Flow Cytometry Market Size, Share, Trends, Industry Analysis Report

By Offering (Instruments, Reagents & Consumables, Software, Accessories, Service), By Technology, By Application, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 128

- Format: PDF

- Report ID: PM1914

- Base Year: 2024

- Historical Data: 2020-2023

Overview

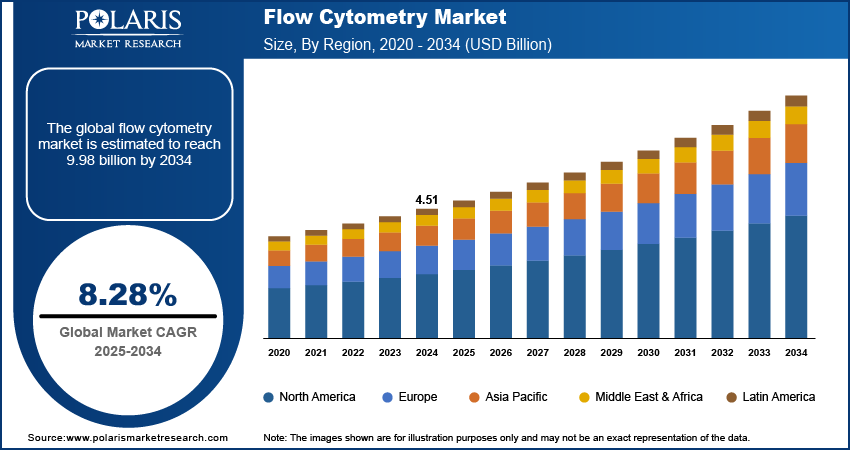

The global flow cytometry market size was valued at USD 4.51 billion in 2024, growing at a CAGR of 8.28% from 2025 to 2034. Key factors driving demand for flow cytometry include expanding healthcare spending, advancements in flow cytometry technology, and the rising prevalence of chronic diseases.

Key Insights

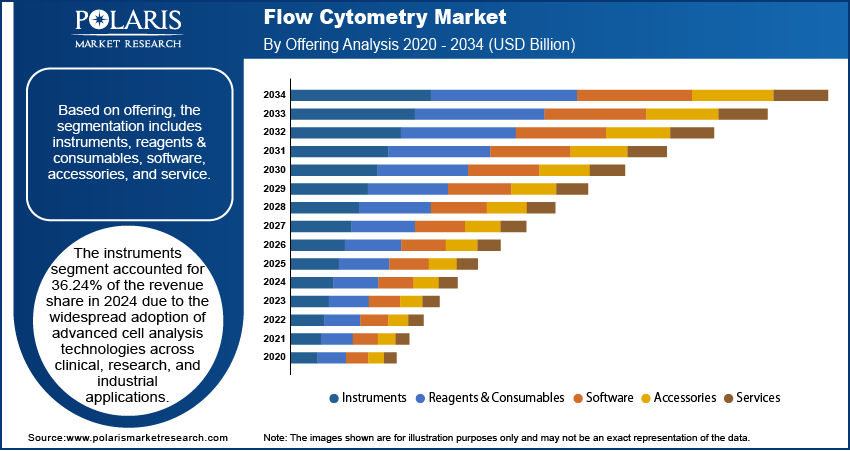

- The instruments segment accounted for 36.24% of the revenue share in 2024 due to growing usage of advanced cell analysis technologies across clinical and research settings.

- The cell-based segment held 75.42% of the revenue share in 2024 due to the flow cytometry application in immunology and oncology.

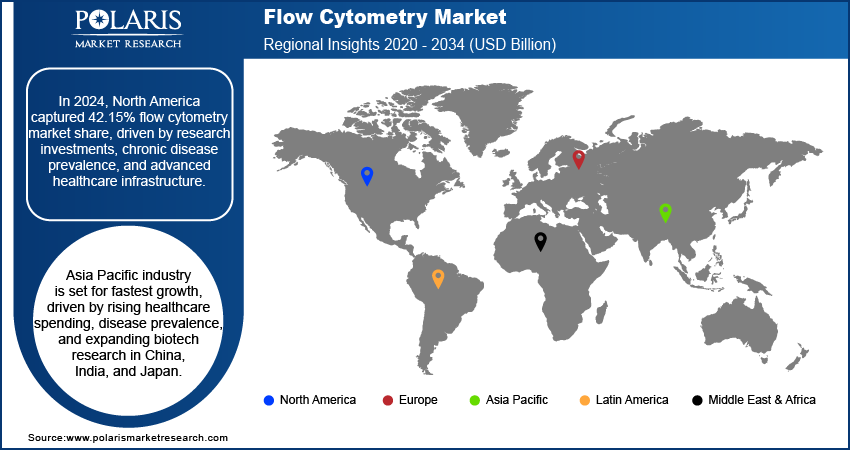

- North America accounted for a 42.15% share of the global flow cytometry market revenue in 2024, due to strong investments in biomedical research.

- The demand for flow cytometry in Germany is being driven by its strong biotechnology and pharmaceutical sectors.

- The industry in Asia Pacific is projected to grow at the fastest pace in the coming years, owing to the rising prevalence of infectious and chronic diseases.

Industry Dynamics

- The expanding healthcare spending is fueling the demand for flow cytometry by encouraging healthcare providers to invest in high-throughput flow cytometry systems for faster, more accurate disease detection and immune monitoring.

- Advancements in flow cytometry technology are driving adoption in hospitals, biotech firms, and academic labs.

- The rising investments in cancer research across the globe fuel the growth of the flow cytometry market.

- The high cost associated with flow cytometry restrains the market growth.

Market Statistics

- 2024 Market Size: USD 4.51 Billion

- 2034 Projected Market Size: USD 9.98 Billion

- CAGR (2025–2034): 8.28%

- North America: Largest Market Share

AI Impact on Flow Cytometry Market

- AI tools enable real-time, high-throughput analysis of cellular images, which improves accuracy and uncovers subtle patterns in cell morphology and behavior.

- AI systems reduce the time and expertise required to interpret complex datasets. It makes flow cytometry more accessible to non-specialists and expands its clinical utility.

- The technology helps model cellular responses to treatments, which accelerates drug screening and target validation in early-stage research.

Flow cytometry is an analytical technique used to measure and analyze the physical and chemical characteristics of cells or particles suspended in a fluid. It provides data on cell size, granularity, and biomarker expression. Flow cytometry enables the simultaneous analysis of thousands of cells per second, making it invaluable in immunology, oncology, and molecular biology for detailed cellular profiling.

Flow cytometry is widely used in clinical diagnostics, research, and drug development. It helps in immunophenotyping, cell sorting, apoptosis detection, and cell cycle analysis. Its ability to analyze multiple parameters simultaneously enhances disease diagnosis and monitors treatment efficacy. The benefits of flow cytometry include high-speed data acquisition, sensitivity, and versatility in handling diverse sample types. Advanced flow cytometers isolate specific cell populations for further study, making them crucial in biomedical research, hematology, and cancer immunotherapy development.

The global flow cytometry market growth is driven by the rising prevalence of chronic diseases. WHO said that by around 2050, chronic diseases such as cardiovascular diseases, cancer, diabetes, and respiratory illnesses are projected to account for 86% of the 90 million deaths each year. This is encouraging clinicians and researchers to rely on flow cytometry to diagnose, monitor, and study these chronic diseases. Flow cytometry enables detailed analysis of cell populations, helping identify disease-specific biomarkers, assess immune system function, and evaluate treatment efficacy for chronic diseases. Additionally, the rising prevalence of chronic diseases is creating the need for early detection and targeted therapies, further accelerating flow cytometry adoption.

Drivers & Opportunities

Expanding Healthcare Spending: Governments, hospitals, and research institutions across the globe are allocating more funds toward advanced diagnostic tools and precision medicine, which is encouraging healthcare providers to invest in high-throughput flow cytometry systems for faster, more accurate disease detection and immune monitoring. According to the UK Census Data 2021, total healthcare expenditure increased by 5.6% in nominal terms in 2023. Research laboratories and pharmaceutical companies worldwide are also benefiting from rising funding, using flow cytometry to accelerate drug discovery, clinical trials, and biomarker analysis. Therefore, as healthcare budgets grow, hospitals and diagnostic centers afford newer, more sophisticated flow cytometers, expanding their use in oncology, immunology, and infectious disease testing, leading to market growth.

Advancements in Flow Cytometry Technology: Innovations such as high-parameter spectral flow cytometry, automated sample handling, and AI-powered data analysis allow researchers and clinicians to detect rare cell populations, analyze complex immune responses, and streamline workflows with unprecedented precision. These improvements enable flow cytometry to support advanced fields such as CAR-T cell therapy, single-cell genomics, and personalized medicine, driving adoption in hospitals, biotech firms, and academic labs. Hence, as the technology becomes more powerful, user-friendly, and cost-effective, a broader range of industries, from cancer diagnostics to vaccine development, invest in flow cytometry systems, fueling market expansion.

Segmental Insights

Offering Analysis

Based on offering, the segmentation includes instruments, reagents & consumables, software, accessories, and service. The instruments segment accounted for 36.24% of the revenue share in 2024 due to widespread adoption of advanced cell analysis technologies across clinical, research, and industrial applications. Laboratories and healthcare institutions invested heavily in high-throughput analyzers and sorters equipped with multi-laser and multi-parameter capabilities to meet the growing demand for precise cellular diagnostics and immunophenotyping. The increasing prevalence of cancer and infectious diseases, along with the integration of automation and AI-driven data acquisition in modern analyzers, further fueled the need for sophisticated instruments. Additionally, the rising adoption of point-of-care and compact systems in emerging countries contributed to the segment’s dominance.

The software segment is projected to grow at a robust pace in the coming years, owing to the expansion of high-dimensional and multiparametric studies. Innovations in cloud-based analytics, machine learning algorithms, and interoperability with laboratory information systems are transforming how users manage and interpret complex cellular datasets. Moreover, the push for personalized medicine and biomarker discovery is encouraging the development of customizable and automated software tools, leading to segment growth.

Technology Analysis

In terms of technology, the segmentation includes cell-based and bead-based. The cell-based segment held 75.42% of the revenue share in 2024 due to its broad application in immunology, oncology, and infectious disease research. Researchers and clinicians preferred this technology for its ability to provide high-resolution, single-cell analysis, enabling detailed insights into cellular functions, viability, and protein expression. The increasing use of cell-based assays in drug discovery, stem cell research, and clinical diagnostics boosted demand. Moreover, the growing adoption of cell-based techniques in clinical trials and personalized medicine, combined with technological advancements in high-throughput systems, contributed to the dominance of the segment.

Application Analysis

In terms of application, the segmentation includes research, industrial, and clinical. The clinical segment accounted for 43.16% of revenue share in 2024 due to increasing demand for precise diagnostic tools in hematology, oncology, and infectious disease management. Hospitals and diagnostic laboratories widely adopted cytometric technologies for immunophenotyping, leukemia and lymphoma diagnosis, and monitoring of HIV progression. The growing burden of chronic diseases, particularly cancer and autoimmune disorders, compelled healthcare providers to rely on highly sensitive and rapid cell analysis methods. Furthermore, the expanding use of cytometric techniques in transplantation monitoring and minimal residual disease detection supported the segment’s adoption in both developed and emerging healthcare systems.

The research segment is projected to grow at a rapid pace during the forecast period, owing to rising investments in life sciences and biotechnology research. Academic institutions, pharmaceutical companies, and government-funded laboratories are increasingly utilizing advanced cellular analysis tools for applications such as drug discovery, stem cell analysis, and immunological studies. Additionally, the growing focus on precision medicine and the development of novel therapeutics continues to boost demand for flow cytometry in research centers.

End Use Analysis

In terms of end use, the segmentation includes commercial organizations, hospitals, academic institutes, and clinical testing labs. The clinical testing labs segment is estimated to grow at a robust pace in the coming years, owing to the rising need for accurate and rapid diagnostic solutions. Independent labs and reference testing centers are increasingly deploying cytometric systems to conduct immunophenotyping, hematological malignancy detection, and infectious disease monitoring with high precision. The surge in chronic and infectious diseases, coupled with the global push for early diagnosis and personalized treatment strategies, continues to drive the expansion of clinical lab services. Moreover, advancements in automation and standardization have improved workflow efficiency, enabling labs to deliver high-throughput testing with greater consistency and reliability.

Regional Analysis

The North America flow cytometry market accounted for 42.15% of global revenue share in 2024. This dominance is attributed to strong investments in biomedical research, a high prevalence of chronic diseases such as cancer and HIV, and advanced healthcare infrastructure. According to U.S. Cancer Statistics, 36.7 million new cancer cases were reported in the U.S. between 2003 and 2022. The region is a hub for pharmaceutical and biotechnology companies that utilize flow cytometry for drug discovery, immunophenotyping, and clinical diagnostics in 2024. Additionally, government funding for life sciences research and the presence of major players such as BD Biosciences and Thermo Fisher Scientific further propelled adoption. The growing emphasis on personalized medicine and the need for rapid, high-throughput cell analysis also contributed to market dominance.

U.S. Flow Cytometry Market Insights

The U.S. held the largest revenue share in the North America flow cytometry landscape in 2024, due to the presence of academic and research institutions, along with significant NIH funding for immunology and oncology studies. The increasing incidence of cancer and infectious diseases necessitated advanced diagnostic tools, boosting the adoption of flow cytometry in clinical labs. Additionally, the rise in stem cell research, the development of novel monoclonal antibodies, and the FDA’s approval of flow cytometry-based assays for minimal residual disease (MRD) detection propelled the demand for flow cytometry.

Europe Flow Cytometry Market Trends

The market in Europe is projected to hold a substantial revenue share in 2034 due to rising government and private funding for life sciences research, particularly in immunology and hematology. The increasing prevalence of autoimmune diseases and cancer, along with the growing adoption of cell-based therapies, is driving demand for flow cytometry in Europe. The European Medicines Agency (EMA) and other regulatory bodies in the region are supporting the use of flow cytometry in clinical trials and diagnostics. Additionally, collaborations between academic institutions and biotech firms, along with the presence of major players such as Beckman Coulter and Miltenyi Biotec, are contributing to market growth.

Germany Flow Cytometry Market Overview

The demand for flow cytometry in Germany is being driven by its strong biotechnology and pharmaceutical sectors. The country’s advanced healthcare system, high R&D expenditure, and increasing focus on precision medicine are also propelling demand. Germany is a major country in cancer research, with flow cytometry playing a crucial role in leukemia and lymphoma diagnostics. The presence of prominent academic research centers and companies is supporting innovation. Additionally, the growing use of flow cytometry in stem cell research and CAR-T cell therapy development is further boosting market growth.

Asia Pacific Flow Cytometry Market Assessment

The industry in Asia Pacific is projected to grow at the fastest pace in the coming years, owing to increasing healthcare expenditure, rising prevalence of infectious and chronic diseases, and expanding biotechnology research in countries such as China, India, and Japan. The share of government health expenditure in the total health expenditure of India between FY15 and FY22 has increased from 29.0% to 48.0%. The growing pharmaceutical industry, government initiatives to improve healthcare infrastructure, and increasing academic-industry collaborations are driving the adoption of flow cytometry. Additionally, the rise in clinical trials and the need for affordable diagnostic solutions are contributing to market expansion.

Key Players & Competitive Analysis

The flow cytometry market is highly competitive, with key players such as BD, Thermo Fisher Scientific, and Bio-Rad Laboratories dominating due to their extensive product portfolios, advanced technological innovations, and strong global distribution networks. Agilent Technologies and Sysmex Corporation are also significant competitors, leveraging their expertise in diagnostics and life sciences to offer high-throughput and automated flow cytometry solutions. Emerging companies such as Cytek Biosciences and Sony Biotechnology are gaining attraction with spectral flow cytometry and compact, user-friendly systems, challenging traditional market leaders. Miltenyi Biotec specializes in cell sorting and immunology applications, while Apogee Flow Systems and Stratedigm focus on niche segments like nanoparticle analysis and portable flow cytometers. Additionally, DH Life Sciences provides cost-effective alternatives, appealing to budget-conscious research labs. The competitive landscape is further intensified by continuous R&D investments, strategic acquisitions, and partnerships aimed at expanding product capabilities and market reach.

A few major companies operating in the flow cytometry industry include Agilent Technologies, Inc.; Apogee Flow Systems Ltd.; BD; Bio-Rad Laboratories, Inc.; Cytek Biosciences; DH Life Sciences, LLC; Miltenyi Biotec; Sony Biotechnology Inc.; Stratedigm, Inc.; Sysmex Corporation; and Thermo Fisher Scientific, Inc.

Key Players

- Agilent Technologies, Inc.

- Apogee Flow Systems Ltd.

- BD

- Bio-Rad Laboratories, Inc.

- Cytek Biosciences

- DH Life Sciences, LLC

- Miltenyi Biotec

- Sony Biotechnology Inc.

- Stratedigm, Inc.

- Sysmex Corporation

- Thermo Fisher Scientific, Inc.

Flow Cytometry Industry Developments

In May 2025, Cytek Biosciences, Inc., announced the launch of the Cytek Aurora Evo system, a new full-spectrum flow cytometer.

In March 2025, Beckman Coulter Life Sciences, an Operating Company of Danaher Corporation, introduced the industry’s first modular solution: the CytoFLEX mosaic Spectral Detection Module.

In May 2023, Sysmex Corporation announced the launch of its Clinical Flow Cytometry1 System, Flow Cytometer XF-1600, Sample Preparation System PS-10, antibody reagents, and other related products in Japan.

Flow Cytometry Market Segmentation

By Offering Outlook (Revenue, USD Billion, 2020–2034)

- Instruments

- Reagents & Consumables

- Software

- Accessories

- Service

By Technology Outlook (Revenue, USD Billion, 2020–2034)

- Cell-based

- Bead-based

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Research

- Industrial

- Clinical

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Commercial Organizations

- Hospitals

- Academic Institutes

- Clinical Testing Labs

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Flow Cytometry Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 4.51 Billion |

|

Market Size in 2025 |

USD 4.88 Billion |

|

Revenue Forecast by 2034 |

USD 9.98 Billion |

|

CAGR |

8.28% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 4.51 billion in 2024 and is projected to grow to USD 9.98 billion by 2034.

The global market is projected to register a CAGR of 8.28% during the forecast period.

North America dominated the market in 2024.

A few of the key players in the market are Agilent Technologies, Inc.; Apogee Flow Systems Ltd.; BD; Bio-Rad Laboratories, Inc.; Cytek Biosciences; DH Life Sciences, LLC; Miltenyi Biotec; Sony Biotechnology Inc.; Stratedigm, Inc.; Sysmex Corporation; and Thermo Fisher Scientific, Inc.

The instruments segment dominated the market revenue share in 2024.

The clinical testing labs segment is projected to witness the fastest growth during the forecast period.