Europe Inulin Market Share, Size, Trends, Industry Analysis Report

By Source (Chicory, Agave, Jerusalem artichokes, Asparagus, Others); By Application; By Country; Segment Forecast, 2024 - 2032

- Published Date:Mar-2024

- Pages: 116

- Format: PDF

- Report ID: PM4474

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

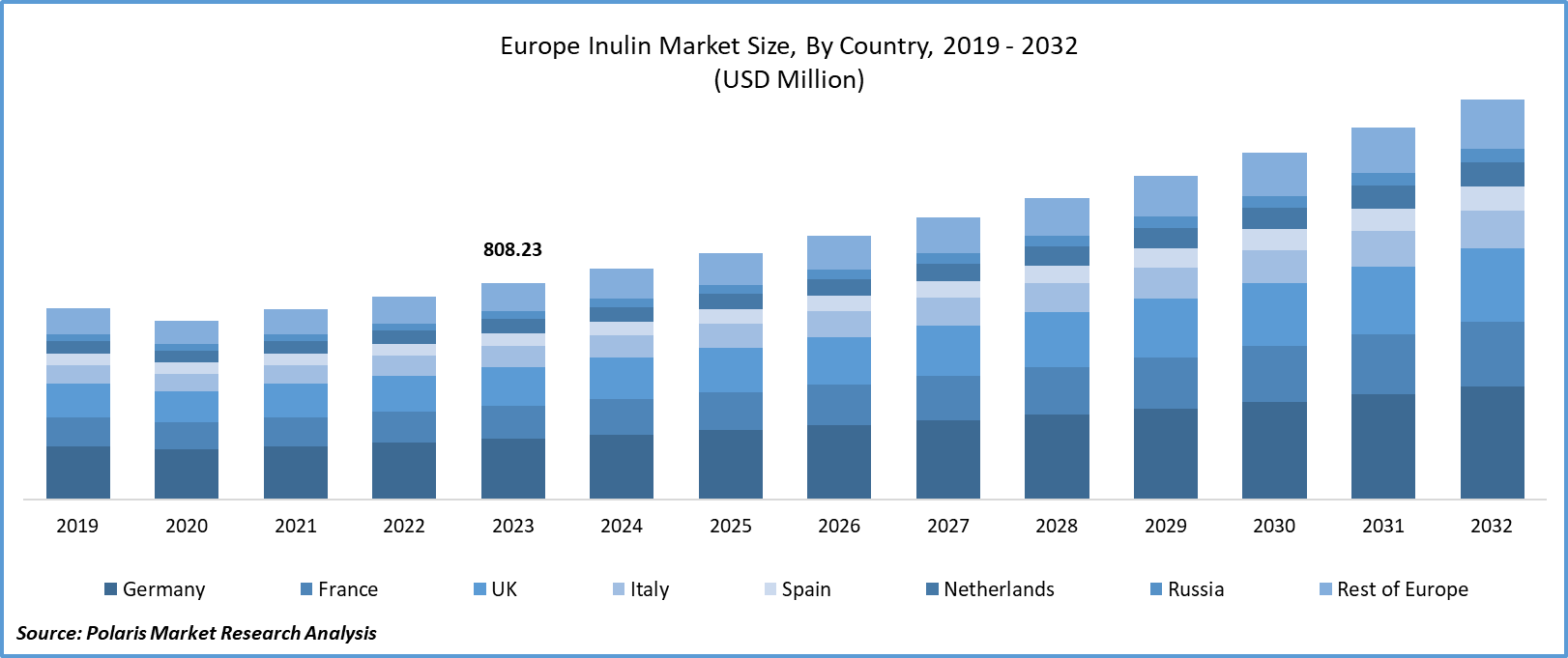

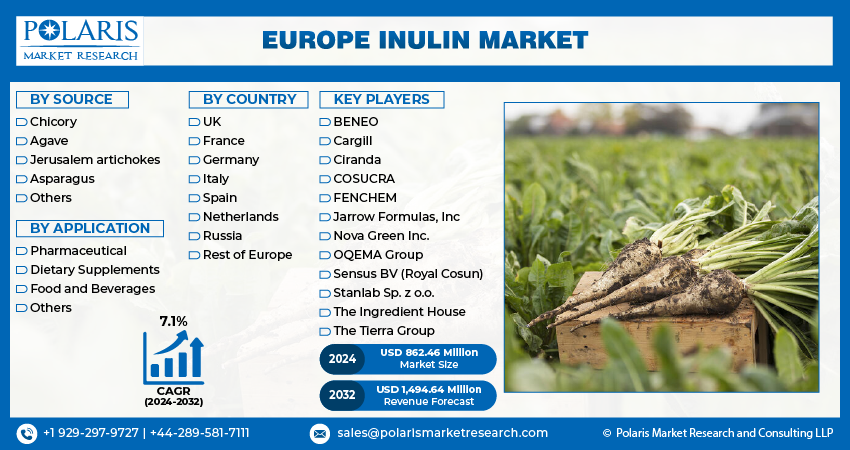

The europe inulin market size was valued at USD 808.23 million in 2023. The market is anticipated to grow from USD 862.46 million in 2024 to USD 1,494.64 million by 2032, exhibiting the CAGR of 7.1% during the forecast period.

Industry Trends

The European region has dominated the global inulin market in 2023, owing to the growing demand for natural and healthy food products. Inulin, a type of fructan, is a popular ingredient used in various applications such as bakery, dairy, beverages, and dietary supplements. The European inulin market is driven by several factors, including increasing consumer awareness about the health benefits of inulin, its versatility, and the rising trend of clean labeling. One of the primary drivers of the European inulin market is the growing consumer interest in healthy eating habits and natural ingredients.

Inulin is perceived as a healthier alternative to traditional sugars due to its low-calorie content and prebiotic properties that promote digestive health. This shift towards healthier options has led to an increased demand for inulin-based products, particularly among consumers who are looking for plant-based alternatives to conventional sweeteners like sugar and artificial sweeteners.

To Understand More About this Research: Request a Free Sample Report

However, there are also some restraining factors affecting the European inulin market. The high cost of production compared to other natural sweeteners like stevia or monk fruit is greatly hampering the market. This higher cost deters some manufacturers from using inulin in their products, especially in price-sensitive markets. Another challenge is the need for more standardization in the quality and composition of inulin raw materials, which impacts the consistency and performance of final products.

Key Takeaways

- Germany dominated the market and contributed over 23% of the share in 2023

- By source category, the chicory segment accounted for the largest market share in 2023

- By application category, the dietary supplements segment is expected to grow with a lucrative CAGR over the forecast period

What are the market drivers driving the demand for Europe inulin market?

Growing emphasis on the use of natural ingredients drives the European inulin market growth.

The growing emphasis on the use of natural ingredients is a significant driver of the European inulin market's growth. Consumers are increasingly seeking out products that are made with natural, healthy, and sustainable ingredients, and inulin fits this criterion perfectly. Inulin is a naturally occurring polysaccharide found in plants, making it an attractive alternative to synthetic ingredients. This shift towards natural ingredients is driven by consumers' desire to avoid artificial additives and preservatives, which they perceive as unhealthy or harmful.

In addition, the trend towards clean labeling and transparency in food production has further fueled the demand for natural ingredients like inulin. As a result, manufacturers are incorporating inulin into their product formulations to meet consumer demands for natural, healthy, and sustainable products, thereby driving the growth of the European inulin market.

Which factor is restraining the demand for inulin?

The high cost of extraction of inulin affects the European market growth.

The high cost of extracting inulin from chicory roots and other sources is considered a significant restraining factor for the European inulin market. The process of extracting inulin involves several stages, including harvesting, cleaning, and drying the chicory roots, followed by a multi-step extraction process that requires specialized equipment and technology. This process is expensive, resulting in a higher cost per kilogram of inulin produced. As a result, the high cost of production is passed on to consumers, making inulin products more expensive compared to other natural sweeteners like stevia or monk fruit sweeteners. This higher price point limits consumer adoption and deters some potential customers from purchasing inulin-based products, thereby hindering the growth of the European inulin market.

Report Segmentation

The market is primarily segmented based on source, application, and country.

|

By Source |

By Application |

By Country |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Category Wise Insights

By Source Insights

Based on source analysis, the market is segmented on the basis of Chicory, agave, Jerusalem artichokes, asparagus, and others. Chicory source of inulin dominated the European market because Chicory is a significant source of inulin. Chicory has been traditionally cultivated and consumed in Europe, particularly in countries such as Belgium, France, and Germany, where it is used as a coffee substitute and additive. This long history of consumption has led to a well-established supply chain and processing infrastructure for chicory root fibers, making it a more accessible and cost-effective option for producers. In addition, Chicory is a hardy crop that can be grown in a variety of conditions, which makes it an attractive choice for farmers in different regions of Europe.

Furthermore, consumer preferences are shifting towards natural, plant-based ingredients, and inulin from Chicory fits this trend, driving up demand and further solidifying its position in the market. Research into the health benefits of inulin, particularly in relation to gut health and digestion, has increased awareness and interest among consumers, leading to higher demand for chicory-derived inulin in various applications, including food and beverages as well as dietary supplements.

By Application Insights

Based on application analysis, the market has been segmented on the basis of pharmaceuticals, dietary supplements, food and beverages, and others. The Dietary Supplements segment is expected to experience significant growth in the European inulin market over the forecast period. The increasing health consciousness and awareness about the benefits of natural ingredients have led to a surge in demand for dietary supplements containing inulin. Also, the growing trend of preventive healthcare and wellness has further fueled the demand for inulin-based supplements, as they are perceived as a natural way to promote digestive health and boost immunity.

The rising popularity of plant-based diets and veganism has also contributed to the growth of the dietary supplements segment, as inulin is often used as a natural alternative to animal-derived ingredients in these products, thereby driving the growth of the dietary supplements segment in the European inulin market.

Country-wise Insights

Germany

The inulin market in Europe is led by Germany, mainly due to its substantial and aging population that has a high demand for natural sweeteners like inulin. This demand is primarily driven by the increasing use of inulin in various applications such as food and beverages and dietary supplements.

Germany's well-established healthcare system further enables easy access to nutritional supplements, which helps to boost the demand for inulin. Consumers in Germany are willing to spend on their health and well-being, which has led to the growth of many leading manufacturers of inulin in the country, including trusted brands like Beneo. All of these factors have contributed to Germany's dominance in the inulin market in Europe.

Competitive Landscape

The major players in the European inulin industry are actively pursuing expansion strategies by venturing into new markets and countries to broaden their clientele and reinforce their hold over the inulin market. These players are also investing in research and development to introduce groundbreaking products that align with the ever-evolving customer preferences and expectations.

Some of the major players operating in the European market include:

- BENEO

- Cargill

- Ciranda

- COSUCRA

- FENCHEM

- Jarrow Formulas, Inc

- Nova Green Inc.

- OQEMA Group

- Sensus BV (Royal Cosun)

- Stanlab Sp. z o.o.

- The Ingredient House

- The Tierra Group

Recent Developments

- In April 2023, the European Association of Chicory Inulin Producers introduced a new website that furnishes scientific evidence to support the health advantages of prebiotic chicory fibers. The website provides detailed technical information on the various benefits of these fibers, which include digestive health, blood glucose regulation, bone health, weight management, and immunity, among others.

Report Coverage

The Europe Inulin market report emphasizes on key countries across the region to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the region. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, source, application, and their futuristic growth opportunities.

Inulin Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 862.46 million |

|

Revenue forecast in 2032 |

USD 1,494.64 million |

|

CAGR |

7.1% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Source, By Application, By Country |

|

Regional scope |

UK, France, Germany, Italy, Spain, Netherlands, Russia, Rest of Europe |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The Europe inulin market size is expected to reach USD 1,494.64 Million by 2032

Key players in the market are BENEO, Cargill, Ciranda, COSUCRA, FENCHEM, Jarrow Formulas, Inc, Nova Green Inc., OQEMA Group

Europe Inulin Market exhibiting the CAGR of 7.1% during the forecast period.

The Europe Inulin Market report covering key segments are source, application, and country.