Ethyl Pyruvate Market Share, Size, Trends, Industry Analysis Report

By Type (98%, 99%); By Application; By Region; Segment Forecast, 2023 - 2032

- Published Date:Aug-2023

- Pages: 119

- Format: PDF

- Report ID: PM3698

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

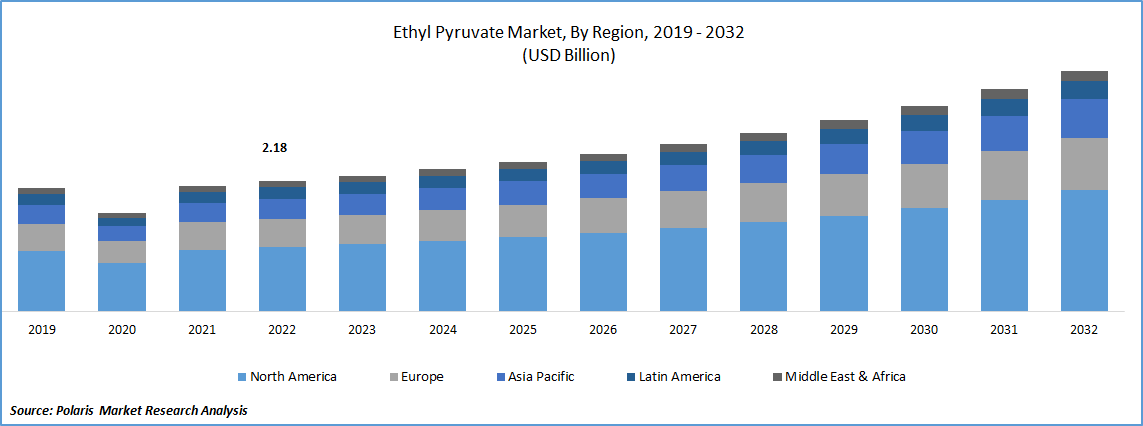

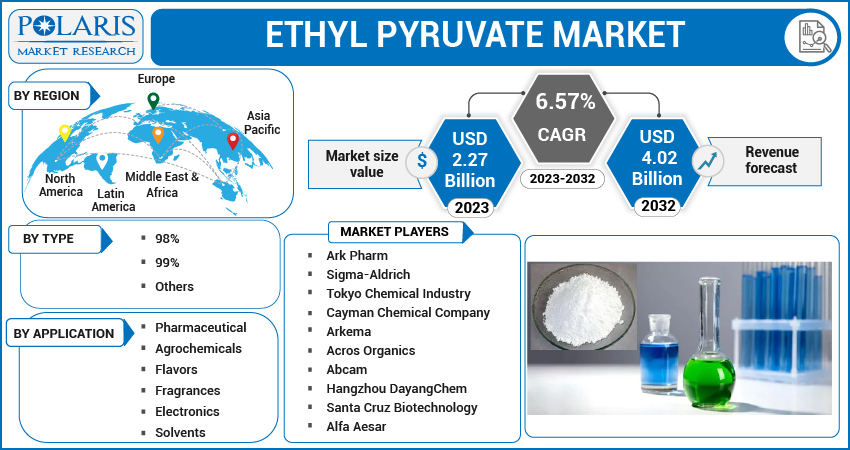

The global ethyl pyruvate market was valued at USD 2.18 billion in 2022 and is expected to grow at a CAGR of 6.57% during the forecast period.

The growth of the ethyl pyruvate market is being driven by several factors related to its application in active and intelligent packaging, particularly in addressing food waste. By incorporating ethyl pyruvate into edible coatings used in active packaging, the shelf life of food products can be extended. Ethyl pyruvate's antioxidant and antimicrobial properties help to prevent oxidation and inhibit the growth of bacteria and fungi, thereby reducing spoilage and extending the freshness of packaged food. This can significantly reduce food waste, as products remain in good condition for longer periods, allowing companies and consumers to make better use of their resources and reduce financial losses.

To Understand More About this Research: Request a Free Sample Report

Furthermore, the use of ethyl pyruvate in nanotechnology applications related to intelligent packaging can contribute to the monitoring of freshness. Nanoparticles incorporating ethyl pyruvate can be designed to react to specific indicators of food spoilage, such as changes in pH or the presence of certain gasses. These nanoparticles can then provide visual cues or other signals to indicate the freshness status of the packaged food. By enabling real-time monitoring, intelligent packaging equipped with ethyl pyruvate-based nanotechnology can help consumers and retailers make informed decisions regarding food consumption and minimize unnecessary waste.

For Specific Research Requirements, Request for a Customized Report

Industry Dynamics

Growth Drivers

Rising adoption of the product in various sectors are boosting the market growth

Ethyl Pyruvate, with its fruity smell, can be used to enhance the taste and aroma of various food and beverage products. Its approval as a flavoring ingredient further supports its utilization in the food industry. The ability to add pleasant fruity notes to food products is a key factor driving the demand. Furthermore, Ethyl Pyruvate has the potential as an insect repellent, as indicated by the example of blocking mosquito attraction to a human hand, and can also contribute to its growth in the flavor segment indirectly. The ability to repel insects can be valuable in the food industry to prevent contamination and infestation, thus ensuring the quality and safety of food products. This insect-repelling property adds another dimension to the application of Ethyl Pyruvate in the flavor segment, making it appealing for manufacturers looking for natural and effective solutions to protect their products from pests.

Researchers are working on the potential applications of ethyl pyruvate in many fields. A recent study published in PubMed Central focused on exploring the potential of a compound called ethyl pyruvate (EP) as a treatment for a lung condition called pulmonary arterial hypertension (PAH). PAH is a challenging disease with limited treatment options available. The study found that ethyl pyruvate can inhibit the growth of certain cells involved in PAH by targeting a specific molecular pathway called the HMGB1/RAGE axis. This discovery sheds light on the inner workings of the disease and suggests that ethyl pyruvate could be a unique and promising treatment option. These findings have sparked interest in further research and application of ethyl pyruvate in the field, potentially leading to new and improved therapies for PAH patients.

Report Segmentation

The market is primarily segmented based on type, application and region.

|

By Type |

By Application |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

99% segment is projected to have a faster growth in the study period

99% segment is expected to have faster growth for the market. Ethyl Pyruvate with 99% purity is considered a premium grade product, offering a high level of purity and quality. This purity level ensures that the compound is free from impurities or contaminants that could affect its performance or safety. As a result, pharmaceutical and research applications prefer using Ethyl Pyruvate with 99% purity for reliable and consistent results. The 99% purity segment finds significant utilization in the pharmaceutical industry. Ethyl Pyruvate is being investigated for its therapeutic potential in treating central nervous system disorders, as well as inflammatory conditions and neurodegenerative diseases. The high purity level of 99% ensures that the compound is suitable for pharmaceutical formulation, ensuring safety and efficacy in therapeutic applications.

By Application Analysis

Agrochemicals segment accounted for the largest market share in 2022

Agrochemicals segment holds the largest market share for the market in the study period. This chemical has been recognized for its potential as a plant growth regulator. It can stimulate plant growth, enhance crop yield, and improve the overall quality of agricultural produce. Ethyl Pyruvate's properties make it valuable for agricultural applications, and as a result, it finds use in the production of agrochemical formulations. Ethyl Pyruvate has been studied for its potential as a biopesticide and for its ability to protect crops against pests and diseases. It has shown promising results in controlling certain plant pathogens and insects, thereby reducing the need for conventional chemical pesticides. The demand for safer and more environmentally friendly solutions in agriculture has contributed to the growth of the segment.

Regional Insights

Europe registered with the highest growth rate in the study period

Europe is projected to witness a higher growth rate for the market. The consistent increase in general government health expenditure in the EU from 1995 to 2021 has been a driving force behind the growth of the ethyl pyruvate market. During this period, government expenditure on health steadily rose, accounting for 11.1% of total expenditure in 1995 and reaching 15.8% of total expenditure in 2021. The rise in government health expenditure reflects a strong emphasis on improving healthcare infrastructure, services, and access to innovative therapies, including ethyl pyruvate. The increased investment in healthcare signifies a growing recognition of the importance of addressing health conditions and improving patient outcomes. As a result, there is a higher demand for effective treatments and therapies, such as ethyl pyruvate, that offer potential benefits in areas like organ transplantation, cardiovascular disorders, neurodegenerative diseases, and inflammatory conditions.

North America is expected to witness a larger revenue share for the market. Growing research activities in North America are significantly contributing to advancements in the understanding of ethyl pyruvate's properties, mechanisms of action, and potential therapeutic applications. These research efforts involve conducting preclinical and clinical studies to investigate the efficacy, safety, and appropriate dosage of ethyl pyruvate in various disease models, such as ischemia-reperfusion injury, inflammation, and oxidative stress. The outcomes of these studies help establish a robust scientific foundation and enhance knowledge in the field.

One notable area of research in North America is the exploration of ethyl pyruvate's potential in mitigating the severity of COVID-19-associated acute ischemic stroke (AIS). Research findings have shed light on the clinical characteristics of COVID-19 patients with AIS and have identified factors that can predict functional outcomes. These insights contribute to a better understanding of the impact of COVID-19 on stroke patients and offer valuable guidance for potential treatment strategies, including the potential use of ethyl pyruvate in North America. The research activities in North America are pivotal in driving advancements in the field of ethyl pyruvate, expanding knowledge, and providing a strong scientific basis for further exploration. They contribute to the growth of scientific literature, foster collaborations, and encourage the development of innovative approaches in healthcare.

Key Market Players & Competitive Insights

The ethyl pyruvate market is fragmented and is anticipated to witness competition due to several players' presence. The players are focusing on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- Abcam

- Acros Organics

- Alfa Aesar

- Ark Pharm

- Arkema

- Cayman Chemical Company

- Hangzhou DayangChem

- Santa Cruz Biotechnology

- Sigma-Aldrich

- Tokyo Chemical Industry

Recent Developments

- In June 2023, A recent study focused on hepatocellular carcinoma (HCC), the most common type of liver cancer, and investigated the role of pyruvate metabolism-related genes in predicting patient outcomes.

- In January 2023, Recent study aimed to investigate the neuroprotective effects of ethyl pyruvate (EP) in the development of diabetic intracerebral hemorrhage. These findings suggest that EP may reduce the inflammatory response associated with diabetic intracerebral hemorrhage and potentially inhibit the activation of inflammasomes through the HMGB1/TLR4 pathway.

Ethyl Pyruvate Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 2.27 billion |

|

Revenue forecast in 2032 |

USD 4.02 billion |

|

CAGR |

6.57% from 2023 - 2032 |

|

Base year |

2022 |

|

Historical data |

2019 - 2021 |

|

Forecast period |

2023 - 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Type, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Ark Pharm, Sigma-Aldrich, Tokyo Chemical Industry, Cayman Chemical Company, Arkema, Acros Organics, Abcam, Hangzhou DayangChem, Santa Cruz Biotechnology & Alfa Aesar. |

FAQ's

The ethyl pyruvate market report covering key segments are type, application and region.

Ethyl Pyruvate Market Size Worth $4.02 Billion by 2032.

The global ethyl pyruvate market is expected to grow at a CAGR of 6.57% during the forecast period.

Europe is leading the global market.

key driving factors in ethyl pyruvate market are rising adoption of the product.