Environmental Test Chambers Market Share, Size, Trends, Industry Analysis Report

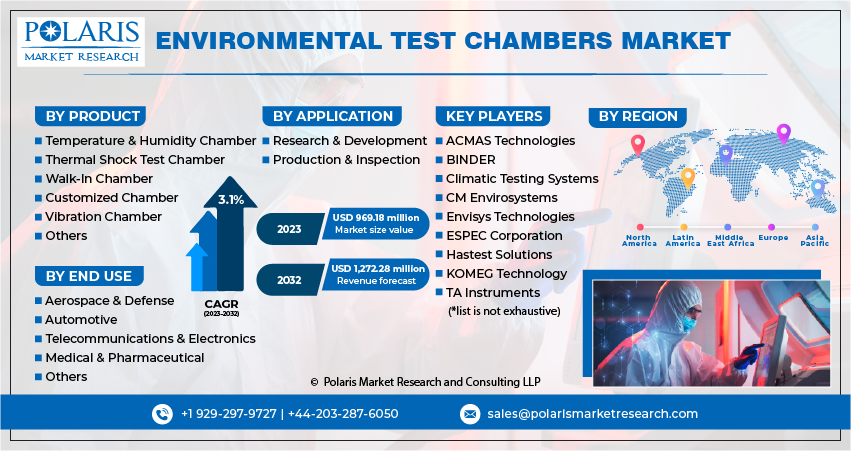

By Product (Temperature & Humidity Chamber, Thermal Shock Test Chamber, Walk-In Chamber, Customized Chamber, Vibration Chamber, and Others); By Application; By End Use; By Region; Segment Forecast, 2023 – 2032

- Published Date:Oct-2023

- Pages: 118

- Format: PDF

- Report ID: PM3801

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

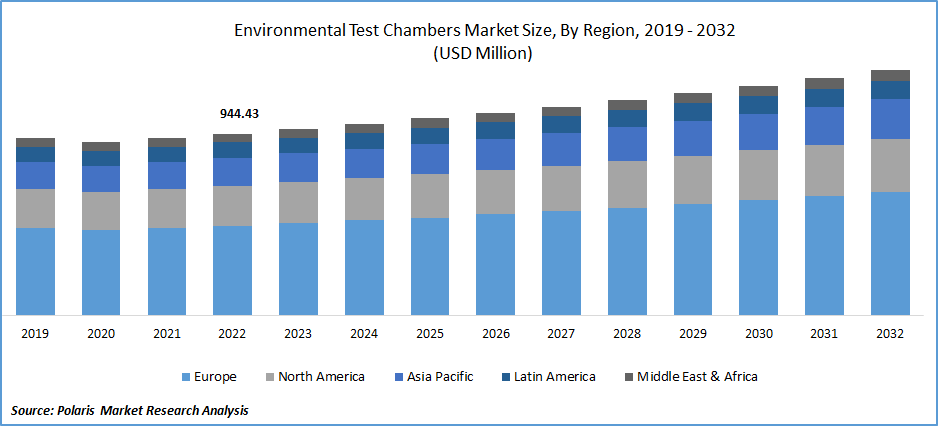

The global environmental test chambers market was valued at USD 944.43 million in 2022 and is expected to grow at a CAGR of 3.1% during the forecast period.

The increasing need and demand for compliance testing and higher product safety assurance in order to meet several industry standards and surging adoption go innovated testing equipment and software for better efficiency and improved accuracy along with the rise in number of companies focusing on reliability of their products, are the primary factors boosting the market growth.

To Understand More About this Research: Request a Free Sample Report

Additionally, continuous change in environmental conditions and complexities associated with the product and penetration towards exploring untapped and international markets with greater demand for quality and performance testing, will also spur the demand and growth of the market in the near future.

- For instance, in April 2022, ESPEC CORP., announced the launch of its new Environmental Stress Chamber AR series featuring R-473A. The newly developed chamber series achieves a significant reduction in the GWP value and offers energy saving by utilizing original ESPEC technologies.

Moreover, there has been a rising demand for environmental test chambers tailored to specific industries and applications, thereby manufacturers who are focusing to capitalize on this opportunity by offering specialized test chambers designed to meet the specific needs and requirements of sectors like automotive, electronics, aerospace, pharmaceuticals, and more, are likely to gain a competitive edge in the market.

However, test chambers mainly those equipped with advanced features and technology requires significant upfront costs and investments, which makes it harder for companies particularly small and medium-sized enterprises to opt for these testing solutions, and acts as a major restraint to the market.

The outbreak of the COVID-19 pandemic has significantly impacted the growth of the environmental test chambers market. The rapid spread of the deadly coronavirus across the globe led to huge disruptions in supply chains due to factory closures, restrictions on movement, and logistics challenge, that significantly affected the production and delivery of environmental test chambers, and leading to delays and supply shortages during the pandemic.

For Specific Research Requirements, Request for a Customized Report

Industry Dynamics

Growth Drivers

Increased utilization of environmental testing equipment

The growing utilization of innovated environmental testing equipment is wide range of testing jobs or applications including prototype evaluation, production testing, reliability testing, research & development, failure analysis, and accelerated stress testing among others coupled with the growing number of favorable regulations in industries like automotive, defense, and electronics mandating the use of these test chambers, are among the leading factors propelling the global market growth.

Furthermore, the rapidly increasing consumer willingness towards adopting energy-efficient solutions and safety devices and rising consumer spending capacity or power across both developed & developing economies, allowing them to spend higher on innovative consumer items and home appliances such as air purifiers, smart sensors, and thermostats, are also likely to drive the demand and growth of the market.

Report Segmentation

The market is primarily segmented based on product, application, end use, and region.

|

By Product |

By Application |

By End Use |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Analysis

Thermal shock test chamber is expected to witness highest growth over forecast period

The thermal shock test chamber segment is expected to grow at highest growth during the study period, that is largely accelerated to its growing use in different types of items to effectively study their characteristics and failures caused due to the numerous materials and thermal expansion coefficients along with the continuously surging product utilization for the thermal shock testing. The ability of thermal shock testing chambers to easily comply with several standards set by government authorities and demonstrate product reliability, leading to a higher product demand in the coming years.

The temperature & humidity chamber segment led the industry market with substantial share in 2022, which is significantly driven by its capabilities to provide high-quality and accurate data, greater flexibility, smaller footprint, and cost-effectiveness compared to other products available in the market. Beside this, the significant product demand for various industries including electronics, pharmaceuticals, aerospace, automotive, and research institutes for the testing and validation of products in diverse environments.

By Application Analysis

Research & development segment held the significant market share in 2022

The research & development segment held the majority market share in terms of revenue in 2022, on account of growing need and prevalence for research to perform range of engineering and technological tasks that is needed to innovate product design & development. Additionally, R&D is being widely used by almost every industry to effectively plan, build, and deliver innovative goods and several R&D departments using environmental test chambers to test prototypes and new designs thoroughly, while ensuring that they meet the required standards and perform well under real conditions, is driving the segment market growth.

The production & inspection segment is projected to exhibit fastest growth rate over the study period, mainly due to its emergence as a crucial factor assessing the performance and quality of products from different industries under several environmental conditions like humidity, temperature, altitude, and vibration.

By End-Use Analysis

Aerospace & defense segment accounted for the largest market share in 2022

The aerospace & defense segment accounted for largest market share in 2022. The growth of the segment market can be mainly accelerated to widespread use of these test chambers in defense & aerospace sector mainly to test components and products for improving their reliability and durability. Moreover, the rapid development of advanced technologies such as unmanned aerial vehicles, satellites, and defense systems, which necessitates rigorous testing to ensure their performance under diverse environmental conditions, is likely to bode well for the market growth.

For instance, in February 2023, India and US announce that they will move jointly to develop new air launched unmanned aerial vehicles, which will be mainly used for the surveillance missions and is likely to take the first flight of prototype by the end of this year.

Regional Insight

Europe region dominated the global market in 2022

Europe region dominated the market with substantial share in 2022, driven by significant growth in the investments in R&D of numerous end-use industries and rising usage of tailored drugs in countries like Germany, France, and UK, that led to higher demand for effective test chambers. In addition, the increasing prevalence about the integration of advanced technologies like Internet of Things, artificial intelligence, and data analytics, resulting to the development of more sophisticated and automated environmental test chambers, are likely to fuel the regional’s market growth.

The Asia Pacific region is anticipated to be the fastest growing region with healthy CAGR over the course of study period, owing to continuous expansion and development of electric vehicle manufacturing facility and exponential growth in semiconductors and electronics sectors in countries like India, China, South Korea, and Taiwan among others. For instance, in February 2023, Volvo Cars, a global leading luxury automobile maker, unveiled about the possibilities of setting up their new global electric vehicle manufacturing plant in India.

Market Key Players & Competitive Insight

The global environmental test chambers market is characterized by intense competition among key players who strive to maintain their market positions through product innovation, technological advancements, and strategic partnerships. The market's competitiveness is driven by the growing demand for reliable and precise testing equipment across various industries, including automotive, defense, and electronics, as well as the increasing emphasis on energy-efficient and safety solutions. Companies in this space are also focusing on expanding their global presence and enhancing customer support services to meet the diverse testing requirements of a broad customer base, both in developed and developing economies.

Some of the major players operating in the global market include:

- ACMAS Technologies

- Angelantoni Test Technologies

- BINDER

- Cincinnati Sub-Zero Products

- Climatic Testing Systems

- CM Envirosystems

- Envisys Technologies

- ESPEC Corporation

- Hastest Solutions

- KOMEG Technology

- Russells Technical Products

- TA Instruments

- Thermotron Industries

- Weiss Technik North America

Recent Developments

- In June 2023, ESA, announced the Europe’s biggest test chamber specially designed for the space antennas. The test chamber will be massive and able to easily accommodate the large satellites within an isolated chamber.

- In July 2021, The European Space Agency, announced that the European Galileo Satellites Enter Thermal Test Chamber before its launch. This standardized thermal testing process is likely to involve a 2-week series of analysis & chamber is super-heated to copy the thermal effects.

Environmental Test Chambers Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 969.18 million |

|

Revenue forecast in 2032 |

USD 1,272.28 million |

|

CAGR |

3.1% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments covered |

By Product, By Application, By End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The global environmental test chambers market size is expected to reach USD 1,272.28 million by 2032.

Key players in the market are TA Instruments, ESPEC Corporation, ACMAS Technologies.

Europe contribute notably towards the global environmental test chambers market.

The global environmental test chambers market is expected to grow at a CAGR of 3.1% during the forecast period.

The environmental test chambers market report covering key segments are product, application, end use, and region.