Fire Alarm and Detection Market Size, Share, Trends, Industry Analysis Report

: By Product (Detectors and Alarm), By Detector Type, By Alarm Type, By Application, and By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 125

- Format: PDF

- Report ID: PM3572

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

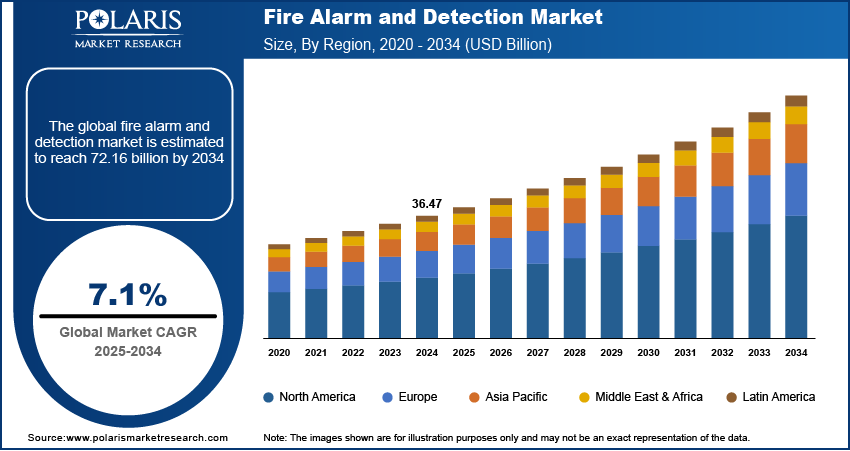

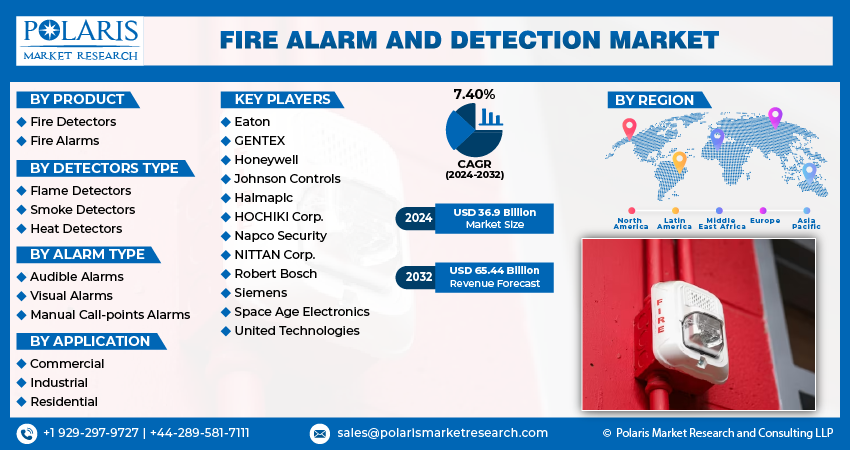

The fire alarm and detection market size was valued at USD 36.47 billion in 2024, exhibiting a CAGR of 7.1% during the forecast period. The market is driven by rising adoption across educational, residential, and commercial sectors, strict government regulations, rapid urbanization, technological advancements, and the expanding industrial and manufacturing landscape, demanding reliable fire safety infrastructure.

Key Insights

The smoke detectors segment is experiencing strong growth due to its affordability, early warning capabilities, and widespread use across residential, commercial, and industrial settings, especially as stricter fire codes and smart detection technologies gain momentum.

The fire detectors segment leads the market due to its crucial role in early hazard detection, with regulatory support and rising safety awareness driving consistent demand across all sectors.

In North America, the market is driven by stringent fire safety regulations, smart technology adoption, and insurance incentives favoring advanced detection systems, especially in the U.S. and Canada.

In Asia Pacific, rapid urbanization, smart city initiatives, and industrial growth are fueling high demand for modern fire alarm systems, particularly in countries such as China, Japan, and South Korea.

Industry Dynamics

Increased fire safety enforcement in public and private buildings is pushing adoption of certified fire alarms and detection systems globally.

Growing fire risk awareness in residential, commercial, and educational sectors is driving demand for advanced fire detection technologies.

Smart technology integration in fire systems creates new demand for connected, automated safety solutions across buildings and infrastructure.

Integration with legacy systems in older industrial facilities can be complex and costly, limiting immediate adoption of advanced solutions.

Market Statistics

2024 Market Size: USD 36.47 billion

2034 Projected Market Size: USD 72.16 billion

CAGR (2025–2034): 7.1%

North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

Fire alarm and detection systems are safety devices designed to identify signs of fire such as smoke, heat, or flames and alert occupants through alarms. These systems help save lives and prevent damage by enabling quick response and evacuation.

Increasing adoption of fire safety equipment in educational institutions and the rising recognition of fire detection in residential and commercial sectors are expected to drive the demand for fire alarms and detection. The market growth is fueled by advancements in technology, heightened awareness of fire safety, urbanization, and industrialization. The growth of commercial and industrial sectors and rising awareness about fire safety are creating a favorable environment for business growth in this industry.

Governments and safety authorities around the world are making fire safety laws stricter to protect lives and property. Buildings now need to meet specific codes and install fire alarm and detection systems as part of compliance. These regulations apply to residential buildings, offices, factories, hospitals, and schools, encouraging the use of modern fire detection technologies. Regular audits and penalties for non-compliance push businesses to invest in reliable systems. The demand for certified and high-quality fire alarms and detectors continues to grow as these safety standards become more widely enforced, driving industry expansion across both developed and developing regions.

Market Dynamics

Rising Urbanization

Rapid urbanization, especially in developing countries, is leading to increased construction of buildings, commercial complexes, factories, and public facilities. According to the World Bank, 57% of the world's population lives in urban areas as of 2023. There is a greater need for fire protection systems to ensure occupant safety and reduce fire-related damage as more structures are built. Governments and private developers are integrating fire alarm and detection systems into both new and renovated buildings. This is especially required for high-rise structures and large industrial plants where fire risk is higher. The expansion of real estate, smart cities, and infrastructure projects is fueling the adoption of fire detection technologies across multiple sectors, thereby driving market growth.

Expansion of Industrial and Manufacturing Sector

The industrial and manufacturing sector is growing globally, employing 15.6 million employees in the US alone, according to the US National Institute of Standards and Technology. The sectors involve processes that carry high fire risks, such as those using flammable materials, heavy machinery, or chemicals. To avoid costly damage and ensure worker safety, companies are required to install reliable fire alarm and detection systems. The need for strong fire safety infrastructure increases as these sectors grow, especially in emerging economies, thereby driving industry growth.

Segment Analysis

Market Assessment by Detector Type

The fire alarm and detection market segmentation, based on detector type, includes flame detectors, smoke detectors, and heat detectors. The smoke detectors segment is expected to witness significant growth during the forecast period. Smoke detectors are widely used in residential, commercial, and industrial buildings as they provide early warnings, helping prevent fire-related damage and loss of life. Their affordability, easy installation, and effectiveness in fire stopping materials at an early stage make them a preferred choice. Growing awareness about fire safety, stricter building codes, and increasing urbanization are driving their demand. Technological advancements, such as smart and interconnected smoke detectors, are also boosting their adoption across sectors.

Market Evaluation by Product

The market segmentation, based on product, includes fire detectors and fire alarms. The fire detectors segment dominated the fire alarm and detection market share in 2024. Fire detectors play a crucial role in detecting potential hazards such as gas leaks that could lead to fire accidents. Regulations implemented in various countries that promote the adoption of fire detectors are significant factors driving product sales. Increasing emphasis on fire safety regulations and the recognition of the importance of early detection in preventing fire incidents are further driving the demand for fire detectors. The demand for fire detectors is expected to remain robust in the coming years due to these favorable regulatory environments.

Regional Insights

By region, the study provides the fire alarm and detection market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America dominated the market due to strict fire safety regulations and high awareness of fire protection. The US and Canada have well-established fire safety codes that require the installation of fire alarms in residential, commercial, and industrial buildings. Frequent upgrades in safety infrastructure, adoption of smart technologies, and the presence of major fire safety companies support continued growth. Insurance policies that favor buildings with advanced safety systems also encourage market expansion. The region’s focus on smart buildings and technological innovation further drives demand for modern fire detection systems in North America.

The Asia Pacific fire alarm and detection market is expected to record the highest CAGR during the forecast period due to urbanization, rising infrastructure development, and growing awareness of fire safety. Countries such as China, Japan, South Korea, and Australia are leading in adopting advanced fire protection systems across commercial and industrial facilities. Demand for reliable detection systems is increasing with expanding manufacturing sectors and government focus on building safety. Smart city projects and growing investments in modern construction further boost the adoption of fire detection systems, thereby driving the market growth in Asia Pacific.

In India, fire detector demand is growing rapidly, driven by urban expansion, rising fire safety awareness, and government regulations. Increased construction of residential and commercial buildings, along with infrastructure growth, has raised the demand for fire detection solutions. The “Make in India” initiative and local manufacturing of fire safety products are also boosting availability and affordability. Sectors such as healthcare, education, retail, and industrial plants are actively adopting fire alarm systems to meet safety norms, thereby driving the market growth.

Key Players and Competitive Analysis

The fire alarm and detection market opportunity is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development, and advanced techniques. These companies pursue strategic initiatives such as mergers and acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the industry by introducing innovative products to meet the demand of specific sectors. The competitive trend is amplified by continuous progress in product offerings. A few major players in the market include Eaton, GENTEX, Honeywell, Johnson Controls, Halmaplc, HOCHIKI Corp., Napco Security, NITTAN Corp., Robert Bosch, Siemens, Space Age Electronics, and United Technologies.

Eaton is an intelligent power management company that provides power solutions through industry-leading aerospace, electrical, vehicle, and hydraulic products and services. The energy-efficient products and services enable customers to effectively manage hydraulic, electrical, and mechanical power. The company’s products and services are categorized under various business segments, including electrical Americas and global, aerospace, vehicle, emobility, and hydraulics. The company offers multiple products, including actuators and motion control, clutches and brakes, cylinders, electric circuit protection, energy storage systems, hydraulic motors & generators, lighting and controls, plastics, pumps, utility & grid solutions, valves, and others. In addition, it provides various services for electrical and power management, including consulting services, engineering studies, design and analysis, grid modernization, power systems automation and control, preventive maintenance, and other turnkey electrical services. Eaton provides advanced fire detection systems designed to quickly identify and alert occupants to fire hazards, supporting safety in commercial and industrial environments with reliable sensors, alarms, and control panels.

Honeywell International Inc. is a multinational conglomerate corporation headquartered in Charlotte, North Carolina. The company offers the products in four areas, including building technologies, aerospace, safety & productivity solutions (SPS), and performance materials and technologies (PMT). Honeywell Aerospace provides aircraft engines, avionics, flight management systems, and services to airlines, airports, manufacturers, space programs, and the military. Moreover, in 2020, the company acquired Ballard Unmanned Systems to expand the product portfolio of the aerospace segment. It operates for various industries such as aerospace and travel, commercial real estate, energy, healthcare, life sciences, logistics & warehouse, retail, and utilities. The Home and Building Technologies segment offers products, solutions, software, and technologies that help customers of homes stay in control and connected to their comfort, energy, and security. The Performance Materials and Technologies segment manufactures and develops process technologies, materials, and automation solutions. Moreover, the Safety and Productivity Solutions segment provides software, products, and connected solutions, including footwear and personal protection equipment designed for play, work, and outdoor activities. Honeywell offers a comprehensive range of fire detection, alarm, and gas-based suppression systems, providing reliable, compliant fire protection and rapid emergency response for buildings of any size or complexity.

List of Key Companies in Fire Alarm and Detection Market

- Eaton

- GENTEX

- Halmaplc

- HOCHIKI Corp.

- Honeywell

- Johnson Controls

- Napco Security

- NITTAN Corp.

- Robert Bosch

- Siemens

- Space Age Electronics

Fire Alarm and Detection Industry Developments

In July 2024, Veiga, a world-class fire alarm and detection system, was launched by HFI, designed and manufactured in India to meet local fire safety needs using globally proven technologies and standards.

In June 2024, Bosch Building Technologies inaugurated first India-based assembly line for AVENAR fire detectors in Naganathapura, reinforcing the company’s ‘Make in India’ commitment and enhancing local production capabilities.

Fire Alarm and Detection Market Segmentation

By Product Outlook (Revenue USD Billion, 2020–2034)

- Fire Detectors

- Fire Alarms

By Detector Type Outlook (Revenue USD Billion, 2020–2034)

- Flame Detectors

- Smoke Detectors

- Heat Detectors

By Alarm Type Outlook (Revenue USD Billion, 2020–2034)

- Audible Alarms

- Visual Alarms

- Manual Call-points Alarms

By Application Outlook (Revenue USD Billion, 2020–2034)

- Commercial

- Industrial

- Residential

By Regional Outlook (Revenue USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Fire Alarm and Detection Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 36.47 billion |

|

Market Size Value in 2025 |

USD 38.99 billion |

|

Revenue Forecast by 2034 |

USD 72.16 billion |

|

CAGR |

7.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 36.47 billion in 2024 and is projected to grow to USD 72.16 billion by 2034.

The global market is projected to register a CAGR of 7.1% during the forecast period.

North America held the largest share of the global market in 2024.

A few key players in the market are Eaton, GENTEX, Honeywell, Johnson Controls, Halmaplc, HOCHIKI Corp., Napco Security, NITTAN Corp., Robert Bosch, Siemens, Space Age Electronics, and United Technologies.

The fire detectors segment dominated the market in 2024, as fire detectors play a crucial role in detecting potential hazards such as gas leaks that could lead to fire accidents.

The smoke detectors segment is expected to witness significant growth during the forecast period as they are widely used in residential, commercial, and industrial buildings because they provide early warnings.