Gynecology Market Size, Share, Trends, Industry Analysis Report

By Product Type (Gynecological Imaging Devices, Surgical Devices, Hand Instruments), By Procedure, By Application, By End User, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 128

- Format: PDF

- Report ID: PM5925

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

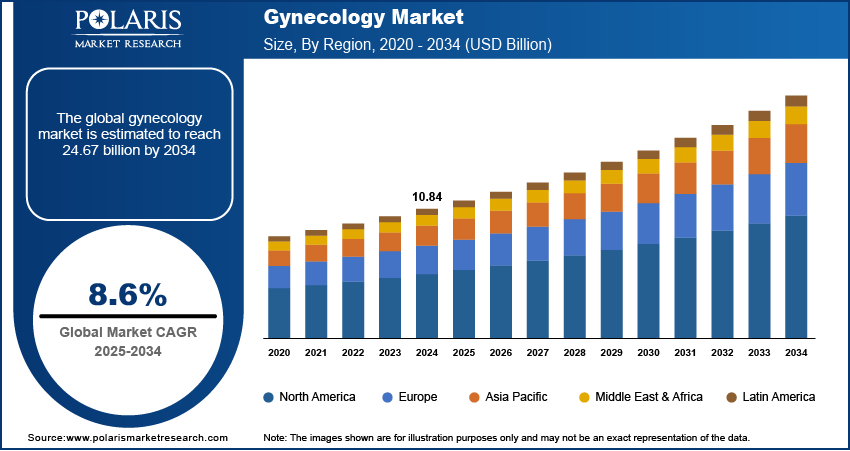

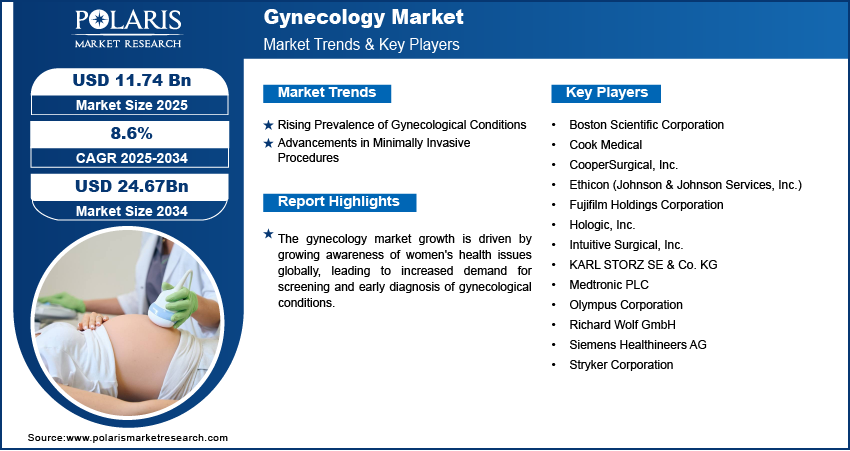

The global gynecology market size was valued at USD 10.84 billion in 2024 and is anticipated to register a CAGR of 8.6% from 2025 to 2034. The market is primarily driven by the rising prevalence of gynecological conditions and a growing awareness of women's health issues. Also, ongoing advances in medical technology, especially for minimally invasive procedures, are boosting market expansion.

Gynecology deals with products and services focused on the health of the female reproductive system. This includes the diagnosis, treatment, and prevention of conditions affecting the uterus, ovaries, fallopian tubes, vagina, and breasts.

With growing age, women become more susceptible to a range of gynecological conditions, including postmenopausal osteoporosis, uterine fibroids, and various cancers, as well as issues such as pelvic organ prolapse and urinary incontinence. This demographic shift naturally increases the demand for specialized gynecological care, diagnostics, and treatment solutions tailored to the needs of older women.

To Understand More About this Research: Request a Free Sample Report

Governments and various health organizations globally are increasingly focusing on women's health through various initiatives and awareness campaigns. These programs aim to educate women about the importance of preventive care, early detection of gynecological diseases, and access to reproductive health services. Such efforts lead to greater health literacy among women, encouraging them to seek regular check-ups and medical interventions.

Industry Dynamics

Rising Prevalence of Gynecological Conditions

The increasing number of women diagnosed with various gynecological conditions is a significant driver. Conditions such as uterine fibroids, endometriosis, polycystic ovary syndrome (PCOS), and different types of gynecological cancers are becoming more common. This rise in disease burden directly leads to a higher demand for diagnostic services, treatment options, and specialized gynecological care.

As per the Global Burden of Disease report worldwide, for women aged 15 years and above, benign gynecological conditions were responsible for over 21 million YLDs, representing more than 5% of all YLDs. In low and middle-income countries, this burden is even higher, with 84% of the global morbidity due to benign gynecological conditions found in these regions. Moreover, HIV/AIDS, PCOS, infertility, and premenstrual syndrome (PMS) were identified as key drivers behind the increased DALYs. This highlights the growing need for gynecological interventions and treatments, thereby driving the growth.

Advancements in Minimally Invasive Procedures

Technological advancements, particularly in minimally invasive surgical techniques, are playing a crucial role in the expansion of the gynecology market. Procedures such as laparoscopy and robotic-assisted surgery offer notable benefits over traditional open surgeries, including reduced pain, smaller incisions, shorter hospital stays, and quicker recovery times. These advantages make minimally invasive options more appealing to both patients and healthcare providers.

An article titled "Recent advances in minimally invasive surgery for gynecologic indications" published on PubMed Central in 2019 noted that minimally invasive surgery has been widely adopted and has become the standard procedure for gynecologic diseases due to advantages such as less postoperative pain, shorter hospital stays, and faster recovery. The continuous innovation in these techniques, making even complex procedures less invasive, directly contributes to increased adoption and growth of the gynecology market.

Segmental Insights

Product Type Analysis

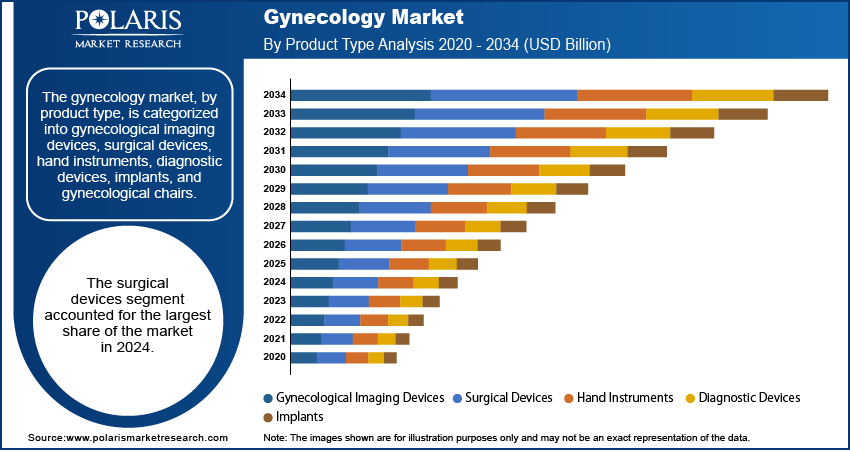

The surgical devices segment held the largest share in 2024. This dominance is largely attributed to the increasing number of gynecological procedures performed globally, including those for common conditions such as fibroids, endometriosis, and various cancers. The demand for surgical devices is also influenced by the growing adoption of female sterilization and contraceptive procedures. A 2025 article on PubMed Central, "Rising global burden of common gynecological diseases in women of childbearing age from 1990 to 2021," noted a significant increase in the burden of gynecological diseases, necessitating more surgical interventions.

The diagnostic imaging devices segment is anticipated to register the highest growth rate during the forecast period. This growth is fueled by continuous technological advancements in imaging modalities, such as 3D and 4D ultrasound, which provide more detailed and accurate diagnoses. The increasing emphasis on early detection and prevention of gynecological conditions, coupled with the rising number of intended and unintended pregnancies worldwide, drives the demand for sophisticated diagnostic imaging. As an illustration, a 2024 article in MDPI titled "Clinical Ultrasound Applications in Obstetrics and Gynecology in the Year 2024" highlighted how the evolution of ultrasound technology, especially with 3D and 4D imaging, has expanded its applications, enhancing diagnostic accuracy and patient care.

Procedure Analysis

The female sterilization and contraceptive procedures segment held the largest share in 2024. This dominance is driven by the global emphasis on family planning and reproductive health. Many women choose these procedures as a long-term or permanent solution for birth control, seeking effective methods to manage their family size. The World Health Organization (WHO) has consistently highlighted the importance of access to family planning services as a fundamental human right, and across many regions, female sterilization remains one of the most widely adopted forms of contraception.

The hysteroscopy segment is anticipated to register the highest growth rate during the forecast period.. This growth is primarily fueled by the increasing preference for minimally invasive diagnostic and therapeutic procedures. Hysteroscopy allows for direct visualization of the uterine cavity, enabling accurate diagnosis and treatment of conditions such as abnormal uterine bleeding, polyps, fibroids, and infertility issues without large incisions. Recent advancements in hysteroscopic techniques, including smaller diameter hysteroscopes and improved imaging capabilities, have made the procedure less invasive and more comfortable for patients, often allowing it to be performed in an outpatient setting.

Application Analysis

The pregnancy & fertility segment held the largest share in 2024, due to the consistently high global birth rates, the increasing trend of delayed pregnancies, and the rising prevalence of infertility issues worldwide. The need for prenatal care, childbirth services, and fertility treatments such as in vitro fertilization (IVF) contributes significantly to this segment's demand. The World Health Organization (WHO) reported in 2024 that approximately one in six people of reproductive age globally experience infertility, underscoring the substantial demand for fertility-related services. This broad base of needs, from routine pregnancy care to advanced reproductive technologies, establishes pregnancy and fertility as the dominant application.

The oncology segment is anticipated to register the highest growth rate during the forecast period. This projected growth is driven by the increasing incidence of gynecological cancers globally, including ovarian, cervical, and endometrial cancers. Enhanced awareness, improved screening programs, and advancements in diagnostic techniques are leading to earlier detection, which, in turn, fuels the demand for advanced treatment modalities. A 2024 article in MDPI titled "Recent Therapeutic Advances in Gynecologic Oncology: A Review" highlighted significant progress in the management of these cancers with novel therapeutic agents such as immune checkpoint inhibitors and antibody-drug conjugates. The continuous innovation in cancer therapies, coupled with the rising patient population, is a key factor accelerating the expansion of the oncology segment.

End User Analysis

The hospitals segment held the largest share in 2024. Hospitals are primary healthcare institutions that offer a comprehensive range of gynecological services, including complex surgeries, diagnostic imaging, emergency care, and long-term treatment plans. Their extensive infrastructure, availability of specialized medical professionals (such as obstetricians and gynecologists), and capacity for inpatient care make them central to managing a wide spectrum of gynecological conditions, from routine check-ups to critical interventions. Nearly all births in the U.S. occur in hospitals. For instance, as highlighted by a 2022 Government Accountability Office (GAO) report on maternal health, showcases essential role of hospitals in obstetric and gynecological care. This broad scope of services and established infrastructure contribute to their leading position.

The ambulatory surgical centers (ASCs) segment is anticipated to register the highest growth rate during the forecast period. This rapid growth is driven by the increasing shift of surgical procedures from traditional hospital settings to outpatient facilities. ASCs offer several advantages, including lower costs, greater convenience, shorter wait times, and a more personalized patient experience for less complex procedures. A 2019 article published on PubMed Central, "Laparoscopic Hysterectomy Outcomes: Hospital vs Ambulatory Surgery Center," indicated that laparoscopic hysterectomies can be safely performed in ASCs with high rates of same-day discharge. As medical technology advances, allowing more gynecological surgeries to be safely performed in an outpatient setting, the appeal of ASCs for both patients and healthcare providers continues to rise, fueling this segment's expansion.

Regional Analysis

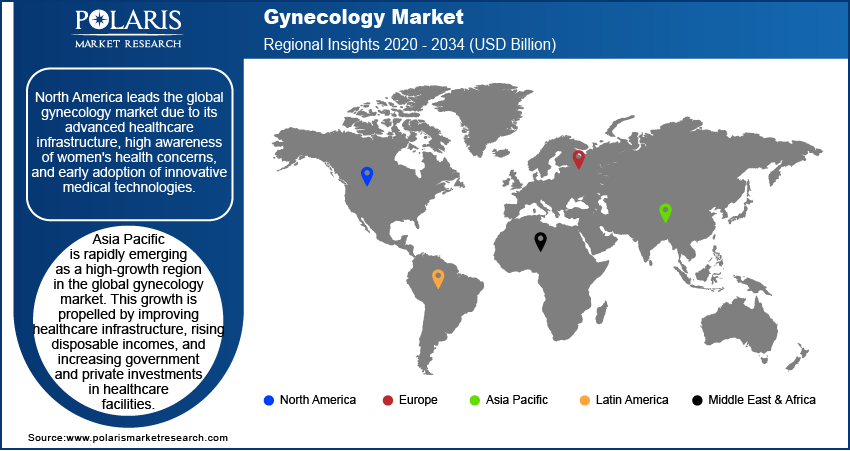

The North America gynecology market held the largest share in 2024 due to its advanced healthcare infrastructure, high awareness of women's health issues, and early adoption of new medical technologies. The region benefits from substantial investments in research and development, leading to the introduction of innovative gynecological devices and therapies. The presence of key market players and favorable reimbursement policies also contribute to market growth. According to a 2019 statistical brief by the Healthcare Cost and Utilization Project (HCUP), approximately 419,000 hysterectomy procedures were performed in ambulatory settings in the U.S., showcasing the volume of gynecological procedures. This robust healthcare ecosystem continues to drive demand across the region.

U.S. Gynecology Market Insight

The U.S. is a dominant country within the North American gynecology market. The country benefits from a high prevalence of gynecological disorders, a strong emphasis on preventative care, and widespread access to advanced diagnostic and treatment options. There is also a continuous focus on improving surgical outcomes through minimally invasive techniques and innovative device development. The significant investments in women's health initiatives further propel the market. The U.S. National Institutes of Health (NIH) highlights that conditions such as fibroids and endometriosis affect a substantial portion of women, driving the demand for various gynecological devices and procedures in the country. The progressive healthcare landscape and patient awareness contribute to the robust demand in the US.

Europe Gynecology Market Outlook

Europe represents a sizable segment of the gynecology market, characterized by the increasing awareness of gynecological illnesses, well-developed healthcare systems, and supportive government initiatives for medical innovation. The region has a strong focus on early diagnosis and the adoption of advanced therapeutic solutions. European countries are also seeing a growing preference for less invasive gynecological procedures, driven by patient demand for quicker recovery times and reduced discomfort. This collective emphasis on women's health and technological integration continues to expand the market across the region.

The Germany gynecology market is a major contributor to the European market. The country's strong economy and robust healthcare infrastructure support the uptake of advanced gynecological products and services. There is a high level of awareness regarding women's health, alongside government programs promoting access to healthcare. The increasing prevalence of gynecological conditions and a rising aging population further fuel demand for various treatments and devices.

Asia Pacific Gynecology Market Overview

Asia Pacific is rapidly emerging as a high-growth area in the gynecology market. This growth is propelled by improving healthcare infrastructure, rising disposable incomes, and increasing government and private investments in healthcare facilities. The growing awareness about women's health and family planning initiatives also contributes to the rising demand for gynecological products and services. As populations continue to grow and access to healthcare expands, the market potential in this region remains substantial.

The China gynecology market stands out as a significant country in Asia Pacific. The country's vast population, coupled with ongoing urbanization and economic development, is leading to an expansion of healthcare services and increased accessibility to medical care. The rising incidence of gynecological disorders and government initiatives focused on improving women's health are key factors stimulating demand. CEIC data from 2022 showed a continuous increase in the number of hospitals in China, indicating expanding healthcare facilities that can provide gynecological care, thereby boosting the market.

Key Players and Competitive Insights

The competitive landscape of the gynecology market is dynamic, with many companies vying for a strong position through product innovation, strategic partnerships, and geographic expansion. Companies often focus on developing specialized devices and technologies that address specific gynecological conditions or improve surgical outcomes, leading to a varied offering of solutions across the industry.

A few prominent companies in the industry include Medtronic PLC; Ethicon (Johnson & Johnson Services, Inc.); Boston Scientific Corporation; CooperSurgical, Inc.; Hologic, Inc.; Stryker Corporation; KARL STORZ SE & Co. KG; Olympus Corporation; Richard Wolf GmbH; Intuitive Surgical, Inc.; Siemens Healthineers AG; Fujifilm Holdings Corporation; and Cook Medical.

Key Players

- Boston Scientific Corporation

- Cook Medical

- CooperSurgical, Inc.

- Ethicon (Johnson & Johnson Services, Inc.)

- Fujifilm Holdings Corporation

- Hologic, Inc.

- Intuitive Surgical, Inc.

- KARL STORZ SE & Co. KG

- Medtronic PLC

- Olympus Corporation

- Richard Wolf GmbH

- Siemens Healthineers AG

- Stryker Corporation

Industry Developments

January 2025: Hologic completed the acquisition of Gynesonics, Inc., a company focused on treatments for abnormal uterine bleeding.

July 2024: Hologic signed a definitive agreement to acquire Endomagnetics Ltd., a medical technology company focused on improving breast cancer care.

Gynecology Market Segmentation

By Product Type Outlook (Revenue – USD Billion, 2020–2034)

- Gynecological Imaging Devices

- Surgical Devices

- Hand Instruments

- Diagnostic Devices

- Implants

- Gynecological Chairs

By Procedure Outlook (Revenue – USD Billion, 2020–2034)

- Hysteroscopy

- Laparoscopy

- Colposcopy

- Endometrial Ablation

- Dilation & Curettage

- Female Sterilization & Contraceptive Procedures

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Oncology

- Urology

- Pregnancy & Fertility

- Menstrual Disorders

- Pelvic Organ Prolapse

- Sexually Transmitted Diseases (STDs)

By End User Outlook (Revenue – USD Billion, 2020–2034)

- Hospitals

- Gynecology Clinics

- Ambulatory Surgical Centers (ASCs)

- Diagnostic Centers

- Research & Academic Institutes

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest of Latin America

Gynecology Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 10.84 billion |

|

Market Size in 2025 |

USD 11.74 billion |

|

Revenue Forecast by 2034 |

USD 24.67 billion |

|

CAGR |

8.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 10.84 billion in 2024 and is projected to grow to USD 24.67 billion by 2034.

The global market is projected to register a CAGR of 8.6% during the forecast period.

North America dominated the market share in 2024.

A few key players in the market include Medtronic PLC; Ethicon (Johnson & Johnson Services, Inc.); Boston Scientific Corporation; CooperSurgical, Inc.; Hologic, Inc.; Stryker Corporation; KARL STORZ SE & Co. KG; Olympus Corporation; Richard Wolf GmbH; Intuitive Surgical, Inc.; Siemens Healthineers AG; Fujifilm Holdings Corporation; and Cook Medical.

The surgical devices segment accounted for the largest share of the market in 2024.

The hysteroscopy segment is expected to witness the fastest growth during the forecast period.