Europe Industrial Fans Market Size, Share, Trends, Industry Analysis Report

By Product (Centrifugal Fans, Axial Fans), By Flow Capacity, By Application, By End Use, By Country – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM6325

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

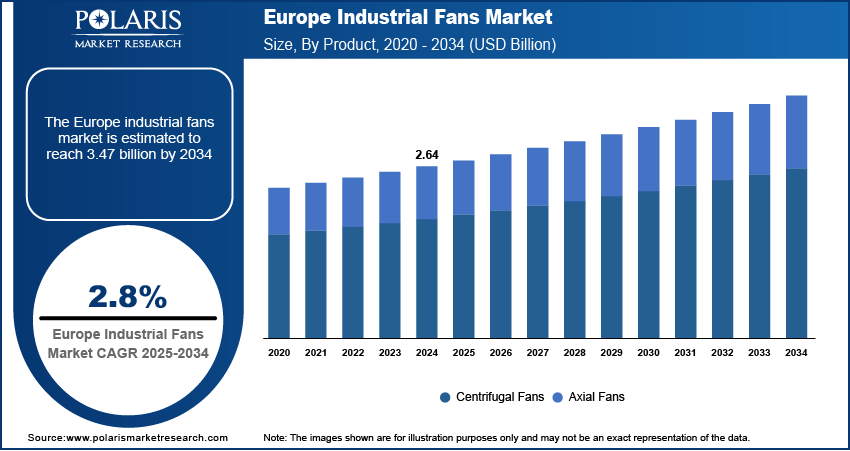

The Europe industrial fans market size was valued at USD 2.64 billion in 2024 and is anticipated to register a CAGR of 2.8% from 2025 to 2034. The demand for industrial fans in Europe is mainly driven by strict environmental and workplace safety rules from the EU. These regulations push companies to use better ventilation systems to keep the air clean for workers and the environment. Also, a growing need for energy-efficient solutions is boosting the market, as businesses look for ways to reduce energy use and meet climate goals.

Key Insights

- By product, the centrifugal fans segment held the largest share of the market in 2024. The dominance of this segment is driven by their ability to provide high pressure and move air efficiently.

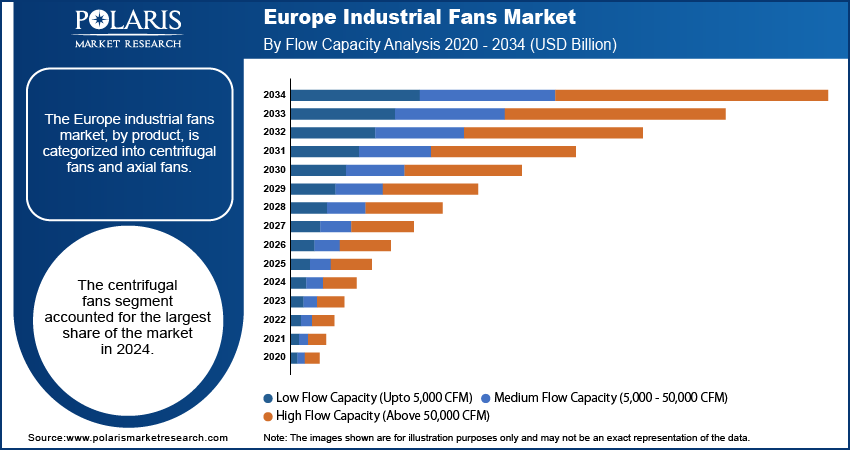

- By flow capacity, the medium flow capacity segment, covering fans with a rate of 5,000 to 50,000 CFM, held the largest share in 2024. The largest share of this segment is due to its balanced performance and energy efficiency.

- By application, the ventilation application segment accounted for the largest share in 2024. The key driver for this application is the universal and constant need for clean air and a safe working environment across all industrial sectors, which is heavily regulated by health and safety standards.

- By end use, the manufacturing segment dominated the market in 2024. This sector dominates the market because of the crucial role industrial fans play in various manufacturing processes.

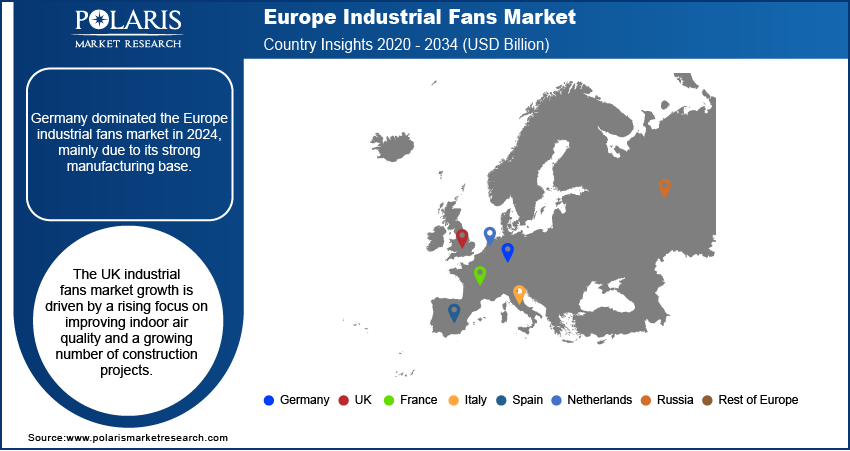

- By country, Germany held the largest share in 2024, driven by its strong and advanced manufacturing industry. The industry constantly invests in high-tech and energy-efficient fan systems to comply with strict national and EU regulations.

Industry Dynamics

- Stringent EU environmental and workplace safety rules drive the Europe industrial fans market growth. These regulations require companies to maintain good air quality and safe working conditions for employees, which boosts the demand for modern ventilation systems.

- A growing focus on energy efficiency fuels the industry expansion. Businesses are replacing older, less efficient fan systems with new models that use less power to lower operational costs and meet climate goals.

- The expansion of different manufacturing industries, such as automotive, chemical, and pharmaceutical, is also pushing demand. These sectors rely on industrial fans for important processes such as cooling, ventilation, and dust control.

Market Statistics

- 2024 Market Size: USD 2.64 billion

- 2034 Projected Market Size: USD 3.47 billion

- CAGR (2025–2034): 2.8%

- Germany: Largest Country Share

AI Impact on Europe Industrial Fans Market

- AI systems integrated with IoT enable real-time monitoring and analytics. It tracks metrics such as vibration, airflow, and temperature. This empowers predictive maintenance and reduces unplanned downtime.

- Various regulations across Europe, such as the Eco-design Directive, push manufacturers toward smart, AI-enabled industrial fans. The fans leverage advanced motor tech and variable speed drives to reduce energy consumption.

- AI empowers manufacturers to customize fan configurations, adapting motor types, airflow patterns, blade geometry, and materials for specific industrial demands. This is improving the performance and efficiency of industrial fans.

Industrial fans are mechanical devices that move air or gas in large volumes to provide ventilation, cooling, or material handling in industrial settings. They are different from home fans because they are built to work in tough environments and meet specific needs, such as managing fumes, dust, or high temperatures. These fans are important for keeping workplaces safe and making sure industrial processes run smoothly.

A factor impacting the growth of the Europe industrial fans market is the increasing adoption of automated systems and advanced manufacturing technologies. As industries in Europe modernize their production facilities, they need specialized fans that can be integrated with these new systems for precise control of airflow. This helps improve efficiency and lower operational costs. Another factor is the growth of niche industrial sectors such as food & beverages and pharmaceuticals. These industries have unique needs for air quality monitoring systems and temperature control to ensure product safety and quality. This boosts the demand for specialized fan solutions.

The growth of cleanroom facilities is another driver. In many high-tech industries, such as medical device manufacturing and semiconductor production, strict air purity standards are required. These standards are set to prevent contamination, which can ruin products and affect worker health. Cleanrooms use special filtration and ventilation systems to maintain a sterile environment. Industrial fans are a key part of these systems, as they are used to control air pressure and flow. For example, according to the WHO, maintaining proper air control in facilities that produce sterile medical products is a must. This need for very clean environments in certain industries is driving the demand for advanced and highly specialized industrial fans across Europe.

Drivers and Trends

Growing Focus on Energy Efficiency: A major driver for the Europe industrial fans market is the strong push for energy efficiency. Companies across the region are under pressure to lower their energy use to reduce costs and meet strict climate goals. This has led to a major shift away from older, less efficient fan models towards new, high-efficiency systems. These modern fans use advanced designs and materials to move air with much less power, which helps businesses save money over time.

This trend is also being fueled by government incentives and regulations aimed at boosting energy performance in the industrial sector. Companies are actively looking for new technologies that can help them meet these goals. The market is seeing a rise in demand for fans that can be integrated into smart systems for better energy management. This focus on saving energy and reducing operational costs is a primary factor driving the Europe industrial fans market growth.

Strict Environmental and Workplace Safety Regulations: Another main driver is the rise of strict environmental and workplace safety regulations within Europe. These rules, often set by the European Union, are designed to protect both the environment and the health of workers. They require industrial facilities to manage emissions, control pollutants, and ensure proper ventilation to maintain a safe and healthy working environment. Industrial fans are essential for these tasks, as they are used in systems for dust collection, fume extraction, and general air circulation.

The implementation of these rules has led to a greater need for specialized and high-performance industrial fans. Industries such as chemicals, pharmaceuticals, and manufacturing must use advanced ventilation to meet air quality standards. This includes filtering out harmful particles and gases. The need to follow these strict rules is creating a constant demand for new fan technology that is more effective at controlling pollution and ensuring safe working conditions.

Segmental Insights

Product Analysis

Based on product, the Europe industrial fans market segmentation includes centrifugal fans and axial fans. The centrifugal fans segment held the largest share in 2024. This is mainly due to their ability to produce high pressure and move air efficiently, which makes them ideal for a wide range of industrial uses. They are commonly used in applications that require moving air through ducts, such as heating, ventilation, and air conditioning systems, as well as in air pollution control and material handling. Centrifugal fans are also well-suited for harsh industrial environments because of their strong design and ability to handle air with dust, particles, or high temperatures. Key sectors such as chemical processing, power generation, and manufacturing heavily rely on these fans for their essential operations. Their robust nature and consistent performance in demanding conditions have solidified their dominant position.

The axial fans segment is anticipated to register the highest growth rate during the forecast period. This growth is linked to their high airflow capacity, which is needed for general ventilation and cooling in large spaces such as warehouses, factories, and commercial buildings. Axial fans are known for their ability to move a large volume of air with low power consumption, making them a very energy-efficient option. As companies in Europe continue to prioritize sustainability and lower their carbon footprint, the demand for these efficient solutions is increasing. Additionally, their compact design and easier installation make them a popular choice for many new construction and renovation projects. The rising need for better air circulation in a variety of industrial and commercial settings is a key factor driving the strong growth of this segment.

Flow Capacity Analysis

Based on flow capacity, the segmentation includes low flow capacity (upto 5,000 CFM), medium flow capacity (5,000 - 50,000 CFM), and high flow capacity (above 50,000 CFM). The medium flow capacity segment held the largest share in 2024. This category of industrial fans is widely used across a diverse range of industries, including manufacturing, automotive, and food and beverage processing. The dominant position of this segment is due to its optimal balance between performance and energy use. Medium flow capacity fans are powerful enough for large-scale operations and are also designed to be energy-efficient. They are often integrated into crucial systems such as heating, ventilation, and air conditioning, as well as in production lines and cleanrooms. The ongoing modernization of industrial facilities and the strong presence of a manufacturing base in key European countries support the consistent demand for these fans, cementing their leading role in the market.

The low flow capacity segment is anticipated to register the highest growth rate during the forecast period. This growth is linked to the increasing use of industrial fans in smaller, more specialized spaces, such as laboratories, workshops, and electronics manufacturing units. These fans are a good fit for localized ventilation needs and are also a popular choice for energy-efficient buildings and facilities. As industries continue to seek compact and flexible solutions for air management, the demand for low-flow capacity fans is rising. Their small size and low energy consumption align well with the focus on sustainability and cost reduction in a variety of smaller-scale industrial environments. This trend is a key factor pushing the fast growth of this segment.

Application Analysis

Based on application, the segmentation includes ventilation, cooling, drying, and material handling. The ventilation segment held the largest share in 2024. This is because proper ventilation is essential in almost every industrial setting, from large factories and warehouses to specialized facilities. Industrial fans used for ventilation ensure clean air circulation, remove harmful gases and fumes, and maintain a safe and comfortable working environment for employees. Stricter health and safety rules, along with a greater focus on indoor air quality, make ventilation fans a vital part of operations for many businesses. The widespread and constant need for these systems across key sectors such as manufacturing, automotive, and chemicals is the main reason for this segment's large market share.

The cooling application segment is anticipated to register the highest growth rate during the forecast period. This growth is driven by rising temperatures and the increasing use of heat-generating machinery in modern industrial processes. As summers become hotter, businesses need effective cooling solutions to prevent equipment from overheating and to keep production lines running smoothly. Additionally, many high-tech industries, such as data centers and electronics manufacturing, have a critical need for precise temperature control. Industrial fans used for cooling help to manage this heat, ensuring the longevity of expensive equipment and the quality of sensitive products. This rising demand for efficient and powerful cooling solutions to deal with modern industrial needs is the primary factor behind the rapid growth of this segment.

End Use Analysis

Based on end-use, the segmentation includes manufacturing, food & beverage, oil & gas, cement, chemical & petrochemical, power generation, mining, and others. The manufacturing segment held the largest share in 2024. This is mainly because of the region's strong industrial base, with countries such as Germany, France, and Italy having large and developed manufacturing sectors. Industrial fans are crucial in these facilities for a variety of tasks, including general ventilation, cooling machinery, and controlling dust and fumes to meet safety standards. The constant need for these fans in production processes, along with efforts to modernize factories and improve energy efficiency, contributes to this segment's leading position. The manufacturing sector's demand for fans is widespread, making it the most significant consumer of these products in the market.

The food and beverage sector is anticipated to register the highest growth rate during the forecast period. This is due to the strict hygiene and air purity rules that govern food production. Industrial fans are used in this industry to control temperature, remove moisture, and prevent contamination, all of which are critical for food safety and product quality. The growth of the packaged food and beverage industry, along with a focus on automation and clean production processes, is driving the demand for specialized fans. These fans are a key component in maintaining the sanitary conditions required by regulations, which is why this end-use segment is growing quickly.

Country Analysis

The Germany industrial fans market accounted for the largest share in 2024. mainly due to its strong manufacturing base. The country is well-known for its automotive industry, which relies on industrial fans for various applications. Also, Germany's focus on technological advancements and smart factories creates a strong demand for modern fan systems with integrated features. Strict regulations on energy efficiency and indoor air quality in the country also prompt companies to invest in high-performance ventilation solutions to ensure a safe working environment and lower their energy consumption.

UK Industrial Fans Market Overview

The UK market for industrial fans is driven by a focus on improving indoor air quality and a growing number of construction projects. The country has seen a push for better ventilation in residential and commercial buildings, partly due to rising awareness of air pollution and health standards. While the UK has been catching up with other European countries in adopting advanced ventilation, recent updates to building standards are helping to close this gap. This is leading to a steady demand for more energy-efficient and regulation-compliant fans for both new builds and renovation projects.

Italy Industrial Fans Market Overview

The industrial fans market in Italy is influenced by its manufacturing sector and a strong move toward sustainable building practices. There is a growing need for energy-efficient ventilation systems that can help companies reduce their carbon footprint while maintaining production efficiency. The country's construction sector is also a major driver, with new building initiatives and a need to update existing infrastructure. This creates demand for fans that are energy-efficient and quiet and made from recyclable materials, in line with modern green building trends.

Key Players and Competitive Insights

The competitive landscape of the Europe industrial fans market is made up of a mix of large global companies and smaller, regional players. FläktGroup Holding GmbH, Howden Group Limited, Greenheck Fan Corporation, Continental Blower LLC, and Trane Technologies PLC are major players. These companies compete on factors such as product innovation, energy efficiency, and a wide range of products for many different uses. The market is also seeing more smaller companies that focus on a specific niche, which adds to the competition and encourages innovation. The competitive environment is dynamic, with companies trying to expand their market share through a mix of new product development, strategic partnerships, and mergers and acquisitions.

A few prominent companies in the industry include Howden Group Limited, FläktGroup Holding GmbH, Continental Blower LLC, Halifax Fan, Magnovent, CBI Group, and Euroventilatori S.P.A.

Key Players

- CBI Group

- Continental Blower LLC

- Euroventilatori S.P.A.

- FläktGroup Holding GmbH

- Greenheck Fan Corporation

- Halifax Fan

- Howden Group Limited

- Magnovent

- Trane Technologies PLC

Europe Industrial Fans Industry Developments

July 2025: Halifax Fan launched the Fan Constructor, a cloud-based fan selection platform that allows users to configure, select, and download fan data and CAD drawings with ease.

June 2025: Fans and Blowers Ltd acquired B.O.B. Stevenson Ltd to enhance its capabilities in industrial fan manufacturing and design.

Europe Industrial Fans Market Segmentation

By Product Outlook (Revenue – USD Billion, 2020–2034)

- Centrifugal Fans

- Axial Fans

By Flow Capacity Outlook (Revenue – USD Billion, 2020–2034)

- Low Flow Capacity (Upto 5,000 CFM)

- Medium Flow Capacity (5,000 - 50,000 CFM)

- High Flow Capacity (Above 50,000 CFM)

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Ventilation

- Cooling

- Drying

- Material Handling

By End Use Outlook (Revenue – USD Billion, 2020–2034)

- Manufacturing

- Food & Beverage

- Oil & Gas

- Cement

- Chemical & Petrochemical

- Power Generation

- Mining

- Others

By Country Outlook (Revenue – USD Billion, 2020–2034)

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

Europe Industrial Fans Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2.64 billion |

|

Market Size in 2025 |

USD 2.71 billion |

|

Revenue Forecast by 2034 |

USD 3.47 billion |

|

CAGR |

2.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 2.64 billion in 2024 and is projected to grow to USD 3.47 billion by 2034.

The market is projected to register a CAGR of 2.8% during the forecast period.

A few key players in the market include Howden Group Limited, FläktGroup Holding GmbH, Continental Blower LLC, Halifax Fan, Magnovent, CBI Group, and Euroventilatori S.P.A.

Germany accounted for the largest share of the market in 2024.

The centrifugal fans segment accounted for the largest share of the market in 2024.

The low flow capacity (upto 5,000 CFM) segment is expected to witness the fastest growth during the forecast period.

The market size was valued at USD 2.64 billion in 2024 and is projected to grow to USD 3.47 billion by 2034.

The market is projected to register a CAGR of 2.8% during the forecast period.

A few key players in the market include Howden Group Limited, FläktGroup Holding GmbH, Continental Blower LLC, Halifax Fan, Magnovent, CBI Group, and Euroventilatori S.P.A.

Germany accounted for the largest share of the market in 2024.

The centrifugal fans segment accounted for the largest share of the market in 2024.

The low flow capacity (upto 5,000 CFM) segment is expected to witness the fastest growth during the forecast period.