Feed Packaging Market Size, Share, Trends, Industry Analysis Report

By Material (Plastic, Paper & Paperboard, Others), By Packaging Type, By End Use, By Packaging Format, By Feed Type, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM6304

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

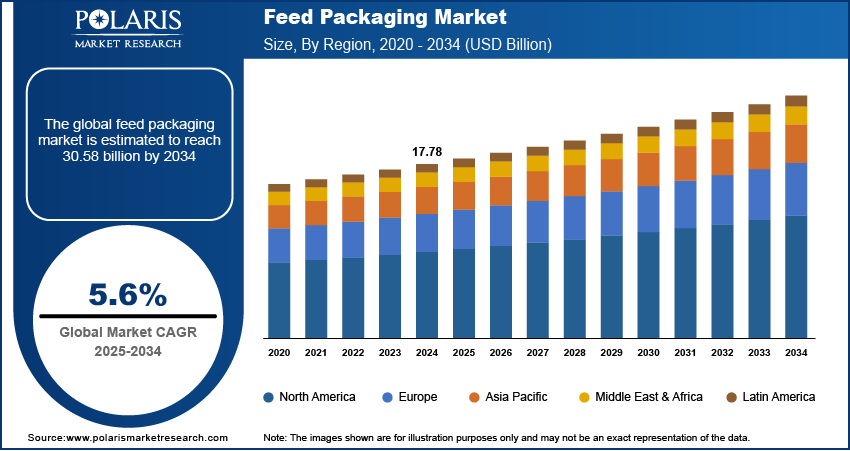

The global feed packaging market size was valued at USD 17.78 billion in 2024 and is anticipated to register a CAGR of 5.6% from 2025 to 2034. The main drivers are the growing global demand for animal protein and the need for better food safety. As more people consume meat, dairy, and eggs, there is a greater need for animal feed, which requires effective packaging.

Key Insights

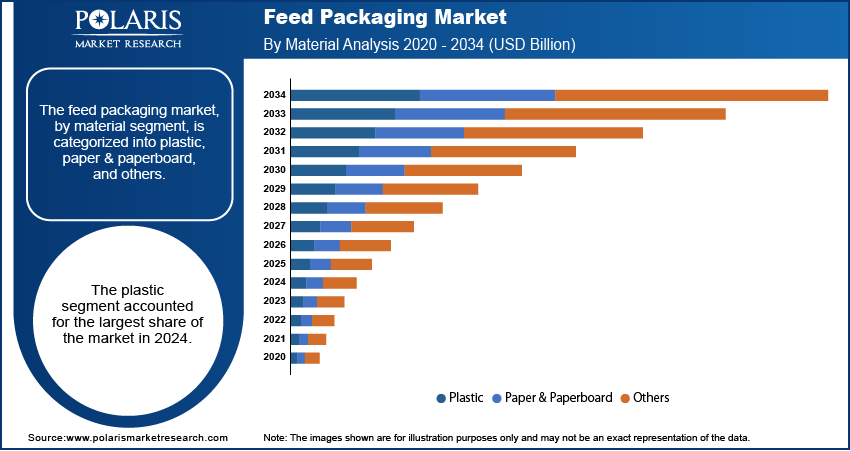

- Based on material, the plastic segment holds the largest share due to its flexibility and cost-effectiveness.

- By packaging type, the flexible packaging segment dominates due to its popularity stems from its low production cost and high efficiency.

- By end use, the livestock feed segment accounts for the largest share because of the large scale of commercial animal farming globally.

- By packaging format, the bags segment holds the largest share because bags, especially those made from woven polypropylene or multi-wall paper, are the standard for packaging bulk quantities.

- In terms of feed type, the dry feed segment holds the largest share, as it is the most common type of animal and pet feed.

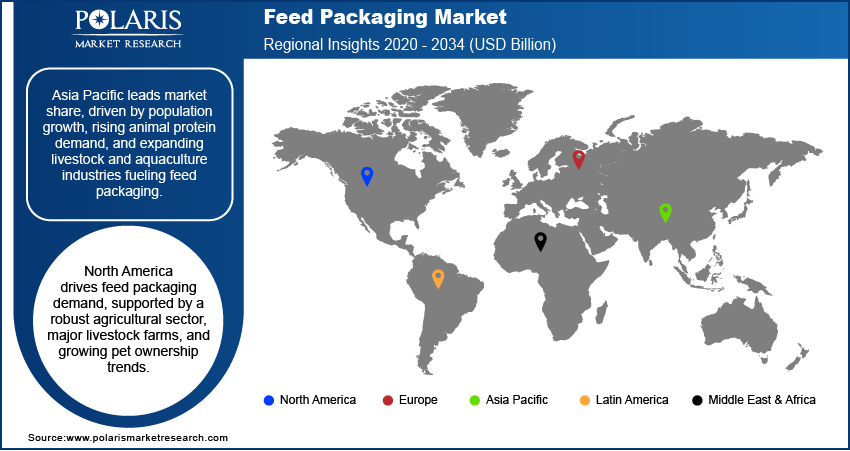

- By region, Asia Pacific holds the largest share, driven by its huge and growing population, which is leading to an increase in demand for animal protein.

Industry Dynamics

- A key factor is the rising demand for animal protein. As the global population and income levels increase, more people are consuming meat, dairy foods, and eggs. This has led to a greater need for large-scale animal farming and commercial feed production, which drives the demand for reliable and efficient packaging to ensure the quality and safety of the feed.

- The growing emphasis on food safety and hygiene is another important driver. Stricter government rules and increased consumer awareness about the quality of animal products have made it essential for feed to be packaged in ways that prevent contamination and spoilage. This is pushing for the use of advanced and tamper-proof packaging materials.

- A major trend is the growing focus on pet humanization and the rising number of pet owners. People are spending more on premium and specialized pet foods, which often come in convenient, smaller, and resealable packaging. This trend boosts the demand for a variety of packaging formats, such as flexible pouches and bags.

Market Statistics

- 2024 Market Size: USD 17.78 billion

- 2034 Projected Market Size: USD 30.58 billion

- CAGR (2025–2034): 5.6%

- Asia Pacific: Largest market in 2024

AI Impact on Feed Packaging Market

- Artificial intelligence (AI) revolutionizes the feed packaging market by introducing smarter, sustainable, and more efficient solutions across the supply chain.

- AI-enabled systems monitor packaging machinery in real time. They predict failures before they happen, which helps minimize downtime.

- Machine learning (ML) algorithms are used in packaging line operations, improving accuracy and speed and reducing waste.

- Computer vision systems identify defects in packaging instantly, which ensures quality control without manual inspection.

The feed packaging involves the materials and containers used to protect and store animal feed and pet food. This packaging helps maintain the quality and nutritional value of the contents. It also protects the feed from moisture, light, and other outside elements during transport and storage.

A key driver is the growing focus on using sustainable and eco-friendly packaging materials. As environmental concerns become more important, many companies are shifting toward solutions such as paper bags, recyclable plastics, and biodegradable films. This is often driven by consumer demand and stricter government rules on plastic waste.

Another driver is the rise of e-commerce and direct-to-consumer sales in the pet food, animal feed, and animal feed acidifier sectors. As more products are sold online, there is a greater need for packaging that can withstand the shipping process while keeping the product fresh. This trend also supports the use of smaller, more convenient packaging sizes. For example, the FDA's rules for animal food labeling require detailed information to be present on the packaging, which helps ensure transparency and safety for consumers buying online.

Drivers and Trends

Rising Global Demand for Animal Protein: The global demand for animal protein, such as meat, dairy, and eggs, is increasing. This is mainly attributed to a growing world population and rising incomes in developing regions. As people's diets change, they consume more animal products, which directly leads to higher production of animal feed. The increased need for feed then drives the demand for packaging that can protect these large quantities of products during transport and storage. This requires strong, cost-effective packaging that can be produced in high volumes.

According to the Food and Agriculture Organization (FAO) of the United Nations in its report that global meat consumption is expected to increase by 47.9 million metric tons over the next decade. The report states that 45% of this consumption growth will happen in middle-income countries. This growing demand for meat drives the need for more animal feed, which in turn boosts the sector for protective packaging.

Strict Regulations on Feed Safety: Another major driver is the increasing focus on food safety and hygiene in the animal feed industry. Governments and health organizations are creating and enforcing stricter rules to prevent contamination and disease outbreaks that can be passed from animals to humans. These regulations require manufacturers to use safe, sanitary, and tamper-proof packaging to ensure the quality and safety of the feed from the factory to the farm. This demand for secure packaging pushes for the development of new materials and designs.

The FDA’s "CVM Updates in October 2023 highlighted an investigation with the Centers for Disease Control and Prevention (CDC) into cases of Salmonella linked to certain pet food brands. This kind of event leads to mandatory recalls and reinforces the need for packaging that can prevent contamination and protect public health. The focus on safety is directly influencing the demand for improved packaging technologies.

Segmental Insights

Material Analysis

Based on material, the segmentation includes plastic, paper & paperboard, and others. The plastic segment held the largest share in 2024. Plastic is a highly durable and flexible material, making it ideal for protecting feed from moisture, light, and other environmental factors. It is also lightweight and cost-effective, which helps reduce transportation costs and makes it an economical choice for both producers and consumers. Common types of plastic packaging include woven polypropylene bags and multi-layer films, which are used for a wide range of feed products, from bulk livestock feed to specialized pet food. The strength and barrier properties of plastic ensure the feed remains fresh and safe for consumption, which is a major concern for both manufacturers and end users. The versatility of plastic allows for various packaging designs and sizes, catering to the diverse needs of different animals and farm operations.

The paper and paperboard segment is anticipated to register the highest growth rate during the forecast period. This is largely driven by a global shift toward sustainable and eco-friendly packaging solutions. As concerns about plastic waste and its environmental impact increase, many companies and consumers are looking for alternatives. Paper and paperboard are renewable, recyclable, and biodegradable, which aligns with modern sustainability goals. This segment includes packaging such as multi-wall paper bags, boxes, and cartons. Innovations in this area, like the use of special coatings and laminations, have improved the barrier properties of paper-based packaging, making it more resistant to moisture and grease. This allows it to be used for a wider range of feed types. The growing demand for environmentally friendly products from pet owners and farmers is pushing companies to adopt these materials, leading to significant developments and a faster growth rate compared to other segments.

Packaging Type Analysis

Based on packaging type, the segmentation includes flexible and rigid. The flexible segment held the largest share in 2024. This is due to a combination of factors, including its low cost and high efficiency. Flexible packaging, such as bags, sacks, and pouches, requires less material to produce, which reduces manufacturing expenses and makes it a more economical choice for manufacturers. It is also very light, which helps lower shipping costs and fuel consumption during transportation. The adaptability of flexible packaging allows for a wide range of sizes and designs, fitting everything from small bags of pet treats to large sacks of bulk livestock feed. Its barrier properties are highly effective at protecting feed from moisture, oxygen, and light, which is critical for maintaining freshness and nutritional value. The convenience and durability of flexible options are also appealing to both commercial feed producers and individual consumers, cementing its leading position in the industry.

The rigid packaging segment is anticipated to register the highest growth rate during the forecast period. This increase is driven by the demand for strong, durable packaging, especially for high-value and specialty feed products. Rigid packaging, like plastic containers, drums, and jars, offers superior protection against physical damage during handling and storage. This is particularly important for premium pet foods and aquatic feeds, where maintaining product integrity is a top priority. The stackability of rigid containers also makes them highly efficient for storage in warehouses and retail spaces. As consumers become more concerned with product safety and quality, the use of rigid packaging provides an added sense of security and a premium feel. Innovations in materials, such as the use of recycled plastics for rigid containers, are also supporting this growth by addressing environmental concerns and meeting consumer demand for sustainable options.

End Use Analysis

Based on end use, the segmentation includes livestock feed, pet food packaging, aquatic feed packaging, and others. The livestock feed segment held the largest share in 2024. This segment includes packaging for feed used for cattle, poultry, swine, and other farm animals. The large size of the livestock industry, driven by the global demand for meat, milk, and natural and processed eggs, requires huge volumes of feed, and in turn, vast amounts of packaging. The packaging used in this area is often designed for durability and capacity, such as large woven bags and bulk containers, to handle the heavy weight and long supply chains from feed mills to farms. The need for cost-effective and strong packaging to protect bulk feed from moisture and contamination is a primary reason for its dominance.

The aquatic feed packaging segment is anticipated to register the highest growth rate during the forecast period. This growth is linked to the rapid expansion of the aquaculture industry, which is a key source of protein for a growing global population. As fish farming becomes more widespread and sophisticated, there is a greater need for specialized feed and, by extension, better packaging to preserve its quality. Aquatic feed often has specific requirements, such as moisture resistance and a long shelf life, to maintain its integrity in different environments. This is driving innovation in packaging materials and formats, like high-barrier films and smaller, more convenient pouches. The increasing investment in aquaculture and the rising demand for seafood around the world are the main factors behind the strong growth of this segment.

Packaging Format Analysis

Based on packaging format, the segmentation includes bags, pouches/pockets, boxes/cartons, jars/containers, and others. The bags segment held the largest share in 2024. Bags, often made from woven polypropylene or multi-wall paper, are the standard for packaging large quantities of dry livestock feed, such as grains and pellets. Their design is efficient for large-scale production and transport, and they can be easily stacked and stored. The durability of these bags ensures that the feed is protected from physical damage and environmental elements during its journey from the factory to the farm. Additionally, bags offer a simple and affordable way to package and distribute feed, which is a key factor in the high-volume livestock sector where cost control is essential. This widespread use for both large-scale farming and smaller-volume retail sales gives bags a leading position.

The pouches/pockets segment is anticipated to register the highest growth rate during the forecast period. The growth is driven mainly by changes in pet ownership and consumer habits. The trend of pet humanization means that pet owners are spending more on premium and specialty foods, which are often sold in smaller, more convenient packaging. Pouches and pockets are popular for these products because they are resealable, easy to store, and visually appealing. This type of packaging helps to keep the product fresh after opening and provides a convenient, single-serving option. The flexibility and high-quality printing capabilities of pouches also help brands stand out on store shelves. The demand for portion-controlled and easy-to-use packaging formats for various pet food products is fueling the rapid growth of this segment.

Regional Analysis

The Asia Pacific feed packaging market accounted for the largest share in 2024, mainly due to its large and increasing population, rising disposable incomes, and urbanization. The demand for animal protein is especially high in this region, which fuels the expansion of the livestock and aquaculture industries. As these industries grow, so does the need for effective packaging to ensure the safety and freshness of feed. The landscape here is seeing a strong move toward flexible packaging formats, which are both affordable and efficient for a wide variety of feed products.

China Feed Packaging Market Insights

China is a major producer and consumer of livestock and aquatic products, which makes it a crucial region for feed packaging. The country’s rapid economic growth and large-scale industrialization have led to huge investments in modern farming and aquaculture, driving the need for advanced packaging technologies. The rise of e-commerce in China has also changed the sector, with a greater need for convenient and durable packaging that can be shipped directly to consumers and businesses. This has made China a key player in shaping the demand for feed packaging in the entire region.

North America Feed Packaging Market Trends

North America is a significant region for feed packaging, driven by its large and well-established agricultural sector. The presence of major livestock farms and a high number of pet owners contributes to the strong demand for both livestock and pet food packaging. In this region, there is a clear trend toward high-quality, safe, and effective packaging that protects products from contamination and spoilage. The region is also being shaped by a growing interest in sustainable packaging materials, with companies working to meet consumer preferences for eco-friendly options. The well-developed retail and e-commerce infrastructure in the region also supports the growth of diverse packaging formats.

U.S. Feed Packaging Market Overview

The U.S. plays a central role in the North American industry, largely due to its huge population of pets and its large-scale livestock sector. The humanization of pets is a powerful trend here, leading to strong demand for premium pet food and specialized packaging such as resealable pouches and stand-up bags. This focus on convenience and product quality is also seen in the livestock feed sector, where packaging must be both durable and efficient for large-volume use. The U.S. also benefits from a developed supply chain and advanced manufacturing technologies that allow for innovative and customized packaging solutions.

Europe Feed Packaging Market Assessment

The European feed packaging is mature and heavily influenced by strict environmental regulations and high consumer awareness about sustainability. There is a strong push across the region to reduce plastic waste and adopt more circular economy principles. This has led to a noticeable shift toward paper-based and other biodegradable packaging materials. European consumers are often willing to pay more for products that use eco-friendly packaging, which encourages companies to invest in research and development for new and improved sustainable solutions. The region also benefits from a significant livestock sector and a large pet-owning population.

Germany feed packaging market has a strong focus on a circular economy and has some of the most advanced recycling systems in the world. Its government policies and consumer attitudes favor the use of recyclable and biodegradable materials. This has pushed local companies to develop cutting-edge solutions, from paper-based bags with special barrier coatings to eco-friendly plastics. The country's strong economy and large domestic market for both livestock and pet food further support its leadership in developing new and sustainable packaging.

Key Players and Competitive Insights

The market includes several key players who are always seeking new ways to make their products better. Competition is based on a range of factors, including product quality, ability to innovate with new materials, and a focus on meeting specific customer needs, such as those for sustainable or customized packaging. Many companies are also expanding their global reach through partnerships and new facilities in different regions to serve a wider customer base. This has created a dynamic landscape where companies compete not only on price but also on technology and presence.

A few prominent companies include Amcor, Mondi Group, Sonoco Products Company, Winpak Ltd., Berry Global Inc., Huhtamaki, ProAmpac, LC Packaging, and NNZ Group.

Key Players

- Amcor plc

- Berry Global Inc.

- Huhtamaki Oyj

- LC Packaging

- Mondi Group

- NNZ Group

- ProAmpac

- Sonoco Products Company

- Winpak Ltd.

Feed Packaging Industry Developments

June 2025: Mondi teamed up with French pet food producer Saga Nutrition to introduce recyclable mono-material packaging for Saga’s dry pet food range, replacing conventional non-recyclable multi-material plastics.

February 2025: UFlex Limited committed a USD 50 million manufacturing facility in Mexico to produce woven polypropylene bags for dry pet food packaging, aiming to serve markets across North and South America.

Feed Packaging Market Segmentation

By Material Outlook (Revenue – USD Billion, 2020–2034)

- Plastic

- Paper & Paperboard

- Others

By Packaging Type Outlook (Revenue – USD Billion, 2020–2034)

- Flexible

- Rigid

By End Use Outlook (Revenue – USD Billion, 2020–2034)

- Livestock Feed

- Pet Food Packaging

- Aquatic Feed Packaging

- Others

By Packaging Format Outlook (Revenue – USD Billion, 2020–2034)

- Bags

- Pouches/Pockets

- Boxes/Cartons

- Jars/Containers

- Others

By Feed Type Outlook (Revenue – USD Billion, 2020–2034)

- Dry Feed

- Pet Treats

- Chilled & Frozen

- Wet Feed

- Others

By Regional Outlook (Revenue-USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Feed Packaging Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 17.78 billion |

|

Market Size in 2025 |

USD 18.73 billion |

|

Revenue Forecast by 2034 |

USD 30.58 billion |

|

CAGR |

5.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 17.78 billion in 2024 and is projected to grow to USD 30.58 billion by 2034.

The global market is projected to register a CAGR of 5.6% during the forecast period.

Asia Pacific dominated the market share in 2024.

A few key players in the market include Amcor, Mondi Group, Sonoco Products Company, Winpak Ltd., Berry Global Inc., Huhtamaki, ProAmpac, LC Packaging, and NNZ Group.

The plastic segment accounted for the largest share of the market in 2024.

The rigid segment is expected to witness the fastest growth during the forecast period.