Aramid Fiber Market Size, Share, Trends, Industry Analysis Report

: By Product (Para-Aramid and Meta-Aramid), Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM1138

- Base Year: 2024

- Historical Data: 2020-2023

Aramid Fiber Market Overview

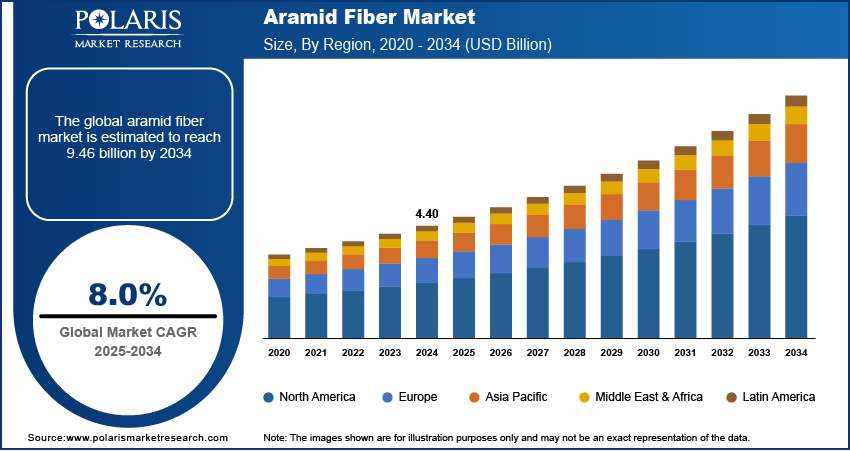

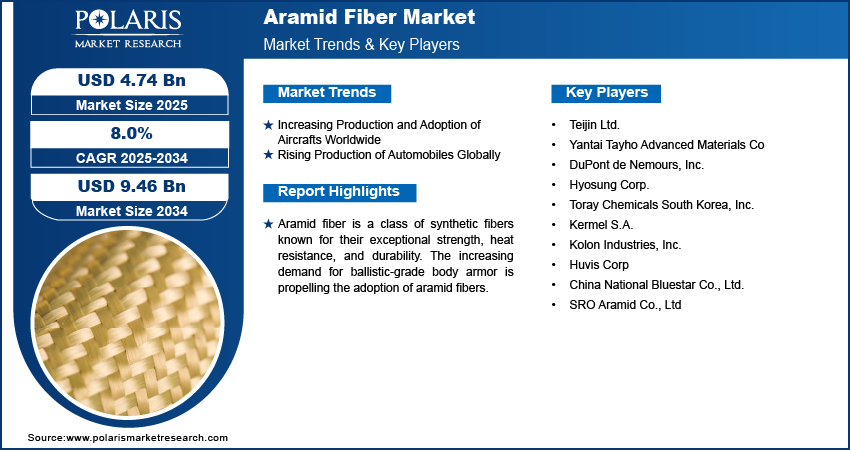

The global aramid fiber market size was USD 4.40 billion in 2024 and is projected to increase to USD 4.74 billion in 2025, reaching USD 9.46 billion by 2034, exhibiting a CAGR of 8.0% from 2025 to 2034. Rising defense spending, growing demand for lightweight durable materials in aerospace and automotive, and increasing focus on personal protection are fueling market growth.

Key Insights

- The para-aramid segment accounted for the largest market share in 2024.

- The security & protection segment dominated the market in 2024 due to the growing demand for superior protective apparatus in the military, law imposition and industrial sectors.

- Asia Pacific aramid fiber market held the largest market share in 2024.

- China led the region towards sizeable growth due to its superior manufacturing potential, and escalating demand for advanced materials across industries.

- North America is anticipated to register the fastest growth during the forecast period.

- The US plays an important part in this growth profiting from elevated defense disbursement, and a robust concentration on invention in efficient materials.

Industry Dynamics

- Aramid fibers find extensive application in aircraft parts, such as fuselages, wings, interior panels, and composite framework to decrease weight and improve fuel productivity while sustaining structural unification.

- Aramid fibers are also used in automotives for parts such as tires, brake pads, clutches, and body panels to enhance performance, fuel productivity, and security of the vehicles.

- There is an opportunity for the market in military operations where lightweight and tough equipment are required.

- Aramid fibers have high manufacturing costs particularly in the price sensitive markets.

Market Statistics

2024 Market Size: USD 4.40 billion

2034 Projected Market Size: USD 9.46 billion

CAGR (2025-2034): 8.0%

Asia Pacific: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

Aramid fiber is a class of synthetic fibers known for their exceptional strength, heat resistance, and durability. These fibers are primarily composed of long-chain polyamide molecules that feature aromatic rings linked by amide groups, giving them unique mechanical properties and making them suitable for a variety of demanding applications such as aerospace, automotive, military, and others.

The increasing demand for ballistic-grade body armor is propelling the aramid fiber market growth. Aramid fibers, including Kevlar and Twaron, are essential components in manufacturing advanced ballistic-grade body armor that withstand high-velocity impacts while ensuring flexibility and comfort for the wearer. Law enforcement and personal safety sectors worldwide are prioritizing protective measures as global security threats increase, leading to increased demand for durable and efficient armor. This surge in body armor demand leads to increased production and utilization of aramid fibers.

The aramid fiber market demand is driven by growing investment in military upgradation across the globe. According to data published by the Stockholm International Peace Research Institute, the total global military expenditure reached USD 2443 billion in 2023, an increase of 6.8 percent in real terms from 2022. Increased defense budgets encourage militaries to focus on modernizing their equipment to improve mobility, protection, and operational efficiency. This, in turn, boosts demand for aramid fiber, as they are extensively used in military wearables and accessories such as body armor, helmets, armored vehicle, and aerospace components. Moreover, as the demand for lightweight and durable equipment increases in military operations, the adoption of aramid fiber is expected to rise due to its exceptional strength, heat resistance, and lightweight properties.

Aramid Fiber Market Dynamics

Increasing Production and Adoption of Aircraft Worldwide

Aramid fibers are widely used in aircraft parts, such as fuselages, wings, interior panels, and composite structures, to reduce weight and enhance fuel efficiency while maintaining structural integrity. As air travel grows and demand for new, fuel-efficient aircraft rises, manufacturers are increasingly incorporating advanced materials like aramid fiber to meet stringent performance and safety standards. As per the data published by the ch-aviation in June 2022, the total worldwide fleet size consisted of 28,674 aircraft, with 23,513 active and 5,161 grounded. Additionally, the adoption of aramid fibers in protective gear and fire-resistant materials for aviation personnel further contributes to its growing demand, making it a vital material in the expanding aerospace industry.

Rising Production of Automobiles Globally

Aramid fibers are widely used in automobile manufacturing for components such as tires, brake pads, clutches, and body panels to improve performance, fuel efficiency, and safety of the vehicles. Additionally, their heat resistance and wear durability make them ideal for high-stress components, especially in electric and high-performance vehicles. Therefore, the demand for aramid fiber is growing with the increasing production of automobiles worldwide. For instance, European Automobile Manufacturers' Association published data stating that around 85.4 million motor vehicles are produced globally every year.

Aramid Fiber Market Segment Analysis

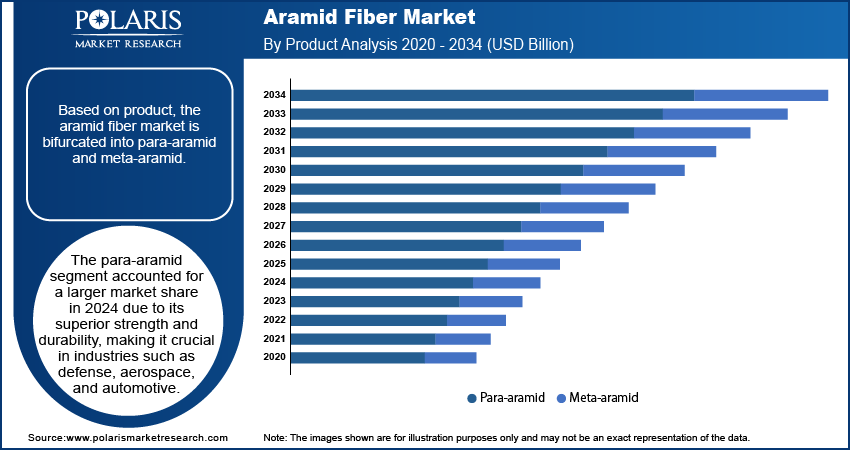

Aramid Fiber Market Assessment Based on Product

The aramid fiber market, based on product, is segmented into para-aramid and meta-aramid. The para-aramid segment accounted for a larger aramid fiber market share in 2024. The superior strength and durability of para-aramid fiber make it crucial in industries such as defense, aerospace, and automotive. It is extensively used in ballistic protection, such as bulletproof vests and helmets, due to its exceptional tensile strength and resistance to high-impact forces. The growing global focus on safety and defense modernization has significantly fueled demand for para-aramid materials. Additionally, its role in automotive applications, including reinforced tires and high-performance components, contributes to its widespread adoption. The material’s ability to enhance product performance while reducing weight has also made it a preferred choice for several critical applications in industries like the military and automotive, reinforcing its market leadership.

The meta-aramid segment is expected to grow rapidly during the forecast period owing to its high heat and flame resistance ability, which aligns with the increasing demand for fireproof and thermal-resistant solutions. Additionally, the transition toward sustainable energy solutions, including electric vehicles, is boosting the use of meta-aramid materials in battery insulation and other high-temperature applications, contributing to its growth in the coming years.

Aramid Fiber Market Evaluation Based on Application

The aramid fiber market, by application, is segmented into security & protection, frictional materials, rubber reinforcement, optical fibers, tire reinforcement, electrical insulation, aerospace, and others. The security & protection segment dominated the market in 2024 due to the increasing demand for high-performance protective gear in the military, law enforcement, and industrial sectors. The global focus on defense modernization and personal safety has significantly fueled this growth. Advanced protective solutions, such as bulletproof vests, helmets, and vehicle armor, rely on high-strength materials like aramid fibers to ensure safety while maintaining mobility. Additionally, industries such as oil & gas, construction, and firefighting require durable, flame-resistant protective clothing to meet stringent safety regulations, contributing to the segment's dominance.

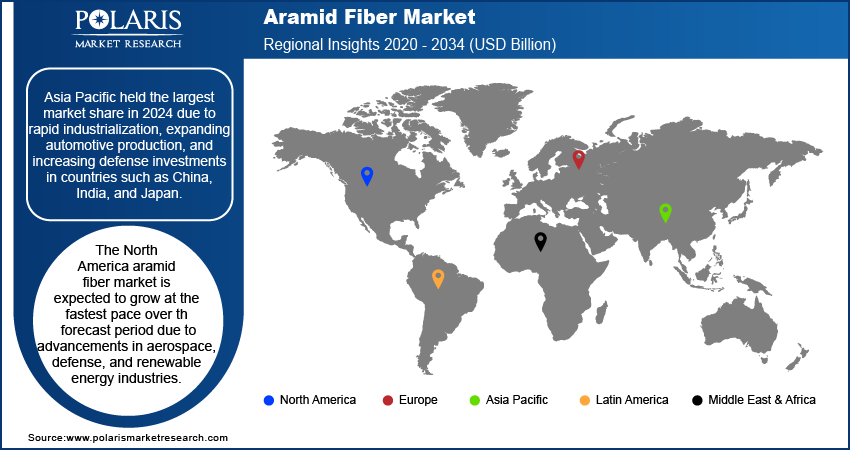

Aramid Fiber Market Regional Analysis

By region, the study provides the aramid fiber market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific held the largest market share in 2024, driven by rapid industrialization, expanding automotive production, and increasing defense investments in countries such as China, India, and Japan. China dominated this region, leveraging its extensive manufacturing capabilities and growing demand for advanced materials across industries. The region's strong presence in the automotive sector has significantly boosted the use of high-strength materials, including aramid fiber, in tire reinforcement and frictional components. Additionally, investments in infrastructure and power generation projects have fueled the demand for durable and heat-resistant materials like aramid fiber, positioning Asia Pacific as the leading region.

The North America aramid fiber market is expected to register the fastest growth during the forecast period, driven by advancements in the aerospace, defense, and renewable energy industries. The US plays a pivotal role in this growth, benefiting from high defense spending and a strong emphasis on innovation in high-performance materials. The aerospace sector’s increasing focus on lightweight and fuel-efficient materials has significantly boosted demand for durable and heat-resistant composites like aramid fibers. Moreover, the region's commitment to renewable energy solutions, particularly wind and solar power, has accelerated the adoption of insulating and protective materials for high-performance applications.

Aramid Fiber Market – Key Players and Competitive Insights

Prominent market players are investing heavily in research and development in order to expand their offerings, which will help the aramid fiber market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations.

The aramid fiber market is fragmented, with the presence of numerous global and regional market players. Major players in the aramid fiber market include TEIJIN LIMITED; Yantai Tayho Advanced Materials Co; DuPont de Nemours, Inc.; Hyosung Corp.; TORAY INDUSTRIES, INC.; Kermel S.A.; Kolon Industries, Inc.; Huvis Corp; China National Bluestar Co., Ltd.; and SRO Aramid Co., Ltd.

DuPont de Nemours, Inc. commonly known as DuPont, is a prominent player in the global materials science sector, headquartered in Wilmington, Delaware. The company was formed from the merger of Dow Chemical and DuPont in 2017 and has since focused on developing specialty materials and innovative solutions across various industries. With a workforce of approximately 28,000 employees, DuPont operates in sectors such as electronics, construction, automotive, food and beverage, and healthcare. Its extensive product portfolio includes adhesives, biomaterials, electronic solutions, industrial films, and a range of fibers and nonwovens. One of DuPont's most notable contributions to materials science is its development of aramid fibers, particularly under the well-known brand names Kevlar and Nomex.

TEIJIN LIMITED is a prominent Japan-based multinational corporation founded in 1918 and headquartered in Tokyo. Initially established as a textile manufacturer, Teijin has evolved into a diversified technology-driven holding company with a focus on high-performance materials and solutions across various sectors, including chemicals, healthcare, and information technology. Teijin operates globally with over 21,000 employees and a network of subsidiaries and affiliates across Asia, Europe, and the Americas. A key area of expertise for Teijin is its Advanced Fibers & Composites Business, which prominently features aramid fibers. The company manufactures aramid fibers under the brand name Twaron, which is recognized for its exceptional strength-to-weight ratio and thermal stability.

List of Key Companies in Aramid Fiber Market

- TEIJIN LIMITED

- Yantai Tayho Advanced Materials Co

- DuPont de Nemours, Inc.

- Hyosung Corp.

- TORAY INDUSTRIES, INC.

- Kermel S.A.

- Kolon Industries, Inc.

- Huvis Corp

- China National Bluestar Co., Ltd.

- SRO Aramid Co., Ltd

Aramid Fiber Industry Developments

September 2023: Sinochem International made its debut at the China International Optoelectronic Exposition (CIOE2023), showcasing its entire line of para-aramid fiber products. These innovative solutions are tailored to meet the specific needs of the optical communication industry, serving as non-metallic reinforcement materials for optical fiber cable applications.

April 2023: DuPont, a prominent player in the global materials science sector, unveiled Kevlar EXO aramid fiber. The company stated that Kevlar EXO is the most significant aramid fiber innovation in over 50 years.

Aramid Fiber Market Segmentation

By Product Outlook (Volume – Tons, Revenue – USD Billion, 2020–2034)

- Para-Aramid

- Meta-Aramid

By Application Outlook (Volume – Tons, Revenue – USD Billion, 2020–2034)

- Security & Protection

- Frictional Materials

- Rubber Reinforcement

- Optical Fibers

- Tire Reinforcement

- Electrical Insulation

- Aerospace

- Others

By Regional Outlook (Volume – Tons, Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Aramid Fiber Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 4.40 billion |

|

Market Size Value in 2025 |

USD 4.74 billion |

|

Revenue Forecast by 2034 |

USD 9.46 billion |

|

CAGR |

8.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Volume in tons, Revenue in USD billion, and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global aramid fiber market size was valued at USD 4.40 billion in 2024 and is projected to grow to USD 9.46 billion by 2034.

The global market is projected to register a CAGR of 8.0% from 2025 to 2034.

Asia Pacific held the largest share of the global market in 2024.

Some of the key players in the market are TEIJIN LIMITED; Yantai Tayho Advanced Materials Co; DuPont de Nemours, Inc.; Hyosung Corp.; TORAY INDUSTRIES, INC.; Kermel S.A.; Kolon Industries, Inc.; Huvis Corp; China National Bluestar Co., Ltd.; and SRO Aramid Co., Ltd.

The meta-aramid fiber segment is projected to witness rapid growth during the forecast period.

The security & protection segment dominated the market in 2024.