Europe Industrial Services Market Size, Share, Trends, Industry Analysis Report

By Type (Engineering & Consulting, Installation & Commissioning, Operational Improvement & Maintenance), By Application, By End Use, and By Country – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 126

- Format: PDF

- Report ID: PM6407

- Base Year: 2024

- Historical Data: 2020-2023

Overview

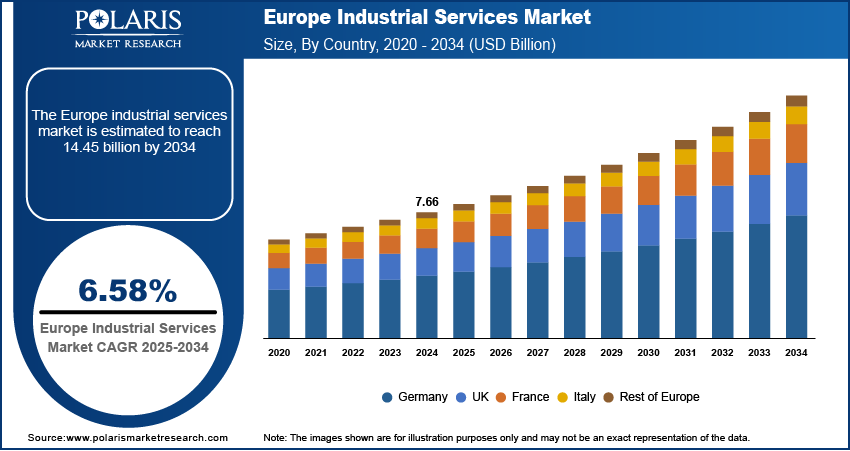

The Europe industrial services market size was valued at USD 7.66 billion in 2024, growing at a CAGR of 6.58% from 2025 to 2034. Key factors driving demand for industrial services in Europe include increasing development of smart factories, growing urbanization, and rising production of automobiles.

Key Insights

- The engineering & consulting services segment held the largest revenue share in 2024 due to the integration of Industry 4.0 technologies in factories.

- The distributed control system (DCS) segment accounted for a major revenue share in 2024 due to strict EU regulatory frameworks for emissions compliance.

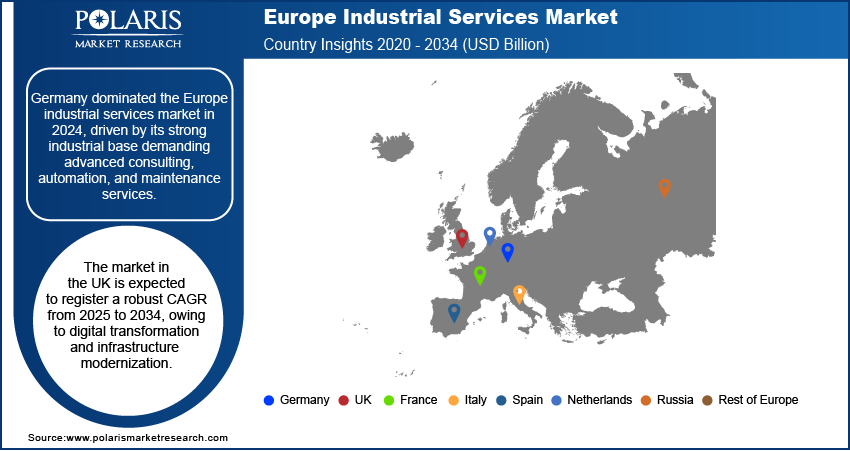

- Germany accounted for the largest Europe industrial services market share in 2024, owing to its strong industrial base.

- The market in the UK is expected to register a robust CAGR from 2025 to 2034, owing to expanding infrastructure modernization.

Industry Dynamics

- Rising production of automobiles propels the demand for industrial services as they help automakers ensure equipment efficiency and minimize downtime.

- Increasing development of smart factories is driving the Europe industrial services market growth as smart factories rely on various advanced technologies such as IoT, AI, robotics, and data analytics.

- Expanding industrialization in the region is expected to create a lucrative market opportunity during the forecast period.

- High cost of industrial services hinders the market growth.

AI Impact on the Europe Industrial Services Market

- AI enhances operational efficiency in Europe’s industrial services by enabling predictive maintenance and reducing downtime through real-time data analytics.

- Automation powered by AI streamlines supply chains, improves quality control, and lowers labor costs across manufacturing and logistics sectors.

- Increasing adoption of AI-driven robotics boosts productivity, driving demand for smart industrial solutions and reshaping service delivery models.

- Concerns around data security, workforce displacement, and high implementation costs pose challenges to widespread AI integration.

Market Statistics

- 2024 Market Size: USD 7.66 Billion

- 2034 Projected Market Size: USD 14.45 Billion

- CAGR (2025–2034): 6.58%

Industrial services refer to a wide range of specialized solutions that support the efficient functioning, maintenance, and optimization of industrial facilities, equipment, and processes. These services include engineering, installation, inspection, testing, repair, and maintenance of machinery, as well as asset management, automation, and environmental compliance support. Companies rely on such services to reduce downtime, increase productivity, extend the lifespan of assets, and ensure regulatory compliance. Industrial services also enhance workplace safety and operational efficiency across industries such as oil and gas, chemicals, automotive, power generation, and manufacturing.

Industrial services encompass a comprehensive range of solutions tailored to support industries in various sectors such as energy, oil and gas, chemicals, automotive, and manufacturing across Europe. These services cover maintenance, installation, repair, inspection, and optimization of industrial systems, enabling companies to achieve operational efficiency and meet strict environmental and safety regulations prevalent in Europe. The market in this region benefits from strong demand for sustainable solutions, smart factory integration, and predictive maintenance driven by Industry 4.0. Countries such as Germany, France, and the UK lead the adoption of advanced industrial services, supported by an established industrial base, government initiatives for digital transformation, and growing emphasis on energy efficiency.

The Europe industrial services market demand is driven by the growing urbanization. According to the European Commission, Europe's level of urbanization is expected to increase to approximately 83.7% by 2050. This is increasing the need for larger water treatment systems, waste management solutions, and energy distribution networks, all of which rely on specialized industrial services. Additionally, urbanization is accelerating industrial automation and smart city technologies, creating new opportunities for industrial service providers specializing in digital infrastructure and IoT solutions. Therefore, the growing urbanization in Europe is propelling the adoption of industrial services.

Drivers & Opportunities

Rising Production of Automobiles: Automakers Europe are relying on industrial service providers to increase production by ensuring equipment efficiency and minimizing downtime. The growing production of automobiles is also leading to the construction of new factories, which is driving demand for engineering & consulting and installation & commissioning services. For instance, European Automobile Manufacturers' Association, in its report, stated that 14.8 million vehicles are manufactured in the European Union per year. Furthermore, stricter environmental regulations are pushing automakers to adopt advanced waste treatment and emission control systems, which require specialized industrial services. Therefore, as automobile production volumes grow in Europe, companies need regular calibration, repair, and upgrading services of robotic systems and conveyor networks.

Increasing Development of Smart Factories: Smart factories rely on advanced technologies such as IoT, AI, robotics, and data analytics, which require specialized installation, integration, and maintenance services. The complexity of smart manufacturing is also driving the demand for cybersecurity services to protect sensitive data and industrial networks from threats. Additionally, predictive maintenance services become essential as factories use real-time monitoring to prevent equipment failures and minimize downtime. The shift toward smart factories is further creating opportunities for industrial service providers offering training, consulting, and optimization solutions, helping businesses maximize efficiency and adapt to rapidly evolving technologies.

Segmental Insights

Type Analysis

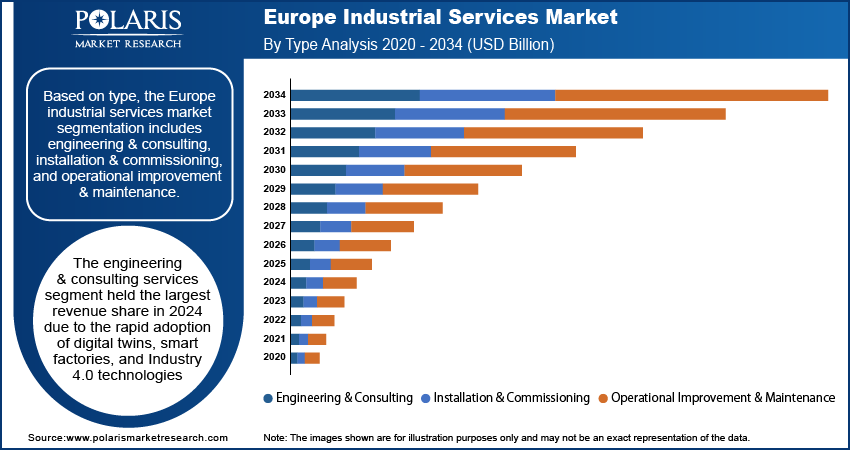

Based on type, the segmentation includes engineering & consulting, installation & commissioning, and operational improvement & maintenance. The engineering & consulting services segment held the largest revenue share in 2024 due to the rapid adoption of digital twins, smart factories, and Industry 4.0 technologies. Automobile manufacturers and process industries sought tailored consulting services to meet stringent EU environmental and safety regulations. The growing shift toward sustainable production also pushed enterprises to engage engineering consultants to implement low-carbon technologies and integrate renewable energy.

The operational improvement & maintenance segment is expected to grow at a rapid pace in the coming years. The growth is attributed to the rising need for asset reliability and cost optimization across industries such as automotive, chemicals, and oil and gas. The strong adoption of IoT-enabled monitoring systems, data analytics, and AI-driven maintenance strategies is fueling the demand for continuous operational services. Moreover, rising labor shortages and the high cost of unplanned outages are encouraging industries to outsource operational improvement & maintenance services to specialized providers.

Application Analysis

In terms of application, the segmentation includes distributed control system (DCS), programmable controller logic (PLC), supervisory control and data acquisition (SCADA), electric motors & drives, valves & actuators, manufacturing execution system, and others. The distributed control system (DCS) segment accounted for a major revenue share in 2024 due to strict EU regulatory frameworks for industrial safety and emissions compliance. Companies in the region invested in DCS solutions to achieve centralized monitoring, real-time control, and seamless integration with advanced analytics platforms. The growing emphasis on decarbonization and energy transition also encouraged utilities and process industries to deploy modern DCS platforms that support renewable energy integration and carbon footprint reduction.

End Use Analysis

In terms of end use, the segmentation includes oil and gas, chemicals, automotive, pharmaceuticals, and others. The oil and gas segment dominated the revenue share in 2024, due to growing focus on asset optimization and safety compliance. The sector faced constant pressure to modernize infrastructure, enhance energy efficiency, and align with the European Union’s decarbonization targets. This drove strong demand for engineering, consulting, and maintenance services tailored to upstream, midstream, and downstream operations. Expanding investments in liquefied natural gas (LNG), offshore projects, and refining upgrades further increased the need for specialized services that improve operational reliability.

The automotive segment is expected to grow at a rapid pace in the coming years, owing to the rising electric vehicle (EV) adoption and smart manufacturing. Automakers in the region are continuously investing in digital transformation, robotics, and advanced production systems to remain competitive, which is increasing the need for industrial services. The automotive sector further relies on industrial service providers for integrating automation, upgrading assembly lines, and ensuring seamless adoption of Industry 4.0 technologies. The European Union’s stringent emissions regulations and ambitious targets for electrification are propelling the demand for automotive industrial services.

Country Analysis

The Germany industrial services market accounted for the largest revenue share in 2024. This is attributed to its strong industrial base across automotive, chemicals, and machinery, which consistently demanded advanced consulting, automation, and maintenance services. German manufacturers invested heavily in digitalization, robotics, and Industry 4.0 technologies to sustain their global competitiveness. This increased the demand for specialized industrial services to integrate Industry 4.0 technologies into existing operations. The country also emphasized energy-efficient production and decarbonization initiatives, which required specialized engineering expertise and operational support. A highly skilled workforce, robust R&D ecosystem, and government-driven programs for smart manufacturing further strengthened Germany’s position as the dominant country in the region.

The UK industrial services market is expected to grow at a robust CAGR from 2025 to 2034, owing to digital transformation and infrastructure modernization. UK-based companies are increasingly relying on industrial service providers for integrating smart factory solutions, predictive maintenance, and sustainable production systems. The push for renewable energy development and offshore wind expansion is also fueling demand for specialized engineering and commissioning services. Additionally, the country’s strong pharmaceutical and automotive sectors are driving the adoption of advanced automation and operational efficiency services.

Key Players & Competitive Analysis

The Europe industrial services market is characterized by intense competition among global leaders such as Siemens, Schneider Electric, ABB, Honeywell International Inc., General Electric Company, and Samson. These companies dominate through advanced automation, predictive maintenance, and digitalization solutions tailored to Europe’s stringent regulatory and sustainability standards. Regional focus on energy efficiency, Industry 4.0 adoption, and decarbonization drives innovation and service differentiation. Startups leverage strong local presence and integrated service ecosystems, while niche players compete through specialized expertise and agile customer support. Cross-border collaboration and strategic alliances are common as firms expand capabilities in digital twins, remote monitoring, and AI-driven analytics.

A few major companies operating in the Europe industrial services industry include ABB, Alstom SA, Emerson Electric Co., Honeywell International Inc., Rockwell Automation Inc., Samson AG, Schneider Electric SE, Siemens AG, Sonepar SA, and Yokogawa Electric Corporation.

Key Players

- ABB

- Alstom SA

- Emerson Electric Co

- Honeywell International Inc.

- Rockwell Automation Inc.

- Samson AG

- Schneider Electric SE

- Siemens AG

- Sonepar SA

- Yokogawa Electric Corporation

Europe Industrial Services Industry Developments

In January 2025, Alstom announced that it had been awarded a contract worth €144 million (i.e., USD 158.4 million) to supply Mitrac traction components and maintenance services for Vande Bharat sleeper trains in India.

In September 2024, ABB announced the launch of a new suite of service offerings designed to simplify maintenance and improve the operational health of crucial mining assets.

Europe Industrial Services Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Engineering & Consulting

- Installation & Commissioning

- Operational Improvement & Maintenance

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Distributed Control System (DCS)

- Programmable Controller Logic (PLC)

- Supervisory Control and Data Acquisition (SCADA)

- Electric Motors & Drives

- Valves & Actuators

- Manufacturing Execution System

- Others

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Oil and Gas

- Chemicals

- Automotive

- Pharmaceuticals

- Others

By Country Outlook (Revenue, USD Billion, 2020–2034)

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

Europe Industrial Services Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 7.66 Billion |

|

Market Size in 2025 |

USD 8.14 Billion |

|

Revenue Forecast by 2034 |

USD 14.45 Billion |

|

CAGR |

6.58% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Country Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 7.66 billion in 2024 and is projected to grow to USD 14.45 billion by 2034.

The market is projected to register a CAGR of 6.58% during the forecast period.

Germany dominated the market in 2024

A few of the key players in the market are ABB, Alstom SA, Emerson Electric Co., Honeywell International Inc., Rockwell Automation Inc., Samson AG, Schneider Electric SE, Siemens AG, Sonepar SA, and Yokogawa Electric Corporation.

The engineering & consulting services segment dominated the market revenue share in 2024.

The automotive segment is projected to witness the fastest growth during the forecast period.

The market size was valued at USD 7.66 billion in 2024 and is projected to grow to USD 14.45 billion by 2034.

The market is projected to register a CAGR of 6.58% during the forecast period.

Germany dominated the market in 2024

A few of the key players in the market are ABB, Alstom SA, Emerson Electric Co., Honeywell International Inc., Rockwell Automation Inc., Samson AG, Schneider Electric SE, Siemens AG, Sonepar SA, and Yokogawa Electric Corporation.

The engineering & consulting services segment dominated the market revenue share in 2024.

The automotive segment is projected to witness the fastest growth during the forecast period.