Glass Mat Market Share, Size, Trends, Industry Analysis Report

By Mat Type (Chopped Strand Mat, Continuous Filament Mat); By Binder Type; By Manufacturing Process; By End-Use Industry; By Region; Segment Forecast, 2023 - 2032

- Published Date:Jul-2023

- Pages: 112

- Format: PDF

- Report ID: PM3544

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

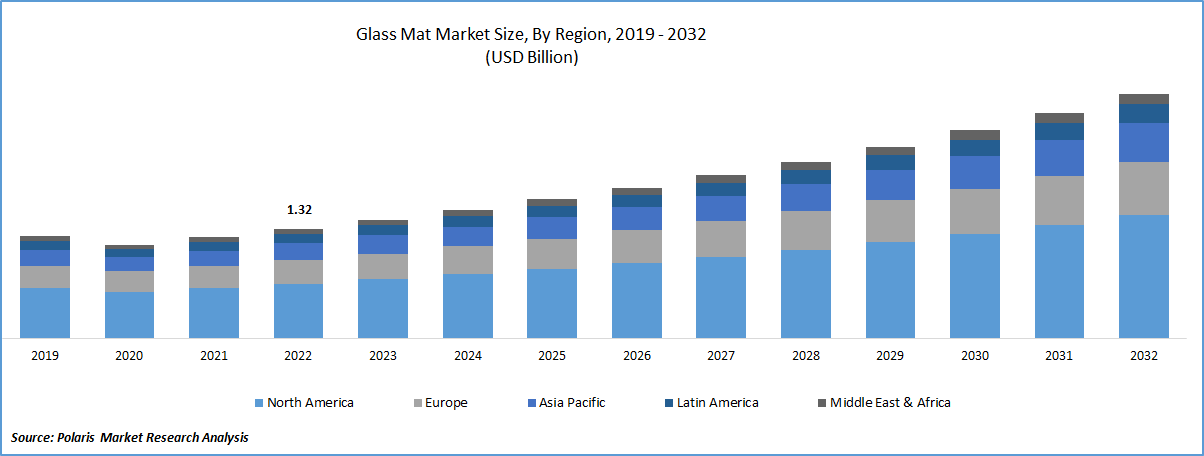

The global glass mat market was valued at USD 1.32 billion in 2022 and is expected to grow at a CAGR of 8.4% during the forecast period. The increasing use of glass mats in the construction and industrial applications end-use industries driving the market growth.

To Understand More About this Research: Request a Free Sample Report

The Owens Corning Company reported net sales of $9.8 billion, up 15% from 2022.The reported net sales increase of 15% for Owens Corning company indicate a positive trend for the glass mat market, as Owens Corning is a major player in the production and distribution of glass fiber-based products, including glass mats. The increase in net sales could be an indication of an increase in demand for Owens Corning's products, including glass mats, which could be due to factors such as the growth in the construction and automotive industries. Additionally, it may suggest that Owens Corning is gaining market share in the glass mat market, which could lead to increased competition and innovation within the industry.

For Specific Research Requirements, Request for a Customized Report

Industry Dynamics

Growth Drivers

The growth of the construction industry around the globe is the major driving factors for this market.

India, one of Asia's major emerging nations, is seeing rapid urbanization and rising housing demand. By 2030, it is anticipated that the Indian real estate market will have grown to $1 trillion, with affordable housing representing one of its most vibrant subsectors. The Indian government is encouraging a number of cutting-edge building technologies to meet this need and address issues with traditional construction such safety, productivity, construction quality, sustainability, and labor recruiting. With the expected growth of the Indian real estate sector and the focus on affordable housing, there is likely to be an increase in demand for construction-related materials, including glass mats. The promotion of innovative construction technologies by the Indian government could also create opportunities for the use of glass mats in new and innovative ways, leading to further growth in the market.

Report Segmentation

The market is primarily segmented based on mat type, binder type, manufacturing process, end-use industry and region.

|

By Mat Type |

By Binder Type |

By Manufacturing Process |

By End-Use Industry |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Continuous Filament Mat type segment is expected to witness fastest growth over the forecast period

Continuous Filament Mat (CFM) segment is expected to have faster growth for the market. CFM has superior mechanical properties compared to chopped strand mat (CSM), such as higher tensile strength, stiffness, and dimensional stability. This makes CFM a preferred choice for applications that require high strength and stiffness, such as wind turbine blades, aerospace components, and automotive parts. It is lightweight compared to other materials such as metals and concrete, which makes it an ideal choice for applications that require lightweight structures, such as aircraft and wind turbine blades. The demand for composites is increasing due to their high strength, stiffness, and lightweight properties. CFM is a key component in composites and is thus driving the growth of the glass mat market.

Emulsion segment accounted for the largest market share in 2022

Emulsion segment holds the largest market share for the market in the study period. Emulsion bonded glass mat is widely used in the vehicle industry. Emulsion bonded glass mat is in high demand due to the growing need for lightweight and fuel-efficient vehicles. The use of emulsion bonded glass mat can help reduce the weight of the vehicle, which can lead to improved fuel efficiency. This glass mat has several advantages over powder bonded glass mat, such as improved flexibility, drapeability, and adhesion. These properties make it easier to handle and install in various applications and result in higher mechanical strength and durability of the final product.

Wet-laid segment is expected to hold the larger revenue share

Wet-laid segment is projected to witness a larger revenue share in the coming years. This glass mat is widely used in the construction industry for applications such as roofing, wallboard, and flooring. The growing construction industry, particularly in developing countries, is driving the demand for wet-laid glass mat. The demand for composites is increasing in various industries, such as aerospace, wind energy, and automotive. Wet-laid glass mat is a key component in composites and is thus driving the growth of the glass mat market. The wet-laid process is highly automated and can produce high volumes of glass mat in a short period of time. This results in improved productivity and reduced manufacturing costs.

Construction & Infrastructure segment is projected to witness higher growth

Construction & Infrastructure segment expected to have higher growth for the market. The Construction Industry is witnessing significant growth globally due to rapid urbanization, increasing population, and infrastructure development. Glass mat is widely used in the construction industry for various applications such as roofing, wallboard, flooring, and insulation. The increasing construction activities are driving the demand for glass mat in the market. Glass mat offers several benefits such as high strength, durability, moisture resistance, and fire resistance, which make it an ideal material for construction. The growing awareness of the benefits of glass mat is driving its demand in the construction industry.

Asia Pacific registered with the highest growth rate in the study period

Asia Pacific is projected to witness a higher growth rate for the market. This region is the largest market for automotive production & sales, with countries such as China, India, & Japan accounting for a large portion of this demand. China remains the largest automobile market in across the globe terms of both annual sales & manufacturing output, and it is projected to produce 35 million vehicles domestically by 2025.

According to the Ministry of Industry and Information Technology's 2021 data, 26 million vehicles were sold, with 21.48 million of them being passenger vehicles, indicating a 7.1% increase from the previous year. The demand for automotive production in China is driving the need for materials like glass mats, which are commonly used as reinforcement materials in the production of various automotive components. This will further create a wide range of opportunities for the growth of the market in coming years.

North America garnered with the larger revenue share in the forecast time frame

North America is expected to witness a larger revenue share for the market. The use of glass mat products in wind energy applications is increasing due to their high strength and durability. As North America focuses on transitioning towards renewable energy sources, the demand for glass mat products is expected to grow. The growth of wind energy in North America is driving the demand for glass mat products due to their use in wind turbine blades.

According to the Wind Vision Report, wind power has the potential to provide renewable electricity across all 50 states of the US by 2050. The wind energy industry can also support a robust domestic supply chain and create over 600,000 jobs by 2050 in manufacturing, installation, maintenance, and supporting services. As the wind energy industry continues to grow in North America, there is an increasing need for high-performance materials that can withstand the harsh operating conditions of wind turbines.

Competitive Insight

Some of the major players operating in the global market include Owens Corning, Jushi, Saint-Gobain, Johns Manville, Chongqing Polycomp International, AGY, Nippon Electric Glass, Binani Industries, Taiwan Glass Industry, Nitto Boseki, PFG Fiber Glass, Taishan Fiberglass, China Beihai Fiberglass, Valmiera Glass, Knauf Insulation, Saertex, 3B - The Fibreglass Company, BGF Industries, Huitex, Saint-Gobain Vetrotex, Binzhou, Nittobo America, Asahi Fiber Glass, Chomarat, PPG Industries, China Jushi, Fiberglass Coatings, Fiber Glass Systems, Fibrelite, PFG America, Porcher Industries, Sichuan Weibo New Material, Technobasalt-Invest, Unifrax & Zhejiang Yuanda Fiberglass.

Recent Developments

In December 2022, Saint-Gobain, France-based company, broke ground for a new glass mat facility on its CertainTeed Roofing campus in Oxford, North Carolina. The company invested $167 million in the facility, the largest ever made in the U.S.-based roofing facility.

Glass Mat Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 1.43 billion |

|

Revenue forecast in 2032 |

USD 2.96 billion |

|

CAGR |

8.4% from 2023 - 2032 |

|

Base year |

2022 |

|

Historical data |

2019 - 2021 |

|

Forecast period |

2023 - 2032 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Mat Type, By Binder Type, By Manufacturing Process, By End-Use Industry, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Owens Corning, Jushi, Saint-Gobain, Johns Manville, Chongqing Polycomp International, AGY, Nippon Electric Glass, Binani Industries, Taiwan Glass Industry, Nitto Boseki, PFG Fiber Glass, Taishan Fiberglass, China Beihai Fiberglass, Valmiera Glass, Knauf Insulation, Saertex, 3B - The Fibreglass Company, BGF Industries, Huitex, Saint-Gobain Vetrotex, Binzhou, Nittobo America, Asahi Fiber Glass, Chomarat, PPG Industries, China Jushi, Fiberglass Coatings, Fiber Glass Systems, Fibrelite, PFG America, Porcher Industries, Sichuan Weibo New Material, Technobasalt-Invest, Unifrax & Zhejiang Yuanda Fiberglass. |

FAQ's

The global glass mat market size is expected to reach USD 2.96 billion by 2032.

Top market players in the Glass Mat Market are Owens Corning, Jushi, Saint-Gobain, Johns Manville, Chongqing Polycomp International, AGY.

North America contribute notably towards the global Glass Mat Market.

The global glass mat market expected to grow at a CAGR of 8.4% during the forecast period.

The Glass Mat Market report covering key are mat type, binder type, manufacturing process, end-use industry and region.