Fiber Optic Preform Market Share, Size, Trends, Industry Analysis Report

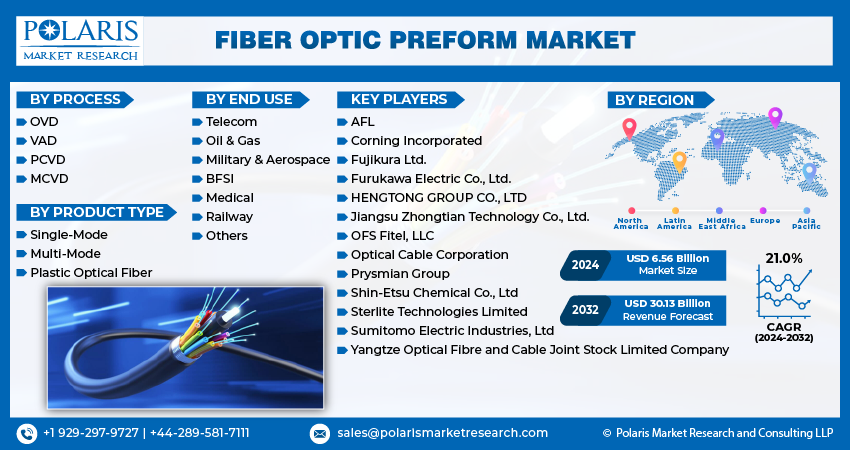

By Process (OVD, VAD, PCVD, MCVD), By Product Type (Single-Mode, Multi-Mode, Plastic Optical Fiber), By End-user, By Region, And Segment Forecasts, 2024 - 2032

- Published Date:Mar-2024

- Pages: 115

- Format: PDF

- Report ID: PM4726

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

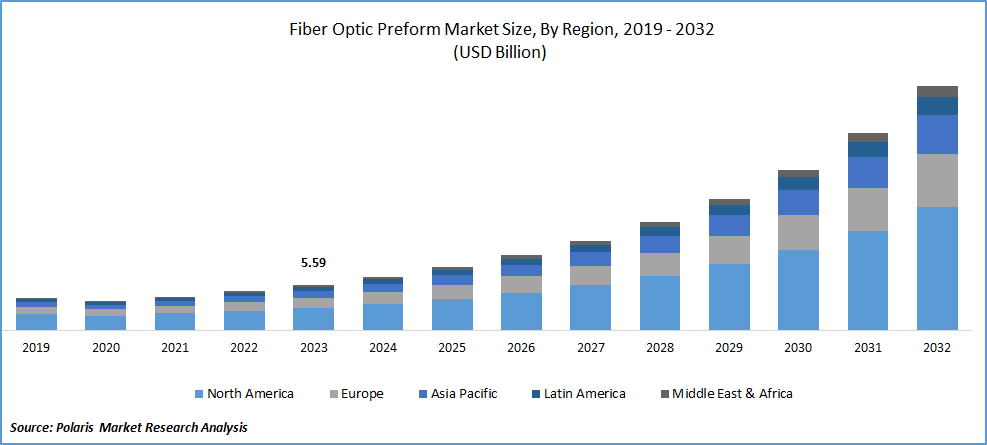

The global fiber optic preform market was valued at USD 5.59 billion in 2023 and is expected to grow at a CAGR of 21.0% during the forecast period.

The expansion can be credited to the increasing demand for high-bandwidth internet connections, opportunities within the healthcare industry, and investments in telecommunication infrastructure, among other factors. As per the Organization for Economic Co-operation and Development (OECD), there was a 12.3% growth in count of fiber broad-band subscriptions across OECD nations from June 2021 to June 2022.

To Understand More About this Research:Request a Free Sample Report

The surge in the data traffic, driven by the widespread use of tablets, laptops, & portable electronic gadgets, is expected to boost the demand for optical fibre. This market is in a constant state of evolution, playing a crucial role in the supply chain of the broader optical fiber & cable industry. The increasing reliance on digital devices and the continuous expansion of communication networks contribute to the ongoing growth and importance of the optical fibre market within the larger context of the industry.

The market exhibits a high level of concentration, primarily dominated by a select group of well-established multinational players. The competitive landscape is equally intense, driven by strategic initiatives undertaken by these key players to introduce advanced and innovative products. To enhance their market position, companies frequently pursue mergers, acquisitions, and backward integration strategies. These efforts aim to broaden their product portfolios, extend their geographical reach, and gain a competitive edge over peers. Consequently, the market experiences significant internal rivalry and competition among established players.

Growth Drivers

- Rising Investments in Telecommunication Infrastructure

Fiber optic preforms are used to create optical fibers that have the potential to transmit data rapidly. Optical fibers are flexible, transparent cables made of high-quality materials such as glass, plastic, and silica, operating based on the principles of total internal light reflection. These fibers find extensive applications in light transmission, laser systems, & flexible bundling. Extensive research and development in fiber optic technology have resulted in numerous innovations, opening diverse applications in industries such as oil & gas, utilities, & defense.

Optical fibre network infrastructure plays a crucial role in major industries such as telecommunication and information technology. The demand for fibre optic cables has risen in tandem with the development of fibre-rich network infrastructure. A key factor propelling the fibre optic preform market is the increasing need for high-bandwidth communication.

Report Segmentation

The market is primarily segmented based on process, product type, end use, and region.

|

By Process |

By Product Type |

By End Use |

By Region |

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Process Analysis

- VAD segment held the largest share in 2023

VAD segment held the largest share. This dominance due to its capability to produce quality preforms characterized by low attenuation & excellent transmission properties. Primary method for manufacturing fiber preforms is VAP, involving the deposition of materials like silica on a rotating rod, which is subsequently drawn into the final optical fiber. VAD stands out as an exceptional technique for the mass production of large quantities of optical fiber, particularly due to its efficiency in handling large glass manufacturing.

OVD segment projected to grow at the fastest rate. These include high scalability, minimal signal loss in data transmission, consistent deposition, and notable flexibility and efficiency.

By Type Analysis

- Multi-mode segment registered the largest market share in 2023

Multi-mode segment accounted for the largest share. Multi-mode optics utilize a considerably wider core compared to single-mode, typically employing a longer wavelength of light. As a result, optical fibers in multi-mode configurations exhibit greater efficiency in collecting light from the laser source. Manufacturers are strategically pursuing vertical integration to streamline and enhance the processes involved in assembly and testing.

Plastic fiber optic segment expected to grow at the fastest rate. This is attributed to several advantages associated with plastic optical fibers, including lower packaging and production costs, enhanced bending capacity, immunity to noise, ruggedness, and flexibility that facilitates easy installation. These attributes make plastic optical fibers an attractive choice for various applications, driving their anticipated growth in the fiber optic preform market

By Application Analysis

- Telecom segment held the significant market revenue share in 2023

Telecom segment held the largest share. This can be attributed to the rising demand for high-speed internet and efficient data transmission. The surge in smartphone usage, the expansion of internet connectivity, and the widespread adoption of cloud services have significantly contributed to the growth of this segment. The telecom industry's increasing reliance on optical fiber technology to meet the demands for faster and more reliable communication has fueled its prominence in the market.

Others segment will grow with significant pace. Segment’s growth is due to increased investments and government initiatives aimed at enhancing connectivity in untapped and rural areas. For instance, in March 2023, CommScope revealed plans to expand the production of fiber-optic cable, with a focus on connecting more communities and underserved areas to facilitate broadband expansion across the U.S. Additionally, the introduction of the new HeliARC fiber optic cable is specifically designed to meet the deployment requirements of rural areas.

Regional Insights

- APAC held the largest share of the global market in 2023

APAC dominated the market. The region's growth is propelled by key factors such as the rising prevalence of internet usage, the continual expansion of the telecom industry, and the robust presence of various end-use industries. Notably, according to Tridens 2023 telecommunication statistics, China stands as the largest mobile market globally with approximately 1.7 billion mobile subscribers. Moreover, China has taken a leading position in the market for 5G deployment and the production of 5G devices, further contributing to the region's dominance in the market.

Region has experienced a notable upswing in the development of telecommunication infrastructure, fueled by a heightened demand for broadband connectivity, the expansion of 4G and 5G networks, and the increasing adoption of smartphones. This surge in telecommunication infrastructure development has consequently led to an increased demand for fiber optic preforms. As the demand for high-speed and reliable communication services grows in tandem with the expansion of network capabilities, the need for optical fiber technology, including fiber optic preforms, becomes instrumental in meeting these evolving requirements in the market.

MEA region projected to grow at the rapid pace. Region’s growth is primarily due to the ongoing digital transformation and robust growth in the telecom and other end-user industries. The digital transformation initiatives undertaken by businesses and governments in the region are driving the need for advanced communication infrastructure, including optical fiber technology. The substantial growth in the telecom sector, coupled with the expansion of various end-user industries, is contributing to the increased demand for optical fiber.

Key Market Players & Competitive Insights

Key players in the industry are consistently involved in merger and acquisition initiatives, expanding their manufacturing facilities, investing in research and development activities, and exploring opportunities for vertical integration throughout the value chain.

Some of the major players operating in the global market include:

- AFL

- Corning Incorporated

- Fujikura Ltd.

- Furukawa Electric Co., Ltd.

- HENGTONG GROUP CO., LTD

- Jiangsu Zhongtian Technology Co., Ltd.

- OFS Fitel, LLC

- Optical Cable Corporation

- Prysmian Group

- Shin-Etsu Chemical Co., Ltd

- Sterlite Technologies Limited

- Sumitomo Electric Industries, Ltd

- Yangtze Optical Fibre and Cable Joint Stock Limited Company

Recent Developments

- In June 2023, Finolex Cables has announced intentions for a substantial investment in its Urse facility located in Pune. The company has earmarked INR 390 crores for this undertaking, with a significant portion of INR 290 crores allocated for the establishment of a new fiber preform plant.

Fiber Optic Preform Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 6.56 billion |

|

Revenue forecast in 2032 |

USD 30.13 billion |

|

CAGR |

21.0% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Process, By Type, By End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

Fiber Optic Preform Market Size Worth $ 30.13 Billion By 2032

The top market players in Fiber Optic Preform Market AFL, Corning, Fujikura, Furukawa Electric, Jiangsu Zhongtian

Asia Pacific contribute notably towards the Fiber Optic Preform Market

The global fiber optic preform market and is expected to grow at a CAGR of 21.0% during the forecast period.

Fiber Optic Preform Market report covering key segments are process, product type, end use, and region