Farm Equipment Rental Market Share, Size, Trends, Industry Analysis Report

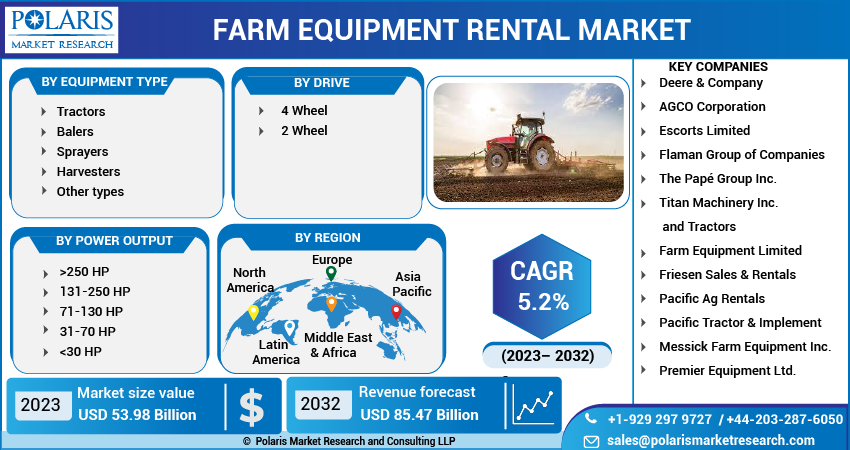

By Equipment Type (Tractors, Balers, Sprayers, Harvesters, and Other types); By Power Output; By Drive; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 112

- Format: PDF

- Report ID: PM3523

- Base Year: 2023

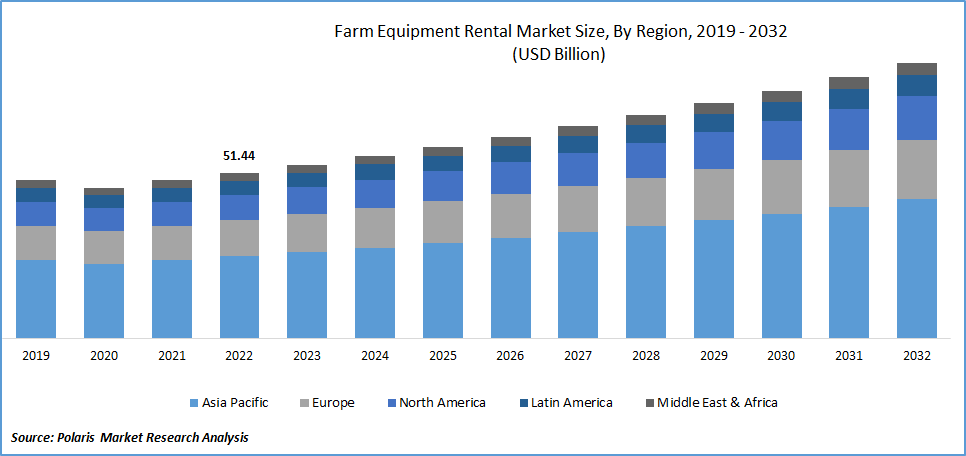

- Historical Data: 2019-2022

Report Outlook

The global farm equipment rental market was valued at USD 53.98 billion in 2023 and is expected to grow at a CAGR of 5.30% during the forecast period. The autonomous farming revolution is gaining a huge thrust in the market with a set of various technologies. Self-driving capabilities have been revolutionizing farm equipment for many years. Adopting autonomous farming technologies has led to new equipment designed to work with these technologies. There are now autonomous tractors and drones that can be used to plant and monitor crops, as well as robots that can harvest crops. For example, in December 2022, Monarch Tractor released its first line of autonomous electric tractors in Central and Northern California. Similarly, there are many rental options for this specialized autonomous farming equipment. This is further heightening the growth of the global market.

To Understand More About this Research: Request a Free Sample Report

Farm equipment rental offers several important benefits for farmers and other stakeholders in the agriculture industry. Accessing the latest farming technology and equipment can be cost-effective and sustainable while reducing financial risk and maintenance costs. They also offer greater flexibility for farmers, who may have varying needs throughout the year. Renting equipment can be more environmentally friendly than purchasing new equipment. By sharing equipment, farmers can reduce the number of machines needed in the industry, reducing the environmental impact of farming operations.

The research study provides a comprehensive analysis of the industry, assessing the market on the basis of various segments and sub-segments. It sheds light on the competitive landscape and introduces farm equipment rental market key players from the perspective of market share, concentration ratio, etc. The study is a vital resource for understanding the growth drivers, opportunities, and challenges in the industry.

The COVID-19 pandemic has also led to an increased demand for contactless rental options, such as online booking and payment systems, which have made it easier for farmers to rent equipment while minimizing the risk of exposure to the virus. However, the pandemic has also negatively impacted the farm equipment rental market. For example, the closures of factories and disruptions in the supply chain have led to shortages of some types of equipment, limiting rental options’ availability. The pandemic has also increased rental companies’ costs, such as higher cleaning and sanitation expenses, which have been passed on to customers in some cases.

For Specific Research Requirements, Request for a Customized Report

Industry Dynamics

Growth Drivers

Escalating the adoption of applications for renting farm equipment is anticipated to propel the global market. Using rental applications has made it easier for farmers to find and rent equipment. For example, in August 2021, Sonalika Group introduced a new ‘Sonalika Agro Solutions’ tractor & a rental app for farmers, from land preparation to harvesting. A huge number of people are adopting such apps because they support farmers in efficiently doing farming, making machinery available all the time. As a result, providers can reach a larger customer base and increase their chances of finding renters for their equipment. This factor is intensely supporting the global market to boosts.

Augmenting demand for renting farm equipment is another factor driving the growth of the global market. This is attributed to the growing need for farmers to access more advanced and specialized equipment that may be cost-prohibitive to purchase outright. For example, in September 2022, spraying robots were available for rent from Jacto for 6 US dollars per hectare. Many other businesses are largely participating in the rental farm equipment market. This factor is further enhancing global revenue.

Report Segmentation

The market is primarily segmented based on equipment type, power output, drive, and region.

|

By Equipment Type |

By power output |

By Drive |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

The Harvester Equipment Segment is Expected to Grow at the Fastest CAGR over the Forecasted Period

The harvester equipment segment is expected to grow at the fastest CAGR during the forecast period. Harvester equipment helps farmers reduce the time and effort required for harvesting crops, leading to increased efficiency and productivity. Moreover, the growing trend of precision agriculture, which involves advanced technologies such as GPS and remote sensing, is also driving the demand for harvester equipment.

Furthermore, farmers are increasingly adopting techniques such as conservation tillage, cover cropping, and crop rotation to reduce soil erosion and increase soil health. Companies are launching harvester equipment across many countries. For example, in April 2023, Mahindra & Mahindra’s arm Swaraj established its new harvester in India. Also in 2021, Sonalika launched India's largest harvester production facility.

71-130 HP Segment Dominating the Global Market in 2022

The 71–130 HP segment is dominating the global market with a share in 2022. The equipment in this range is versatile and can be used for various farming activities, such as tilling, planting, and harvesting. This versatility makes it a popular choice among farmers who require equipment that can handle multiple tasks. The 71–130 HP range of equipment is ideal for small and medium-sized farms. It provides enough horsepower to handle most farming operations while being affordable and cost-effective.

The 4-Wheel Drive Segment Held the Largest Share in the Global Market in 2022

In 2022, the 4WD segment dominated the market share. Four-wheel drive equipment provides better traction and stability, essential for farming operations in challenging terrains and adverse weather conditions. This equipment can easily traverse uneven and muddy fields, ensuring that farming operations are not hindered by adverse weather.

The growing popularity of four-wheel-drive farm equipment has led to product launches by several companies. For example, Mahindra unveiled a 4-wheel drive tractor under Arjun Novo. The dominance of 4-wheel-drive equipment in the farm equipment rental market can be attributed to its versatility, advanced technology features, cost-saving benefits, and easy maintenance and repair.

Asia Pacific is Accounting the Largest Share of the Global Market

In 2022, Asia Pacific is expected to lead the global market with a share. This is attributed to the huge growth in farming, increasing product launches, and many other growth factors. An upsurge in government support in the countries is one of the prominent factors influencing the market growth in this region. For example, in October 2019, the government of India established the CHC farm machinery app, which gives farmers tractors and other farm equipment for rent. This app helps small and marginal farmers easily hire farm machinery.

Also, governments can offer tax incentives to farmers who rent equipment. By providing tax breaks or credits, governments can reduce the overall cost of renting equipment, making it more attractive to farmers looking to increase their yields and reduce expenses. Such initiatives taken by the governments of Asian countries are helping the market grow and are poised to enhance sales in the upcoming years. Subsequently, this factor is driving the market growth in this region.

North America accounts for a significant share of the global market due to growing technological advancements and the use of several latest technologies. The advent of automation in the farming and agriculture industries is reinventing the market and has led businesses to invest heavily in it. For example, in December 2021, a US-based company of autonomous mobile spraying robots for the agriculture sector, GUSS Automation, launched a mini autonomous sprayer intended to autonomously deploy agricultural chemicals to crops. Similarly, many other regional players are drastically focusing on agricultural autonomy. Therefore, autonomous farming in the region is driving a new agricultural era and improving market sales.

Competitive Insight

The global market involves Deere & Company, AGCO Corporation, Escorts Limited, Flaman Group, Pape Group, Titan Machinery, Farm Equipment, Friesen Sales & Rentals, Pacific Tractor, Messick Farm Equipment, and Premier Equipment

Recent Developments

In October 2021, Tractors and Farm Equipment Limited (TAFE) launched a free tractor rental scheme to support small farmers in India. The scheme would cover around 1,20,000 acres and promote nearly 50,000 farmers from May to July 2021.

Farm Equipment Rental Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 56.68 billion |

|

Revenue forecast in 2032 |

USD 85.47 billion |

|

CAGR |

5.30% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019– 2022 |

|

Forecast period |

2024– 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Equipment Type, By Power Output, By Drive, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Deere & Company, AGCO Corporation, Escorts Limited, Flaman Group of Companies, The Papé Group Inc., Titan Machinery Inc. and Tractors, Farm Equipment Limited, Friesen Sales & Rentals, Pacific Ag Rentals, Pacific Tractor & Implement, Messick Farm Equipment Inc., and Premier Equipment Ltd. |

The analysis of farm equipment rental market extends to a comprehensive market forecast up to 2032, coupled with a retrospective examination. Avail yourself of a complimentary PDF download to sample this in-depth industry analysis. report to suit their needs. By customizing the report, you can get data as per your format and definition. Also, the customization option allows you to gain a deeper dive into a specific segment, region, customer, or market competitor.

FAQ's

The Farm Equipment Rental Market report covering key are equipment type, power output, drive, and region.

Farm Equipment Rental Market Size Worth $ 85.47 Billion By 2032.

The global farm equipment rental market expected to grow at a CAGR of 5.2% during the forecast period.

Asia Pacific is Farm Equipment Rental Market.

key driving factors in Farm Equipment Rental Market are High cost of agriculture equipment.