Europe Artificial Intelligence in Manufacturing Market Size, Share, Trends, Industry Analysis Report

By Component (Hardware, Software), By Technology, By Application, By End Use, By Country – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM6398

- Base Year: 2024

- Historical Data: 2020-2023

Overview

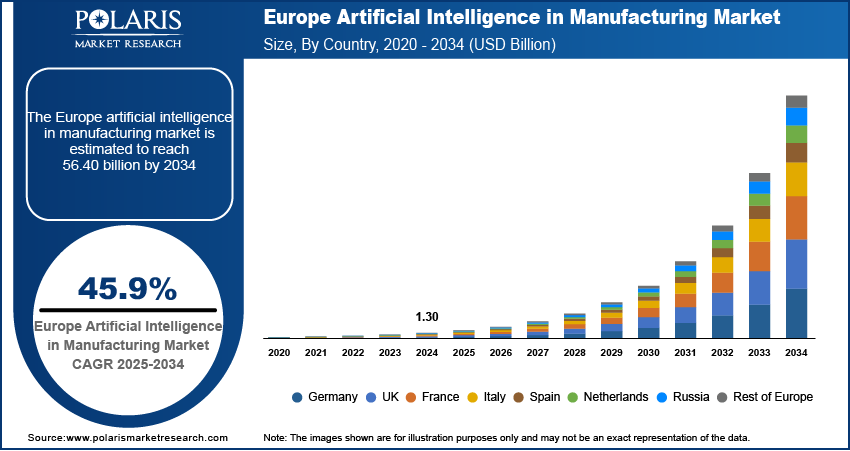

The Europe artificial intelligence (AI) in manufacturing market size was valued at USD 1.30 billion in 2024, growing at a CAGR of 45.9% from 2025 to 2034. The market growth is driven by strong push from EU digital and industrial policies, increasing focus on Industry 4.0 and smart factory innovation, and rising AI adoption by the small and medium-sized enterprises in Europe.

Key Insights

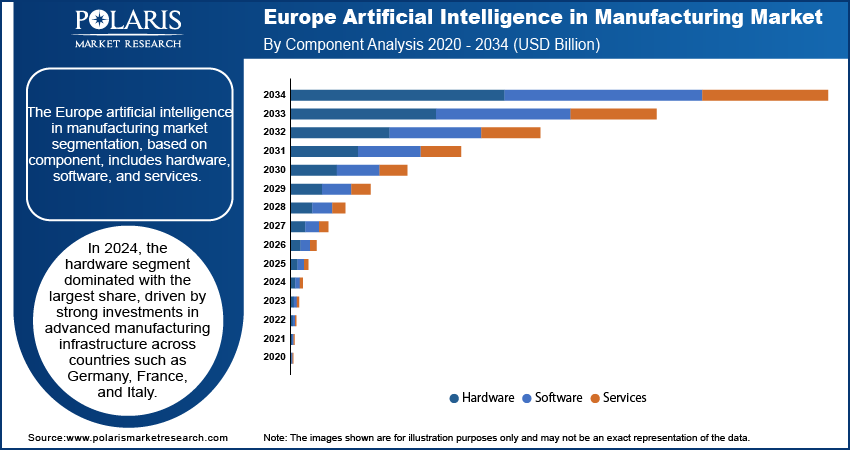

- The hardware segment led the market in 2024, supported by substantial investments in advanced manufacturing infrastructure across key European countries such as Germany, France, and Italy.

- The production planning segment is projected to grow significantly as manufacturers focus on enhancing flexibility and responsiveness amid supply chain challenges, fluctuating energy costs, and evolving consumer demands.

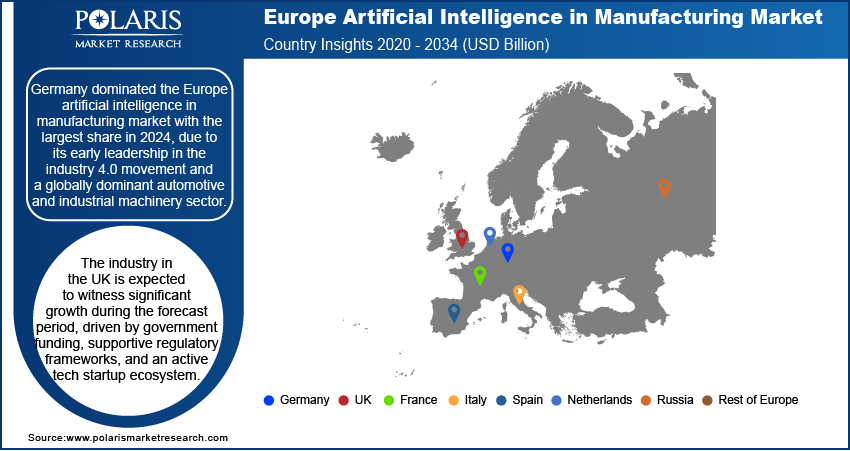

- Germany accounted for the largest market share in 2024, driven by its pioneering role in the Industry 4.0 movement and its strong presence in the automotive and industrial machinery sectors.

- The UK is expected to experience notable growth during the forecast period, fueled by government-backed funding initiatives, favorable regulatory support, and a dynamic ecosystem of tech startups driving AI innovation in manufacturing

Industry Dynamics

- Strong push from EU digital and industrial policies drives the demand.

- Industry 4.0 and smart manufacturing innovation fuel the industry growth.

- Rising demand for personalized products is boosting the adoption of AI in manufacturing.

- High initial investment costs and integration complexities are restraining the adoption of AI in manufacturing.

Market Statistics

- 2024 Market Size: USD 1.30 billion

- 2034 Projected Market Size: USD 56.40 billion

- CAGR (2025–2034): 45.9%

- Germany: Largest market in 2024

Artificial intelligence (AI) in manufacturing refers to the use of AI technologies such as machine learning, computer vision, and robotics to optimize production processes, improve quality control, and reduce downtime. It enables predictive maintenance, real-time monitoring, and automated decision-making across supply chains and factory operations. AI helps manufacturers increase efficiency, lower costs, and respond more quickly to market demands by analyzing large volumes of data.

Europe benefits from a world-class academic and research environment that fuels innovation in AI technologies for manufacturing. Universities, public research centers, and industry players collaborate through EU-funded projects to develop advanced AI solutions catered to industrial needs. Countries such as Germany, France, and the Netherlands host major research clusters focused on machine learning, robotics, and industrial automation. This strong knowledge base accelerates the commercialization of AI and ensures that European manufacturers have early access to practical and high-quality solutions. Consequently, the region’s research strength drives growth in AI-based manufacturing technologies.

Europe has a large base of small and medium-sized enterprises (SMEs), which are now increasingly integrating AI into their operations due to EU support and falling technology costs. Programs such as Digital Innovation Hubs provide SMEs with access to AI tools, training, and funding, making technology adoption more feasible. Businesses contribute significantly to AI deployment growth by experimenting with scalable, low-cost solutions for automation, predictive maintenance, and process optimization as these businesses modernize. The active involvement of SMEs across Europe adds depth to the AI ecosystem and drives the growth of overall industry.

Drivers & Opportunities

Strong Push from EU Digital and Industrial Policies: Europe’s AI adoption in manufacturing is strongly influenced by coordinated EU-level policies aimed at digital and industrial transformation. Initiatives such as the Digital Europe Programme and Horizon Europe provide significant funding to boost AI development and integration, especially for small and medium-sized manufacturers. Additionally, the European Commission is actively promoting AI research, digital infrastructure, and cross-border collaboration to ensure European industries stay globally competitive. These supportive policies reduce barriers to AI adoption and encourage companies to invest in smart technologies, thereby driving the growth.

Industry 4.0 and Smart Factory Innovation: Europe has been a pioneer in the global Industry 4.0 movement, particularly with Germany’s Industrie 4.0 initiative. European manufacturers are investing in AI to transition toward smart factories that use real-time data, automation, and robotics for better decision-making. The presence of strong industrial players, combined with a tech-savvy workforce, supports advanced AI integration across sectors like automotive, aerospace, and machinery. AI plays a major role in achieving high efficiency, product customization, and supply chain resilience as more companies shift toward digital manufacturing, thereby fueling the adoption of AI in manufacturing across Europe.

Segmental Insights

Component Analysis

The segmentation, based on component, includes hardware, software, and services. In 2024, the hardware segment dominated with the largest share, driven by strong investments in advanced manufacturing infrastructure across countries such as Germany, France, and Italy. European manufacturers are rapidly adopting AI-integrated machinery, sensors, and edge computing systems to modernize factory operations under Industry 4.0 initiatives. The push for smarter, more connected production environments requires high-performance AI hardware that process large amounts of real-time data. Additionally, funding from EU programs for digital transformation and innovation has accelerated the procurement of robotics, AI chips, and IoT devices, fueling the hardware segment growth across the region.

Technology Analysis

The segmentation, based on technology, includes machine learning (ML), computer vision, context awareness, and natural language processing. The computer vision segment accounted for significant growth due to rising demand for high-precision quality control, especially in regulated industries like automotive, aerospace, and pharmaceuticals. European manufacturers are using AI-powered vision systems for automated inspection, defect detection, and real-time production monitoring to meet strict EU safety and quality standards. The region’s strong focus on product consistency and traceability, driven by both consumer expectations and regulatory requirements, has made computer vision a major area of AI investment. Additionally, advancements from European AI startups and research institutions have made the technology more accessible, boosting adoption across mid-sized manufacturers, further boosting the segment growth.

Application Analysis

The segmentation, based on application, includes material movement, predictive maintenance & machinery inspection, production planning, field services, quality control & reclamation, and others. The production planning segment is expected to experience significant growth as manufacturers seek greater agility and responsiveness in the face of supply chain disruptions, energy cost fluctuations, and shifting consumer demand. AI is increasingly being adopted to optimize production schedules, manage resources more efficiently, and reduce operational waste. In Europe’s highly competitive and customized manufacturing environment, especially in sectors such as industrial machinery and consumer goods, AI-driven planning tools are crucial for improving lead times and productivity. EU-backed digitalization initiatives and pilot programs have further encouraged more widespread adoption of AI in planning and operations, thereby driving the segment growth.

End Use Analysis

The segmentation, based on end use, includes semiconductor & electronics, energy & power, medical devices, automobile, heavy metal & machine manufacturing, and others. The medical devices segment dominated with the largest share driven by the region’s strong focus on healthcare innovation, regulatory compliance, and precision manufacturing. Germany, Switzerland, and the Netherlands are major hubs for medical device production, where AI is used for quality assurance, predictive maintenance, and smart assembly processes. The need to meet strict EU medical device regulations (such as MDR) has pushed manufacturers to adopt AI to ensure traceability and quality. Additionally, growing demand for personalized and connected health technologies has encouraged the integration of AI in design and production workflows across the European medical sector, positively impacting the segment growth.

Country Analysis

Germany Artificial Intelligence in Manufacturing Market Trends

The market in Germany dominated with the largest share in 2024, due to its early leadership in the industry 4.0 movement and a globally dominant automotive and industrial machinery sector. German manufacturers are heavily investing in AI for predictive maintenance, quality inspection, and production optimization. The government's support through programs such as Plattform Industrie 4.0 promotes AI adoption, especially among SMEs. Additionally, the country’s strong engineering tradition and world-class research institutions fuel AI innovation. These factors make Germany a major hub for smart factory development and one of the most advanced adopters of AI in manufacturing across Europe.

UK Artificial Intelligence in Manufacturing Market Insights

The industry in the UK is expected to witness significant growth during the forecast period, driven by government funding, supportive regulatory frameworks, and an active tech startup ecosystem. Initiatives such as the Made Smarter program and UK AI Strategy provide manufacturers with financial support and technical guidance to integrate AI technologies. High labor costs and the need to improve post-Brexit competitiveness are pushing manufacturers to invest in automation and data-driven decision-making. Additionally, collaborations between universities and industry are fostering AI research in manufacturing applications and are fueling AI adoption across sectors such as aerospace, food processing, and pharmaceuticals.

France Artificial Intelligence in Manufacturing Market Analysis

The France industry is projected to witness substantial growth during the forecast period due to national efforts to modernize industry and meet ambitious sustainability targets. The French government’s France 2030 plan includes substantial funding to promote smart industry initiatives, including AI integration across manufacturing. French manufacturers are using AI to reduce energy use, improve process efficiency, and support the shift toward low-carbon and circular production models. The strong presence of high-tech industries such as aerospace, automotive, and luxury goods further drives the need for AI in quality control and process optimization. Moreover, policy support and environmental priorities are further fueling the growth in the country.

Netherlands Artificial Intelligence in Manufacturing Market Overview

The Netherlands industry is projected to witness substantial growth during the forecast period, driven by its strong digital infrastructure, advanced logistics sector, and focus on high-tech innovation. Government and industry collaboration through initiatives such as Smart Industry NL promotes AI-driven solutions in manufacturing, with a focus on predictive analytics, robotics, and digital twins. Dutch manufacturers benefit from a well-connected innovation ecosystem that links startups, research centers, and industrial partners. The country’s emphasis on export-driven manufacturing and efficient, high-quality production processes further drives the adoption of AI technologies, thereby boosting the growth.

Key Players and Competitive Analysis

The Europe AI in manufacturing market features a mix of established industrial leaders, technology providers, and emerging AI innovators. Major European companies such as Siemens AG and SAP SE are at the forefront, offering integrated AI solutions for automation, predictive maintenance, and smart factory transformation. Siemens, in particular, plays a leading role through its Digital Industries division, while SAP integrates AI into its ERP and supply chain platforms. Other global players, including Microsoft, IBM, and Google, maintain a strong presence in Europe through local partnerships and cloud-based AI services tailored for European manufacturers. Additionally, firms such as Sight Machine and SparkCognition are expanding in Europe, targeting industries like automotive, aerospace, and pharmaceuticals. National initiatives such as Germany’s Industrie 4.0 and France’s France 2030 are fostering local AI ecosystems, encouraging collaborations between startups, research institutions, and industrial players. The competitive focus is increasingly on sustainable, secure, and scalable AI applications.

Key Players

- AIBrain Inc.

- Amazon Web Services

- Aquant Inc.

- Cisco Systems Inc

- General Electric Company

- General Vision Inc.

- Google LLC (Alphabet Inc.)

- IBM Corporation

- Intel Corporation

- Micron Technology Inc.

- Microsoft Corporation

- Mitsubishi Electric Corporation

- NVIDIA Corporation

- Oracle Corporation

- Rethink Robotics

- Rockwell Automation Inc

- SAP SE

- Siemens AG

- Sight Machine

- Spark Cognition Inc.

Europe Artificial Intelligence in Manufacturing Industry Developments

In January 2025, Accenture launched its AI Refinery for Industry, introducing 12 industry-specific AI agent solutions to accelerate enterprise adoption of agentic AI, enhance workforce capabilities, and streamline business operations across sectors using NVIDIA’s advanced AI technology.

In June 2025, Amazon launched its new AI foundation model, DeepFleet, to enhance robotic fleet efficiency and deployed its one millionth robot, improving delivery speed, reducing operational costs, and reinforcing its leadership in intelligent warehouse automation.

Europe Artificial Intelligence in Manufacturing Market Segmentation

By Component Outlook (Revenue, USD Billion, 2020–2034)

- Hardware

- Software

- Services

By Technology Outlook (Revenue, USD Billion, 2020–2034)

- Machine Learning (ML)

- Computer Vision

- Context Awareness

- Natural Language Processing

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Material Movement

- Predictive Maintenance & Machinery Inspection

- Production Planning

- Field Services

- Quality Control & Reclamation

- Others

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Semiconductor & Electronics

- Energy & Power

- Medical devices

- Automobile

- Heavy Metal & Machine Manufacturing

- Others

By Country Outlook (Revenue, USD Billion, 2020–2034)

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

Europe Artificial Intelligence in Manufacturing Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.30 Billion |

|

Market Size in 2025 |

USD 1.88 Billion |

|

Revenue Forecast by 2034 |

USD 56.40 Billion |

|

CAGR |

45.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Europe Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 1.30 billion in 2024 and is projected to grow to USD 56.40 billion by 2034.

The market is projected to register a CAGR of 45.9% during the forecast period.

Germany dominated the market share in 2024.

A few of the key players in the market are Microsoft Corporation; Mitsubishi Electric Corporation; NVIDIA Corporation; Oracle Corporation; Rethink Robotics; Rockwell Automation Inc; SAP SE; Siemens AG; Sight Machine; and Spark Cognition Inc.

The hardware segment dominated the market share in 2024.

The production planning segment is expected to witness the significant growth during the forecast period.