Self Service Technology Market Share, Size, Trends & Industry Analysis Report

By Type (ATM, Kiosk, Vending Machine); By Application; By End-User; By Region; Segment Forecast, 2025 - 2034

- Published Date:Jun-2025

- Pages: 116

- Format: PDF

- Report ID: PM4177

- Base Year: 2024

- Historical Data: 2020-2023

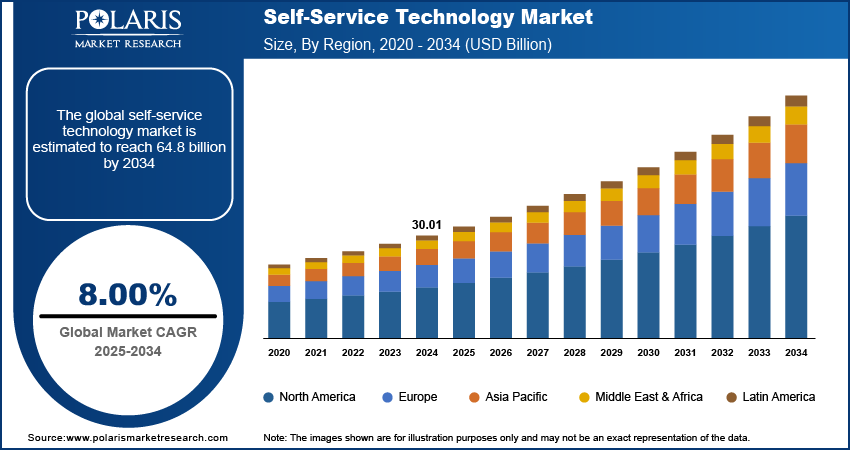

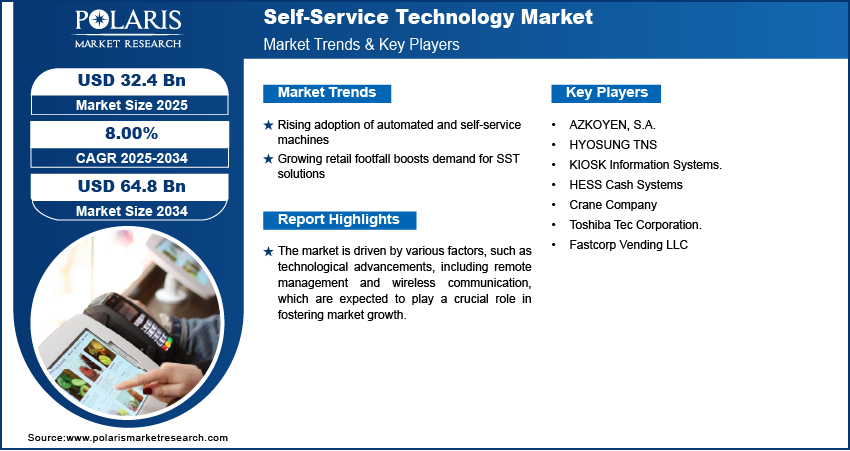

The global Self Service Technology Market was valued at USD 30.01 billion in 2024 and is expected to grow at a CAGR of 8.00% from 2025 to 2034. The market expansion is fueled by rising demand for contactless and efficient customer service solutions across retail, banking, and hospitality sectors, especially post-pandemic.

The market is driven by various factors, such as technological advancements, including remote management and wireless communication, which are expected to play a crucial role in fostering market growth. The incorporation of biometric security services, such as fingerprint recognition, ensuring secure financial transactions, is anticipated to be a key driver for industry expansion. These technologies empower customers to access services independently without direct involvement from service employees.

To Understand More About this Research: Request a Free Sample Report

The government in several regions has imposed restrictions on the deployment of food and beverage vending machines in various locations, including schools and colleges. This has consequently curtailed the demand for such machines. In response, manufacturers have started introducing and advocating for energy-saving vending machines that not only offer additional value benefits but also contribute to societal well-being. These machines consume less power, aiding in energy conservation compared to earlier models. As an example, refrigerated vending machines certified as ENERGY STAR save approximately 1,000 kWh annually and exhibit a 40% improvement in energy efficiency.

The increasing embrace of mobile devices, & and connected systems are transforming customer buying experiences in both the digital and physical realms. Various formats, ranging from convenience stores to food and beverage retail, are progressively incorporating self-service technologies to deliver personalized experiences to customers. These technologies contribute to enhanced customer support. Additionally, the imperative for workforce optimization and cost reduction is prompting sectors such as banking, travel and hospitality, retail, and healthcare to adopt automated and intelligent technologies.

The research report offers a quantitative and qualitative analysis of the Self Service Technology Market to enable effective decision-making. It covers the key trends and growth opportunities anticipated to have a favorable impact on the market. Besides, the study covers segment and regional revenue forecasts for market assessment.

As consumers increasingly prioritize social distancing and adhere to stringent regulations, businesses have been compelled to suspend their operations, leading to a reduction in spending on opportunistic technologies. Despite the short-term impact of social lockdowns, the heightened demand for groceries, medical supplies, merchandise, and home improvement has driven businesses to embrace self-assisted technologies, promoting social distancing and zero-touch practices.

Industry Dynamics

Growth Drivers

- Increasing demand for automated machines drives the market

The rising demand for self-service machines and automated devices, along with the adoption of wireless communication, technological advancements, and remote management, stands out as significant drivers for the increasing demand in the Self-service Technology (SST) sector. Furthermore, the surge in consumer footfall in retail stores and the escalating consumption of goods and services acquired in-store play pivotal roles in driving this demand. The flourishing retail industry, particularly in emerging economies, is expected to present numerous growth opportunities in this sector.

Moreover, the widespread understanding of the advantages offered by these machines, including streamlined check-in and check-out processes, congestion reduction, and enhanced customer experiences in sectors like retail, airports, and banking, is expected to have a positive impact on demand. In addition to targeting urban areas, manufacturers and service providers are now focusing on rural areas further to bolster the growth of the self-service technology industry. As an illustration, in 2019, Karnataka Gramin Bank deployed mobile ATMs in the Ballari, Kalaburagi, and Gulbarga districts of Karnataka.

Report Segmentation

The market is primarily segmented based on product type, application, and region.

|

By Product Type |

By Application |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

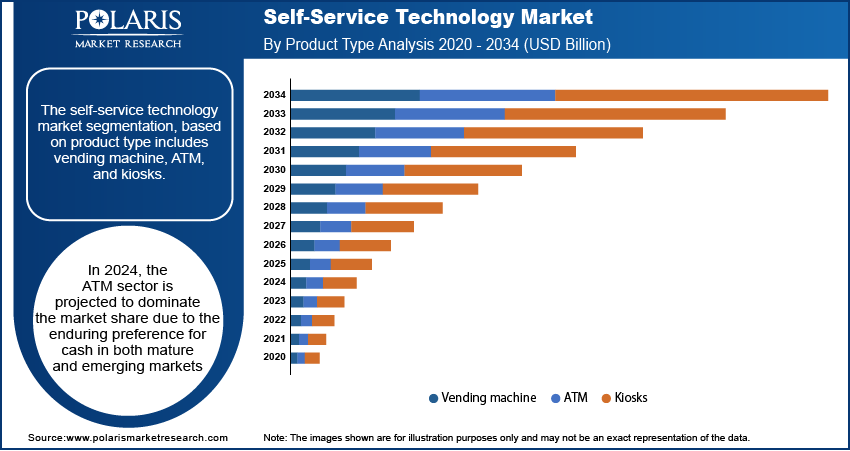

By Product Type Analysis

- ATM segment accounted for the largest market share in 2024

In 2023, the ATM sector is projected to dominate the market share. Despite the emergence of digital payment alternatives, the enduring preference for cash in both mature and emerging markets continues to fuel the growth of ATM installations. Banks are swiftly rolling out cash-dispensing ATMs and automated cash recycling systems to enhance operational efficiency and elevate customer experience. Additionally, the rising inclination towards smaller transactions among consumers is amplifying the deployment of self-service ATMs.

Concurrently, the vending machine industry is poised for substantial expansion. Heightened demand for vending machines within the business landscape serves as a pivotal growth catalyst. Businesses are increasingly adopting vending machines to curtail ancillary expenses, maximize spatial utilization, and mitigate queues. The escalating number of commercial ventures and corporate entities prioritizing streamlined service delivery further augments the uptake of vending machines.

By Application Analysis

- Retail segment held the significant market share in 2024

The retail segment held a significant market share. Retailers are motivated to embrace self-service technologies by the imperative to deliver high-quality service and enhance the overall customer experience. Among the preferred technologies, kiosks and vending machines stand out. The increasing influx of shoppers and the desire to facilitate a seamless checkout experience further fuel the adoption of self-service technologies in retail stores.

QSR segment is expected to gain a substantial growth rate. The expanding presence of QSRs, coupled with a rising volume of consumer orders and the imperative to reduce waiting times at counters with fewer employees, is fueling the demand for self-service systems. Moreover, the intensifying competition among restaurants to deliver efficient service while managing operational costs is a key factor contributing to self-service technology market growth. Additionally, the increasing focus on enhancing guest satisfaction and order accuracy and fostering smarter business practices is propelling the adoption of automated self-service systems in the QSR sector.

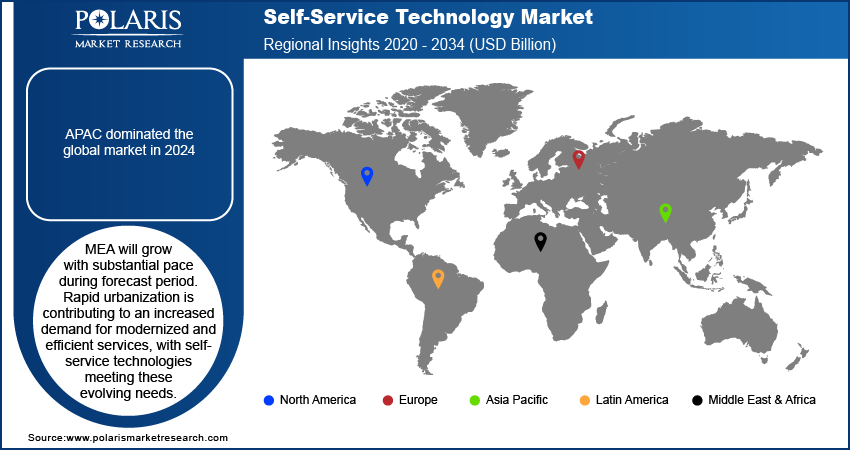

Regional Insights

- APAC dominated the global market in 2024

APAC dominated the global market. This growth can be attributed to the escalating deployment of ATMs, self-service kiosks, and vending machines in the emerging economies of the region. Additionally, the increasing awareness and growing consumer inclination toward this technology are expected to fuel demand across the region. The rapid urbanization observed in countries like India, China, and Japan, coupled with the exponential growth in the banking sector, has generated significant demand for automated machines in this region.

MEA will grow with substantial pace during forecast period. Rapid urbanization is contributing to an increased demand for modernized and efficient services, with self-service technologies meeting these evolving needs. Rising disposable incomes among the population are fostering a greater inclination towards convenient and time-saving solutions, further driving the adoption of self-service technologies.

Additionally, the widespread adoption of mobile internet and smartphones in the region is playing a pivotal role. As mobile technology becomes more prevalent, individuals are increasingly comfortable with digital interactions and are inclined to use self-service options. Government initiatives aimed at promoting digital transformation and enhancing the efficiency of public services are also contributing to the growth of self-service technologies in the region.

Key Market Players & Competitive Insights

Market players are strategically emphasizing inorganic growth strategies, including acquisitions, mergers, and collaborations, to enhance their market share. These approaches involve partnering with or acquiring other companies in the industry to achieve various objectives and strengthen their position in the market.

Some of the major players operating in the global market include:

- AZKOYEN, S.A.

- HYOSUNG TNS

- KIOSK Information Systems.

- HESS Cash Systems

- Crane Company

- Toshiba Tec Corporation.

- Fastcorp Vending LLC

Recent Developments

- In June 2024,Sherweb launched a white-label Self-Service Portal, allowing MSPs to offload routine tasks to clients, speed up service, streamline operations, and focus more on strategic, revenue-generating initiatives.

- In May 2023, Applova Inc. unveiled a collaboration with Samsung to introduce a self-service kiosk solution tailored for restaurants. The kiosks provide contactless options for both ordering and payment, aiming to enhance operational efficiency, drive sales, and contribute to increased profits for restaurants.

- In June 2022, Zello introduced a new product called Zello Kiosk, which seamlessly integrates touchscreen kiosks with the company's renowned push-to-talk technology. This innovative solution empowers retail staff to engage efficiently, ensuring customers have a positive shopping experience from the moment they step into the store.

- In May 2022, Solvpath and sticky.io have announced a collaboration. Their joint efforts aim to assist e-commerce merchants in efficiently addressing customer support inquiries by leveraging intelligent self-service methods.

Self-Service Technology Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 32.4 billion |

|

Revenue forecast in 2034 |

USD 64.8 billion |

|

CAGR |

8.00% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Product Type, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

In today’s hyper-connected world, running a business around the clock is no longer an option. And at Polaris Market Research, we get that. Our sales & analyst team is available 24x5 to assist you. Get all your queries and questions answered about the Self Service Technology Market report with a phone call or email, as and when needed.

Browse Our Top Selling Reports

Okara Market Size, Share 2024 Research Report

Soy Grits Market Size, Share 2024 Research Report

Backlit Displays Market Size, Share 2024 Research Report

FAQ's

key companies in self-service technology market are AZKOYEN, HYOSUNG, KIOSK Information Systems, HESS Cash Systems, Crane Company

The global self-service technology market is expected to grow at a CAGR of 12.5% during the forecast period.

The self-service technology market report covering key segments are product type, application, and region.

key driving factors in self-service technology market are Increasing demand for automated machines drives the market

The global self-service technology market size is expected to reach USD 106.16 billion by 2032