Experience Travel Services Market Size, Share, Trends, Industry Analysis Report

: By Experience Type, Consumer Demographics, Price Point, Duration (Short-Term, Medium-Term, and Long-Term), Booking Channel, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:May-2025

- Pages: 129

- Format: PDF

- Report ID: PM5579

- Base Year: 2024

- Historical Data: 2020-2023

Experience Travel Services Market Overview

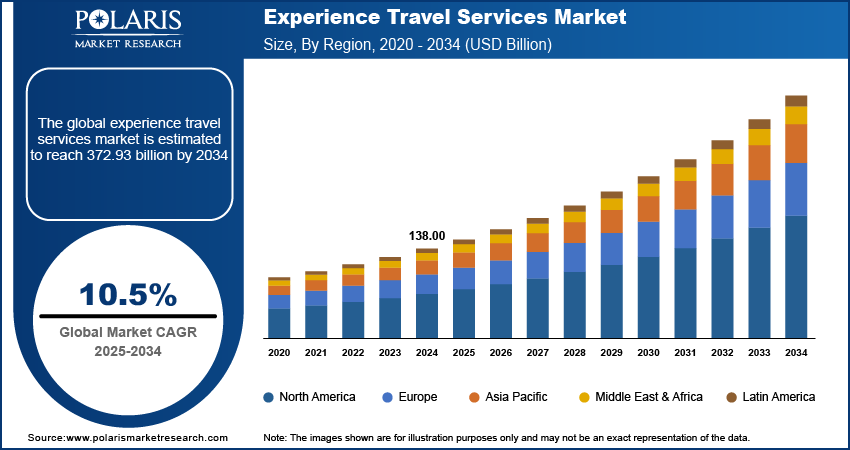

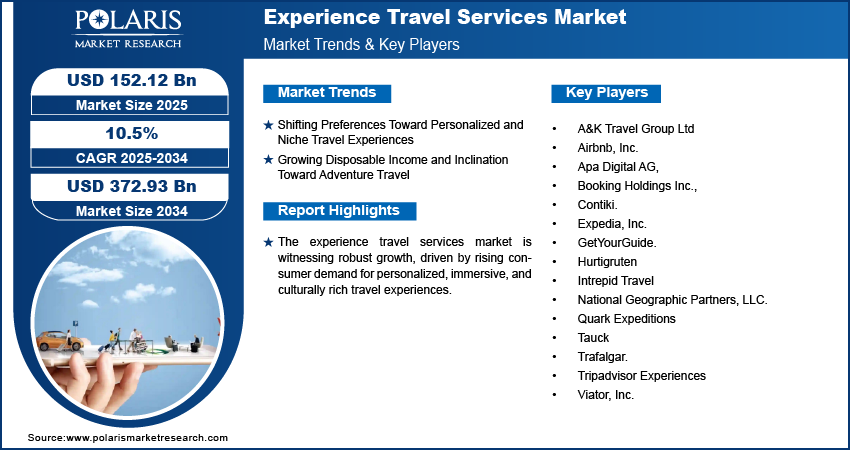

The global experience travel services market size was valued at USD 138.00 billion in 2024. It is expected to grow from USD 152.12 billion in 2025 to USD 372.93 billion by 2034, at a CAGR of 10.5% during 2025–2034.

Experience travel services refer to curated travel offerings that emphasize unique, engaging, and personalized activities over traditional sightseeing, aiming to create memorable and emotionally resonant journeys. The experience travel services market has been gaining notable momentum due to evolving consumer preferences and a broader shift in travel behavior toward more meaningful interactions. One of the primary drivers contributing to this growth is the increasing demand for immersive and cultural experiences. Today’s travelers, especially millennials and Gen Z, are actively seeking deeper engagement with local cultures, traditions, and communities. This trend reflects a desire to move beyond superficial tourism to connect authentically with destinations through food, art, history, and local lifestyles. As a result, travel providers are increasingly tailoring itineraries that facilitate participation in cultural activities, homestays, local workshops, and storytelling experiences.

To Understand More About this Research: Request a Free Sample Report

The experience travel services market demand is increasingly influenced by rising digitalization and increasing adoption of mobile platforms, enabling seamless booking and personalization. In a 2023 report, the NTTO stated that in the US international visitor arrivals reached 66.5 million, representing a 31% increase from 2022. Consumers can research, plan, and book their trips with unprecedented ease and flexibility with widespread smartphone penetration and the increasing availability of travel applications. These platforms offer convenience and enable travelers to discover niche experiences that align with their individual preferences, interests, and values. Furthermore, digital tools such as AI-powered recommendation engines, real-time updates, and interactive maps are enhancing the end-to-end travel journey. This seamless integration of technology into travel planning is transforming how experiences are accessed and consumed, driving experience travel services market development.

Experience Travel Services Market Dynamics

Shifting Preferences Toward Personalized and Niche Travel Experiences

Rather than opting for generic tour packages, consumers are prioritizing highly customized experiences that allow for deeper personal engagement, whether through themed retreats, eco-conscious tours, or culturally immersive activities. This transition is fueled by a desire for authenticity, emotional fulfillment, and storytelling value, which traditional travel services often fail to deliver as modern travelers increasingly seek journeys that reflect their interests, lifestyles, and values. Travel providers are responding by offering curated itineraries, flexible planning tools, and specialized services designed to meet the unique expectations of each traveler segment, thereby enhancing overall satisfaction and loyalty. Hence, the shifting preferences of consumers toward personalized and niche travel experiences boost the experience travel services market growth.

Growing Disposable Income and Inclination Toward Adventure Travel

Growing disposable income combined with a heightened inclination toward adventure travel is supporting experience travel services market growth. According to a February 2025 data from the US Bureau of Economic Analysis (BEA), disposable personal income (DPI), defined as personal income minus personal taxes, rose by USD 191.6 billion 0.4%, reflecting continued growth in consumer spending. More individuals are allocating a portion of their earnings toward experiential and high-adrenaline activities as economic conditions improve and disposable incomes rise, particularly among younger and middle-income demographics. Adventure travel, encompassing activities such as trekking, scuba diving, and wilderness expeditions, offers a compelling value proposition for those seeking excitement, personal achievement, and escape from routine. This trend aligns well with the experiential travel paradigm, where physical engagement and emotional intensity are central themes, ultimately boosting demand for structured yet adventurous travel experiences across diverse geographies.

Experience Travel Services Market Segment Insights

Experience Travel Services Market Assessment by Experience Type

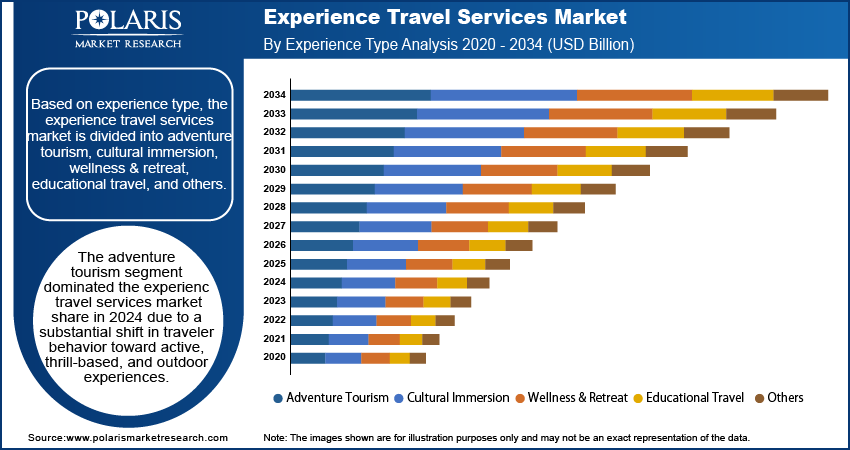

The global experience travel services market segmentation, based on experience type, includes adventure tourism, cultural immersion, wellness & retreat, educational travel, and others. The adventure tourism segment dominated the experience travel services market share in 2024 due to a substantial shift in traveler behavior toward active, thrill-based, and outdoor experiences. Increasing interest in exploring offbeat destinations, engaging in physically challenging activities, and seeking emotional and personal enrichment through nature-based travel has boosted the demand for adventure tourism. This segment appeals strongly to millennials and Gen Z travelers who prioritize experiential value over material possessions. Moreover, the growing availability of structured, safety-compliant adventure packages by service providers has improved accessibility and participation, further driving market share within the broader experience travel landscape.

Experience Travel Services Market Evaluation by Consumer Demographics

The global experience travel services market segmentation, based on consumer demographics, includes solo travelers, couples, families, friend groups, and others. The solo travelers segment is expected to witness the fastest growth during the forecast period driven by rising financial independence, changing lifestyle choices, and the growing popularity of self-discovery through travel. Individuals, particularly in younger demographics and among women, are increasingly opting for solo trips to explore destinations at their own pace, focus on personal wellness, and experience deeper cultural interactions. Digital platforms and social media have played a key role in normalizing and promoting solo travel by providing safety information, itineraries, and community support. This growing confidence and infrastructure developments for solo traveling are expected to accelerate the experience travel services market opportunities during the forecast period.

Experience Travel Services Market Outlook by Region

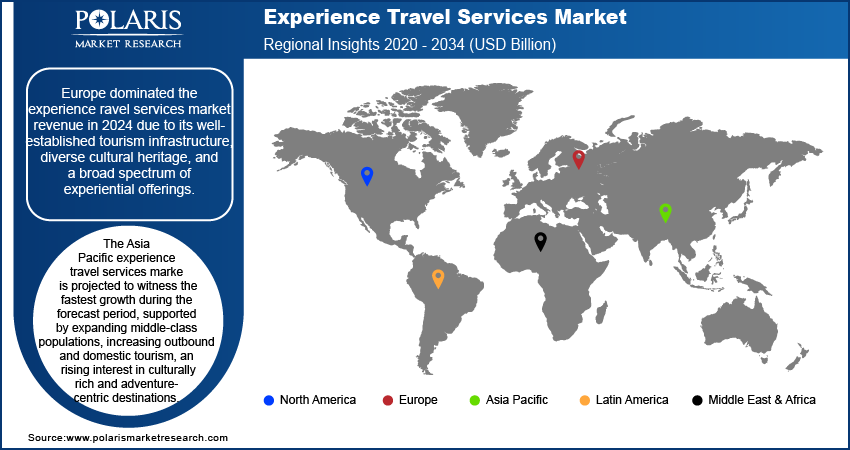

By region, the report provides the experience travel services market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Europe dominated the experience travel services market revenue share in 2024 due to its well-established tourism infrastructure, diverse cultural heritage, and a broad spectrum of experiential offerings. The region's blend of historical landmarks, culinary traditions, art, and localized events attracts a wide range of travelers seeking immersive and authentic experiences. For instance, in January 2024, the IATA reported that European airlines witnessed a 22.0% increase in traffic compared to 2022, with capacity up 17.5% and a load factor of 83.8%. December’s demand grew by 13.6% compared to the previous year, further highlighting the region's strong recovery and continued appeal to travelers. Additionally, seamless intra-regional connectivity, comprehensive transportation networks, and a high concentration of curated travel services enhance the ease and appeal of experiential tourism across European countries. These favorable conditions have positioned Europe at the dominant position in the global experience travel services market expansion.

The Asia Pacific experience travel services market is projected to witness the fastest growth during the forecast period supported by expanding middle-class populations, increasing outbound and domestic tourism, and rising interest in culturally rich and adventure-centric destinations. Countries within the region are actively promoting tourism through infrastructure development, digital transformation, and targeted marketing campaigns to attract experience-seeking travelers. According to a report by the IBEF, in March 2024, the Minister of Civil Aviation and Steel announced the inauguration of 15 airport projects worth USD 12.1 billion by 2028, further highlighting the experience travel services market opportunities. Additionally, the diversity of languages, traditions, and natural landscapes across Asia Pacific offers vast potential for personalized and niche travel experiences.

Experience Travel Services Key Market Players & Competitive Analysis Report

The competitive landscape features global leaders and regional players competing for experience travel services market share through innovation, strategic alliances, and regional expansion. Global players utilize strong R&D capabilities, technological advancements, and extensive distribution networks to deliver advanced solutions, meeting the growing demand for disruptive technologies and sustainable value chains. Experience travel services market trends highlight rising demand for emerging technologies, digitalization, and business transformation driven by economic growth, geopolitical shifts, and macroeconomic trends. Global players focus on strategic investments, mergers and acquisitions, and joint ventures to strengthen their market position. Post-merger integration and strategic alliances are key strategies to improve competitive positioning and expand regional footprints. Regional companies, meanwhile, address localized needs by offering cost-effective solutions and leveraging economic landscapes. Competitive benchmarking includes market entry assessments, expansion opportunities, and partnership ecosystems to meet the demand for innovative products and future-ready solutions. The market is experiencing technological advancements, such as disruptive technologies and digital transformation, reshaping industry ecosystems. Companies are investing in supply chain management, procurement strategies, and sustainability transformations to align with experience travel services market demand, trends, and future development strategies. Pricing insights, revenue growth analysis, and competitive intelligence are critical for identifying opportunities and driving long-term profitability. A few key major players are A&K Travel Group Ltd; Airbnb, Inc.; Apa Digital AG; Booking Holdings Inc.; Contiki; Expedia, Inc.; GetYourGuide; Hurtigruten; Intrepid Travel; National Geographic Partners, LLC; Quark Expeditions; Tauck; Trafalgar; and Tripadvisor Experiences.

Airbnb, Inc. specializes in the travel and hospitality industry, renowned for revolutionizing how people book accommodations and experience destinations. Airbnb launched Airbnb Experiences in 2016 to connect travelers with unique, local-led activities beyond its core offering of short-term rentals. This platform enables hosts to share their passions, ranging from cooking classes and photography tours to cultural immersions, with guests seeking authentic experiences. Airbnb Experiences fosters deeper engagement between travelers and local communities by emphasizing expertise, insider access, and personal connection. Activities are designed to go beyond traditional tours, offering niche opportunities that allow guests to "live like a local." The initiative appeals to diverse audiences, such as solo travelers, families, and groups, and provides hosts with an additional revenue stream through a 20% commission fee on bookings. Airbnb Experiences has become a key driver in transforming the travel industry by prioritizing authenticity and personalization, with over 40,000 experiences across 1,000 cities globally as of 2020.

Booking Holdings Inc., headquartered in Norwalk, Connecticut, specializes in online travel and related services. The company operates through five major consumer-facing brands: Booking.com, Priceline, Agoda, KAYAK, and OpenTable. These platforms collectively facilitate a wide range of travel-related services, such as accommodation bookings for over 3.4 million properties worldwide, flight reservations, car rentals, vacation packages, and restaurant bookings. Booking Holdings also provides meta-search services that allow users to compare travel options across multiple platforms easily. The company enhances value for both customers and local partners in more than 220 countries and territories through its subsidiary brands, such as Rocketmiles and Fareharbor. In the realm of experience travel services, Booking Holdings integrates tours and activities into its offerings, enabling travelers to book unique experiences in over 1,300 cities globally. This focus on personalization and convenience aligns with its mission to make it easier for everyone to experience the world. Booking Holdings continues to innovate in the travel sector while prioritizing customer satisfaction and operational excellence by leveraging advanced digital technologies and maintaining a strong presence across diverse markets.

List of Key Companies in Experience Travel Services Market

- A&K Travel Group Ltd

- Airbnb, Inc.

- Apa Digital AG,

- Booking Holdings Inc.,

- Contiki.

- Expedia, Inc.

- GetYourGuide.

- Hurtigruten

- Intrepid Travel

- National Geographic Partners, LLC.

- Quark Expeditions

- Tauck

- Trafalgar.

- Tripadvisor Experiences

- Viator, Inc.

Experience Travel Services Industry Development

August 2024: Thomas Cook India and SOTC Travel launched a self-service app to streamline post-booking travel management. The app provides real-time updates, document access (visas, itineraries, and tickets), and tracking features, addressing traditional pain points in the holiday planning process for iOS/Android users.

March 2024: GoNexus Group launched the NexusTours App, a global travel management tool offering itinerary tracking, online check-ins, digital voucher storage (eWallet), and 24/7 chatbot support. Available in English and Spanish, it streamlines transfers and experiences for travelers.

Experience Travel Services Market Segmentation

By Experience Type Outlook (Revenue, USD Billion, 2020–2034)

- Adventure Tourism

- Cultural Immersion

- Wellness & Retreat

- Educational Travel

- Others

By Consumer Demographics Outlook (Revenue, USD Billion, 2020–2034)

- Solo Travelers

- Couples

- Families

- Friend Groups

- Others

By Price Point Outlook (Revenue, USD Billion, 2020–2034)

- Budget/Economy

- Mid-Range

- Premium

- Luxury/Ultra-Luxury

By Duration Outlook (Revenue, USD Billion, 2020–2034)

- Short-Term

- Medium-Term

- Long-Term

By Booking Channel Outlook (Revenue, USD Billion, 2020–2034)

- Direct Booking Platforms

- Online Travel Agencies (OTAs)

- Travel Advisors/Agents

- Tour Operators

- Mobile Apps

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Experience Travel Services Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 138.00 billion |

|

Market Size Value in 2025 |

USD 152.12 billion |

|

Revenue Forecast in 2034 |

USD 372.93 billion |

|

CAGR |

10.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global experience travel services market size was valued at USD 138.00 billion in 2024 and is projected to grow to USD 372.93 billion by 2034.

The global market is projected to register a CAGR of 10.5% during the forecast period.

Europe dominated the market revenue share in 2024.

A few of the key players in the market are A&K Travel Group Ltd; Airbnb, Inc.; Apa Digital AG; Booking Holdings Inc.; Contiki; Expedia, Inc.; GetYourGuide; Hurtigruten; Intrepid Travel; National Geographic Partners, LLC; Quark Expeditions; Tauck; Trafalgar; and Tripadvisor Experiences.

The adventure tourism segment dominated the market share in 2024.

The solo travelers segment is expected to witness the fastest growth during the forecast period.