various devices such as smartphones, laptops, and TVs. Frequent product upgrades and limited device lifespans lead to significant e-waste generation. Increased consumer awareness and recycling programs have further driven market demand for efficient disposal and recovery solutions, creating a growth opportunity for businesses focused on managing e-waste from consumer electronics.

Electronic Waste Management Market Regional Analysis

By region, the study provides electronic waste management market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, Asia Pacific accounted for the largest share of the electronic waste management market revenue due to the region's rapid industrialization, high population density, and increasing electronic consumption. Countries such as China, India, and Japan are major hubs for electronics manufacturing and consumption, leading to a significant rise in e-waste generation. Additionally, Asia Pacific is home to a large number of consumers who frequently upgrade their electronic devices, further driving the regional market growth. Government initiatives, such as stricter regulations and extended producer responsibility (EPR) programs, have also boosted the adoption of recycling and sustainable disposal practices in the region. For instance, in 2019, Indonesia introduced the ‘Roadmap to Waste Reduction by Producers,’ urging industries to adopt 100% recyclable plastic products and 50% recycled content by 2029. Similarly, in 2022, the Philippines passed the EPR Act, mandating a 20% recovery rate by 2023, increasing to 40% by 2024, with annual increments aiming for 80% by 2028. Moreover, Asia Pacific is witnessing growing investments in advanced e-waste recycling infrastructure, creating significant electronic waste management market opportunities.

North America is expected to register the highest CAGR during the forecast period due to increasing electronic consumption, rising e-waste generation, and stringent government regulations. In 2022, the US and Canada generated around 7.9 million metric tons (Mt) of electronic waste annually, or 21.2 kg per capita. The US accounts for 7.2 Mt, whereas Canada produces 0.7 Mt. The region has a high rate of electronic device upgrades and disposals, particularly in the consumer electronics and IT sectors, driving the need for efficient waste management solutions. Additionally, growing awareness about the environmental impact of improper e-waste disposal has led to greater participation in recycling programs. These regulatory frameworks are pushing manufacturers and businesses to take more responsibility for e-waste recycling. Furthermore, the region is investing heavily in advanced recycling technologies and infrastructure, which is fueling the North America electronic waste management market expansion.

Electronic Waste Management Market – Key Players & Competitive Analysis Report

The competitive landscape of the electronic waste management market is highly dynamic and fragmented, characterized by a mix of global players and regional companies. Key market participants are focusing on expanding their service offerings, adopting advanced recycling technologies, and enhancing operational efficiencies to gain a competitive edge. Major players in the market include waste management companies; specialized e-waste recyclers; and technology providers that offer solutions for collection, dismantling, recycling, and recovery of valuable materials from e-waste. Companies are increasingly investing in sustainable and eco-friendly practices in response to the growing demand for circular economy solutions. Key strategies include mergers and acquisitions, partnerships with local governments, and collaborations with electronics manufacturers to enhance e-waste collection and recycling systems. The electronic waste management market players are focusing on technological innovation for developing automated sorting systems, advanced material recovery processes, and artificial intelligence (AI)-driven solutions to optimize recycling operations. Additionally, there is a rising focus on developing cost-effective and scalable recycling infrastructure to handle the growing volume of e-waste.

Aurubis AG is engaged in the production and recycling of non-ferrous metals, specializing primarily in copper. The company was founded in 1866 and headquartered in Hamburg, Germany. Aurubis has a diverse product portfolio that includes copper cathodes, wire rods, flat rolled products, and various copper alloys, alongside other metals such as gold, silver, lead, nickel, tin, and zinc. The company also produces by-products such as sulfuric acid and iron silicate. It provides essential services related to metal refining and recycling, catering to industries such as electronics, construction, automotive, and renewable energy. Aurubis AG is also actively engaged in electronic waste management. The company's recycling operations contribute to the recovery of valuable metals from electronic waste, thereby reducing environmental impact and promoting sustainable resource use.

Tetronics is engaged in the field of environmental clean technology, specializing in resource recovery and hazardous material destruction systems. The company was founded in 1964 and is headquartered in Swindon, UK. It offers a diverse product portfolio, primarily focusing on high-temperature Direct Current (DC) Plasma Arc technology, which is utilized for waste management and resource recovery across various industries. The services provided by Tetronics include the design, installation, and maintenance of plasma treatment systems that convert hazardous waste into safe, inert products while recovering valuable materials. Their technology is applied in numerous sectors, including industrial waste treatment, precious metal recovery, and decarbonization of industrial processes. In terms of electronic waste management, Tetronics plays a significant role by utilizing its plasma technology to recover precious metals from electronic waste materials. This process mitigates the environmental impact of e-waste and contributes to the circular economy by transforming discarded electronics into valuable resources.

List of Key Companies in Electronic Waste Management Market

- Aurubis AG

- Boliden Group

- Desco Electronic Recyclers

- EcoCentric

- ENVIRO-HUB HOLDINGS LTD.

- ERI

- Greentec

- Kuusakoski

- MRITECHNOLOGIES

- Namo eWaste Management Ltd.

- Sims Limited

- Stena Metall AB

- Tetronics Environmental Technology Company

- Umicore

- WM Intellectual Property Holdings, L.L.C.

Electronic Waste Management Industry Developments

In September 2024, Aurubis AG inaugurated its recycling facility in Augusta, Georgia. The facility, Aurubis Richmond, is the first secondary smelter in the US dedicated to multimetal recycling, enhancing efficiency and sustainability in metal recovery processes.

In April 2024, ERI, the e-waste recycler in the US and creator of RecycleNation and the Impact Podcast, received formal approval from the US Department of Energy for its USD 5 million initiative to boost participation in electronics and consumer battery recycling.

In March 2024, the US Department of Energy launched the Electronics Scrap Recycling Advancement Prize, a program that offers up to USD 4 million in prizes for innovations in recovering essential materials from electronic waste. The initiative aims to improve the efficiency of e-scrap reclamation processes and promote a circular economy for electronic materials.

Electronic Waste Management Market Segmentation

By Material Recovery Outlook (Volume, Thousand Metric Tons; Revenue, USD Billion; 2020–2034)

- Plastic

- Glass

- Metal

- Others

By Recycler Type Outlook (Volume, Thousand Metric Tons; Revenue, USD Billion; 2020–2034)

- Plastic Recycler

- Glass Recycler

- Metal Recycler

- Printed Circuit Board Recycler

By Source Type Outlook (Volume, Thousand Metric Tons; Revenue, USD Billion; 2020–2034)

- Communication and Technology

- Consumer Electronics

By Application Outlook (Volume, Thousand Metric Tons; Revenue, USD Billion; 2020–2034)

- Disposal

- Recycle

By Regional Outlook (Volume, Thousand Metric Tons; Revenue, USD Billion; 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Electronic Waste Management Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 59.70 billion |

|

Market Size Value in 2025 |

USD 65.35 billion |

|

Revenue Forecast by 2034 |

USD 148.50 billion |

|

CAGR |

9.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion, Volume in Thousand Metric Tons, and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global electronic waste management market size was valued at USD 59.70 billion in 2024 and is projected to grow to USD 148.50 billion by 2034.

The global market is projected to register a CAGR of 9.5% during the forecast period.

In 2024, Asia Pacific accounted for the largest market share due to the region's rapid industrialization, high population density, and increasing electronic consumption

A few of the key players in the market are Aurubis AG; Boliden Group; Desco Electronic Recyclers; EcoCentric; ENVIRO-HUB HOLDINGS LTD.; ERI; Greentec; Kuusakoski; MRITECHNOLOGIES; Namo eWaste Management Ltd.; Sims Limited; Stena Metall AB; Tetronics Environmental Technology Company; Umicore; and WM Intellectual Property Holdings, L.L.C

In 2024, the metal segment accounted for the largest market share due to the high economic value and industrial demand for recovered metals such as gold, silver, copper, and aluminum.

In 2024, the consumer electronics segment accounted for the largest market share due to the high turnover rate of devices such as smartphones, laptops, and TVs.