Fiber To The Home Market Size, Share, Trends, & Industry Analysis Report

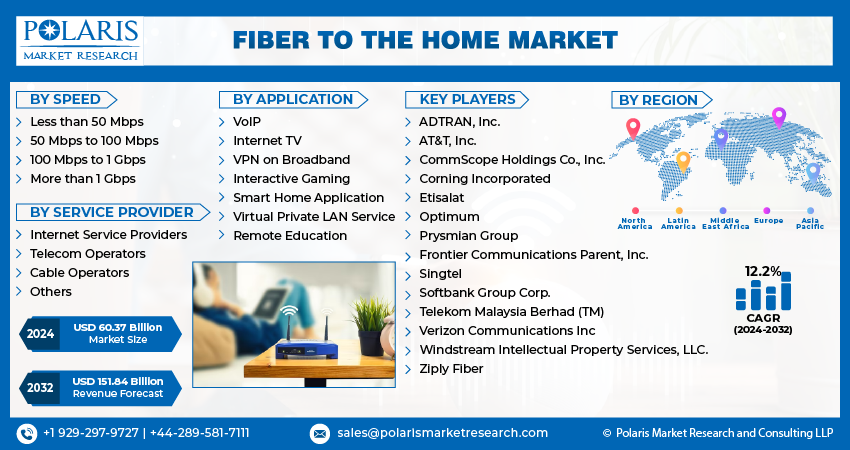

By Speed (Less than 50 Mbps, 50 Mbps to 100 Mbps), By Service Provider, By Application, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 118

- Format: PDF

- Report ID: PM4081

- Base Year: 2024

- Historical Data: 2020-2023

Overview

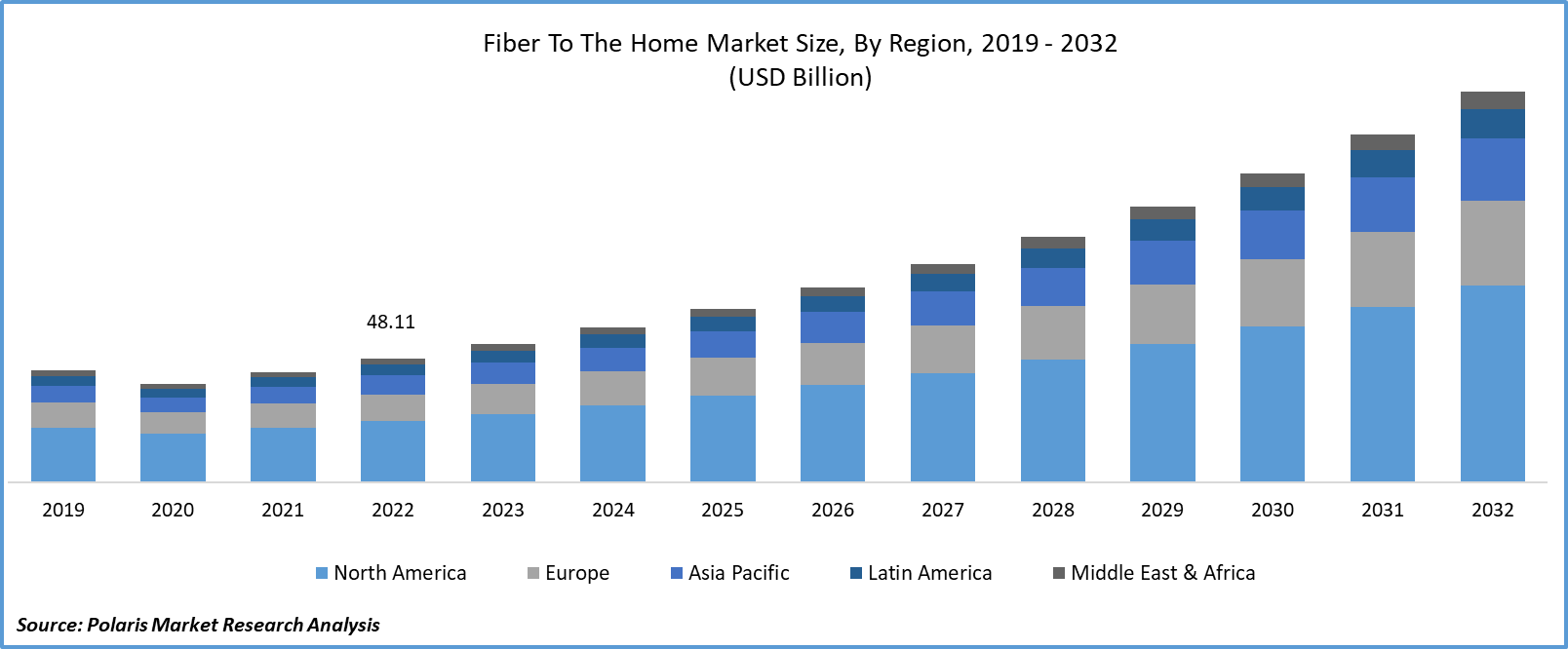

The global fiber to the home market was valued at USD 62.64 billion in 2024 and is expected to grow at a CAGR of 12.3% during the forecast period. The fiber-to-the-home (FTTH) market is poised for continued growth, driven by the insatiable demand for high-speed internet, technological advancements, and government support. While facing challenges related to initial investments and competition, the potential impacts of FTTH on economic growth, digital inclusion, and innovation are substantial. By capitalizing on opportunities in rural expansion, advanced services, and IoT integration, providers can shape the future of connectivity and usher in a new era of digital transformation.

Key Insights

- The 50 Mbps to 100 Mbps segment is expected to witness the fastest CAGR during the forecast period due to rising demand for higher internet speeds for activities like streaming, gaming, and remote work.

- The telecom operators segment held the largest market share in 2024, as telecom operators are instrumental in the establishment and enlargement of FTTH networks.

- Asia Pacific dominated with largest share in 2024 due to rising increasing demand for high-speed internet.

- North America is projected to account for a significant share in the global market due to proliferation of data-intensive activities like streaming and remote work.

Industry Dynamics

- Increasing demand for high-speed internet is fueling the growth.

- Government support to make internet accessible is driving the industry growth.

- Technological advancement is driving the growth.

- The high cost and complexity of last-mile infrastructure deployment is limiting the growth.

Market Statistics

- 2024 Market Size: USD 62.64 Billion

- 2034 Projected Market Size: USD 199.40 Billion

- CAGR (2025-2034): 12.3%

- Largest Market: Asia Pacific

To Understand More About this Research: Request a Free Sample Report

Fiber to the home (FTTH) is the attachment or usage of optical fiber from an intermediate extremity to personalized buildings to provide a high-speed internet connection. Compared to alternate technologies, FTTH greatly increases the connection speeds obtainable to computer users. It promises connection speeds of up to 100 megabits per second, which are 20 to 100 times as swift as a usual cable modem or DSL connection.

The established trait of FTTH is that it links optical fiber directly to homes, apartment buildings, and businesses. FTTH utilizes optical fiber for the majority or all last-mile telegraphy. The fiber to the home market demand is on the rise as the optical fiber passes on data utilizing light signals to obtain escalated performance. In the FTTH approach frameworks, fiber optic cables operate from a primary office and via a fiber dispensation hub. The cables then permeate through a network access point and ultimately into the home via a terminal that is provided as a junction box.FTTH technology offers unparalleled internet speeds, often surpassing traditional broadband connections. It translates into faster downloads, seamless streaming, and enhanced online experiences for users.

The deployment of FTTH networks stimulates economic growth by fostering innovation, attracting businesses, and supporting a thriving digital ecosystem. It promotes technological advancements and facilitates the emergence of new industries and services. Fiber to the Home (FTTH) technology serves as a pivotal tool in narrowing the digital divide, guaranteeing that even in remote or underserved regions, high-speed internet is accessible. It contributes to creating a more equitable landscape, affording everyone equal opportunities for education, business endeavors, and social interaction.

For instance, in October 2023, V.tal, a major global provider of comprehensive digital infrastructure solutions and owner of Brazil's largest neutral fiber optic network, agreed with Ligga, a prominent telecommunications operator in Paraná. This contract entails the provision of FTTH (Fiber to The Home) services. V.tal will grant access to over 22 million HPs (homes passed) situated across approximately 300 municipalities for Ligga to manage. This collaboration will significantly broaden the availability of high-speed residential internet for end consumers, due to an expansion of the service coverage area.

However, the upfront capital expenditure required to deploy FTTH networks can be substantial. It includes costs associated with laying fiber optic cables, network equipment, and other infrastructure. This financial commitment can be a significant barrier for smaller service providers. Established technologies like cable and DSL networks already have a presence in many regions. Convincing consumers to switch to FTTH can be challenging, especially if they are satisfied with their current internet service.

Additionally, retrofitting densely populated urban areas with FTTH infrastructure can be logistically complex and expensive. Existing underground utilities, city planning regulations, and other factors can pose challenges to installation.

Industry Dynamics

Growth Drivers

Increasing demand for high-speed internet is projected to spur product demand

The proliferation of data-intensive activities like streaming, gaming, telecommuting, and online education has heightened the demand for ultra-fast internet. FTTH meets this need by delivering speeds that can support these applications seamlessly. Continuous innovation in fiber optic technology has made FTTH more affordable and feasible for widespread deployment. The development of more efficient equipment and installation techniques has accelerated its adoption.

Moreover, governments worldwide are recognizing the importance of robust digital infrastructure and are implementing policies to encourage FTTH deployment. Financial incentives, grants, and regulatory support are driving service providers to invest in FTTH networks.

Report Segmentation

The market is primarily segmented based on speed, service provider, application, and region.

|

By Speed |

By Service Provider |

By Application |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Speed Analysis

The 50 Mbps to 100 Mbps segment is expected to witness the fastest CAGR during the forecast period

The 50 Mbps to 100 Mbps segment is expected to witness the fastest CAGR during the forecast period. As consumers increasingly demand higher internet speeds for activities like streaming, gaming, and remote work, this segment has emerged as a popular choice. The transition to more data-intensive applications has amplified the need for faster and more reliable connections. Service providers are responding by offering packages in this speed range, providing a balanced combination of performance and affordability. Additionally, advancements in FTTH technology have made it more cost-effective to deliver these higher speeds, further driving the growth of this segment. This shift towards faster internet connections is not only enhancing user experiences but also fostering innovation in various industries.

By Service Provider Analysis

The telecom operators segment held the largest market share in 2024

The telecom operators segment held the largest fiber to the home market share in 2024. Telecom operators are instrumental in the establishment and enlargement of FTTH networks, drawing upon their established infrastructure and specialized knowledge. As the call for high-speed internet surges, operators are committing substantial resources to advance FTTH technology, addressing consumers' desires for swifter and more dependable connectivity. Moreover, telecom operators are seizing the opportunity for financial expansion within the FTTH market. They are strategically positioning themselves to tap into the potential revenue streams offered by the increasing demand for top-tier internet services. It includes the provision of diverse packages and services tailored to cater to various consumer needs and preferences.

The COVID-19 pandemic has further accelerated the importance of robust and high-speed internet connectivity, driving the telecom operators’ segment to expand FTTH networks to meet the surge in demand for remote work, online education, and telehealth services. Overall, the telecom operators’ segment is poised for continued growth as they continue to invest in and upgrade their FTTH infrastructure to provide faster and more reliable internet services to consumers.

Regional Insights

Asia Pacific Region Held the Largest Market in 2024

The Asia Pacific region held the largest market share in 2024. China has emerged as a global player in FTTH deployment, with extensive initiatives to expand ultra-fast broadband access. The surge is propelled by the increasing demand for high-speed internet, driven by factors like streaming, gaming, and remote work. Additionally, the rapid urbanization and rising disposable incomes in China further fuel the demand for advanced broadband connectivity, positioning FTTH as a critical technology for the country's digital transformation and economic progress.

North America is expected to witness fastest growth

The fiber to the home market in North America is experiencing the fastest growth. This surge is fueled by escalating demand for high-speed internet connectivity, driven by the proliferation of data-intensive activities like streaming and remote work. Technological advancements and government initiatives further bolster this expansion. FTTH networks, offering ultra-fast and reliable internet directly to residences, are becoming increasingly prevalent. Moreover, the COVID-19 pandemic has underscored the critical importance of robust digital infrastructure, further accelerating the adoption of FTTH technology. This dynamic growth in North America's FTTH market signifies a pivotal shift towards advanced and widespread broadband access across the region.

Key Market Players & Competitive Insights

The Fiber to the Home market is anticipated to witness competition due to major players' existence. Major service providers in the market are continuously progressing their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- ADTRAN, Inc.

- AT&T, Inc.

- CommScope Holdings Co., Inc.

- Corning Incorporated

- Etisalat

- Frontier Communications Parent, Inc.

- Optimum

- Prysmian Group

- Singtel

- Softbank Group Corp.

- Telekom Malaysia Berhad (TM)

- Verizon Communications Inc

- Windstream Intellectual Property Services, LLC.

- Ziply Fiber

Recent Developments

- In July 2023, Windstream and Sterlite Technologies revealed an extended collaboration to bolster Windstream's extensive fiber construction ventures. This expanded partnership will underpin consumer-centric fiber-to-the-home projects led by Kinetic by Windstream, along with the development of high-capacity, long-haul optical fiber routes tailored for content and cloud providers by Windstream Wholesale.

Fiber To The Home Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 62.64 billion |

| Market size value in 2025 | USD 70.17 billion |

|

Revenue forecast in 2034 |

USD 199.40 billion |

|

CAGR |

12.3% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Speed, By Service Provider, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

• The market size was valued at USD 62.64 Billion in 2024 and is projected to grow to USD 199.40 Billion by 2034

• The market is projected to register a CAGR of 12.3 during the forecast period

• A few of the key players in the market are ADTRAN, Inc., AT&T, Inc., CommScope Holdings Co., Inc., Corning Incorporated, Etisalat, Frontier Communications Parent, Inc., Optimum, Prysmian Group, Singtel, Softbank Group Corp., Telekom Malaysia Berhad (TM), Verizon Communications Inc., Windstream Intellectual Property Services, LLC., and Ziply Fiber.

• The telecom operator accounted for the largest market share in 2024.

• The 50 Mbps to 100 Mbps segment is expected to record significant growth.