Europe Men’s Jewelry Market Size, Share, Trends, Industry Analysis Report

By Type (Traditional, Luxury), By Product, By Material, By Category, By Distribution Channel, By Age, By Country – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM4861

- Base Year: 2024

- Historical Data: 2020-2023

Overview

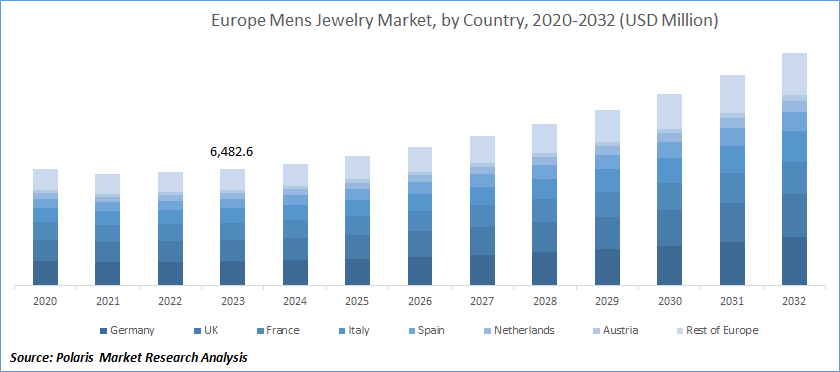

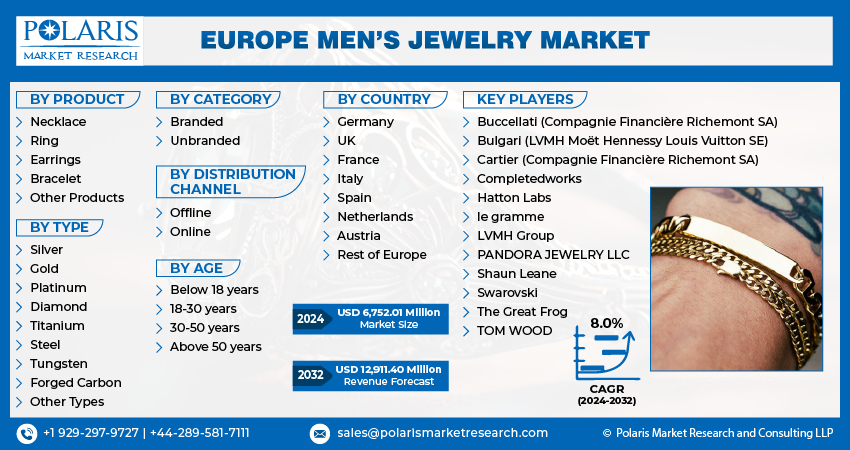

The Europe men’s jewelry market size was valued at USD 6.72 billion in 2024, growing at a CAGR of 9.3% from 2025 to 2034. The growth is driven by growth of the e-commerce sector in the region and influence of social media and pop culture.

Key Insights

- The necklaces segment accounted for 26.52% share in 2024, as necklaces are one of the fastest-growing products in Europe.

- The traditional segment is expected to reach USD 23.84 billion by 2034 due to its cultural and sentimental value

- The silver segment accounted for 12.45% share in 2024, as silver is one of the most popular materials in the Europe men’s jewelry market, offering the perfect balance between luxury and affordability

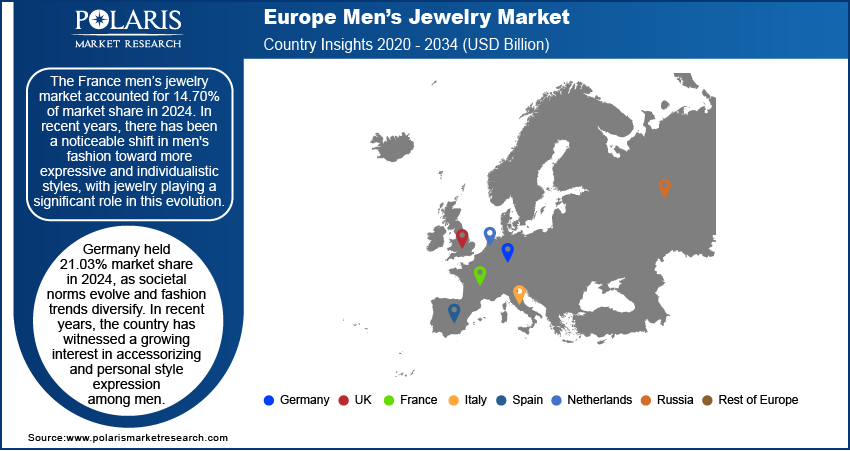

- France accounted for a 14.70% share in the market in 2024. In recent years, there has been a noticeable shift in men's fashion toward more expressive and individualistic styles, with jewelry playing a significant role in this evolution

- Germany held 21.03% market share in landscape in 2024, as societal norms evolve and fashion trends diversify. In recent years, Germany has witnessed a growing interest in accessorizing and personal style expression among men.

The men’s jewelry industry offers accessories designed specifically for men, including rings, bracelets, necklaces, cufflinks, and earrings. Traditionally limited to wedding bands and watches, it has evolved to include a wide range of styles, materials, and fashion statements. Today, men’s jewelry blends function, symbolism, and personal expression, reflecting cultural shifts and growing acceptance of male adornment.

The demand for men's jewelry in Europe is witnessing steady growth driven by evolving fashion trends, changing societal attitudes toward male adornment, and the rising popularity of accessorizing among men. European consumers, particularly in countries with strong luxury fashion traditions such as Italy, France, and the UK, are increasingly adopting a diverse range of jewelry pieces, including bracelets, necklaces, and rings.

The European industry benefits from the proliferation of online retail channels, providing consumers with greater accessibility to a wide array of men's jewelry styles and brands. While traditional precious metals such as gold and silver remain popular choices, there is a growing demand for contemporary designs featuring alternative materials such as stainless steel, titanium, and leather, catering to a broader spectrum of tastes and price points.

Sustainability and ethical sourcing are gaining prominence, with consumers showing increasing interest in jewelry crafted from recycled materials or produced through fair-trade practices. Overall, the men's jewelry industry in Europe presents opportunities for both established luxury brands and emerging designers to capitalize on the growing demand for male-oriented accessories, thereby driving the growth.

Industry Dynamics

- Rise of e-commerce and direct-to-consumer brands is driving the growth.

- The influence of social media and pop culture has influenced men to discover and wear jewelry in the region.

- Focus on sustainable jewelry is shaping the industry growth.

- The high cost of men’s jewelry products is limiting the growth and adoption of innovative designs.

Rise of E-commerce and Direct-to-Consumer Brands: The e-commerce sector in Europe is growing at a rapid pace. According to the Eurostat, 46% of European internet users bought clothes, shoes, and accessories online in 2024. Online shopping has made it easier than ever for men to explore and purchase jewelry. Many European brands now sell directly to consumers through sleek websites and social platforms, cutting out the middleman and offering better prices and customization. E-commerce further enables personalized shopping experiences, such as virtual try-ons or custom engraving. The convenience, broader selection, and privacy of online shopping appeal to male buyers who may be less comfortable for in-store shopping. This shift to digital retail fuels the demand across urban and suburban areas, thereby driving the industry growth.

Influence of Social Media and Pop Culture: Social media platforms such as Instagram and TikTok have transformed how men discover and wear jewelry. Influencers, musicians, and actors are seen showcasing bold rings, chains, and earrings, inspiring their followers to try similar styles. Pop culture plays a major role in setting fashion trends, and jewelry is no exception. Viral content, celebrity endorsements, and user-generated posts make men’s jewelry more visible and desirable. Brands benefit from increased exposure and consumer interest as younger consumers seek to emulate these styles, especially in fashion-forward European cities, thereby driving the growth.

Segmental Insights

Product Analysis

The necklaces segment accounted for 26.52% share in 2024 in Europe. Men are increasingly wearing chains and pendants as everyday fashion items, influenced by celebrities and streetwear culture. Simple chains, religious symbols, and dog tags are especially popular, offering both style and personal meaning. The variety in lengths, styles, and materials such as silver, stainless steel, and leather appeals to different fashion preferences. European brands are responding by offering more versatile and gender-neutral necklace designs, thereby driving the segment growth.

Type Analysis

The traditional segment is expected to reach USD 23.84 billion by 2034, due to its cultural and sentimental value. These items are often passed down through generations or worn for formal occasions, making them timeless staples. Many European consumers still prefer these classic styles, especially in markets such as the UK, Italy, and Germany, where heritage and symbolism play a big role. Brands are updating traditional designs with modern touches, such as custom engraving or minimalist detailing, to keep them relevant. The mix of tradition and modernity fuels the demand for traditional jewelry among men.

Material Analysis

The silver segment accounted for a 12.45% share in 2024, as silver is one of the most popular materials in the men’s jewelry market in Europe, offering the perfect balance between luxury and affordability. It has a clean, masculine look and pairs well with both casual and formal outfits. Silver is also easier to maintain than other metals, which makes it appealing to everyday wearers. Many emerging and premium brands use sterling silver to create rings, bracelets, and chains that look high-end without being overly expensive, thereby driving the growth.

Distribution Channel Analysis

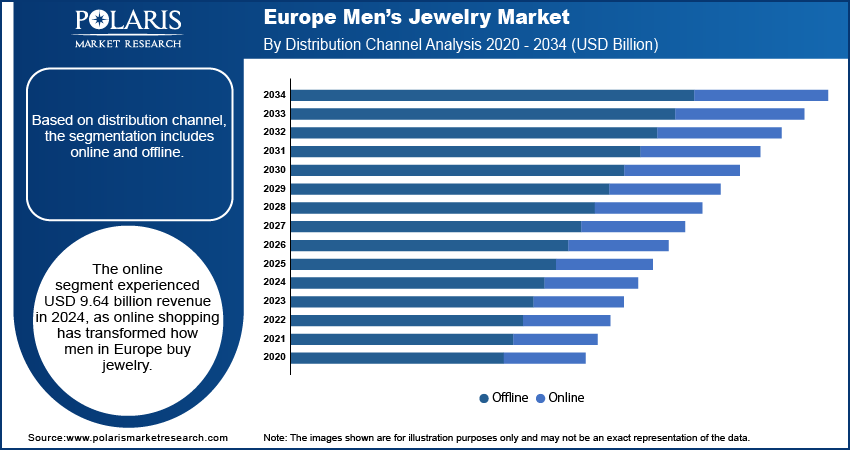

The online segment experienced USD 9.64 billion in revenue in 2024, as e-commerce has transformed how men in Europe buy jewelry. Online retail platforms and direct-to-consumer websites allow customers to browse a wide range of styles, read reviews, and compare prices. This convenience is especially appealing to younger buyers and those living outside major cities. Brands also use digital tools such as virtual try-ons, size guides, and personalized recommendations to enhance the shopping experience. Social media marketing and influencer partnerships help drive traffic to online stores, thereby driving the segment growth.

Country Analysis

The France men’s jewelry market accounted for a 14.70% share of the Europe market in 2024. In recent years, there has been a noticeable shift in men's fashion toward more expressive and individualistic styles, with jewelry playing a significant role in this evolution. French men are exploring a variety of jewelry pieces, including bracelets, necklaces, and rings, to complement their outfits and showcase their personalities. Luxury brands based in France, renowned for their craftsmanship and heritage, are catering to this growing demand by expanding their men's jewelry collections and offering a diverse range of designs to appeal to different tastes and preferences. Additionally, emerging designers and independent jewelry brands are contributing to the growth with innovative and contemporary offerings, further enriching the landscape of men's jewelry in France. In January 2024, Louis Vuitton introduced a men's luxury jewelry line titled “Les Gastons Vuitton.” This collection showcases titanium alongside the distinctive touch of Amfitheatrof's design prowess. Additionally, the upward trend of introducing new products reflects evolving fashion sensibilities and a cultural shift toward greater acceptance of male adornment. Companies are tapping into the growing interest among French men in accessorizing and expressing their style with each new product launch. The competitive landscape of the industry in France is witnessing heightened activity as companies vie to offer innovative designs and premium quality materials to cater to diverse preferences. Moreover, the growing influence of social media and digital platforms has facilitated greater visibility and accessibility to men's jewelry trends and products, further fueling the growth.

Germany Men’s Jewelry Market Insights

Germany held 21.03% share of the Europe market in 2024 as societal norms evolve and fashion trends diversify. In recent years, the country has witnessed a growing interest in accessorizing and personal style expression among men. One significant trend driving this shift is the changing perception of masculinity. Traditional stereotypes around men's fashion are giving way to more fluid and inclusive definitions, allowing men to feel more comfortable and confident in experimenting with jewelry as part of their wardrobe. This cultural shift is reflected in the increasing acceptance and adoption of male jewelry in Germany, particularly among younger generations who view jewelry as a means of self-expression and individuality. Furthermore, popular culture and social media influence consumer preferences significantly. Celebrities, influencers, and fashion icons often showcase stylish jewelry looks, inspiring men to incorporate similar accessories into their outfits. This trend awareness, coupled with the accessibility of online shopping platforms, has made it easier for German consumers to discover and purchase a wide range of men's jewelry options from both domestic and international brands. Additionally, there is a growing demand for diverse styles and materials in men's jewelry. While classic pieces such as watches and wedding bands remain popular staples, there is also increasing interest in contemporary designs such as minimalist bracelets, statement rings, and layered necklaces. Materials ranging from traditional precious metals such as gold and silver to alternative options, including stainless steel, titanium, and leather, cater to varying tastes and budgets, thereby driving the growth.

UK Europe Men’s Jewelry Market Trends

The market in the UK is projected to register a CAGR of 9.4% from 2025 to 2034, driven by their appreciation for style and personal expression. For many, jewelry serves as more than just accessory; it is a reflection of their individuality and taste. They are drawn to exquisite designs for the sense of luxury and sophistication they provide, which elevates their outfits and makes them feel special. Additionally, jewelry enthusiasts appreciate the artistry and skill that go into creating finely crafted pieces, recognizing the effort and attention to detail that are invested in their creation. Moreover, exquisite jewelry designs enable enthusiasts to express their unique personality and make a statement, whether it's through bold statement pieces or delicate, understated elegance. In August 2022, the London-based Hatton Labs launched its AW22 collection, La Croisette. Designed for jewelry enthusiasts. Moreover, there has been a surge in the popularity of independent jewelry designers and brands in the UK, offering unique and innovative designs targeted specifically for men. The Great Frog is a manufacturer of luxury goods and jewelry, which provides skull rings, eye pendants, and eye rings with unique designs.

Italy Men’s Jewelry Market Overview

The market in Italy is expanding, as Italian men have a long-standing tradition of appreciating fine accessories, including jewelry, as a means of expressing their style and status. The market offers a diverse range of products, from classic pieces to more contemporary and avant-garde designs, catering to the varied tastes of Italian consumers. Luxury brands play a significant role in shaping the men's jewelry demand in Italy, with renowned Italian houses such as Bulgari, Damiani, and Pomellato. These brands are known for their exquisite craftsmanship, use of high-quality materials, and timeless designs, attracting both domestic and international clientele. Damiani Jewelry is a luxury goods and jewelry manufacturing company specializing in high jewelry, fine jewels, and luxury goods. The company offers bracelets, charms, necklaces, and rings in men’s jewelry. Additionally, there is a growing interest in independent designers and artisanal jewelry makers who offer unique and bespoke pieces tailored to individual preferences. This trend reflects a broader shift towards personalized and artisanal products in the fashion industry, aligning with Italian consumers' appreciation for quality and craftsmanship. Moreover, the rise of e-commerce platforms has made it easier for Italian consumers to access a wide variety of men's jewelry options, including both domestic and international brands. This accessibility has contributed to the democratization of fashion and has further fueled the demand for men's jewelry in Italy. Overall, the men's jewelry market in Italy continues to thrive, driven by a combination of traditional craftsmanship, innovative designs, and evolving consumer preferences, making it an integral part of the country's rich and diverse fashion landscape.

Netherlands Men’s Jewelry Market Analysis

The men’s jewelry market in the Netherlands is projected to hold a substantial share by 2034. The Dutch men's jewelry market reflects the European Union's general sentiment toward masculinity and self-expression. A growing number of men are embracing accessorizing as a mode of personal expression. Various key players in the market manufacture unique and luxury jewelry for men. For instance, Juweelco offers men's jewelry in silver, stainless steel, titanium, wedding rings, gold, gemstones, diamonds, and accessories. Furthermore, the market is witnessing the rise of 'athleisure,' an informal style inspired by athletic gear. Athleisure encourages comfortable clothing and accessories, creating room for bracelets, necklaces, and earrings made of rubber, leather, and stainless steel. These materials convey a relaxed vibe while remaining visually appealing, fitting neatly within the athleisure aesthetic. Independent designers and smaller labels tend to dominate this corner of the market, catering to niche interests and offering handcrafted, unique pieces.

Key Players and Competitive Analysis

The Europe men’s jewelry market is dynamic and increasingly competitive, blending heritage craftsmanship with modern aesthetics. Luxury brands such as Bulgari, David Yurman, and T&CO. (LVMH) dominate the high-end segment, appealing to affluent consumers with timeless pieces. Niche and fashion-forward brands such as Shaun Leane, Spinelli Kilcollin, and Completedworks offer avant-garde designs attracting trend-conscious buyers. Clocks + Colours, Jaxxon, and Miansai serve the mid-tier market, focusing on bold, masculine aesthetics and direct-to-consumer strategies. The Great Frog and Hatton Labs cater to subcultural and Gen Z tastes with edgy, gothic, or street-style influences. Scandinavian minimalism is represented by TOM WOOD and le gramme, appealing to design-conscious consumers. Meanwhile, artisanal brands such as John Hardy and Bernard James emphasize sustainability and craftsmanship. This landscape reflects a shift from traditional gifting to personal style expression, with digital channels and cultural relevance playing crucial roles in brand positioning and growth.

Key Players

- Bernard James

- Bulgari

- Clocks + Colours

- Completedworks

- David Yurman

- Hatton Labs

- Jaxxon

- John Hardy

- le gramme

- Miansai

- Shaun Leane

- Spinelli Kilcollin

- T&CO. (LVMH Moët Hennessy Louis Vuitton SE)

- The Great Frog

- TOM WOOD

Europe Men’s Jewelry Industry Development

- November 2023: Tiffany & Co. revealed its new creative project in collaboration with the modern artist Daniel Arsham, which introduces a limited-edition T1 bracelet.

Europe Men’s Jewelry Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Necklace

- Ring

- Wedding Band

- Earrings

- Bracelet

- Other Products

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Traditional

- Luxury

By Material Outlook (Revenue, USD Billion, 2020–2034)

- Silver

- Gold

- Platinum

- Diamond

- Titanium

- Steel

- Tungsten

- Forged Carbon

- Other Types

By Category Outlook (Revenue, USD Billion, 2020–2034)

- Branded

- Unbranded

By Distribution Channel Outlook (Revenue, USD Billion, 2020–2034)

- Offline

- Online

By Age Outlook (Revenue, USD Billion, 2020–2034)

- Below 18 Years

- 18–30 Years

- 30–50 Years

- Above 50 Years

By Country Outlook (Revenue, USD Billion, 2020–2034)

- France

- Germany

- UK

- Italy

- Netherlands

- Spain

- Austria

- Rest of Europe

Europe Men’s Jewelry Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 6.75 Billion |

|

Market Size in 2025 |

USD 7.10 Billion |

|

Revenue Forecast by 2034 |

USD 15.97 Billion |

|

CAGR |

9.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Country Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 6.75 billion in 2024 and is projected to grow to USD 15.97 billion by 2034.

The market is projected to register a CAGR of 9.3% during the forecast period.

Germany dominated the market in 2024.

A few of the key players in the market are Bernard James, Bulgari, Clocks + Colours, Completedworks, David Yurman, Hatton Labs, Jaxxon, John Hardy, le gramme, Miansai, Shaun Leane, Spinelli Kilcollin, T&CO. (LVMH Moët Hennessy Louis Vuitton SE), The Great Frog, and TOM WOOD.

The neckless sealants segment is expected to witness the largest share during 2025–2034.

The online segment is expected to witness the fastest growth during the forecast period.