Okara Market Share, Size, Trends & Industry Analysis Report

By Product Type (Fresh, Dried); By Application (Food & Beverage, Animal Feed, Cosmetics); By Distribution Channel; By Region; Segment Forecast, 2025 - 2034

- Published Date:Jun-2025

- Pages: 130

- Format: PDF

- Report ID: PM4164

- Base Year: 2024

- Historical Data: 2020-2023

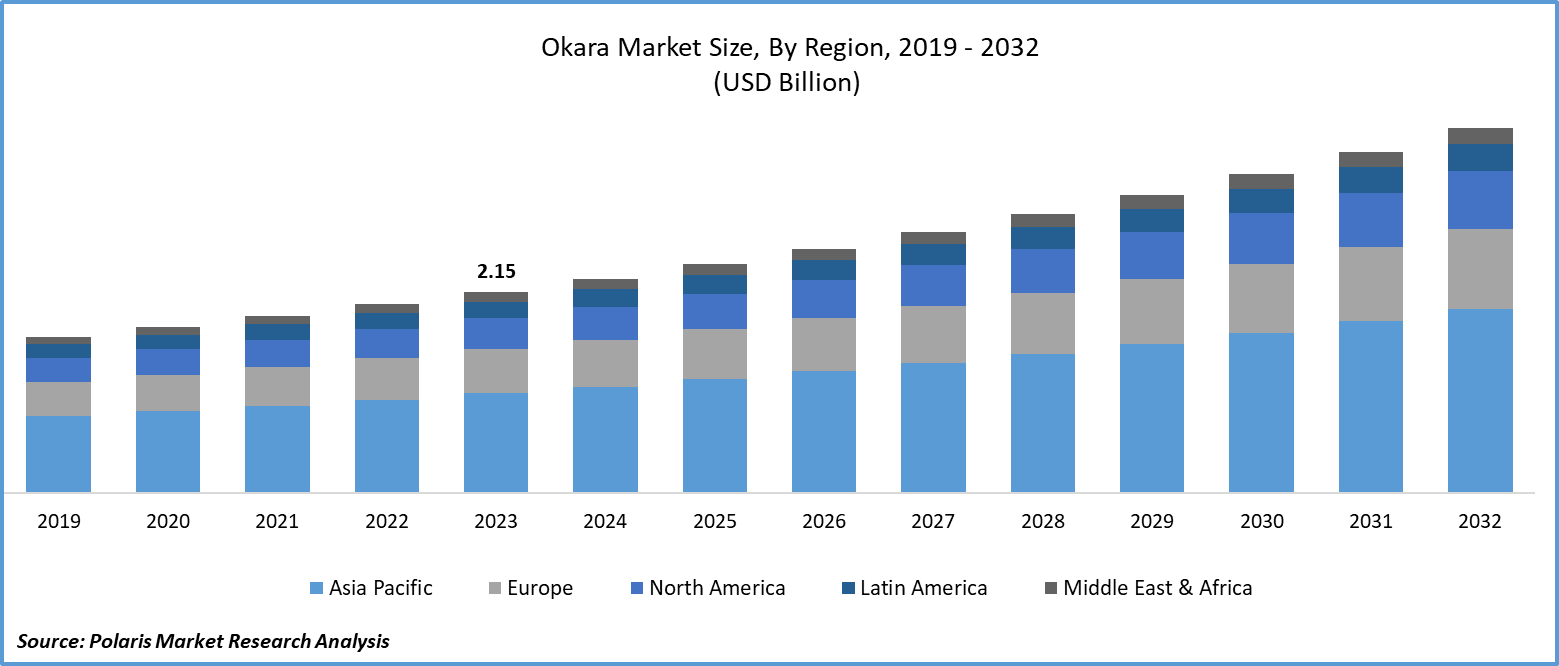

The global Okara Market was valued at USD 0.6 billion in 2024 and is anticipated to grow at a CAGR of 9.80% from 2025 to 2034. Increasing utilization in food processing and animal feed applications is a key growth driver.

The drastic increase in the adoption of products such as gluten-free, plant-based, and vegan flour containing a variety of nutritional values such as lipids, proteins, and dietary fibers, along with the surge in the production of soybeans that resulted in greater production of soy milk and tofu that naturally transition into okara production as a by-product, are among the leading factors influencing the growth of the global market growth.

To Understand More About this Research: Request a Free Sample Report

- For instance, the global production of soy has grown over 10-fold in the last 50 years, and even since 2000, the production of soy has doubled. The soybean production has increased from approx. 30 million tonnes per year in 1960 to almost 350 million tonnes now.

With the growing consumer preferences for food products with clean labels, which means consumers prefer ingredients that are natural, minimally processed, and easily recognizable to them, the demand for okara is likely to boost dramatically as they align with these preferences. Apart from this, continuous research & development efforts mainly focused on exploring new ways to utilize okara in innovative products and introducing new okara-based products, creating lucrative growth opportunities for the market.

- For instance, in April 2023, SoiLabs, a Singapore-based food tech firm, announced its plans to launch finished products that are made from soy waste. The company has partnered with Sanyo Chemical in order to accelerate the commercialization of upcycled foods in Japan.

However, limited consumer awareness about okara and its potential health benefits and high product costs associated with okara, as it involves some additional processing steps that often increase the overall production costs of tofu and soy milk, are among the factors likely to hamper global market growth.

Industry Dynamics

Growth Drivers

- Growing awareness about its health benefits and rising vegan population

Okara has been emerging as a rich source and raw material for preparing several fiber and dietary supplements in order to prevent metabolic syndromes, as they contain significant amounts of essential nutrients like protein, vitamins, dietary fiber, and certain minerals that are crucial for maintaining good health and wellness. Besides this, the continuous increase in the popularity of plant-based diets as a result of the growing adoption of vegan and vegetarian lifestyles has further boosted the demand for soy-based products, including Okara, which, in turn, generates huge growth potential for the market.

For instance, as per a recent report published in 2023, approx. 6% of Americans are estimated to be Vegan, and the number has increased by over 600% since 2014. Worldwide, about 79 million people follow a vegan diet, and the number is continuously increasing and could double in just a few years.

Report Segmentation

The market is primarily segmented based on product, nutritional sources, application, and region.

|

By Product |

By Nutritional Sources |

By Application |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Analysis

- Bakery segment accounted for the largest market share in 2024

The bakery segment accounted for the largest share in 2024. The growth of the segment market can be largely attributed to the surge in the number of consumers seeking healthier, artisanal, and diverse baked goods and exponential growth in consumer disposable incomes, particularly in emerging economies like India, China, and Indonesia, that allows them to spend higher on their health and wellness.

Furthermore, with the increasing focus on health and wellness worldwide, consumers are increasingly looking for bakery products that are made from healthier ingredients such as whole grains, less sugar, and natural additives, thereby, bakeries that can offer healthier options are gaining huge traction in the market and could open new growth avenues for the segment market.

By Nutritional Sources Analysis

- Dietary fiber segment held the maximum market share in 2024

The dietary fiber segment held the maximum market share, mainly due to the drastic shift toward plant-based diets and vegetarian or vegan lifestyles across the globe that has driven the demand and need for plant-based protein sources, including soy-based products like okara along with the growing focus on developing and introducing new products that incorporate okara as a major source of dietary fiber.

Ongoing research and development efforts in the food industry focused on the discovery of new applications and processing techniques for okara that help to unlock the full potential of okara as a valuable source of dietary fiber are also likely to have a positive impact on the segment’s growth. For instance, in December 2022, Tetra Pak introduced a new cutting-edge processing method for soy drinks that mainly aims to meet the surging demand for plant-based beverages as a healthy option among health-conscious consumers.

By Application Analysis

- Food processing segment is expected to witness highest growth over the forecast period

The food processing segment is expected to witness the highest growth rate throughout the study period, mainly attributable to a rapid increase in the demand and proliferation for processed food products and the development of new processing technologies and techniques that lead to reduced food waste and offer better processing compared to traditional techniques. As okara is widely considered a sustainable food source since it is a byproduct of soybean processing and utilizing it in food products helps reduce waste and supports eco-friendly practices, the food processing segment is likely to emerge drastically, especially for okara.

Regional Insights

- The demand in North America is expected to witness significant growth

The Asia Pacific region dominated the global market, which is mainly attributable to the constant surge in demand for plant-based protein sources and their significant use in various traditional dishes and cuisines across the region. Besides this, the presence of supportive government policies that promote sustainable agriculture, alternative protein sources, and waste reduction could positively impact the production and utilization of okara.

The North America region is anticipated to emerge as the fastest growing region with a healthy CAGR over the forecast period on account of a substantial rise in the number of vegan and vegetarian populations who are seeking plant-based alternatives to traditional animal products coupled with the surging popularity of specific dietary trends such as keto-diet and low-carb diet. Apart from this, food manufacturers and chefs across the region are constantly seeking innovative ways to incorporate several new ingredients into their products. Additionally, the use of okara is not limited to dietary products.

Key Market Players & Competitive Insights

The okara market is highly competitive with the presence of several regional and global market players operating in the market. The leading market players are extensively focusing on consolidating their market position, and thereby, they are adopting various business development and expansion strategies, including partnerships, collaborations, acquisitions & mergers, and new product launches.

Some of the major players operating in the global market include:

- House Foods Group Inc.

- Innpac India Pvt. Ltd.

- Invigorate Foods

- Kikkoman Corporation

- Meijtofu

- Midas Soy Nutritions

- Morinaga Nutritional Foods Inc.

- OKM Co. Ltd.

- Pulmuone Co. Ltd.

- Schouten

- Star Soya Food

- Vitasoy International Holdings

Recent Developments

- In May 2024, Singapore start-up Jiro-Meat scaled up production of its okara-based meat, aiming for commercial launch within six months, using fermentation to upcycle soy pulp into a clean-label, cost-effective alternative.

- In November 2021, Luya Foods completed its funding to redefine the plant protein source from the fermentation of the up-cycled okara. The company defines itself as a flavourful plant-based alternative to meat and has a production capacity of more than 14 million tonnes.

- In August 2021, Soynergy announced its plan to launch a new probiotic drink that is made from okara with the help of the company’s biotech platform, which contributes towards zero-waste food manufacturing.

Okara Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 0.7 billion |

|

Revenue forecast in 2034 |

USD 1.5 billion |

|

CAGR |

9.80% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Product, By Nutritional Sources, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The global okara market size is expected to reach USD 1.5 billion by 2034

Key players in the market are Morinaga Nutritional Foods, Pumuone Co., Vitasoy International Holdings

Asia Pacific contribute notably towards the global okara market

The global okara market is expected to grow at a CAGR of 9.80% during the forecast period.

The okara market report covering key segments are product, nutritional sources, application, and region.