Germanium Market Size, Share, Trends, Industry Analysis Report

By Type (Germanium Ingot, Germanium Tetrachloride, High Purity GeO2, Others), By Application, and By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM6338

- Base Year: 2024

- Historical Data: 2020-2023

Overview

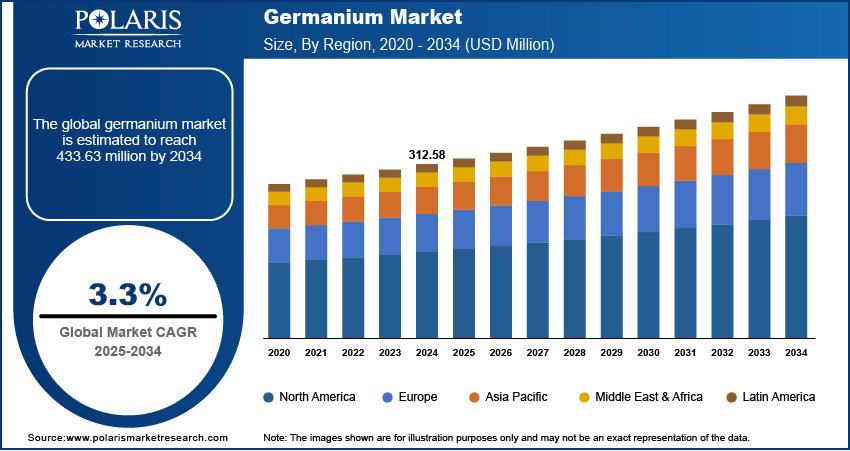

The global germanium market size was valued at USD 312.58 million in 2024, growing at a CAGR of 3.3% from 2025 to 2034. The increasing defense and aerospace modernizations alongside worldwide digital infrastructure expansion is driving the germanium market.

Key Insights

- The germanium ingot segment held the highest market share in 2024.

- The fiber optics segment is expected to witness healthy growth for deployment of 5G, data centers, and high-speed networks.

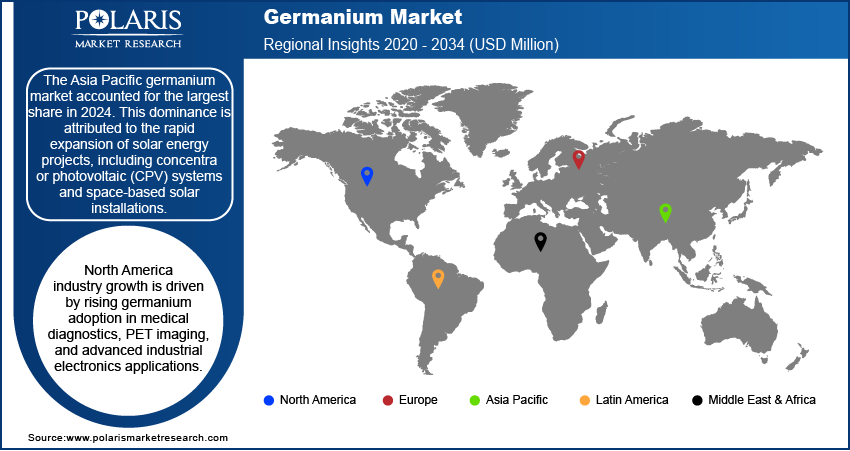

- Asia Pacific dominated the global germanium market in 2024.

- China germanium market is growing due to the rising electronics industry coupled with surging demand for smartphones, semiconductors, and Hi-Fi devices.

- The North America market is expected to witness a steady growth from 2025-2034 due to growing applications in medical diagnostics and industrial electronics.

- The U.S. germanium industry is led by defense and aerospace due to its applications in IR optics and surveillance systems.

Industry Dynamics

- Increase in digital infrastructure for fiber optics satcom and semiconductors supporting 5G and data centers is pushing germanium demand.

- Defense and aerospace investments boost germanium use in IR optics, thermal imaging and high-performance sensors.

- Innovations in optoelectronics creates opportunity in the market for solar cells, photodetectors and quantum computing.

- High production costs and extraction complexity limit broader market adoption.

Market Statistics

- 2024 Market Size: USD 312.58 Million

- 2034 Projected Market Size: USD 433.63 Million

- CAGR (2025–2034): 3.3%

- Asia Pacific: Largest Market Share

The germanium industry supplies electronics, optics, and renewable energy industries based on its semiconductor, infrared, and catalytic characteristics. It is applied in fiber optics, night vision, and solar cells in aid of 5G, aerospace, and energy technologies. Increasing demand for high-performance products and innovation in refining, recycling, and alloying enhance efficiency and market expansion. Germanium fuels innovation in next-generation electronics, renewable energy, and optical uses.

Germanium demand is fueled by the adoption of renewable energy, with wafers playing an important role in high-efficiency solar systems like CPV and space-based photovoltaics. Rising clean energy goals in the world are creating new growth prospects for suppliers. An example is India's COP26 commitment, which targets 500 GW of non-fossil electricity by 2030, 50% renewable contribution, and net-zero emissions by 2070. These efforts highlight germanium's crucial contribution to future solar power infrastructure, thus boosting the market growth.

Evolving developments in nanotechnology and quantum computers are propelling the demand for germanium as it possesses high carrier mobility, silicon compatibility, and higher transistor performance speed, allowing quantum processors, high-speed chips, and power-efficient devices.

Drivers & Opportunities

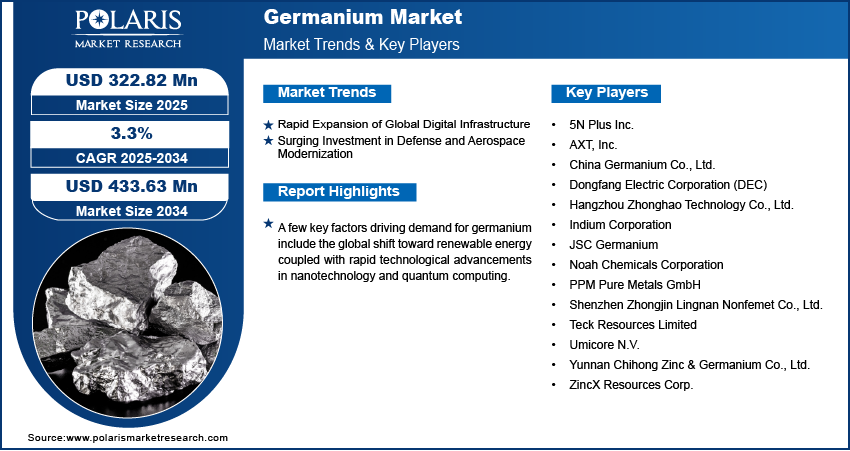

Rapid Expansion of Global Digital Infrastructure: The rapid international rollout of 5G networks, data centers, and high-speed internet infrastructure is heavily increasing demand for fiber-optic components, thereby fueling the growth of the market. As stated by GSMA, global investments in 5G infrastructure are expected to hit USD 1 trillion by 2025, pointing towards the scope of international digital expansion. This heightened digital connectivity is increasing the demand for high-performance germanium-based optical materials that provide signal clarity, transmission efficiency, and reliability in emerging communication networks.

Surging Investment in Defense and Aerospace Modernization: The use of germanium in infrared optics for surveillance, night vision and thermal imaging is pushing defense budgets and modernization programs. Germanium lenses and components are needed by advanced military and aerospace platforms as it is a material with a high refractive index and infrared transmission. For instance, in June 2025, the U.S. Department of Defense awarded contracts amounting to USD 200 million to develop AI-enhanced defense technologies such as IR and thermal imaging systems. These investments are significantly increasing the demand for germanium across the defense and aerospace technologies.

Segmental Insights

By Type

By type, the germanium market is divided into germanium ingot, germanium tetrachloride, high-purity GeO₂, and others. The germanium ingot segment is dominating the market in 2024 due to its applications in electronics, solar and optical fields, which require high-quality crystalline germanium. With its purity and stability, it is readily accepted for downstream processing into semiconductor wafers, IR optics, photovoltaic devices, etc.

The High-purity GeO₂ fibre is expected to growth at a rapid pace between 2025-2034, due to of fibre-optics, IR optics, and high-tech electronics demand. Its thermal stability, chemical purity, and exact composition make it crucial for the new generation of semiconductors and high-performance photonics.

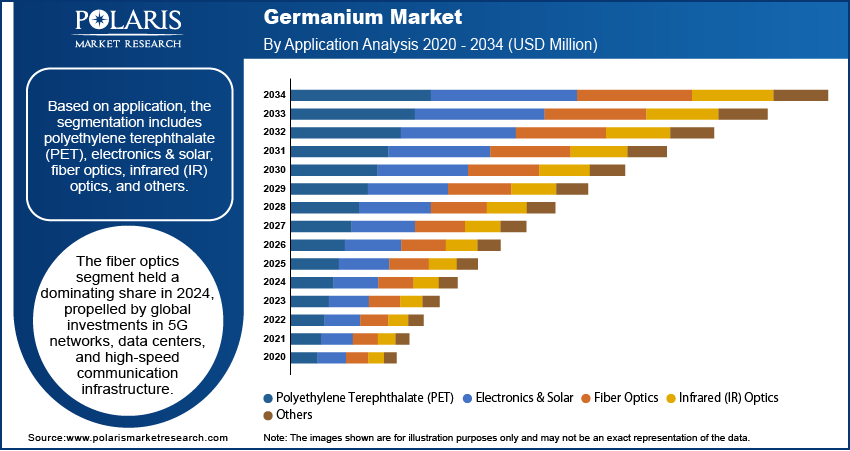

By Application

On the basis of application, the market is divided into polyethylene terephthalate (PET), electronics & solar, fiber optics, infrared (IR) optics and others. The electronics & solar segment led in 2024 due to the rising semiconductor production, solar PV installations, and consumer electronics. Worldwide semiconductor revenue amounted to USD 627.6 billion in 2024, up 19.1% from 2023 (SIA), reflecting germanium's role in high-performance devices and solar cells.

The fiber optics segment is projected to growth at the fastest pace due to the growing 5G infrastructure, data centers, and rising demand high-speed networks. Germanium optic fibers improve signal transmission, lower attenuation, and accommodate high-bandwidth connectivity globally.

Regional Analysis

Asia Pacific held the leading market share in 2024, fueled by growing demand for solar applications such as CPV and space-based systems, as well as increasing investment in 5G networks and broadband. Industrialization, electronics production, and adoption of high-performance devices are driving germanium applications in semiconductors, photonics, and IR optics.

China Germanium Market Analysis

China dominates the Asia Pacific market owing to increasing electronics production, smartphones, and semiconductors. In the first half of 2025, the electronic information industry expanded 11.1% YoY, with revenue of dominant companies increasing 9.4% to USD 907.11 billion and profits increasing 11.9% to USD 30.7 billion, which fueled the demand for germanium ingots, tetrachloride, and high-purity GeO₂ across the country.

North America Germanium Market Overview

The North American market is projected to expand strongly between 2025-2034, driven by medical diagnostics, PET scanners, and industrial electronics. Growing demand of semiconductors for consumer and high-speed computing further increasing the germanium market growth.

U.S. Germanium Market Analysis

The U.S. led the North America market, fueled by escalating defense and aerospace budgets fueling usage of germanium-based IR optics, night vision technology, and surveillance systems. According to the Stockholm International Peace Research Institute, in 2024, U.S. military expenditure increased by 5.7% to USD 997 billion for the modernization of weapons and nuclear capabilities to stay ahead of Russia and China. This surge in investment is increasing the demand for germanium across the U.S. defense sector.

Europe Germanium Market Outlook

The European germanium market obtained large market shares in 2024 due to huge investments in digital infrastructure, broadband expansion and the intelligent grid. The International Energy Agency states that the European Union's plan of action for the electricity grid, released late in 2022, estimates investments of around USD 633 billion by 2030 in order to upgrade and extend the grid.

Key Players & Competitive Analysis

The global market for germanium is mainly dominated by 5N Plus, AXT, and China Germanium that supply high-purity germanium to the electronics, fiber optics and semiconductor industries. Increasing demand in photovoltaics, 5G, and IR sensing are fueling growth, which is fueled by R&D, strategic alliances, and advanced applications in nanotechnology and defense.

Key players in the germanium industry are 5N Plus Inc., AXT, Inc., China Germanium Co., Ltd., Dongfang Electric Corporation (DEC), Hangzhou Zhonghao Technology Co., Ltd., Indium Corporation, JSC Germanium, Noah Chemicals Corporation, PPM Pure Metals GmbH, Shenzhen Zhongjin Lingnan Nonfemet Co., Ltd., Teck Resources Limited, Umicore N.V., Yunnan Chihong Zinc & Germanium Co., Ltd., Yunnan Lincang Xinyuan Germanium Industrial Co., Ltd., and ZincX Resources Corp.

Key Players

- 5N Plus Inc.

- AXT, Inc.

- China Germanium Co., Ltd.

- Dongfang Electric Corporation (DEC)

- Hangzhou Zhonghao Technology Co., Ltd.

- Indium Corporation

- JSC Germanium

- Noah Chemicals Corporation

- PPM Pure Metals GmbH

- Shenzhen Zhongjin Lingnan Nonfemet Co., Ltd.

- Teck Resources Limited

- Umicore N.V.

- Yunnan Chihong Zinc & Germanium Co., Ltd.

- Yunnan Lincang Xinyuan Germanium Industrial Co., Ltd.

- ZincX Resources Corp.

Germanium Industry Developments

In May 2024: Umicore teamed up with STL to recycle germanium from DRC mining waste to promote sustainable material recovery and circular economy initiatives.

In September 2023: Umicore and RENA Technologies jointly developed next-generation germanium wafers in September 2023 to improve semiconductor and solar cell performance.

Germanium Market Segmentation

By Type Outlook (Revenue, USD Million, 2020–2034)

- Germanium Ingot

- Germanium Tetrachloride

- High Purity GeO2

- Others

By Application Outlook (Revenue, USD Million, 2020–2034)

- Polyethylene Terephthalate (PET)

- Electronics & Solar

- Fiber Optics

- Infrared (IR) Optics

- Others

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Germanium Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 312.58 Million |

|

Market Size in 2025 |

USD 322.82 Million |

|

Revenue Forecast by 2034 |

USD 433.63 Million |

|

CAGR |

3.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 312.58 million in 2024 and is projected to grow to USD 433.63 million by 2034.

The global market is projected to register a CAGR of 3.3% during the forecast period.

Asia Pacific dominated the market in 2024.

A few of the key players in the market are 5N Plus Inc., AXT, Inc., China Germanium Co., Ltd., Dongfang Electric Corporation (DEC), Hangzhou Zhonghao Technology Co., Ltd., Indium Corporation, JSC Germanium, Noah Chemicals Corporation, PPM Pure Metals GmbH, Shenzhen Zhongjin Lingnan Nonfemet Co., Ltd., Teck Resources Limited, Umicore N.V., Yunnan Chihong Zinc & Germanium Co., Ltd., Yunnan Lincang Xinyuan Germanium Industrial Co., Ltd., and ZincX Resources Corp.

The germanium ingot segment dominated the market revenue share in 2024, driven by its widespread use in electronics, solar, and optical applications, where high-quality crystalline germanium is essential for efficient performance.

The fiber optics segment is projected to witness the fastest growth during the forecast period, propelled by global investments in 5G networks, data centers, and high-speed communication infrastructure