Food Amino Acids Market Share, Size, Trends, & Industry Analysis Report By Product (Lysine, Glutamic Acid, Methionine, Tryptophan, Others); By Source; By Application; By Region; Segment Forecast, 2025 - 2034

- Published Date:May-2025

- Pages: 115

- Format: PDF

- Report ID: PM1123

- Base Year: 2024

- Historical Data: 2020-2023

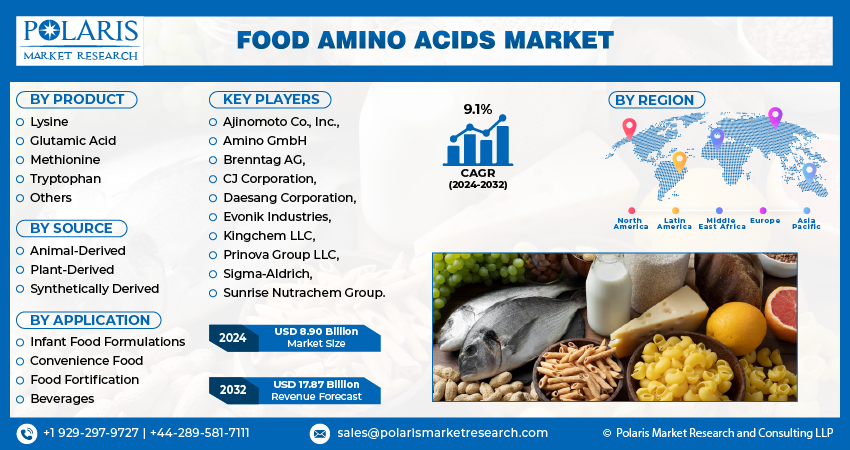

The global food amino acids market was valued at USD 8.6 billion in 2024 and is projected to grow at a CAGR of 7.50% from 2025 to 2034. The market is driven by the rising demand for dietary supplements and functional foods that promote health and wellness.

Food Amino Acids Market Overview

The market for food amino acids is experiencing growth driven by the rising consumer awareness of the health benefits associated with amino acids. Increased demand for food products rich in amino acids is a direct result of this awareness. Additionally, the need for protein supplementation in diets and the rising prevalence of disorders related to sedentary lifestyles are significant contributors to the expanding market for food amino acids. These factors serve as crucial drivers, propelling market growth.

A total of nine amino acids are considered essential for the human body, which are known as complete proteins. There are some foods that contain all the nine amino acids, such as beef, eggs, soy, fish, etc. Some people often prefer to take amino acids through supplements, which often boost athletic performance and help the body relax and develop a good mood. The usage of supplements for taking all nine amino acids is a major growth driver for the amino acids market.

The research study provides a comprehensive analysis of the industry, assessing the market on the basis of various segments and sub-segments. It sheds light on the competitive landscape and introduces Food Amino Acids Market key players from the perspective of market share, concentration ratio, etc. The study is a vital resource for understanding the growth drivers, opportunities, and challenges in the industry.

To Understand More About this Research:Request a Free Sample Report

Amino acids are molecules used by all living beings to make proteins. These proteins are further broken down in the digestive system to make amino acids. The body further utilizes these amino acids for doing certain activities such as transporting nutrients, building muscles, preventing diseases, perform other tasks. Not having proper intake of amino acids can lead to various conditions, which include digestive problems, infertility, depression, decline in mental alertness, weak immune system, and various other health issues.

Due to more awareness about health, as the past years have been tough due to covid-19 for, many people who struggled due to weak immune systems are now inclined towards following a protein-rich diet with the use of dietary supplements. Due to this, there is an increase in demand for supplements, which has created a huge potential for industry growth.

Food Amino Acids Market Dynamics

- Market Drivers

- Increase in the health awareness in consumers which likely to spur the market

Due to the recent COVID-19 pandemic situation, people are now more health conscious and are using supplements, which are driving the market. Completing the total protein intake required to lead a healthy life is boosting the use of supplements. Amino acids, mainly branched chain-amino acids (BCAAs), are very popular in sports nutritional products due to their efficiency in muscle recovery and increased performance.

BCAAs are widely used as a pre-workout or during-workout alternative by athletes and gym-going people, which has created a huge potential in the market for food amino acids. Positive results are attracting a huge population towards food amino acid products.

The increased demand for amino acid-rich products is driving the demand for amino acid-enriched products. The increasing market demand for vegetarian supplements is fueled by the recognition that non-vegetarian foods predominantly serve as complete protein sources, containing all nine essential amino acids. This shift underscores a growing preference for plant-based alternatives among consumers.

Market Restraints

- High cost of production of amino acids may hamper the market growth

Higher cost of production not only hampers the company to produce products at a much higher rate but also restrains them to sell it at a higher price for earning profit. Certain amino acids are found to be produced at a high cost, which directly affects the price of the final product. Due to the increased cost of production, there are limitations to the widespread of amino acids in different products. Despite the increased awareness, there might be a lack of knowledge among consumers about the specific benefits of amino acids. Limited awareness could affect the market growth as consumers may not actively look for amino acid enriched products as they would cost much higher.

Report Segmentation

The market is primarily segmented based on product, source, application, and region

|

By product |

By source |

By application |

By Region |

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

Food Amino Acids Market Segmental Analysis

By Product Analysis

The glutamic acid segment exhibited the most significant revenue share of the market. Anticipated to contribute to the upward trajectory of the food amino acids market is the growing utilization of glutamic acid as a flavor enhancer in diverse diets and beverages. The incorporation of glutamate enhances the taste profile, leading to increased consumption. The market for food amino acids is expected to be propelled using glutamic acid as a flavor enhancer in various food and beverage products, including sauces, snacks, and ready-to-eat soups.

The lysine segment is anticipated to grow at the fastest rate over the forecast period. The major sources of lysine are red meat, pork, and poultry. It has limited consumer segmentation as it is found in non-vegetarian food. Its vegetarian alternatives are soybeans, fenugreek seeds, tofu, etc.

By Source Analysis

Plant based amino acids are forecasted to grow fastest at a much higher rate due to the increased awareness for animal welfare, a huge population is shifting towards plant based amino acids as they are adopting vegetarian and vegan diets to complete their daily intake of protein. Beans, nuts, seeds, quinoa, whole grains, buckwheat, and soy are the rich source of plant-based amino acids.

Animal based amino acids have the largest share. They include milk, milk products, eggs, meat, poultry, and fish, which have a high number of amino acids, which have an outstanding score of 100% composition and 95 to 98% true protein digestibility. Their protein concentration is observed to increase after cooking. Eggs are the most cost efficient and natural complete protein option available in the market.

By Application Analysis

The convenience food segment is projected to experience the most rapid growth during the forecast period. The convenience and simplicity associated with these products contribute to a surge in global consumer demand. This category encompasses bakery and confectionery items, fast foods, premade salads, as well as meat, fish, sandwiches, and wraps. Convenience food products are very dynamic and customizable.

The increasing popularity of ready-to-eat products can be attributed to factors such as a rise in female workforce participation, increased adoption of household technologies, and a growth in consumer income. Additionally, factors like a burgeoning urban population, limited cooking skills, extended working hours, consumer preferences for nutritious and easily prepared items, along with a boost in disposable income and a heightened demand for snacks and fried products, are expected to propel the convenience food products forward.

Food Amino Acids Market Regional Insights

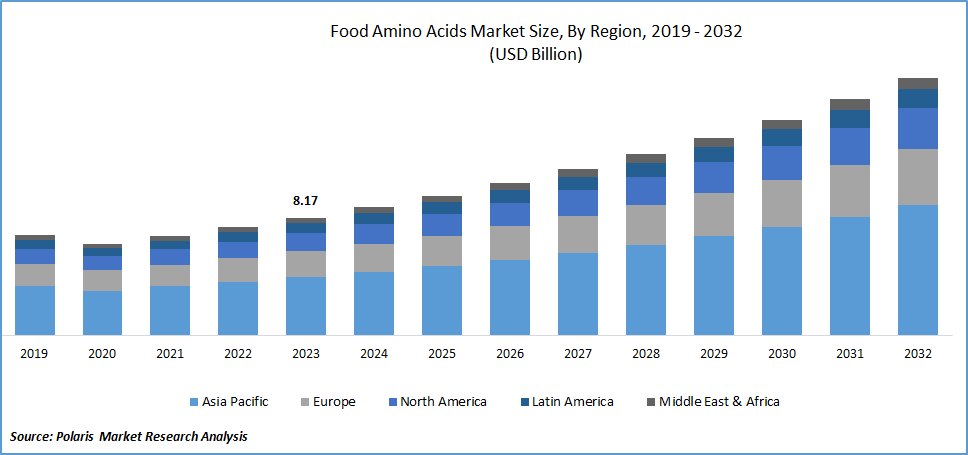

- Asia pacific region holds the largest share of the market in 2023

Asia Pacific region dominated the global market with largest share of the market, driven by the burgeoning economic development in emerging nations like India, Vietnam, South Korea, and other Southeast Asian countries. Poultry farming is getting a boost in Asian countries. Consumers in this region are increasingly adopting protein-rich diets, incorporating meat, eggs, vegetables, and milk-based products, thus fueling the demand for these amino acids. Additionally, the expanding Food and Beverage (F&B) sector, propelled by a growing population, heightened consumer health awareness, and the rising trend of integrating dietary supplements with food further contributes to the robust growth in this region.

Competitive Landscape

Intense competition among established market players presents a substantial obstacle for new entrants aspiring to join the market. Numerous players are already providing high-quality amino acid products to diverse end-users, encompassing food and beverage manufacturers, the pharmaceutical industry, dietary supplements manufacturers, and various others.

Some of major players operating in the industry include:

- Ajinomoto Co., Inc.,

- Amino GmbH

- Brenntag AG,

- CJ Corporation,

- Daesang Corporation,

- Evonik Industries,

- Kingchem LLC,

- Prinova Group LLC,

- Sigma-Aldrich,

- Sunrise Nutrachem Group.

Recent Developments

- In July 2024, Alpino Health Foods launched the world’s first 100% peanut-based protein powder, offering 24 grams of clean, plant-based protein per scoop, formulated in the Netherlands to meet India’s demand for natural, sustainable nutrition.

- In November 2023, a new powder methionine plant was proposed to be constructed by Adisseo in China, consisting of an annual production capacity of 150 kilotons. The operations of the plant are supposed to be started in 2027

- In January 2022, Merck KGaA entered a partnership with Absci to utilize the Bionic Protein non-standard amino acid technology in the production of custom enzymes designed for Merck's biomanufacturing applications. This collaboration enabled the company to expand its research initiatives.

Report Coverage

The food amino acids market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, product types, sources, applications, and their futuristic growth opportunities.

Food Amino Acids Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 9.25 billion |

|

Revenue forecast in 2034 |

USD 17.7 billion |

|

CAGR |

7.50% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

By product, By source, By applications, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

Explore the landscape of Food Amino Acids Market in 2024 through detailed market share, size, and revenue growth rate statistics meticulously organized by Polaris Market Research Industry Reports. This expansive analysis goes beyond the present, offering a forward-looking market forecast till 2032, coupled with a perceptive historical overview. Immerse yourself in the depth of this industry analysis by acquiring a complimentary PDF download of the sample report.

FAQ's

Food Amino Acids Market Size Worth $ 17.7 Billion By 2034.

The top market players in Food Amino Acids Market include Ajinomoto Co., Inc., Amino GmbH, Brenntag AG, CJ Corporation, Daesang Corporation.

Asia pacific is region contribute notably towards the Food Amino Acids Market

Food Amino Acids Market exhibiting the CAGR of 7.50% during the forecast period.

Food Amino Acids Market report covering key segments are product, source, application, and region.