Europe Beta Carotene Market Share, Size, Trends, Industry Analysis Report

By Source (Natural and Synthetic); By Application; By Country; Segment Forecast, 2024 - 2032

- Published Date:Feb-2024

- Pages: 115

- Format: PDF

- Report ID: PM4252

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

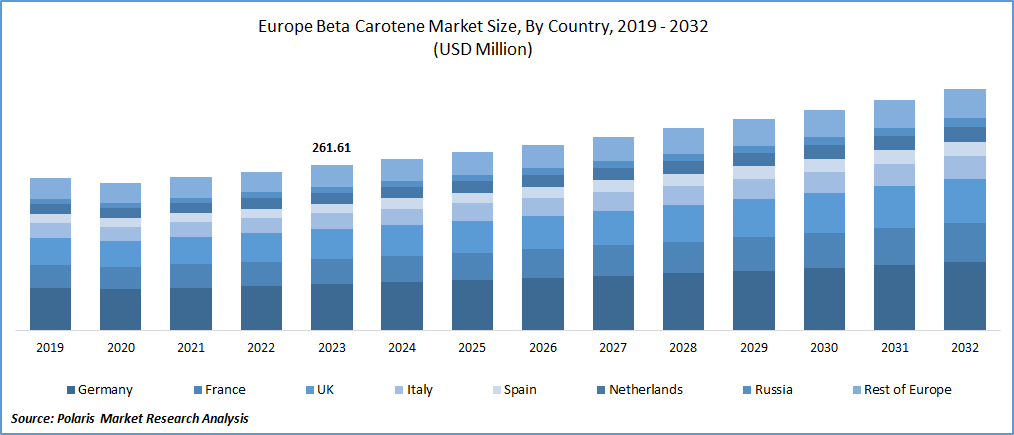

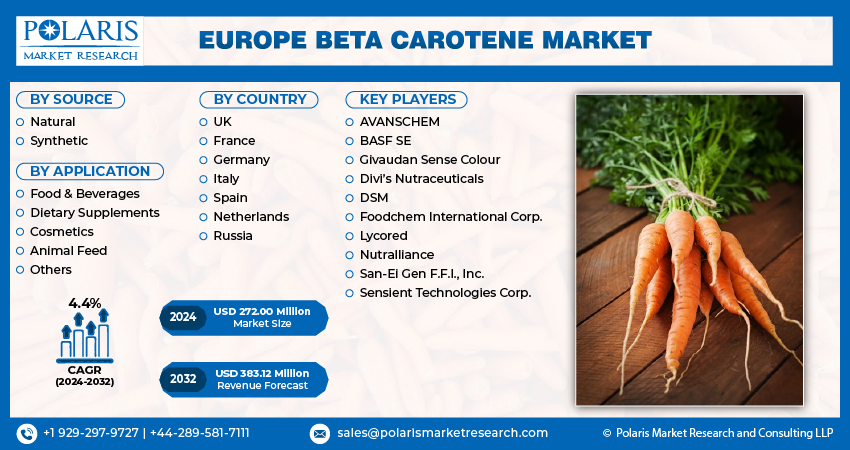

The Europe beta carotene market was valued at USD 261.61 million in 2023 and is expected to grow at a CAGR of 4.4% during the forecast period.

The market is a significant sector in the nutritional industry, with a growing demand for natural food colorants and dietary supplements. Beta-carotene, a prototype of vitamin A, has gained popularity due to its potential health benefits, including improved eye health, immune function, and antioxidant properties. One of the key drivers of the growth of the market is the growing awareness about healthy eating habits and preventive healthcare. Consumers are becoming increasingly conscious of their diets and seek natural ingredients that promote wellness and disease prevention. This shift towards healthier lifestyles drives the demand for beta-carotene as a natural alternative to synthetic additives in food products.

The market is rapidly growing since changing preferences, increasing disposable income, and a growing interest in international culinary meals are all contributing to the rising demand for beta carotene in the Europe. Busy consumers are seeking convenient ways to add flavor and variety to their meals, and beta carotene offers a simple solution. The trend towards home cooking and experimentation with new recipes has further boosted the demand for beta carotene. The market is also benefiting from the increasing focus on health and wellness, as many consumer’s view spices as a natural and healthy way to add flavor to their meals.

To Understand More About this Research: Request a Free Sample Report

Beta-carotene also finds application in various industries, expanding its market reach. It is used not only in food and beverages but also in animal feed and cosmetics. Its adaptability and safety profile make it an attractive choice across diverse sectors. Also, a strengthening regulatory framework in Europe supports the growth of the market. The European Union has implemented stringent regulations on food safety and quality, encouraging manufacturers to adopt natural and safe ingredients like beta-carotene. This has led to increased investment in research and development, resulting in new and innovative products containing beta-carotene.

However, the market is hindered by the high cost of production, which limits the widespread adoption of beta-carotene. In addition, concerns regarding the potential toxicity of certain sources of beta-carotene, such as cigarette smoke, hinder market growth.

Growth Drivers

Expanding applications of beta-carotene in cosmetics and animal feed industries drive market growth

The expanding applications of beta-carotene in the cosmetics and animal feed industries are driving the growth of the market. In the cosmetics industry, beta-carotene is used in skincare products to protect against sun damage, promote skin health, and reduce the appearance of fine lines and wrinkles. Its antioxidant properties make it an attractive ingredient for anti-aging products, and its ability to enhance skin elasticity and firmness has also made it popular in moisturizers and lotions.

In the animal feed industry, beta-carotene is added to livestock feed to improve the nutritional value of meat and eggs produced by animals such as chickens and pigs. This has led to increased demand for beta-carotene from farmers and producers looking to meet consumer demands for higher-quality food products. As a result, the growing use of beta-carotene in these industries is expected to contribute significantly to the expansion of the market over the assessment period.

Report Segmentation

The market is primarily segmented based on source, application, and region.

|

By Source |

By Application |

By Country |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Source Analysis

The natural source of beta carotene held the dominating revenue share in 2023.

In 2023, the natural source of beta-carotene held the dominant revenue share in the European market. This is because of the growing consumer preference for natural ingredients over synthetic ones, associated with increasing health awareness and environmental concerns. The demand for natural beta-carotene has been fueled by its extensive use as an antioxidant, anti-inflammatory agent, and pigment in various food products, such as dietary supplements, functional foods, and animal feed.

Also, the European Union's stringent regulations on food additives and colorants have led manufacturers to opt for naturally sourced beta-carotene, which is generally recognized as safe (GRAS) and compliant with EU legislation. Further, the region's strong emphasis on sustainability and eco-friendliness has encouraged companies to adopt environment-friendly extraction methods, such as supercritical fluid extraction, to obtain beta-carotene from natural sources like algae, plants, and fungi. All these factors collectively contribute to the dominance of natural beta-carotene in the European market.

By Application Analysis

The food and beverage application dominated the market in 2023.

The food and beverage application segment dominated the market in 2023, owing to the growing demand for natural food colorants and the increasing awareness among consumers about the health benefits of beta-carotene. Beta-carotene is widely used as a natural food colorant in various applications, such as soft drinks, juices, ice creams, and baked goods. Also, the growing emphasis on natural ingredients has led to an increased demand for beta-carotene as a natural alternative to synthetic colors.

The European Union's ban on artificial food colors, including the controversial Red Dye 40, Yellow 5, and Yellow 6, has further fueled the demand for natural alternatives like beta-carotene. As a result, the food and beverage industry has been the major driver of the European beta-carotene market, with prominent players investing heavily in product innovation and expansion to meet the rising consumer demands.

Country Insights

Germany is expected to grow at a significant CAGR over the forecast period

Germany is expected to grow at a significant CAGR over the forecast period, owing to its large and aging population, increasing health consciousness, and high-income groups. According to the World Health Organization (WHO), Germany has one of the highest life expectancies in Europe, with an average lifespan of 81 years. This demographic trend creates a strong demand for preventive healthcare measures and nutritional supplements, including beta-carotene, which can help protect against age-related diseases such as macular degeneration and cancer.

Also, Germans have a relatively high per capita income, allowing them to spend more on premium food products and dietary supplements that contain beta-carotene. In addition, the country's robust healthcare system and well-established distribution channels facilitate the availability and accessibility of beta-carotene products. Therefore, Germany's favorable demographics, economic conditions, and healthcare infrastructure are expected to drive the growth of the beta-carotene market in Europe over the coming years.

Key Market Players & Competitive Insights

Manufacturers are engaged in various activities to promote their products and expand their customer base. They are investing heavily in research and development to improve the quality and efficiency of their production processes, as well as to develop new and innovative applications for Europe beta-carotene market.

Some of the major players operating in the Europe market include:

- AVANSCHEM

- BASF SE

- Givaudan Sense Colour

- Divi’s Nutraceuticals

- DSM

- Foodchem International Corp.

- Lycored

- Nutralliance

- San-Ei Gen F.F.I., Inc.

- Sensient Technologies Corp.

Recent Developments

- In September 2021, Divi's Nutraceuticals, a company headquartered in India, launched CaroNat, a naturally sourced food ingredient intended to provide a dark yellow to orange coloration to a variety of foods and beverages, including those in the dairy industry for Asia-Pacific, North America, and Europe regions.

Europe Beta Carotene Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 272.00 Million |

|

Revenue Forecast in 2032 |

USD 383.12 Million |

|

CAGR |

4.4% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD Million, and CAGR from 2024 to 2032 |

|

Segments Covered |

By Source, By Application, By Country |

|

Country scope |

UK, France, Germany, Italy, Spain, Netherlands, Russia |

|

Customization |

Report customization as per your requirements concerning countries, regions, and segmentation. |

FAQ's

AVANSCHEM, BASF SE, Givaudan Sense Colour, Divi’s Nutraceuticals, DSM, Foodchem International Corp are the key companies in Europe Beta Carotene Market.

The Europe beta carotene market is expected to grow at a CAGR of 4.4% during the forecast period.

Source, application, and region are the key segments covered.

The growing awareness about healthy eating habits and preventive healthcare are the key driving factors in Europe Beta Carotene Market.

The europe beta carotene market size is expected to reach USD 383.12 million by 2032