Green Tea Chocolate Market Share, Size, Trends, Industry Analysis Report

By Type (Dark Chocolate, and White Chocolate); By Form; By Application; By Region; Segment Forecast, 2023-2032

- Published Date:Jul-2023

- Pages: 118

- Format: PDF

- Report ID: PM3529

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

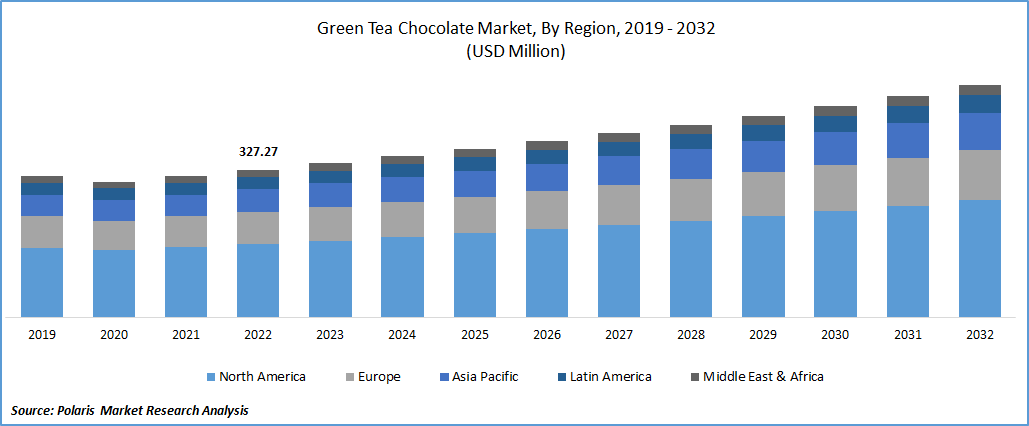

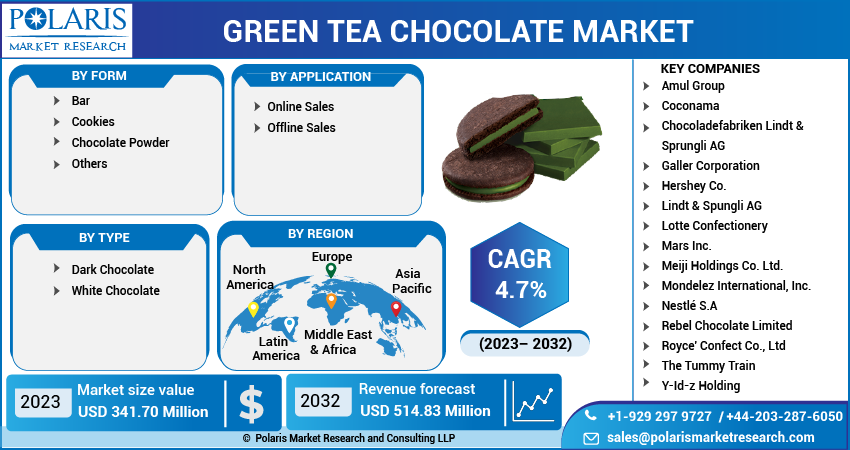

The global green tea chocolate market was valued at USD 327.27 million in 2022 and is expected to grow at a CAGR of 4.7% during the forecast period. Consumers worldwide are becoming increasingly enamored with green tea chocolate, which is anticipated to increase significantly during the forecast period. Due to the health advantages of green tea, businesses have developed green tea chocolate to make the flavor more appealing to consumers of all ages. One of the most important categories of chocolate is green tea chocolate. Matcha or green tea chocolate has a robust, classic flavor and the ideal amount of sweetness. It also contains caffeine and green tea powder. Matcha chocolate is more alluring to consumers because of its distinctive flavor. Matcha is mostly used to make highly bitter, thick tea but is also extensively utilized to make matcha chocolates. Matcha is considered healthier than other chocolate varieties since it has a high amount of vitamins, minerals, and amino acids.

To Understand More About this Research: Request a Free Sample Report

Green tea should be steamed or pan-fired to maintain the leaf profile attributes as soon as possible after harvest. Green tea from China is frequently pan-fired, but green tea from Japan is typically steamed in bamboo trays; each preparation method produces a distinct flavor. Steamed teas are harsh and vegetal, whereas pan-fired teas have a lighter, toastier taste. No matter how heated, the leaves are dried and rolled after harvest.

Lighter chocolates, particularly white and milk chocolate, go nicely with green teas. For instance, matcha is a tea grown in a controlled, shaded environment, producing beautifully developed leaves. Green tea is consumed orally to increase mental clarity and reasoning. Additionally, it is taken orally to treat stomach problems, nausea, vomiting, diarrhea, headaches, non-alcoholic fatty liver disease (NAFLD), depression, inflammatory bowel disease (ulcerative colitis or Crohn's disease), weight loss, and osteoporosis. A mellow, silky white or milk chocolate would mix better overall because dark chocolate can be overbearing, with green tea flavors complementing or interfering with the chocolate's flavor.

Further, rising cholesterol and cardiovascular disease are the major factors boosting the demand for green chocolate that is driving the market growth. As per the WHO, the biggest cause of death worldwide, cardiovascular diseases (CVDs), claim 17.9 million lives annually. Also, as per the CDC, the total cholesterol level in about 94 Mn Americans aged 20 or older is higher than 200 mg/dL. In the US, 28 Mn persons have more than 240 mg/dL of total cholesterol levels. Almost 7% of American kids and teenagers between 6 and 19 have high total cholesterol. To be healthy for the heart, lowering bad cholesterol, and act as a relaxant to lessen stress and prevent cardiovascular disease, green tea chocolate also includes antioxidants that assist the body battle unstable molecules. However, the high cost of green tea chocolate relative to other chocolates will probably limit the market's expansion.

For Specific Research Requirements, Request for a Customized Report

Industry Dynamics

Growth Drivers

The rising prevalence of Parkinson's' and the benefits of green tea chocolate for treating Parkinson's and Alzheimer's, is the major factor supporting the green tea chocolate market growth. The L-theanine found in green tea and dark chocolate induces a state of calm and relaxation and activates brain waves resembling those that occur during meditation. On the other hand, some things can enhance mental health, increase the extent of alertness and focus, stop the beginning of diseases like Parkinson's and Alzheimer's, and prevent age-related deterioration.

Report Segmentation

The market is primarily segmented based on form, type, application, and region.

|

By Form |

By Type |

By Application |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Chocolate Bars segment is expected to witness the fastest growth during forecast period

A chocolate bar, often known as a sweet bar, is a sweet treat made of chocolate that may include layers or mixes of nuts, fruit, caramel, nougat, and wafers. With the help of the antioxidants present in this bar, which also contains green tea leaves, matcha powder, and chocolate, the body may get rid of dangerous substances and experience less oxidative stress. By hydrating skin, more antioxidants can also enhance its quality. Additionally, it offers UV protection and permits the skin to oxygenate itself properly.

The major players focus on developing chocolate bars that boost market growth. In July 2019, with the introduction of KitKat Green Tea Matcha, Nestlé was bringing Japanese flavors to the UK, and its Nesquik brand is now offered in the Nescafé Dolce Gusto coffee pod system. A limited-edition version of Hershey's original milk chocolate bar was released, with each piece featuring an emoji. To introduce Lavazza Iced Cappuccino, a ready-to-drink iced coffee, in the UK this summer, Lavazza and PepsiCo have formed a new strategic relationship. These factors are propelling segmental growth.

Online Sales accounted for the significant market share in 2022

Chocolate is easily accessible at any convenience store, grocery store, or pharmacy. It is frequently located in two different areas of the store: the candy aisle and set up on shelves placed in a line near the cashier as a last-minute addition to the primary items being bought.

The online sales of green tea chocolates are rising owing to the various benefits online channels offer. The discounts offer as well as through AI showing similar products driving segmental growth.

Due to the increase in online grocery and other goods orders, customers are less likely to be enticed by snacks in the checkout queue. This change in the shopping experience might mean consumers who buy chocolate online do so with more thought than consumers who purchase chocolate in-store. In other words, consumers are more likely to make planned purchases of chocolate when they shop online than to make impulsive ones. The shopping experience has changed from in-store to online due to the cultural shift.

The demand in Asia-Pacific is expected to witness significant growth during projected period

One of the world's top producers and exporters of green tea chocolate is thought to be China. The anticipated period shows the strongest growth in South and East Asia. The simple accessibility of green tea in these areas will likely increase demand in the international market. The idea of green tea started in China and then expanded worldwide. The leaves of the Camellia Sinensis are used to make green tea chocolate. China is the world's top producer of green tea chocolate, and it will likely continue to hold that position during the projected period. The most well-liked Chinese green tea offered for sale in the United States is Dragonwell. Particularly in the premium, traditionally brewed "pre-rain" Dragonwell brews, the mild and sweet flavor is frequently associated with notes of chestnuts.

Furthermore, due to consumers' increasing awareness of health and well-being, Europe and North America, regions are also likely to experience high growth. The demand for healthier food options and advanced knowledge of the health advantages of green tea are two factors contributing to the North American region's expansion. Due to rising consumer demand for healthier food options and rising green tea consumption as a beverage and ingredient, the market for green tea chocolate is expanding in Europe.

Competitive Insight

Some of the major players operating in the global market include Amul Group, Coconama, Chocoladefabriken Lindt, Galler Corporation, Hershey, Lindt & Spungli, Lotte Confectionery, Mars Inc., Meiji Holdings., Mondelez International, Nestlé, Rebel Chocolate, Royce' Confect, Tummy Train, and Y-Id-z Holding

Recent Developments

- In November 2019, In partnership with Tempo Tea Bar, Rebel Chocolate unveiled a new bar containing three servings of matcha, 20% protein, and 40% less sugar. A variant of Rebel Chocolate's high protein white chocolate has been "tweaked" with matcha, the famous green tea known for being rich with antioxidants and allegedly boasting a plethora of other health advantages. It is free of lactose, gluten, and palm oil, much like all of Rebel Chocolate's chocolate, and it is marketed as "the healthiest chocolate ever.

Green Tea Chocolate Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 341.70 million |

|

Revenue Forecast in 2032 |

USD 514.83 million |

|

CAGR |

4.7% from 2023 - 2032 |

|

Base year |

2022 |

|

Historical data |

2019 - 2021 |

|

Forecast period |

2023- 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments Covered |

By Form, By Type, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Amul Group, Coconama, Chocoladefabriken Lindt & Sprungli AG, Galler Corporation, Hershey Co., Lindt & Spungli AG, Lotte Confectionery, Mars Inc., Meiji Holdings Co. Ltd., Mondelez International, Inc., Nestlé S.A, Rebel Chocolate Limited, Royce' Confect Co., Ltd, The Tummy Train, and Y-Id-z Holding |

FAQ's

key companies in green tea chocolate market are Amul Group, Coconama, Chocoladefabriken Lindt, Galler Corporation, Hershey, Lindt & Spungli, Lotte Confectionery, Mars Inc.

The global green tea chocolate market is expected to grow at a CAGR of 4.7% during the forecast period.

The green tea chocolate market report covering key segments are form, type, application, and region.

key driving factors in green tea chocolate market are growing awareness about the health benefits of green tea.

The global green tea chocolate market size is expected to reach USD 514.83 million by 2032.