Fructooligosaccharides Market Share, Size, Trends, Industry Analysis Report

By Source (Chicory, Sucrose); By Form; By Application; By Region; Segment Forecast, 2024- 2032

- Published Date:Jan-2024

- Pages: 114

- Format: PDF

- Report ID: PM4036

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

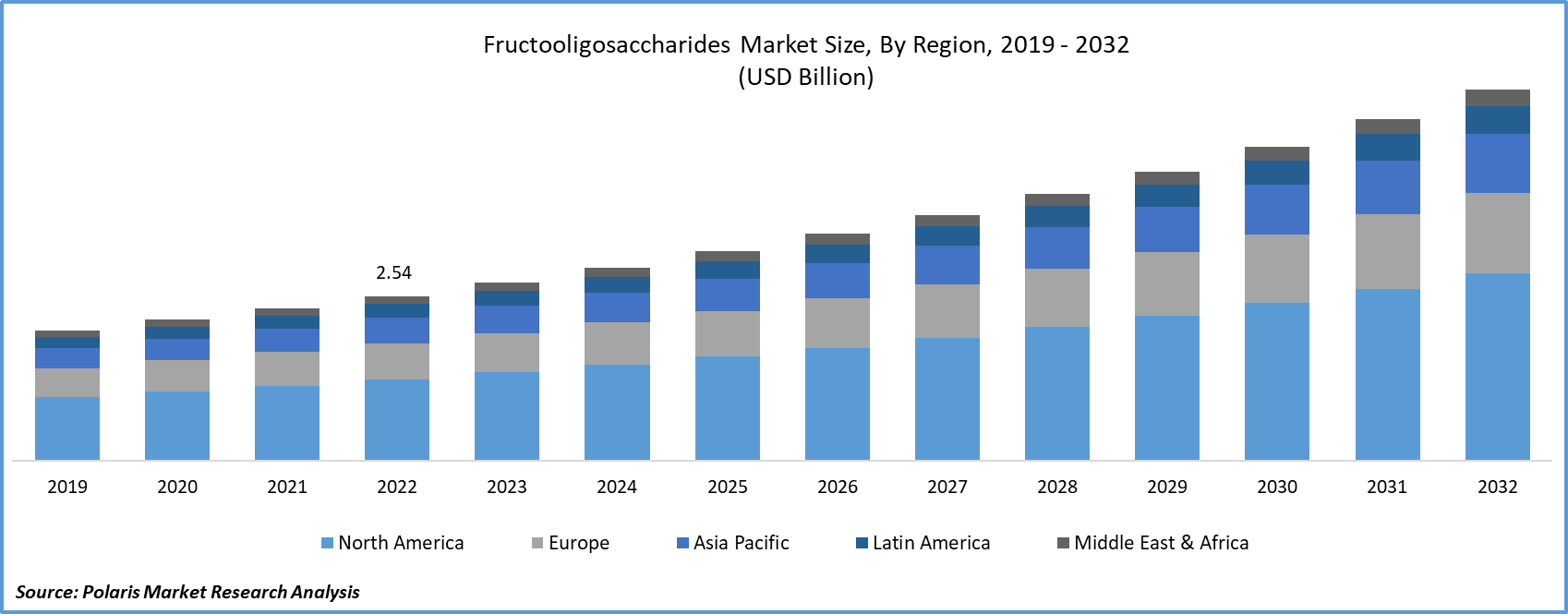

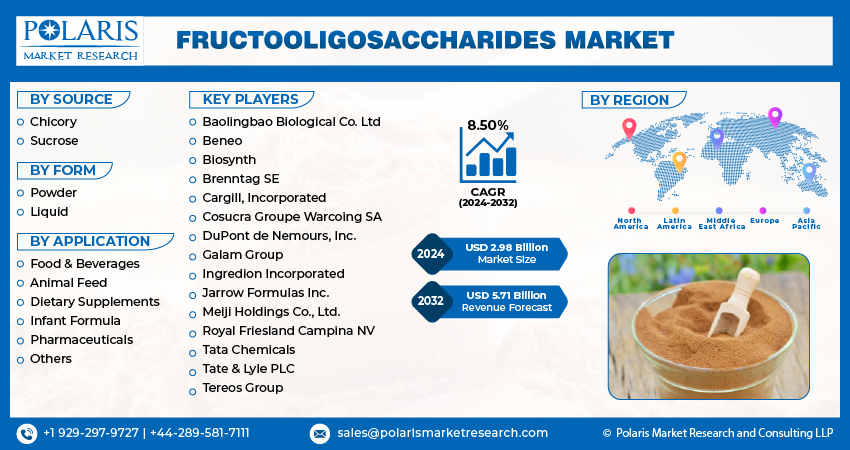

The global fructooligosaccharides (FOS) market was valued at USD 2.75 billion in 2023 and is expected to grow at a CAGR of 8.50% during the forecast period.

The industry for functional foods and dietary supplements is on the rise. FOS, as a versatile prebiotic, is being incorporated into a wide array of these products to enhance their health-promoting qualities. This is particularly appealing to consumers seeking holistic approaches to wellness.

To Understand More About this Research: Request a Free Sample Report

Regulatory authorities in several countries have granted recognition to FOS as safe food ingredients. This acknowledgment has paved the way for FOS to be more widely used in various food and beverage products, further bolstering their market potential.

Manufacturers have a promising opportunity to diversify their FOS product range. By offering different formulations and applications, they can cater to a broader and more discerning consumer base.

- In May 2023, Beneo introduced Beneo-scL85, a short-chain fructooligosaccharide (scFOS), further expanding its offerings in the market. The new product is developed to offer enhanced versatility in consumer sugar replacement and the enrichment of foods with dietary fiber.

Ongoing research into the health advantages of FOS and innovative product development has the potential to yield novel FOS-based products with enhanced functionality. This, in turn, can create fresh market opportunities. FOS can play a pivotal role in nutraceuticals and pharmaceuticals, addressing specific health concerns. This presents a growth opportunity for FOS in specialized applications within these sectors.

Post-COVID-19 pandemic, the fructooligosaccharides (FOS) market has seen significant transformations. Heightened health consciousness among consumers has driven demand for FOS, known for its prebiotic and digestive health benefits. FOS aligns with the trend for functional foods and dietary supplements focused on immune support, contributing to their growing incorporation into these products. Consumers now favor clean labels and natural ingredients, further enhancing FOS's appeal. Ongoing research and regulatory support, along with supply chain resilience and the convenience of online shopping, have collectively influenced the post-pandemic FOS market's evolution.

Growth Drivers

- Increase in health awareness, greater focus on wellness, and rise in demand for functional foods and weight management supplements is projected to spur the market demand

A growing awareness of the importance of health and well-being is one of the primary catalysts behind the expansion of the fructooligosaccharides market. Consumers are actively seeking health-promoting products, and FOS recognized for its prebiotic attributes, aligns perfectly with this trend.

Digestive health issues, such as irritable bowel syndrome and other gastrointestinal disorders, are becoming increasingly prevalent. FOS's role in nurturing a balanced gut microbiome has positioned it as a natural solution to address these concerns, thus fueling demand.

The global obesity epidemic continues to be a pressing concern. FOS can aid in weight management by inducing a sense of fullness and reducing overall calorie intake. Consequently, products enriched with FOS are gaining favor among individuals seeking effective weight management solutions.

Report Segmentation

The market is primarily segmented based on source, form, application, and region.

|

By Source |

By Form |

By Application |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Source Analysis

- Chicory segment accounted for a significant share in 2022

The chicory segment accounted for a significant share in 2022. Fructooligosaccharides (FOS) derived from chicory are natural, plant-based prebiotic fibers that have gained recognition for their potential health benefits. Chicory root, specifically the inulin extracted from it, is a primary source of FOS. FOS have a low glycemic index, meaning they have a minimal impact on blood sugar levels. This quality makes them appealing to individuals, including those with diabetes, looking for low-glycemic dietary options.

By Form Analysis

- Liquid form emerged as the largest segment in 2022

Liquid form emerged as the largest segment in 2022. Liquid Fructooligosaccharides (FOS) have found extensive utility across a spectrum of industries due to their distinct attributes and potential contributions to well-being. Within the domain of food and beverages, liquid FOS operates as a natural sweetener and functional component. It is commonly featured in items such as yogurt, dairy beverages, and energy bars, augmenting taste and consistency while facilitating an overall reduction in sugar content. Moreover, it plays a significant role in the bakery and confectionery sector by enhancing the quality, longevity, and flavor of products like cookies and cakes.

The dominance of liquid FOS stems from its effortless incorporation into diverse applications and its capacity to advance digestive health and overall health in human and animal contexts. Consequently, it stands as a versatile and invaluable constituent spanning the sectors of food, beverages, pharmaceuticals, and personal care.

By Application Analysis

- Infant formula segment accounted for a major share in 2022

The growing use of Fructooligosaccharides (FOS) in infant formula is a prominent trend, influenced by various factors. FOS, recognized as prebiotic fibers, are being incorporated into infant formula for their numerous benefits. FOS contributes to enhanced digestive health in infants. As prebiotics, they support the growth of beneficial gut bacteria, fostering a balanced gut microbiome. This is particularly critical for infants whose digestive systems are still developing.

Moreover, the nurturing of healthy gut microbiota by FOS can significantly bolster an infant's evolving immune system, helping them build stronger defenses against illnesses and infections. Scientific research continues to support the inclusion of FOS in infant nutrition, further motivating their use in formula products. Regulatory approval and the awareness of parents about the potential benefits of FOS also play a significant role in their increased adoption.

Regional Insights

- Europe emerged as the largest region in 2022

Europe emerged as the largest region in 2022. FOS are widely used as functional ingredients in various products, including food and beverages, dietary supplements, and pharmaceuticals. Europe is witnessing a surging demand for functional foods and dietary supplements. Consumers are actively seeking products that contribute to digestive health and overall well-being. FOS, recognized as prebiotic fibers, are frequently integrated into these products to improve gut health. The European Union maintains a robust regulatory framework for food and dietary supplement ingredients, including FOS. The European Food Safety Authority (EFSA) plays a pivotal role in evaluating health claims associated with ingredients, leading to the approval of specific health claims related to FOS.

North America is expected to experience significant growth during the forecast period. Consumers in the region are progressively placing a higher premium on their health and are actively on the lookout for products that can provide health advantages. FOS, renowned for its prebiotic attributes that support gut health and overall wellness, has gained substantial traction as a result. This has prompted their inclusion in a diverse array of food and dietary offerings to meet this burgeoning consumer demand. The market for functional foods and dietary supplements is experiencing a robust upswing in the U.S. Many enterprises are integrating FOS into their product lines to create functional foods and supplements designed to cater to consumers actively seeking health-enhancing options.

Key Market Players & Competitive Insights

The fructooligosaccharides sector displays a fragmented landscape and has heightened competition due to the active involvement of numerous players. Key companies in this industry consistently introduce innovative products as a strategic move to strengthen their market position. These industry frontrunners prioritize initiatives such as forming partnerships, improving product portfolios, and nurturing collaborations to gain a competitive edge over their peers and establish a significant presence in the market.

Some of the major players operating in the global market include:

- Baolingbao Biological Co. Ltd

- Beneo

- Biosynth

- Brenntag SE

- Cargill, Incorporated

- Cosucra Groupe Warcoing SA

- DuPont de Nemours, Inc.

- Galam Group

- Ingredion Incorporated

- Jarrow Formulas Inc.

- Meiji Holdings Co., Ltd.

- Royal Friesland Campina NV

- Tata Chemicals

- Tate & Lyle PLC

- Tereos Group

Recent Developments

- In June 2022, Tate & Lyle PLC acquired Quantum Hi-Tech Biological Co., Ltd. The acquisition is aimed at enhancing the company’s product offerings, while strengthening its presence in China and other parts of Asia.

- In January 2022, Galam announced investment plans worth $30 million for launch of a production plant for its prebiotic GOFOS.

Fructooligosaccharides Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 2.98 billion |

|

Revenue forecast in 2032 |

USD 5.71 billion |

|

CAGR |

8.50% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019-2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Source, By Form, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |