Elevator Control System Market Share, Size, Trends, Industry Analysis Report

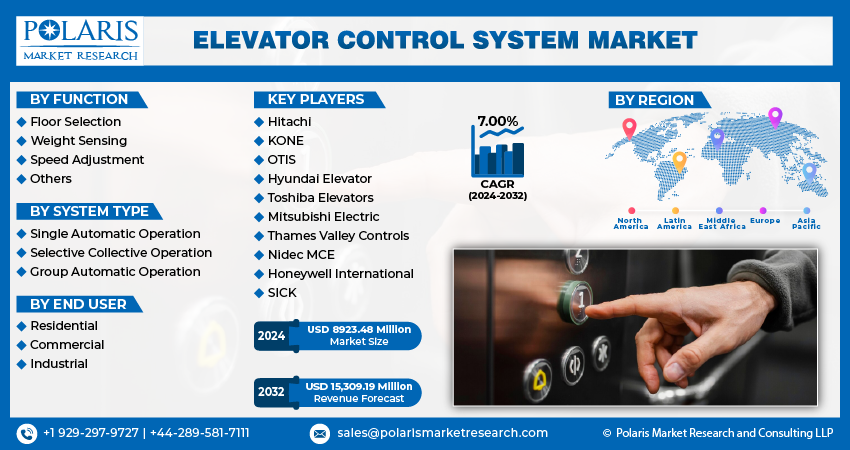

By Function (Floor Selection, Weight Sensing, Speed Adjustment, and Others); By System Type; By End User; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 112

- Format: PDF

- Report ID: PM3520

- Base Year: 2023

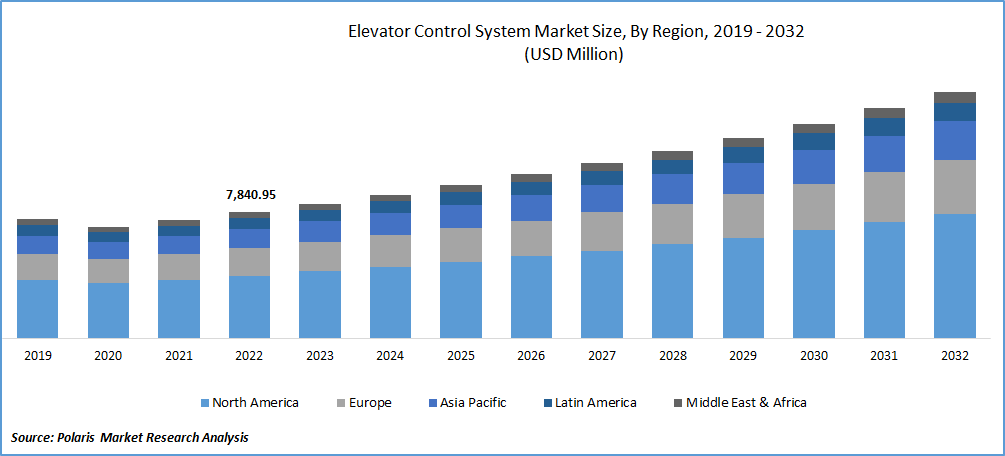

- Historical Data: 2019-2022

Report Outlook

The global Elevator Control System market was valued at USD 8362.37 million in 2023 and is expected to grow at a CAGR of 7.00% during the forecast period. Elevators were previously controlled by control panels comprised of electromechanical switching components (relays, contactors). The wiring schematics, or electrical connections, of these components, are in the form of a logic circuit. With the emergence of electronics and IoT (Internet of Things) technology, it is increasingly employed in elevator control systems. Implementing IoT architecture and collecting diagnostic data may enhance elevator servicing and maintenance operations.

To Understand More About this Research: Request a Free Sample Report

Another example of the use of AI in elevator control systems is traffic management. Elevator systems can have sensors that gather data on traffic patterns, usage rates, and wait times. AI algorithms can analyze this data to optimize elevator operations and reduce passenger wait times. For example, AI can adjust elevator speeds and routing dynamically to reduce peak-hour wait times.

Relay-based control systems are the oldest type of elevator control system and use electromechanical relays to control the movement of the elevator. These systems are reliable but limited in terms of functionality and flexibility. Microprocessor-based control systems, on the other hand, use microprocessors and software to control elevator movements. These systems offer more advanced features, such as destination control, group control, and traffic management algorithms, which can help to reduce waiting times and improve the efficiency of elevator operations. Networked control systems are the most advanced type of elevator control system and are typically used in high-rise buildings with multiple elevators. These systems use a network of sensors and controllers to manage elevator movements in real-time, providing the most efficient and responsive elevator service.

With IoT integration, elevators can have sensors that gather traffic patterns, usage rates, and energy consumption data. This information can be analyzed using AI algorithms to optimize elevator operations and reduce energy consumption. By leveraging IoT technology, elevator manufacturers and service providers can offer new features and services to their customers, such as remote monitoring and maintenance, mobile apps for elevator access and control, and real-time notifications of elevator status and availability. Moreover, adopting IoT-enabled elevators can support global government initiatives and energy efficiency and sustainability programs. IoT-enabled elevators can contribute to a more sustainable and environmentally friendly transportation system by reducing energy consumption and emissions.

Due to COVID-19, Germany’s economy contracted by 4.9% in 2020. The construction industry was estimated to have a significantly lower impact (of COVID-19 and the ongoing Russia-Ukraine war) due to government initiatives and the expected demand for residential buildings over the next few years. On August 2020, China launched the ‘New Infrastructure’ campaign to balance the economic impact of COVID-19 and increase sustainable growth. The campaign focuses on seven key areas of the construction sector. This will ultimately support the market of elevator control systems in the long run.

Industry Dynamics

Growth Drivers

The need for smart and efficient technologies is becoming increasingly important in the context of urbanization and its associated challenges and opportunities. Adopting these technologies can help address critical issues such as sustainability, affordability, and livability in cities and urban areas. People are migrating from rural to urban regions at an increasing rate across the region.

The United Nations Department of Economic and Social Affairs (UN DESA) predicts a rise in urban population in India and China. Between 2018 and 2050, India is expected to contribute for 35% of the global urban population increase. India and China will have 416 million, 255 million, and 189 million urban people throughout this era. Migration from rural to urban areas has prompted governments in both emerging and established countries to invest in new infrastructure projects. As a result, increased urbanization will drive up demand for IoT in elevators in the future years.

Report Segmentation

The market is primarily segmented based on function, system type, end user, and region.

|

By Function |

By System Type |

By End User |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Weight sensing is expected to witness the fastest growth over the projected period.

The Elevator Control System Market is anticipated to experience rapid growth, with weight-sensing technology leading the way. Weight sensing is poised to be the fastest-growing segment of the market. This technology enables precise monitoring of the weight and occupancy of elevators, ensuring optimal performance, efficiency, and passenger safety. Implementing weight sensing systems allows for real-time adjustments in elevator operation, such as load balancing and accurate floor leveling. With increasing demands for smarter and more efficient elevator systems, the adoption of weight-sensing technology is expected to surge, contributing significantly to the overall growth of the Elevator Control System Market.

The selective Collective Operation system accounted for the largest market share in 2022

In 2022, the selective Collective Operation system emerged as the dominant player in the Elevator Control System Market, capturing the largest market share. This system offers advanced features and benefits, making it highly sought after in the industry. Selective Collective Operation optimizes elevator operation by grouping passengers with similar destinations, reducing travel time, and improving energy efficiency. It intelligently manages elevator assignments and minimizes waiting time for passengers. With its ability to handle complex traffic patterns and provide a seamless elevator experience, the selective Collective Operation system has gained widespread adoption and contributed significantly to the market's growth and success in 2022.

The demand in Asia Pacific is expected to witness significant growth over the forecast period

Asia Pacific is having largest market share as it is witnessing the growing presence of multinational corporations owing to the opportunities offered by emerging markets in terms of infrastructure and lower labor costs. The companies are looking for ways to streamline operations in more mature markets and increase headcount in Asian countries. China is a major market responsible for the growth of skyscrapers. According to the CTBUH, China accounted for 61.5% of new buildings in 2018, of which 14 were built in Shenzhen.

Europe is expected to grow with the highest CAGR during the forecast period as it is a manufacturing hub of elevators and its control system. Also, its growing investment in construction projects. In 2020, USD 81.1 Bn was invested in German real estate. Commercial investment accounted for USD 60.6 Bn of total projects. Germany has also allotted USD 2.6 Bn as part of its 2021-26 National Recovery and Resilience Plan (NRRP) for investment in energy-efficient buildings.

Competitive Insight

Some major global players operating in the global market include Hitachi, KONE, OTIS, Hyundai Elevator, Toshiba Elevators, Mitsubishi Electric, Thames Valley Controls, Nidec MCE, Honeywell International, and SICK.

Recent Developments

In March 2021, the world's 1st digitally linked elevator class, the KONE DX Class Elevators, was introduced by KONE Elevator India.

In April 2021, Jardine Schindler Group inked an agreement for the know Touch – Contactless Elevator Control Panel solution with the Hong Kong Productivity Council. The solution is simple and straightforward to install, and it can be used in various lift types without requiring extensive mechanical modifications or changing the original button system, enabling quick retrofitting.

Elevator Control System Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 8923.48 million |

|

Revenue forecast in 2032 |

USD 15,309.19 million |

|

CAGR |

7.00% from 2024 - 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 - 2032 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Function, By System Type, By End User, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Hitachi Ltd., KONE, OTIS, Hyundai Elevator Co., Ltd., Toshiba Elevators and Building Systems, Mitsubishi Electric, Thames Valley Controls, Nidec MCE, Honeywell International Inc., and SICK AG |

FAQ's

The global elevator control system market size is expected to reach USD 15,309.19 million by 2032.

Top market players in the Elevator Control System Market are Hitachi, KONE, OTIS, Hyundai Elevator, Toshiba Elevators, Mitsubishi Electric, Thames Valley Controls.

Asia Pacific contribute notably towards the global Elevator Control System Market.

The global Elevator Control System market expected to grow at a CAGR of 6.9% during the forecast period.

The Elevator Control System Market report covering key are function, system type, end user, and region.