Filtration and Drying Equipment Market Share, Size, Trends, Industry Analysis Report

By Technology, By End-use (Food & Beverage, Chemical, Pharmaceutical, Water & Wastewater Treatment, Others), By Region, And Segment Forecasts, 2024 - 2032

- Published Date:Feb-2024

- Pages: 119

- Format: PDF

- Report ID: PM4260

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

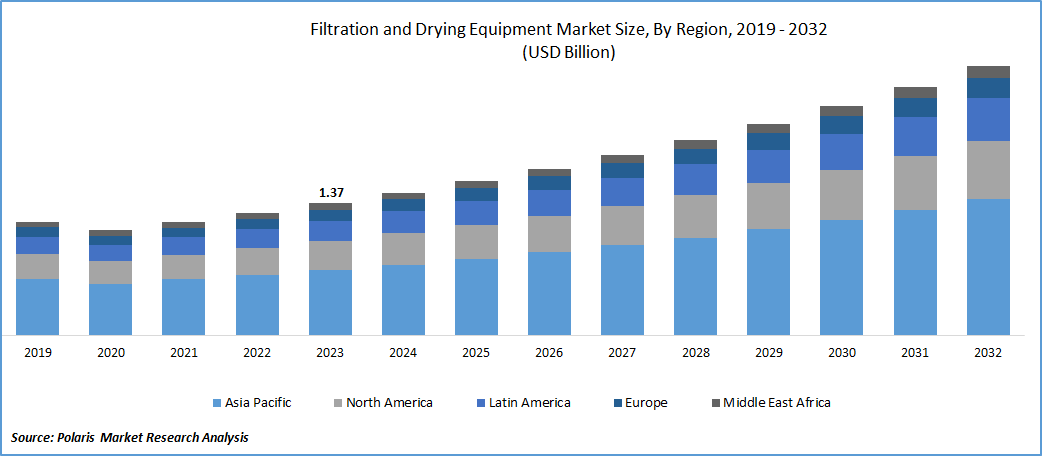

The global filtration and drying equipment market size and share was valued at USD 1.37 billion in 2023 and is expected to grow at a CAGR of 8.3% during the forecast period.

The expansion of filtration and drying equipment is primarily fueled by their commercial use, growing economies, rapid advancements in the food industry, adoption of innovative business models, cutting-edge technology, and increased research and development investments in the pharmaceutical sector. According to the American Health Rankings 2021 report, there were 55.8 million adults aged 65 and above in the U.S. This aging demographic often requires medical treatments and medications, leading to increased demand for pharmaceutical products.

To Understand More About this Research: Request a Free Sample Report

Additionally, the pharmaceutical industry is benefiting from the overall rise in the population, contributing to a higher demand for healthcare services and medications. Moreover, improved purchasing power among individuals, coupled with increased access to quality healthcare and pharmaceuticals, is making these products more accessible to both poor and middle-class families. This enhanced accessibility ensures a broader consumer base for pharmaceutical companies, further boosting the industry's growth.

The agglomeration occurring in the Agitated Nutsche Filter-Dryer leads to notable changes in the particle size distribution of products. This alteration could lead to uneven content and imprecise input for downstream mixes. The undesirable formation of large agglomerates necessitates additional size reduction processes for subsequent processing, which is anticipated to impede the market's growth.

The research report offers a quantitative and qualitative analysis of the filtration and drying equipment market to enable effective decision-making. It covers the key trends and growth opportunities anticipated to have a favorable impact on the market. Besides, the study covers segment and regional revenue forecasts for market assessment.

Product innovations, technological advancements, and the introduction of regulatory policies have been detailed in the report to enable businesses to make more informed decisions. Furthermore, the impact of the COVID-19 pandemic on the filtration and drying equipment market demand has been examined in the study. The report is a must-read for anyone looking to develop effective strategies and stay ahead of the curve.

Growth Drivers

The demand for pharmaceuticals and biopharmaceuticals has been increasing due to a growing global population and rising health awareness.

Industry growth is being propelled by a heightened focus among pharmaceutical companies on rare and specialty diseases. Innovations in areas such as nucleic acid research, biologics, cell therapies, bio-electronics, & implantable technologies have attracted investments not only from traditional pharmaceutical firms but also from non-pharmaceutical companies such as Facebook & Qualcomm. This influx of investments from diverse sectors is contributing to the expansion of the pharmaceutical industry in the United States.

The demand for the equipment is surging, particularly among the urban population, owing to significant investments by major players in the food & beverage industry and government initiatives. Additionally, the market is expected to expand due to enhanced system performance, reduced downtime, and increased applications in corrosive and hazardous environments.

Report Segmentation

The market is primarily segmented based on technology, end-use, and region.

|

By Technology |

By End Use |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Technology Analysis

ANFD segment garnered the largest share in 2023

ANFD segment dominated the market. ANFD offers several advantages, including the ability to maintain an inert gas atmosphere, blend products before discharge, and ensure product purity throughout the entire process. This versatile equipment, utilized in industries such as dyes, pharmaceuticals, chemicals, and textiles, combines the functions of a dryer and filter within a single unit.

ANFD finds diverse applications in industries such as dye, paints, varnish, surface coatings, pharmaceutical production, and wastewater treatment. It operates as a closed vessel, facilitating the separation of solids and liquids under pressure or vacuum conditions. This closed system guarantees product purity and cleanliness, creating odorless, contamination-free, and environmentally non-polluting working environments. ANFD is extensively utilized in pharmaceutical and chemical manufacturing, as well as in laboratory settings.

Centrifuges segment will grow at a significant pace. Segment growth is primarily due to the reduction of unpleasant odors during dewatering compared to traditional methods. This leads to a substantial decrease in both odorous disturbances and the expenses related to using deodorants on the premises. A centrifuge is a device utilized to separate fluids, and gases, because of its density. The resulting forces cause the heavier substances to settle at the container's bottom.

By End-Use Analysis

Chemical segment accounted for the largest market share in 2023

Chemical segment accounted for the largest market share. The industry experienced a surge in the use of filtration and drying equipment due to their excellent chemical resistance and their ability to meet essential filtration parameters. This ensures the production of high-quality end products. Filtration and drying equipment find extensive applications in the pharmaceutical industry, aiding in the large-scale production of drugs and biological products.

They are instrumental in evaluating suspensions and emulsions, as well as determining the molecular weight of colloids. In drug bulk production, this equipment plays a crucial role in separating drugs from the mother liquor through processes like centrifugation after crystallization. For instance, the centrifugation method is employed to separate traces of mother liquor from aspirin crystals.

Filtration and drying processes are essential in upholding the optimal operational conditions of food and beverage processing equipment. They also contribute significantly to preserving the freshness of food and beverages, extending their shelf life. Widely employed in industrial manufacturing, filtration, and drying equipment play a vital role by eliminating impurities, ensuring the purity of final products, and safeguarding the taste and overall quality of the manufactured food and beverages.

Waste water treatment segment will exhibit a robust growth rate. Filtration and drying equipment market plays a crucial role in water and wastewater treatment as well as sewage processing. They are utilized for eliminating particles, including metal shavings, from industrial lubricants. This equipment is essential for separating valuable synthetic materials during the production process.

Regional Insights

Asia Pacific accounted for the largest share of the global market in 2023

The market's growth is attributed to the increasing demand for filtration & drying equipment across diverse sectors including pharmaceuticals, food & beverage, & waste-water treatment. The growth of the pharmaceutical industry in this region is propelled by higher healthcare expenditures, augmented research & development investments, and the emergence of biologics & biosimilars. Additionally, the presence of favorable regulatory frameworks and reimbursement policies is anticipated to boost the demand for pharmaceutical products, fostering market expansion.

LATAM will grow at a substantial pace. This growth can be attributed to the rising demand for high-quality water in power, & energy installations, driving the expansion of the water and wastewater treatment sector. Additionally, strong environmental regulations & substantial investments in sewage treatment projects have propelled the demand for filtration and drying equipment in the region.

Key Market Players & Competitive Insights

Companies are employing tactics like acquisitions, investments, and innovation to boost their revenues. They are enhancing their production capacities to cater to specific markets. The market is highly competitive, marked by the presence of major companies and a substantial global consumer base. These companies operate through dedicated distribution networks.

Some of the major players operating in the global market include:

- GMM Pfaudler

- Tsukishima Holdings Co., Ltd.

- HEINKEL Process Technology GmbH

- Jaygo Incorporated

- Amar Equipment Pvt. Ltd.

- Shree Bhagwati Machtech (India) Pvt. Ltd.

- Powder Systems Limited

- HLE Glascoat

Recent Developments

- In May 2023, Amar Equipment collaborated with the HLE Glascoat to develop a lab-scale agitated nutsche filter dryer. This partnership aims to transform production processes by leveraging HLE Glascoat’s effective marketing strategies and Amar Equipment's manufacturing expertise.

- In April 2023, HEINKEL introduced BLUETECTOR, a cutting-edge peeler centrifuge series. This innovation ensures exceptional flexibility and efficiency, offering diverse solutions that enhance product quality across different solids and significantly boost overall productivity for large-scale production volumes.

Filtration and Drying Equipment Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 1.48 billion |

|

Revenue Forecast in 2032 |

USD 2.79 billion |

|

CAGR |

8.3% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By End Use, By Technology, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

Delve into the intricacies of filtration and drying equipment in 2024 through the meticulously compiled market share, size, and revenue growth rate statistics by Polaris Market Research Industry Reports. Uncover a comprehensive analysis that not only projects market trends up to 2032 but also provides valuable insights into the historical landscape. Immerse yourself in the depth of this industry analysis by acquiring a complimentary PDF download of the sample report.

FAQ's

The Filtration and Drying Equipment Market report covering key segments are technology, end use, and region.

The global filtration and drying equipment market size is expected to reach USD 2.79 billion by 2032.

The global filtration and drying equipment market is expected to grow at a CAGR of 8.3% during the forecast period.

Asia Pacific regions is leading the global market.

Stringent Regulatory Standards are the key driving factors in Filtration and Drying Equipment Market.