Gypsum Market Size, Share, Trends, & Industry Analysis Report

By Form (Natural, Synthetic), By Product, By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM6002

- Base Year: 2024

- Historical Data: 2020-2023

Overview

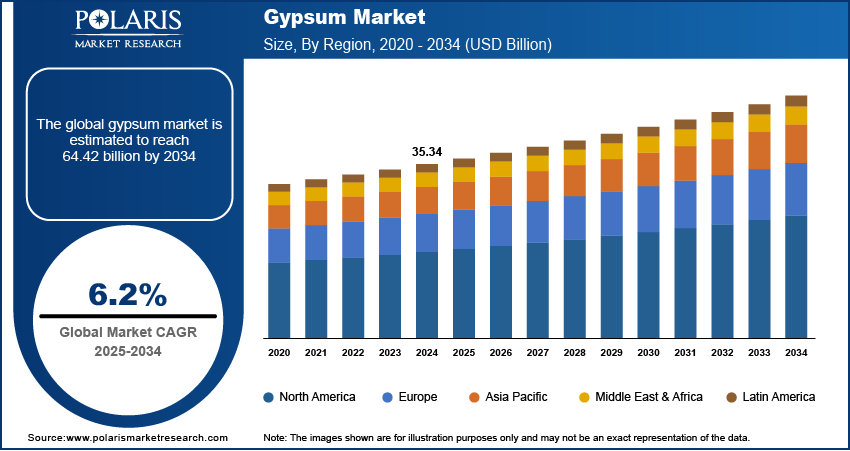

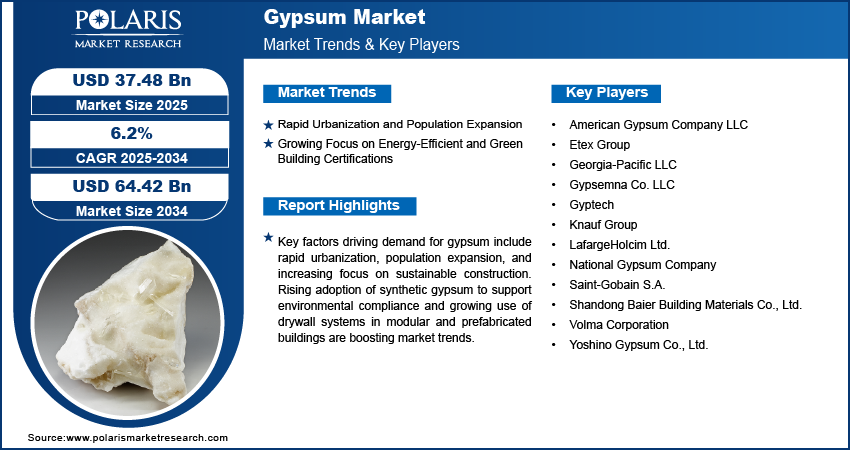

The global gypsum market size was valued at USD 35.34 billion in 2024, growing at a CAGR of 6.2% from 2025–2034. Rapid urbanization, along with a growing focus on energy-efficient and certified green buildings is boosting demand for gypsum-based construction materials.

Key Insights

- The drywalls segment accounted for largest market share in 2024.

- The plaster segment is projected to grow at the fastest rate over the forecast period, driven by the rising adoption of ready-to-use gypsum plasters in residential and institutional infrastructure projects.

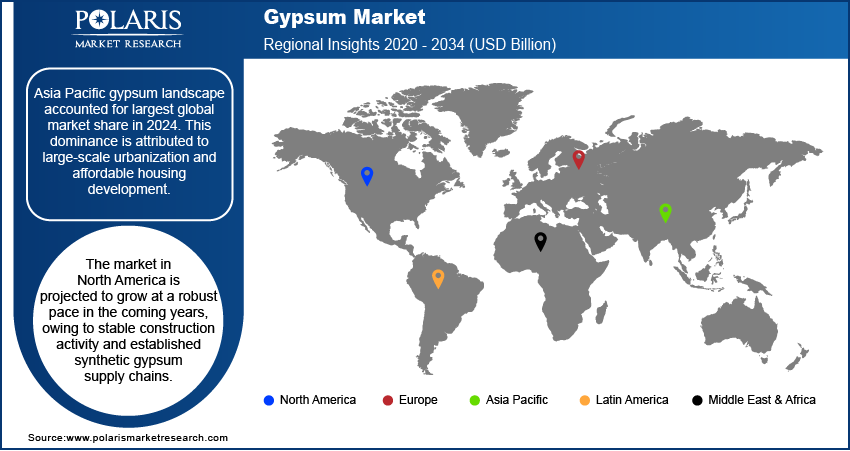

- The Asia Pacific gypsum market accounted for largest share of the global market in 2024, due to rapid urbanization, affordable housing initiatives, and consistent raw material availability.

- The China gypsum market held largest regional share of the Asia Pacific market in 2024, with high public investment in large-scale urban development and increasing adoption of sustainable construction materials at the national level.

- The market in North America is projected to grow with a fastest CAGR from 2025-2034, driven by consistent demand for renovation, retrofitting, and energy-efficient building systems.

- The US market is expanding steadily, fueled by strong demand in residential renovation and institutional infrastructure and increasing use of synthetic gypsum to meet environmental compliance standards.

Gypsum is widely used in construction, agriculture, and industrial applications due to its cost-effectiveness, fire resistance, and acoustic properties. Increasing demand for gypsum-based wallboards and plasters in residential and commercial infrastructure projects is driving market expansion. Gypsum products are preferred for their ease of installation, lightweight characteristics, and moisture resistance in the construction sector.

Moreover, rising urbanization and population growth across developing economies are driving the need for affordable housing and public infrastructure, boosting gypsum consumption. These products are used to improve soil structure, control salinity, and enhance water infiltration in the agriculture sector, due to increasing focus on sustainable farming practices.

Regulatory policies such as Leadership in Energy and Environmental Design (LEED), Energy Performance of Buildings Directive (EPBD), and Green Building Evaluation Standard (GBES) are promoting the use of eco-friendly construction materials with the use of synthetic gypsum derived from flue-gas desulfurization processes. This trend is driven by the digital circular economy approach and efforts to reduce landfill disposal of industrial byproducts. Manufacturers are investing in process optimization and automation to improve product consistency and reduce energy usage in gypsum board production. As per the Department of Energy (DoE), the department reviewed 22 LEED-certified GSA buildings and found 34% lower CO₂ emissions, 25% less energy use, 11% less water consumption, and over 80 million tons of waste diverted from landfills. Furthermore, rising global focus on green building certification standards and energy-efficient construction is fueling demand for gypsum-based insulation systems. Additionally, growing strategic collaborations between building material suppliers and construction firms are enabling integrated product development and supply chain efficiencies.

Industry Dynamics

- Rapid urbanization and population growth in developing economies are driving the demand for gypsum-based building materials in residential and commercial construction.

- Rising adoption of sustainable construction materials is fueling the use of synthetic gypsum produced from flue-gas desulfurization systems.

- Expansion of precision agriculture is creating opportunities for gypsum application in soil conditioning, salinity reduction and water retention improvement.

- Volatile raw material prices and energy-intensive manufacturing processes are limiting cost-efficiency for gypsum producers in price-sensitive markets.

Rapid Urbanization and Population Expansion: Urban growth and demographic expansion in developing countries are increasing the demand for gypsum due to its cost-efficiency, durability, and lightweight. According to the United Nations, around 55% of the global population lives in urban areas, projected to reach 68% by 2050. Nearly 2.5 billion more people are expected to move to cities by then, with around 90% of this growth occurring in Asia and Africa. Gypsum products such as wallboards and plasters are widely used in large-scale residential and commercial developments due to their ease of installation, fire resistance, and acoustic insulation properties. Government initiatives aimed at expanding affordable housing, urban transit systems and public infrastructure are further increasing the demand for gypsum-based materials. Additionally, rising population density in Asia Pacific, the Middle East, and Africa is driving demand for gypsum panels in vertical and modular construction. This ongoing urbanization is supporting consistent demand for gypsum materials for gypsum products across multiple construction projects during the forecast period.

Growing Focus on Energy-Efficient and Green Building Certifications: Increasing regulatory policies to meet sustainable building practices are driving the adoption of gypsum materials. This promotes several green certifications such as Leadership in Energy and Environmental Design (LEED), Building Research Establishment Environmental Assessment Method (BREEAM), and Indian Green Building Council (IGBC) while fueling the consumption of gypsum products across regions. Gypsum provides many properties, including thermal insulation, moisture resistance, and recyclability that meet green certification standards, making it well-suited for low-energy buildings and environmentally sustainable interior applications. Moreover, rising investments in green infrastructure projects and the expansion of energy codes are pushing construction firms to use materials with a lower environmental impact. Thus, construction companies are incorporating gypsum materials to meet indoor air quality and emissions compliance standards across the public and private sectors.

Segmental Insights

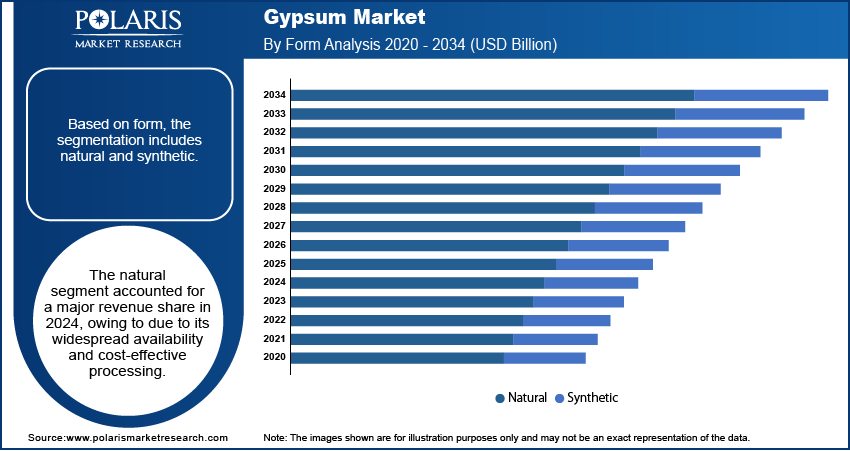

Form Analysis

Based on form, the segmentation includes natural and synthetic. The natural segment accounted for largest revenue share in 2024, due to driven by its widespread availability and low processing requirements. It is primarily used in cement, drywall, and plaster production across residential and commercial applications. Natural gypsum is widely used due to availability and alignment with conventional production practices with traditional methods. Consistent supply from large-scale mining operations and strong demand from Asian and Middle Eastern markets support its dominance.

The synthetic segment is projected to grow at the fastest pace during the forecast period, owing to the increasing adoption of sustainable construction materials and regulatory mandates promoting the reuse of industrial byproducts. Synthetic gypsum derived from flue-gas desulfurization processes is integrated into wallboards and plasters. Advancements in processing technologies and efforts to reduce dependency on natural reserves are accelerating its market penetration.

Product Analysis

By product, the market includes cement, drywall, plaster, soil amendment, gypsum blocks, and others. The drywall segment held the largest revenue share in 2024, owing to its extensive use in residential and commercial construction. These products offer fire resistance, acoustic control, and ease of installation, making them the preferred solution for interior wall systems. Urban infrastructure expansion and rising demand for modular buildings are further driving adoption. Drywalls are also preferred for their compatibility with rapid construction timelines and labor-efficient deployment. Product developments in water-resistant and high-strength boards are expanding their applicability in moisture-prone environments. With increasing demand for sustainable, lightweight, and standardized building materials, drywalls continue to lead gypsum product consumption globally.

The plaster segment is anticipated to grow at the fastest rate, owing to increasing use in decorative and functional surface finishing. Ready-to-use gypsum plasters are preferred over traditional cement-based options due to faster application, smooth finish, and lower on-site labor requirements. Demand is growing in urban housing and public infrastructure projects in the Asia Pacific and Africa. Regulatory initiatives targeting dust reduction and efficient resource use are supporting the increased use of pre-mixed gypsum formulations. Manufacturers are enhancing product performance through innovations in crack resistance and thermal insulation across new builds and refurbishments.

End User Analysis

By end user, the market includes residential, commercial & institutional, and industrial sectors. The residential segment held the largest revenue share in 2024, due to rising construction of affordable housing, apartments, and single-family homes across developing regions. As per the US Bureau of Economic Analysis, the real private residential fixed investment rose from USD 761.6 billion in 2019 to USD 794.9 billion in 2024, an increase of 4.4% over the period. Governments are promoting low-cost housing initiatives and urban renewal programs is driving the use of gypsum in walls, ceilings, and partition systems. Builders prefer gypsum boards and plasters for their thermal insulation, ease of handling, and fire-retardant properties. The demand for gypsum is strong in the Asia Pacific and Latin America due to high urban population growth and construction activities. Gypsum's compatibility with sustainable building practices and shorter project cycles positions it as a key material across residential construction applications.

The commercial & institutional segment is anticipated to grow at the fastest rate, owing to expansion in offices, hospitals, educational facilities, and hospitality infrastructure. Developers are deploying gypsum-based materials to meet design flexibility, acoustic control, and fire safety standards in large-scale projects. Demand is rising in emerging markets undergoing service-sector growth and urban infrastructure development. Energy-efficient gypsum panels and plasters are integrated into certified green buildings. Institutional facilities prefer gypsum for quick installation and reduced maintenance. Additionally, investments in tourism and healthcare construction are accelerating segment growth in regions implementing climate-resilient and energy-compliant building codes.

Regional Analysis

Asia Pacific gypsum market accounted for largest share of the global market share in 2024. This dominance is due to rapid urbanization and rising demand for affordable housing across China, India, and Indonesia, among others. As per the Population Reference Bureau (PRB), Asia's urban population grew from 27% in 1980 to 48% by 2015, with China reaching 56%, India 33%, and Indonesia 54%. By 2050, urbanization in Asia is expected to surpass 60%, adding over a billion city dwellers. Also, increasing government-led infrastructure programs are accelerating the use of gypsum-based materials in residential and commercial construction. These factors are pushing manufacturers to expand production capacities to meet growing domestic demand, with the growth in smart city programs and the availability of raw materials in this region.

China Gypsum Market Insight

China held largest market share in the Asia Pacific gypsum landscape in 2024, driven by the strong government investments in residential and commercial infrastructure. Rising urban redevelopment projects and high-rise construction are increasing the demand for gypsum-based drywalls and plasters. Additionally, the government initiatives promoting synthetic gypsum from industrial byproducts aim to reduce reliance on natural resources while boosting national goals for sustainable construction and environmental compliance. The presence of large-scale manufacturing capacity and centralized policy implementation is driving market growth across the country.

North America Gypsum Market Trend

The market in North America is projected to grow with a fastest CAGR from 2025-2034, due to strong demand for gypsum-based materials in residential renovation and commercial construction. Also, the growing public infrastructure investments and energy-efficient retrofitting programs in the US and Canada is driving gypsum consumption. Moreover, the easy availability of synthetic gypsum in this region fuels the demand for gypsum products in new construction and renovation projects. Furthermore, the presence of strict building codes, growing focus on indoor air quality, coupled with the increasing adoption of synthetic gypsum in power plants is contributing to market growth.

US Gypsum Market Overview Outlook

The market in the US is expanding due to the federal investment in affordable housing and infrastructure modernization. According to the National Low Income Housing Coalition (NLIHC), the US federal budget for FY2025 proposes USD 32.3 billion for housing vouchers, USD 6.2 billion for public housing operations, and USD 4.7 billion for homeless assistance. The rising demand for energy-efficient materials is increasing the use of gypsum boards and plaster in institutional and residential buildings. Additionally, strict environmental regulations are promoting the use of synthetic gypsum to reduce ecological impact across the country. This shift is enhancing sustainability and scalability in gypsum production within the US construction sector across diverse building applications.

Middle East & Africa Gypsum Market Overview

The gypsum landscape in the Middle East & Africa is projected to hold a substantial share in 2034, driven by large-scale infrastructure projects in Saudi Arabia, UAE, and Egypt, among others. For instance, in September 2024, Saudi Arabia's Vision 2030 infrastructure and construction initiatives reached a combined project value of USD 1.3 trillion. This surge reflects the country’s strategic push to diversify its economy through large-scale urban development and tourism-driven investments. The growing government-led urban development and tourism-focused construction are increasing demand for gypsum-based products in this region. Additionally, the high temperatures and arid conditions in the region are increasing demand for gypsum products for their lightweight and fire-resistant properties to meet energy-efficient buildings programs.

Key Players & Competitive Analysis Report

The gypsum market is moderately consolidated, with competition focused on production capacity, product quality, and distribution reach. Leading manufacturers are investing in process automation, energy-efficient production technologies, and lightweight product innovations to improve cost efficiency and performance. Key strategies include expanding regional production, securing raw material supply, and partnering with construction firms for bulk orders. Moreover, companies are focusing on synthetic gypsum adoption to meet sustainability targets and reduce environmental impact. Continuous product standardization and expansion into emerging markets are key approaches adopted by market players to expand regional presence and align with demand trends across residential and commercial construction sectors.

Major companies operating in the gypsum industry include Saint-Gobain S.A., Knauf Group, Etex Group, National Gypsum Company, Georgia-Pacific LLC, LafargeHolcim Ltd., Yoshino Gypsum Co., Ltd., Gypsemna Co. LLC, American Gypsum Company LLC, Shandong Baier Building Materials Co., Ltd., Gyptech, and Volma Corporation.

Key Players

- American Gypsum Company LLC

- Etex Group

- Georgia-Pacific LLC

- Gypsemna Co. LLC

- Gyptech

- Knauf Group

- LafargeHolcim Ltd.

- National Gypsum Company

- Saint-Gobain S.A.

- Shandong Baier Building Materials Co., Ltd.

- Volma Corporation

- Yoshino Gypsum Co., Ltd.

Industry Developments

- May 2025: Eagle Materials announced plans to modernize and expand its gypsum wallboard production facility in Bernalillo, New Mexico. The project aims to enhance manufacturing efficiency and increase production capacity to meet rising regional demand.

- May 2025: Knauf India introduced DewBloc, a next-generation gypsum plasterboard designed to resist sagging and delamination in high-humidity environments. This innovation aims to enhance durability and performance in drywall and ceiling construction applications.

- February 2025: CGC Inc. introduced the Sheetrock UltraLight Pro Panel, a new lightweight gypsum panel designed to meet the performance needs of professional contractors. This product offers improved strength, easier handling, and is optimized for fire-rated wall and ceiling assemblies.

Gypsum Market Segmentation

By Form Outlook (Revenue, USD Billion, 2020–2034)

- Natural

- Synthetic

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Cement

- Drywalls

- Plaster

- Soil Amendment

- Gypsum Blocks

- Others

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Residential

- Commercial & Institutional

- Industrial

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Gypsum Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 35.34 Billion |

|

Market Size in 2025 |

USD 37.48 Billion |

|

Revenue Forecast by 2034 |

USD 64.42 Billion |

|

CAGR |

6.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 35.34 billion in 2024 and is projected to grow to USD 64.42 billion by 2034.

The global market is projected to register a CAGR of 6.2% during the forecast period.

Asia Pacific dominated the market in 2024.

A few of the key players in the market are Saint-Gobain S.A., Knauf Group, Etex Group, National Gypsum Company, Georgia-Pacific LLC, LafargeHolcim Ltd., Yoshino Gypsum Co., Ltd., Gypsemna Co. LLC, American Gypsum Company LLC, Shandong Baier Building Materials Co., Ltd., Gyptech, and Volma Corporation.

The drywalls segment dominated the market in 2024. This is due to widespread use in residential and commercial construction.

The commercial and institutional segment is expected to witness the fastest growth during the forecast period, owing to rising investments in office, hospital, and hospitality infrastructure