Gastroparesis Drugs Market Share, Size, Trends, Industry Analysis Report

By Drug Class (Prokinetic Agents, Antiemetic Agents, and Botulinum Toxin Injections); By Disease Class; By End User; By Region; Segment Forecast, 2024- 2032

- Published Date:Mar-2024

- Pages: 118

- Format: PDF

- Report ID: PM4776

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

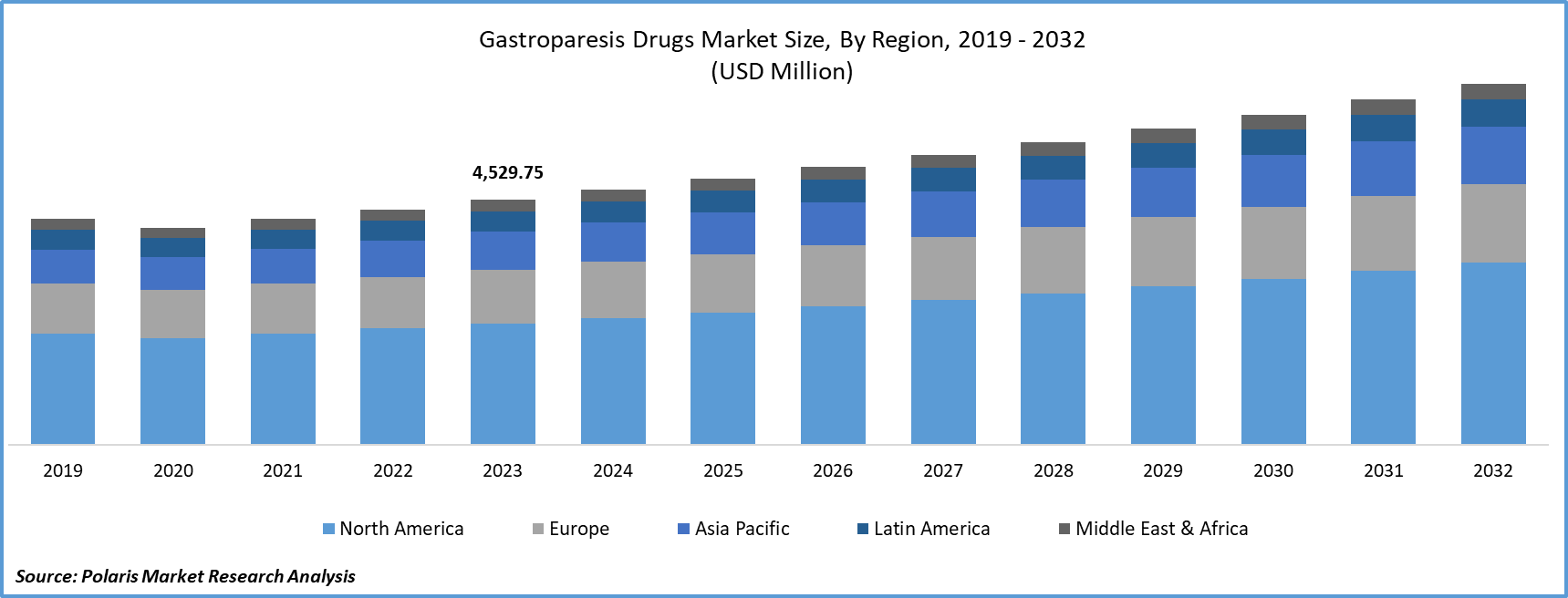

Global gastroparesis drugs market size was valued at USD 4,529.75 million in 2023. The market is anticipated to grow from USD 4,720.90 million in 2024 to USD 6,662.35 million by 2032, exhibiting the CAGR of 4.4% during the forecast period.

Market Overview

The rapid increase in the prevalence of idiopathic gastroparesis across the globe and the substantial rise in the number of surgical procedures that led to greater occurrence of post-surgical gastroparesis are prominent factors boosting the demand for gastroparesis drugs. Moreover, growing research & development activities by leading companies for the development of new advanced drugs for effective treatment are further propelling the market’s growth.

To Understand More About this Research: Request a Free Sample Report

Furthermore, previously, gastroparesis was considered a rare disease and was difficult to diagnose and treat. However, there have been several breakthrough advances and innovations, such as smooth muscle cells, PDGFRα+ cells syncytium, and interstitial cells of Cajal, that shift the overall paradigm of understanding of its complex entity and management. The rising incidences of gastroparesis forced healthcare organizations and government authorities to focus on the disease and increase accessibility to advanced diagnostic modalities.

Growth Factors

Rising prevalence of diabetes and geriatric population to boost market growth

The increasing prevalence of gastroparesis among the diabetic patients is the major factors boosting the market growth, as the incidence of diabetes increases dramatically worldwide, the risk of developing gastroparesis among individuals also rises. Also, the growing aging or geriatric population who are more susceptible to the disease due to several physical changes in body, likely to foster demand for effective treatment options for gastroparesis. For instance, according to the World Health Organization, more than 422 million people globally are suffering with diabetes, and every year over 1.5 million deaths are directly associated to diabetes.

Regulatory approvals for new drugs for gastroparesis treatment to boost market growth

The rising number of regulatory approvals for new and improved drugs for the treatment of gastroparesis from major government authorities such as the US Food and Drug Administration and European Medicines Association, coupled with the expansion of existing treatment solutions, is projected to have a positive impact on global market growth. For instance, according to a report published by the Regenerative Medicine Foundation, stem cell-combo therapy has the potential to bring long-term relief for gastroparesis that can cure gastroparesis.

Restraining Factors

Lack of novel treatment options and regulatory hurdles to restrain growth

The Gastroparesis Drugs Market faces significant challenges due to a lack of novel treatment options and regulatory hurdles. Gastroparesis, a condition characterized by delayed gastric emptying, presents a pressing need for effective pharmaceutical interventions. However, the development of new drugs for gastroparesis has been limited, resulting in a scarcity of innovative treatment options. Moreover, regulatory hurdles pose formidable barriers to market entry for pharmaceutical companies seeking to introduce new therapies. The stringent regulatory requirements, particularly in the Asia-Pacific region, prolong the approval process and increase the costs associated with bringing new gastroparesis drugs to market. These factors collectively contribute to the limited availability of advanced pharmaceutical solutions for patients suffering from gastroparesis.

In addition to the lack of novel treatment options and regulatory hurdles, several restraining factors further impede the growth of the Gastroparesis Drugs Market. One such factor is the complexity of gastroparesis itself, which presents challenges in understanding its underlying mechanisms and developing targeted therapeutic approaches.

Furthermore, the high cost of drug development, coupled with the uncertain commercial viability of gastroparesis drugs, deters pharmaceutical companies from investing significant resources in research and development efforts.

Moreover, the limited awareness and underdiagnosis of gastroparesis among healthcare professionals and patients alike contribute to a relatively small patient pool, constraining market potential.

Additionally, the availability of alternative treatment modalities, such as dietary modifications and symptom management strategies, presents competition for pharmaceutical interventions in the gastroparesis treatment landscape. These restraining factors collectively exert pressure on market growth and limit the opportunities for expansion within the Gastroparesis Drugs Market.

Report Segmentation

The market is primarily segmented based on drug class, disease class, end user, and region.

|

By Drug Class |

By Disease Class |

By End User |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Drug Class Insights

Prokinetic agents segment accounted for the largest market share in 2023

The prokinetic agents segment accounted for the largest share in 2023. Segment’s dominance is attributed to widespread use because of its ability to improve the movement of the stomach and boost the contractions of the stomach muscles. In addition, they are most frequently prescribed to patients having gastroparesis, which causes symptoms like vomiting and nausea while hindering digestion, which fuels its demand and market growth.

The botulinum toxin injections segment will grow at the highest growth rate. This growth is fueled by their surging use to treat fine lines and wrinkles and their ability to offer a highly targeted treatment approach for gastroparesis compared to others. Moreover, there are potential benefits in the management of gastroparesis, and growing R&D focused on exploring the efficacy of botulinum toxin injections could also bode well for the segment’s growth.

By Disease Class Insights

Diabetic gastroparesis segment held the majority share in 2023

The diabetic gastroparesis segment held the maximum market share in 2023. This dominance is attributed to increasing incidences of diabetes worldwide, which has the highest risk of developing gastroparesis among individuals or patients. As people change their lifestyles and consume unhealthy products significantly, they are developing diseases like diabetes that also result in an increased prevalence of gastroparesis. For instance, as per a report published by the Indian Council of Medical Research in August 2023, the prevalence of diabetes in India was around 100.1 million.

By End User Insights

Pharmacies segment is expected to witness highest growth

The pharmacies segment will grow at the highest growth rate. Segment’s growth is attributable to easy accessibility to pharmacies for patients purchasing gastroparesis drugs and other related treatment medications, continuous expansion of retail pharmacy chains, and their focus on building an online presence as well.

The hospital's segment led the significant market in 2023. This dominance is attributed to the presence of specialized healthcare professionals’ robust infrastructure for the diagnosis and treatment of gastroparesis, and a drastic increase in the number of patients admitted to hospitals with gastroparesis and other related health conditions.

Regional Insights

North America region dominated the global market in 2023

The North American region dominated the global market in 2023. The region’s dominance is accelerated by a higher prevalence of gastroparesis and diabetes in the region and the robust presence of advanced healthcare infrastructure as well as specialized gastroenterology clinics, particularly in developed countries. In addition, the region’s significant prediabetic population, availability of favorable policies, and growing awareness among people about the conditions and its available treatment options further contribute to the region’s growth. For instance, as per a report published by the Centers for Disease Control and Prevention, over 98 million people in the United States have prediabetes, which accounts for 1 in every 3 in the country.

Europe will grow at a rapid pace during the forecast period, owing to the incidence of gastroparesis and rapid advances in drug delivery methods in the region, such as novel drug delivery systems and controlled-release formulations that offer a more convenient and effective treatment option. Also, the strong focus of companies on patient-centric care and improving the quality of gastroparesis patient life is likely to have a positive impact on the region’s growth.

Key Market Players & Competitive Insights

Strategic partnerships to drive the competition

The gastroparesis drugs market is highly fragmented and is anticipated to witness competition due to several players' presence. Key companies are constantly focusing on improving efficacy, ensuring safety, improving motility, and offering competitive pricing for their drugs for the treatment of gastroparesis. Companies are also looking to secure regulatory approvals for their new drugs from government agencies such as US FDA and European Medicines Agency.

Some of the major players operating in the global market include:

- Abbott Laboratories (US)

- AbbVie Inc. (US)

- Allergan Inc. (US)

- Evoke Pharma (US)

- Medtronic Plc (Ireland)

- Neurogastrx Inc. (US)

- Pfizer Inc. (US)

- Rhythm Pharmaceuticals Inc. (US)

- Salix Pharmaceuticals (US)

- TEVA Pharmaceutical (Israel)

- Vanda Pharmaceuticals Inc. (US)

Recent Developments in the Industry

- In February 2023, Renexxion Ireland announced the start of a Phase IIb trial of gastroparesis therapy. This trial has been mainly designed to assess the safety, tolerability, and efficacy of naronapride among gastroparesis patients. It will further help in the development of new drugs for gastroparesis.

- In November 2022, Evoke Pharma announced that the US Patent and Trademark Office issued a new US patent, No. 11,517, 545, under the title of “Treatment of Moderate and Severe Gastroparesis.” This patent will expire in 2038 and cover methods of treating gastroparesis with metoclopramide.

Report Coverage

The gastroparesis drugs market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, drug class, disease class, end user, and their futuristic growth opportunities.

Gastroparesis Drugs Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 4,720.90 million |

|

Revenue forecast in 2032 |

USD 6,662.35 million |

|

CAGR |

4.4% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The Gastroparesis Drugs Market report covering key segments are drug class, disease class, end user, and region.

Gastroparesis Drugs Market Size Worth $6,662.35 Million By 2032

Gastroparesis drugs market exhibiting the CAGR of 4.4% during the forecast period.

North America is leading the global market

key driving factors in Gastroparesis Drugs Market are Rising prevalence of diabetes and geriatric population