Gas Turbine Market Size, Share, & Industry Analysis Report

: By Capacity (≤200 MW and >200 MW), By Technology, By End Use, and By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 112

- Format: PDF

- Report ID: PM2455

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

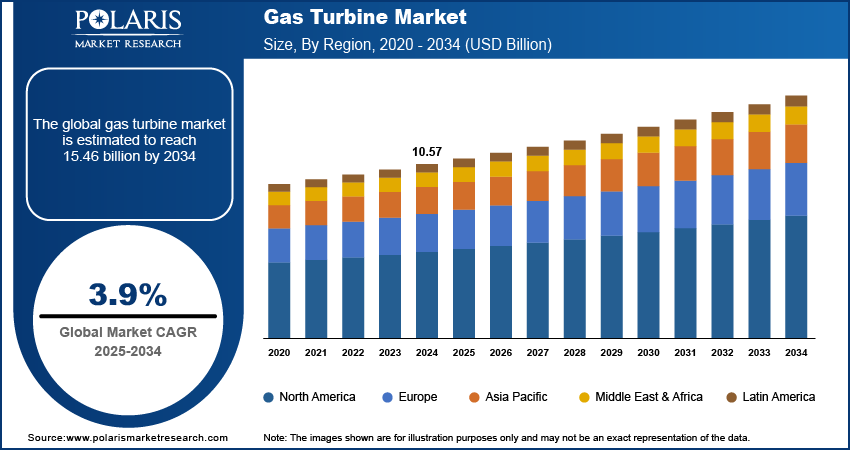

The gas turbine market size was valued at USD 10.57 billion in 2024. It is projected to grow from USD 10.95 billion in 2025 to USD 15.46 billion by 2034, exhibiting a CAGR of 3.9% during 2025–2034. The gas turbine market encompasses a range of combustion engines that convert chemical energy into mechanical energy, primarily using natural gas. These turbines are integral to various sectors, including power generation, aviation, and industrial operations, owing to their efficiency, dependability, and ability to operate with lower emissions compared to traditional fossil fuel plants. The industry is witnessing substantial growth, driven by increasing global energy demand, especially in developing nations, and the industry transition toward more sustainable energy sources. Gas turbines offer a flexible and reliable solution for meeting rising electricity needs, aligning with the global shift toward cleaner energy.

Key Insights

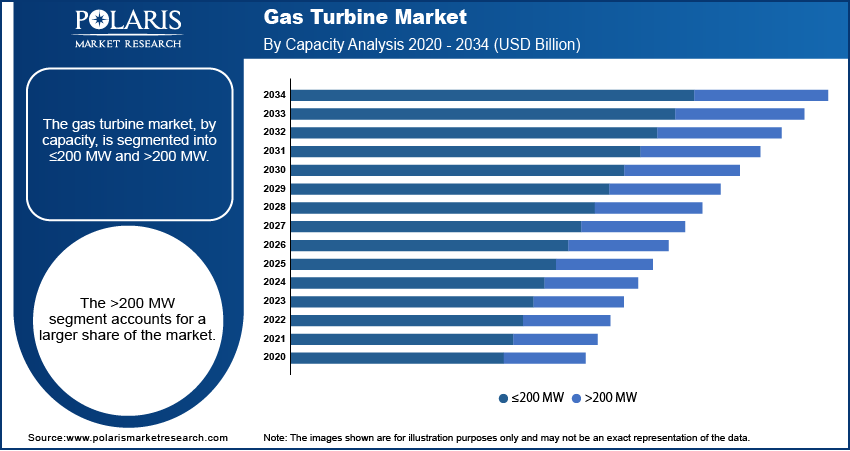

- By capacity, the >200 MW capacity gas turbines held the largest share in 2024. This dominance is primarily driven by the increasing need for large-scale and high-power output.

- By technology, the combined cycle technology held the largest share in 2024 due to its significantly higher operational efficiency.

- By end-use, the power & utility segment held the largest share in 2024 due to the continuous rise in global electricity demand, and fueled by increasing population.

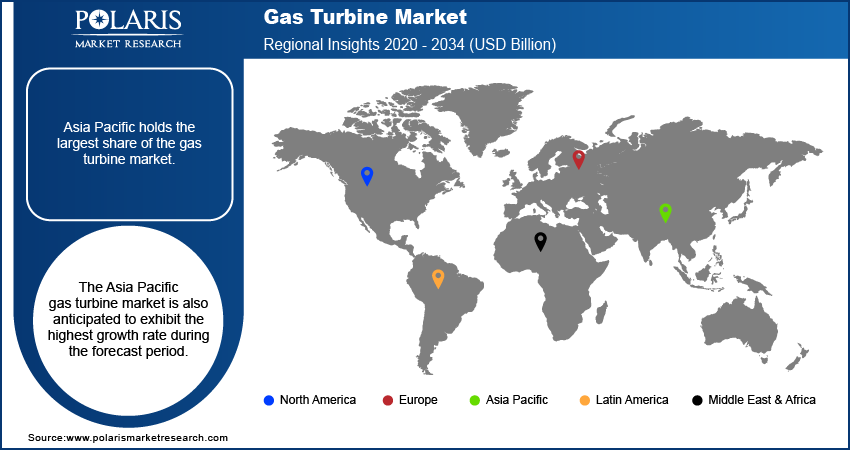

- By region, the Asia Pacific region held the largest share in 2024 due to rapid industrialization, increasing urbanization, and significant government and private sector investments.

Industry Dynamics

- The global push for cleaner energy solutions and tougher government regulations on carbon emissions is driving the shift from coal-fired plants to natural gas-based power generation.

- Rapidly increasing electricity demand, primarily driven by industrialization and swelling urban populations, particularly across emerging economies, creates a continuous need for reliable, large-scale power capacity.

- The increasing integration of intermittent renewable energy sources, like solar and wind power, is heightening the need for flexible, quick-start power solutions to maintain grid stability.

Market Statistics

- 2024 Market Size: USD 10.57 billion

- 2034 Projected Market Size: USD 15.46 billion

- CAGR (2025-2034): 3.9%

- Asia Pacific: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

The rising demand for electricity, spurred by growing industrialization and urbanization, particularly in Asia Pacific, is a significant driver. Gas turbines are increasingly preferred over coal-powered facilities due to their reduced emissions and greater efficiency. Furthermore, government policies favoring low-carbon power generation and the expansion of synthetic natural gas infrastructure are boosting the size. The flexibility of gas turbines in providing quick and efficient power, especially during peak demand, and their compatibility with renewable energy sources in hybrid systems, further contribute to development and industry trends.

Market Dynamics

Rising Global Energy Demand

The escalating global energy demand, propelled by rapid industrialization and urbanization, especially in developing economies, stands as a primary driver. The International Energy Agency (IEA) reported that global energy demand grew by 2.2% in 2024, significantly higher than the average annual increase of 1.3% between 2013 and 2023. Emerging and developing economies accounted for over 80% of this increase. Global electricity consumption surged by 4.3% in 2024, nearly double the average annual increase over the past decade, driven by record temperatures, industrial growth, electrification of transport, and the expansion of data centers and AI. Gas turbines, with their ability to provide substantial power output and operational flexibility, are well-suited to meet this growing demand. Their efficiency in converting fuel to energy and their relatively lower emissions compared to traditional coal-fired plants make them an increasingly attractive option for expanding power generation capacities globally, thereby driving the growth.

Shift Toward Natural Gas

The increasing preference for natural gas as a cleaner alternative to coal in power generation is a significant driver for gas turbines. This shift is largely attributed to growing environmental concerns and stringent emission regulations aimed at reducing carbon dioxide emissions. As per IEA, natural gas demand witnessed the strongest increase among fossil fuels in 2024, rising by 115 billion cubic meters (bcm) or 2.7%, compared to an average annual increase of around 75 bcm over the past decade. Moreover, natural gas accounts for about a quarter of global electricity generation, and gas-fired power plants can quickly adjust output, making them crucial for responding to demand fluctuations and supporting the integration of intermittent renewables. As natural gas infrastructure expands and its availability increases, the demand for gas turbines, which efficiently utilize this fuel, rises correspondingly.

Government Support and Policies

Supportive government policies and initiatives aimed at promoting cleaner power generation technologies are crucial growth factors. While a recent report from the Economic Times in February 2021 indicated that the Indian government had no new policy to support gas-based power plants at that moment, the broader global trend reveals a growing inclination toward gas as a transition fuel. For instance, the Indian government's move to place LNG under OGL, as mentioned by the Press Information Bureau in March 2025, facilitates easier access to natural gas for power generation. Moreover, various schemes by the Ministry of New and Renewable Energy focus on promoting cleaner energy sources, which indirectly benefits as gas turbines often complement renewable energy sources by providing grid stability and backup power. Such government backing, whether direct or indirect, fosters investments in gas-based power infrastructure and the adoption of gas turbine technology, thereby driving the development.

Segmental Insights

Market Assessment By Capacity

The gas turbine market, by capacity, is bifurcated into ≤200 MW and >200 MW. The >200 MW segment holds a larger share. This is primarily attributed to the extensive use of these high-capacity turbines in power generation facilities. Turbines with this capacity are favored for their ability to deliver substantial power output, making them essential for large-scale energy production. Power plants across the world rely on these larger gas turbines to meet the increasing demand for electricity and ensure power grid stability. The efficiency and reliability of these >200 MW capacity turbines in base-load and peak-load operations solidify their dominant position.

The ≤200 MW segment is anticipated to exhibit a higher growth rate in the coming years. Several factors, including the increasing adoption of distributed power generation systems and the rising need for efficient power solutions in industrial and commercial sectors, drive this growth. These smaller capacity gas turbines offer greater flexibility and are suitable for a wider range of applications, such as combined heat and power (CHP) systems, and for providing power in remote locations or during peak demand periods. The growing emphasis on energy efficiency and the integration of gas turbines with renewable energy sources in microgrids are further fueling the demand for turbines in the ≤200 MW capacity range, indicating a strong potential and promising outlook for this segment.

Market Evaluation By Technology

The segmentation, by technology, includes open cycle and combined cycle. The combined cycle segment accounts for a larger share, due to the superior energy efficiency offered by combined cycle gas turbines (CCGTs). By capturing the waste heat from the gas turbine to generate additional steam power, CCGT plants achieve significantly higher thermal efficiencies compared to open cycle systems. This enhanced efficiency translates to lower fuel consumption and reduced operating costs, making combined cycle technology the preferred choice for large-scale power generation facilities seeking to maximize output and minimize environmental impact. The established track record and economic benefits of combined cycle plants contribute to their leading share.

The open cycle segment is expected to witness a higher growth over the forecast period. This anticipated growth is driven by the increasing need for flexible and quick-start power generation solutions to support the integration of intermittent renewable energy sources, such as solar and wind power. Open cycle gas turbines (OCGTs) are characterized by their ability to start up and shut down rapidly, making them ideal for peaking power plants and grid stabilization applications. As the penetration of renewables in the energy mix continues to rise, the demand for OCGTs to provide backup power and ensure grid reliability is also increasing, thereby positioning the open cycle segment for substantial development and a high growth rate.

Market Evaluation By End Use

The segmentation, by end use, includes power & utility and industrial. The power & utility segment holds a larger share, owing to the widespread utilization of gas turbines for electricity generation on a large scale. Power plants globally rely on gas turbines, particularly combined cycle configurations, to provide base-load and peak-load power, catering to the substantial energy demands of residential, commercial, and industrial consumers. The established infrastructure and the continuous need for reliable and efficient power generation solutions solidify the power & utility sector's dominant position.

The industrial segment is projected to experience a higher growth rate during the forecast period. This growth is fueled by the increasing adoption of gas turbines for various industrial applications, including oil and gas, manufacturing, and processing industries. The demand for on-site power generation, combined heat and power (CHP) systems for enhanced energy efficiency, and the need for a reliable power supply in critical industrial operations are driving this growth. Furthermore, the ability of gas turbines to operate on various fuels, including natural gas and other industrial gases, makes them an attractive option for industries seeking energy independence and operational flexibility, thereby contributing to the strong potential and high demand trends in the industrial segment.

Regional Analysis

The gas turbine industry demonstrates significant geographical diversity, with varying dynamics, drivers, and demand trends across different regions. North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa present unique characteristics influenced by factors such as energy policies, economic development, industrial growth, and environmental regulations. Understanding these regional nuances is crucial for assessing the overall potential and formulating effective entry assessments and penetration strategies. The outlook in each region is shaped by a combination of global trends and localized factors, contributing to a complex yet promising landscape for gas turbine technology.

Asia Pacific holds the largest share and the highest growth, primarily driven by the rapid industrialization and urbanization occurring in countries such as China and India, leading to a substantial increase in energy demand. The growing investments in power generation infrastructure to support economic expansion, coupled with the increasing adoption of gas turbines for their efficiency and flexibility, contribute significantly to the region's leading position. Furthermore, supportive government policies in China that promote gas-based power generation as a cleaner alternative to coal propel the size and development in this region. The continued surge in energy demand, coupled with increasing investments in modern and efficient power generation technologies, positions the region for substantial growth factors. The rising awareness regarding environmental sustainability is also driving the adoption of gas turbines as a cleaner energy solution compared to traditional fossil fuels in India. Moreover, the expansion of natural gas infrastructure and the implementation of favorable government initiatives across various countries in Asia Pacific are expected to further accelerate the Asia Pacific gas turbine market growth in the coming years.

The North America gas turbine market is driven by the need for grid modernization, the replacement of aging power infrastructure, and the growing integration of renewable energy sources. The US is a significant country in the regional market. The demand is primarily fueled by increasing electricity consumption, a shift away from coal-fired power plants, and the flexibility that gas turbines offer in supporting renewable energy integration. The US government is actively promoting cleaner energy solutions through initiatives such as the Inflation Reduction Act, which provides incentives for low-carbon technologies, including gas turbines capable of running on hydrogen or natural gas blends. The ongoing replacement of older, less efficient turbines from the 1960s and 1970s also contributes to the US gas turbine market growth. The oil & gas sector also creates substantial demand for gas turbines for compression and pumping applications in pipeline networks.

Key Players and Competitive Insights

A few major players in the gas turbine market include General Electric Company (GE Vernova); Siemens Energy AG; Mitsubishi Heavy Industries, Ltd. (Mitsubishi Power, Ltd.); Kawasaki Heavy Industries, Ltd.; Bharat Heavy Electricals Limited; Ansaldo Energia S.p.A.; Solar Turbines Incorporated (Caterpillar Inc.); MAN Energy Solutions SE; Harbin Electric Corporation; and Nanjing Turbine & Electric Machinery (Group) Co., Ltd. These companies are actively involved in the design, manufacturing, and servicing of a wide range of gas turbines for various applications across the power generation and industrial sectors.

The competitive landscape is characterized by a few dominant global players and several regional manufacturers. Competition revolves around technological innovation, product efficiency, reliability, and the ability to offer comprehensive service solutions. Key strategies employed by these players include continuous research and development to improve turbine performance and reduce emissions, strategic collaborations and partnerships to expand reach, and offering customized solutions to meet specific customer requirements across different end-use industries and geographical regions. Owing to the competition based on pricing and aftermarket services, players are striving to offer cost-effective and long-term value to their customers.

General Electric Company (GE Vernova), located in the US, offers a comprehensive portfolio of heavy-duty and aeroderivative gas turbines. Their offerings cater to a wide spectrum of power generation needs, from large-scale utility power plants to industrial and marine applications. GE Vernova’s gas turbines are known for their advanced technology, high efficiency, and operational flexibility, with models capable of running on various fuels, including hydrogen blends.

Siemens Energy AG, headquartered in Germany, is another major participant in the gas turbine, providing a broad range of gas turbines for power generation and mechanical drive applications. Their product portfolio includes heavy-duty, industrial, and aeroderivative gas turbines, known for their high efficiency, reliability, and environmental compatibility. Siemens Energy’s gas turbines are utilized in various settings, including large power plants, combined heat and power (CHP) systems, and oil and gas facilities.

List of Key Companies in Gas Turbine Market

- Ansaldo Energia S.p.A.

- Bharat Heavy Electricals Limited

- General Electric Company (GE Vernova)

- Harbin Electric Corporation

- Kawasaki Heavy Industries, Ltd.

- MAN Energy Solutions SE

- Mitsubishi Heavy Industries, Ltd. (Mitsubishi Power, Ltd.)

- Nanjing Turbine & Electric Machinery (Group) Co., Ltd.

- Siemens Energy AG

- Solar Turbines Incorporated (Caterpillar Inc.)

Gas Turbine Industry Developments

- October 2025: Xcel Energy has acquired 10 large gas turbines and related generation equipment from Siemens Energy to support the development of two upcoming power plants. The investment follows a sharp rise in regional electricity demand, fueled by changing energy requirements and the planned retirement of Xcel Energy’s Tolk Station.

- April 2025: Siemens Energy and Sumitomo Corporation announced a Memorandum of Understanding (MoU) to explore solutions for the decarbonization of mining equipment operations jointly. This collaboration aims to address the urgent need in the mining industry to reduce greenhouse gas emissions from heavy machinery.

- October 2022: GE Gas Power and NTPC Ltd. signed an MoU to explore the feasibility of co-firing hydrogen blended with natural gas in GE's 9E gas turbines installed at NTPC's Kawas gas power plant in Gujarat. This collaboration aims to reduce carbon dioxide emissions from the power plant and potentially scale up the implementation across NTPC's other units in India.

Gas Turbine Market Segmentation

By Capacity Outlook (Revenue – USD Billion, 2020–2034)

- ≤200 MW

- >200 MW

By Technology Outlook (Revenue – USD Billion, 2020–2034)

- Open Cycle

- Combined Cycle

By End Use Outlook (Revenue – USD Billion, 2020–2034)

- Power & Utility

- Industrial

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest of Latin America

Gas Turbine Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 10.57 billion |

|

Market Size Value in 2025 |

USD 10.95 billion |

|

Revenue Forecast by 2034 |

USD 15.46 billion |

|

CAGR |

3.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy: The gas turbine market has been segmented into detailed segments of capacity, technology, and end use. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Market Entry Strategies: For a robust growth and marketing strategy, companies prioritize technological innovation, focusing on enhancing efficiency and reducing emissions to align with global sustainability goals. Expanding service offerings, including digital solutions for predictive maintenance and performance optimization, can create stronger customer relationships and recurring revenue streams. Strategic collaborations and partnerships, particularly for developing and deploying hydrogen-ready turbines and carbon capture technologies, will be crucial for future relevance. Targeted marketing efforts should emphasize the life-cycle cost benefits, reliability, and flexibility of gas turbines, especially in supporting the integration of renewable energy sources for grid stability and distributed power generation. Highlighting the advancements in fuel flexibility, including the ability to co-fire with hydrogen, will also attract environmentally conscious customers and regions with evolving energy policies.

FAQ's

The global market size was valued at USD 10.57 billion in 2024 and is projected to grow to USD 15.46 billion by 2034.

The market is projected to register a CAGR of 3.9% during the forecast period.

Asia Pacific had the largest share of the market in 2024.

A few major players are General Electric Company (GE Vernova); Siemens Energy AG; Mitsubishi Heavy Industries, Ltd. (Mitsubishi Power, Ltd.); Kawasaki Heavy Industries, Ltd.; Bharat Heavy Electricals Limited; Ansaldo Energia S.p.A.; Solar Turbines Incorporated (Caterpillar Inc.); MAN Energy Solutions SE; Harbin Electric Corporation; and Nanjing Turbine & Electric Machinery (Group) Co., Ltd.

The >200 MW segment accounted for a larger share of the market in 2024.

Following are a few of the trends: ? Decarbonization Initiatives: A major trend is the increasing focus on reducing carbon emissions from gas turbines. This involves research and development into alternative fuels such as hydrogen and ammonia, as well as advancements in carbon capture, utilization, and storage (CCUS) technologies to mitigate the environmental impact of natural gas combustion. ? Hydrogen Co-firing: The blending of hydrogen with natural gas in existing gas turbines is gaining traction. This approach allows for a gradual reduction in carbon emissions without requiring entirely new infrastructure in the short term. The percentage of hydrogen that can be co-fired is increasing with technological advancements. ? Efficiency Improvements: Continuous innovation in gas turbine design and materials is leading to higher thermal efficiencies. Advanced cooling technologies, improved materials, and optimized combustion systems are key areas of development aimed at maximizing power output while minimizing fuel consumption.

A gas turbine is a type of internal combustion engine that converts the chemical energy of fuel into mechanical energy by using a rotating assembly. It operates on the principle of the Brayton cycle, which involves compressing air, mixing it with fuel, igniting the mixture in a combustor, and then expanding the hot, high-pressure gas through a turbine to produce rotational work. This mechanical power can then be used to drive an electrical generator to produce electricity or to provide thrust in applications such as aircraft propulsion.