Hand-held X-ray Market Share, Size, Trends, Industry Analysis Report

By Technology; By Application; By End-Use (Hospitals, Outpatient Facilities, Research & Manufacturing, Ambulatory Surgical Centers, Diagnostic Imaging Centers, Specialty Clinics, Others); By Region; Segment Forecast, 2023 - 2032

- Published Date:Jun-2023

- Pages: 117

- Format: PDF

- Report ID: PM3347

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

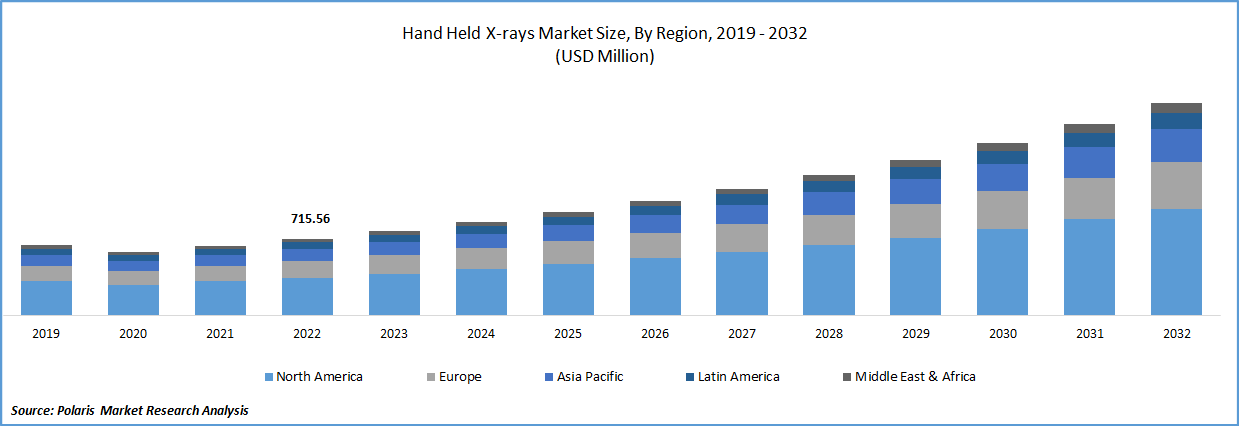

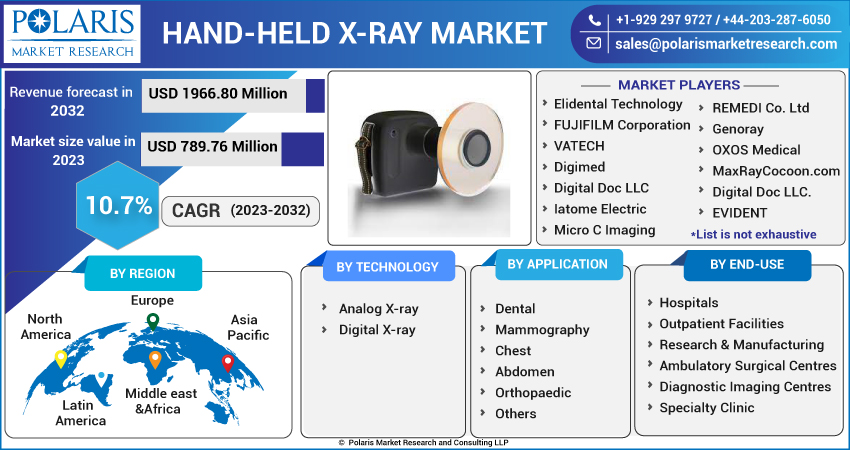

The global hand-held x-ray market was valued at USD 715.56 million in 2022 and is expected to grow at a CAGR of 10.7% during the forecast period. The global market is experiencing a rapid expansion globally, with a surge in demand for compact, lightweight, and portable imaging devices across various applications. The market’s remarkable growth can be attributed to the rising number of orthopedic surgeries and the escalating need for point-of-care diagnostics, particularly in remote and underserved areas moreover, with the ongoing developments in digital imaging technologies and the increasing demand for portable medical devices, the market is expected to sustain its upward trajectory in the foreseeable future with opportunities for innovation and expansion across multiple sectors, including medical, veterinary, and industrial applications.

To Understand More About this Research: Request a Free Sample Report

In addition, the rising incidence of chronic illnesses has resulted in a substantial emphasis on quick communication between diagnostic tools and x-ray devices and driving the hand-held x-ray market, along with the uptake and integration of smart devices by industry participants. Furthermore, the market's expansion and extensive development in various industries such as dental, orthopedic, hospitals, veterinary, and medical sectors are key drivers influencing its growth.

The adoption of x-ray devices is being driven by the advantages they offer over traditional imaging systems, including enhanced mobility, faster and more precise diagnosis, and improved patient comfort and safety and these are driving the market at rapid pace.

For instance, in November 2022, canon medical systems announced the launch of its new vantage Orian 1.5t MRI system. The vantage Orian features advanced imaging technologies and a streamlined workflow to improve efficiency and productivity. This system is designed to offers advanced imaging capabilities, including high-resolution images with low radiation exposure, and is designed to be comfortable for patients, faster scanning time and easy to use for healthcare professionals.

The global market has been significantly impacted by the outbreak of the COVID-19 pandemic. The sudden surge in the deadly coronavirus resulted in an increased requirement for portable and compact imaging equipment to aid in the diagnosis and monitoring of patients with COVID-19, thereby fueling the demand for these devices. Additionally, COVID-19-related restrictions and shutdowns have led to supply chain disruptions and manufacturing delays, resulting in a slight decline and longer lead times in the adoption of x-ray devices worldwide. However, the escalating crisis has led to an increased demand for various healthcare machines to obtain accurate results, thereby contributing positively to the market’s growth.

For Specific Research Requirements, Request for a Customized Report

Industry Dynamics

Growth Drivers

The global market for these devices is being driven by several factors. Firstly, the market benefits from the significant presence of established players who are increasingly focused on addressing the growing prevalence of chronic diseases. These devices are particularly useful in diagnosing and monitoring chronic conditions like osteoporosis and lung disease. Secondly, technological advancements have led to the development of wireless connectivity, real-time imaging, and automated image processing, which have significantly improving the safety, efficiency, and accuracy of these devices. Finally, the growing geriatric population has resulted in an increased demand for the devices, as they are essential in providing long-term care and medical attention. All of these factors are contributing to the growth of the global market.

Moreover, the market is expected to witness significant growth due to the increasing prevalence of dental problems such as cavities, infections, and bone loss in the oral region. This device is a valuable tool for dental professionals in diagnosing and treating such conditions. They provide quick and accurate imaging, facilitating prompt and effective treatment planning. Furthermore, their portability and convenience make them easily accessible and useful in various dental settings, thereby driving the market's growth as a crucial factor in addressing the rising incidence of dental problems.

Report Segmentation

The market is primarily segmented based on technology, application, end-use, and region.

|

By Technology |

By Application |

By End-Use |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

The Digital X-Ray Segment Accounted for the Largest Market Share in 2022

The segment growth can be attributed to several advantages that digital x-ray offers, including better image quality, growing use of mobile x-ray systems, improved storage and transfer of images, reduced radiation exposure, and faster processing times. The popularity of digital x-ray has surged in the medical imaging industry, with ongoing technological advancements in areas such as image processing and software driving growth in the market.

This trend is expected to continue in the near future, with digital x-ray technology becoming increasingly advanced and ubiquitous in medical and dental settings. In February 2022, Orthoscan, a company specializing in imaging technology for orthopedic surgery, launched the Orthoscan FD Pulse hand-held x-ray system. This system offers high-resolution images with a low dose of radiation, and is designed to be lightweight and portable for use in the operating room.

Moreover, during the anticipated period, the analog x-ray segment is expected to exhibit high market growth. The growth of this segment is primarily driven by the widespread utilization of analog x-ray, which offers several advantages such as lower cost, durability, ease of use, less sensitivity to environmental factors, and the absence of a need for digital storage infrastructure. These factors make analog x-ray a preferred option for many medical and dental practitioners, particularly in regions with limited resources or infrastructure.

Dental Segment Held the Significant Market Revenue Share in 2022

The dental segment held the largest market revenue share in 2022 and is likely to retain its position over the anticipated period on account of growing prevalence of various dental ailments among the populace, increasing dental problems and the availability of dental products are factors driving the growth of this segment. Additionally, the market segment is experiencing a boost due to the introduction of new products in the dental sector.

For instance, in October 2022, Videray Technologies, announced the launch of the most powerful device “PX Ultra”. This is a great opportunity for this industry to gain the demand. PX Ultra was industry’s first hand-held x-ray imager machine having 160 kw with the ability to identify anomalies through up to 10mm of steel.

Moreover, the orthopedic segment is expected to grow fastest during the anticipated period. The increasing number of orthopedic surgeries being performed are key factors driving the growth of the segment market. Additionally, orthopedic physicians rely on x-rays to diagnose and evaluate abnormalities, such as broken bones, joint injuries, and spinal injuries. The increasing fracture incidences are also expected to contribute to the expansion of the orthopedic segment.

Outpatient Facilities Segment is Expected to Witness Fastest Growth

The outpatient facilities are projected to grow fastest during the anticipated period due to the growing preference for outpatient care, where patients can receive medical treatment without being admitted to a hospital. This is especially true for minor illnesses and injuries, routine checkups, and preventive care. Furthermore, advancements in diagnostic imaging technology and surgical techniques have made outpatient procedures safer, faster, and less invasive, thereby increasing the demand for outpatient services. Outpatient care has become more popular due to increasing healthcare costs and insurance deductibles, which has made patients more cost-conscious.

However, the hospitals segment led the industry accounted for a rapid market growth owing to its efforts to increase the availability of hospital facilities and medical services to a wider patient population. The rising number of orthopedic surgeries has contributed significantly to the segment's growth as these surgeries require specialized medical equipment and expertise. Patients undergoing orthopedic surgeries also require ongoing medical attention and rehabilitation, which can only be provided in hospitals. Therefore, hospitals have become the primary healthcare provider for such patients, contributing to the growth of the hospitals segment in the healthcare industry.

North America Dominated the Global Market in 2022

North America region dominated the global market in 2022 and is projected to maintain its dominance throughout the anticipated period. The region's dominance can be attributed to several factors, including the presence of well-established healthcare infrastructure, increasing adoption of technologically advanced imaging devices, and a rise in the prevalence of chronic diseases that require diagnostic imaging. Additionally, the region has a high healthcare expenditure and insurance coverage, which facilitates the adoption of these devices. Moreover, favorable reimbursement policies and a strong focus on R&D activities have also contributed to the growth.

However, Asia Pacific is anticipated to grow rapidly during the forecast period. The growing population, impelling medical tourism, increased demand for better imaging devices and supportive government initiatives for improving healthcare infrastructure, increasing prevalence of chronic disorders, and rising number of surgical cases are further expected to boost the market in the coming years.

Competitive Insight

Some of the major players operating in the global market include Elidental Technology; FUJIFILM; VATECH; Digimed; Digital Doc LLC; Iatome Electric; Micro C Imaging; Nanoray; Posdion; Dental Imaging Technologies; REMEDI; Genoray; OXOS Medical; MaxRayCocoon.com; Digital Doc; EVIDENT; Carestream Dental.

Recent Developments

- In October 2022, DEXIS, a provider of digital imaging solutions for dentistry, released its new DEXIS Titanium intraoral scanner. This scanner includes a hand-held x-ray attachment, and can capture high-quality images of teeth and other oral structures with minimal radiation exposure.

- In October 2022, Samsung Medison unveiled its new RS85 Prestige ultrasound system, which includes a hand-held x-ray option. This system offers advanced imaging capabilities with low radiation exposure, and is designed to provide enhanced accuracy and speed for clinical diagnosis.

- In September 2022, Fujifilm Medical Systems introduced its new FDR D-EVO GL DR panel, which includes a hand-held x-ray option. This panel offers high-quality images with low radiation exposure, and is designed to be lightweight and portable for use in a variety of clinical settings.

- In September 2022, GE Healthcare introduced its new Venue Go Plus ultrasound system, which includes a hand-held x-ray option. This system offers high-quality images with low radiation exposure, and is designed to be easy to use and transport in a variety of healthcare settings.

Hand-held X-ray Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 789.76 million |

|

Revenue forecast in 2032 |

USD 1966.80 million |

|

CAGR |

10.7% from 2023– 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023– 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments covered |

By Technology, By Application, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Elidental Technology; FUJIFILM Corporation; VATECH; Digimed; Digital Doc LLC; Iatome Electric; Micro C Imaging; Nanoray; Posdion; Dental Imaging Technologies Corporation; REMEDI Co. Ltd; Genoray; OXOS Medical; MaxRayCocoon.com; Digital Doc LLC.; EVIDENT; Carestream Dental LLC. |

FAQ's

key companies in hand-held x-ray market are Elidental Technology; FUJIFILM; VATECH; Digimed; Digital Doc LLC; Iatome Electric; Micro C Imaging; Nanoray; Posdion; Dental Imaging Technologies.

The global hand-held x-ray market expected to grow at a CAGR of 10.7% during the forecast period.

The hand-held x-ray market report covering key segments are technology, application, end-use, and region.

key driving factors in hand-held x-ray market are growing orthopedic surgical cases.

The global hand-held X-ray market size is expected to reach USD 1,966.80 million by 2032.