Hearing Aid Dispenser Market Share, Size, Trends, Industry Analysis Report

By Ownership (Independent, Manufacturer-owned. Retail chains, Others), By Gender (Male, Female), By Region, And Segment Forecasts, 2024 - 2032

- Published Date:Apr-2024

- Pages: 118

- Format: PDF

- Report ID: PM4856

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

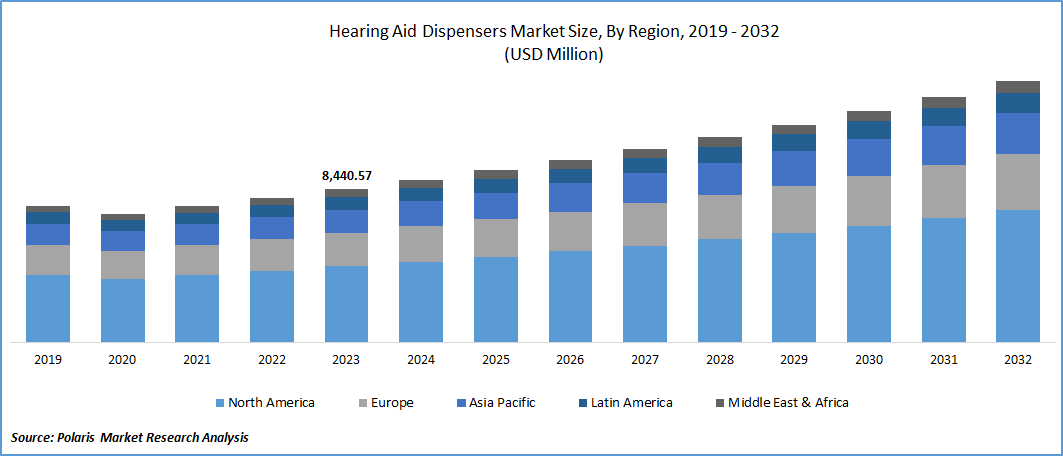

Hearing aid dispenser market size was valued at USD 8,440.57 million in 2023. The market is anticipated to grow from USD 8,947.00 million in 2024 to USD 14,406.08 million by 2032, exhibiting the CAGR of 6.1% during the forecast period.

Market Overview

The hearing aid dispenser plays an important role in the area of audiology by supporting individuals with hearing Impairment uncover the multiple appropriate solution to enhance the quality of life. These are qualified to precisely measure hearing loss using a variety of procedures, including audiograms, to establish the degree of impairment. By comprehending the individual needs and importance of each patient, a hearing aid dispenser can suggest and fit suitable hearing aid devices to handle specific hearing challenges effectively. In addition to performing examinations and advising hearing aids, hearing aid dispensers also deliver necessary guidance and support to patients throughout the whole process.

To Understand More About this Research:Request a Free Sample Report

For instance, in August 2023, Akoio launched a revolutionary hearing aid battery dispenser, facilitating user experience with secure storage, automatic tab removal, and long-lasting German-made batteries. Facilitating everyday use, it features a modern design with a non-slip grip, allowing easy battery replacement and secure disposal of used ones.

Hearing aid dispensers are proficient at customizing and adjusting devices to meet each person's comfort level and specific hearing needs. They provide patients with individualized care to improve their overall hearing experience. In addition, according to the U.S. Department of Health and Human Services, hearing problems are common in the U.S. in a range of age groups. Age is the main predictor of difficulty hearing, with 15% of American adults over the age of 18 reporting some degree of trouble; that's especially true for those in the 60s and 70s. Hearing loss affects men nearly twice as often as it does women, and non-Hispanic White adults are more likely to have it than members of other racial or ethnic groups.

Growth Factors

Technological Advancements in Hearing Aid Devices

The rapid development in the technology of hearing aid devices has significantly raised the hearing aid dispenser market growth over the forecast period. Technology advancements such as wireless communication, digital signal processing, and reducing have completely changed the way hearing aids seem and work. Instantaneous digital signal processing allows for the processing of sound, providing users with more natural and clear sound. Furthermore, sensor technology incorporated into hearing aids may measure physiological indicators such as body temperature and heart rate, giving users and medical experts important health data.

Aging Population Demographics and Increased Awareness of Hearing Health

The rising geriatric population plays an important role in driving the hearing aid dispenser market. The increasing prevalence of age-related hearing loss globally. According to the World Health Organization (WHO), over the age of 65, some degree of people have hearing loss, and as predicted by WHO, this older age group percentage is rising over the forecast period. Furthermore, the demand for hearing aid devices and related services is rising among the older population and increasing the tendency to seek out hearing services and investing in the hearing aids to manage their hearing disabilities rising the increasing ion the demand for hearing aid dispenser market.

Restraining Factors

Limited Insurance Coverage and Reimbursement for Hearing Aid Devices

The lack of insurance coverage and payment for hearing aids severely hampers the accessibility and affordability of hearing healthcare. In contrast to other medical equipment or therapies, insurance policies frequently do not cover the entire cost of hearing aids; thus, patients must pay cash for them. Many people, particularly those with fixed incomes or limited financial resources, may be discouraged from seeking essential hearing assistance due to this lack of coverage. Lack of insurance coverage for implanted hearing aids can lead to access difficulties and untreated loss of hearing, which can have detrimental effects on a person's general health, social relationships, and quality of life.

Report Segmentation

The market is primarily segmented based on ownership, gender, and region.

|

By Ownership |

By Gender |

By Region |

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Ownership Insights

The manufacturer-owned segment accounted for the largest market share in 2023. Within the hearing aid dispensers market, the Manufacturer-Owned category comprises stores or clinics that are privately owned and run by hearing aid producers. With complete control over product sales and distribution, manufacturers can keep a direct line of communication open with customers under this ownership structure.

The manufacturer owns these stores and frequently has a variety of brands of hearing aids made by the main firm, giving customers options. Manufacturer-owned clinics may also provide fittings, hearing evaluations, and continuing assistance to guarantee that their clients have the best possible device performance. Hearing aid producers can use their name recognition, technical know-how, and marketing assets to draw in and keep consumers in a competitive environment by owning and running their retail locations.

Independent segment is anticipated to hold a significant share of the market. Independent ownership includes a wide range of companies run by individuals or small groups of practitioners. These organizations include independently operated hearing aid stores, family-owned hearing aid facilities, private practice audiologists, independent contractors, and independent consultants. Every one of these groups offers a different strategy for meeting the requirements of people who have hearing loss; these strategies are frequently distinguished by individualized care, a localized presence, and an emphasis on forming enduring bonds with customers. Due to their ability to meet the unique demands of their local communities, act as alternatives to large companies, and enhance the availability of hearing healthcare services usually these companies are essential to the industry.

By Gender Insights

Male Segment Held the Majority Share in 2023

The male segment held the maximum market share in 2023. This increase is attributed to a number of things, including the fact that some professions or sectors have higher noise exposure than others, which raises the demand for services and draws more men to enter this industry. Furthermore, the implementation of educational and awareness initiatives has contributed to the increase of male involvement in the field and the development of an improved knowledge of audiology health, which in turn has encouraged men to assume positions as dispensers. The growing number of male experts in this industry has also been attributed to changes in societal views that have normalized the process of seeking assistance for listening concerns.

The female segment is anticipated to grow at the fastest GAGR during the forecast period. The market for hearing aids has historically been oriented toward male consumers, but as women's knowledge of hearing health has grown, so too has the number of female users. Manufacturers, as well as distributors, have been expanding their marketing campaigns aimed at women in addition to providing more understated and aesthetically pleasing hearing aid designs in order to appeal to this market.

Regional Insights

North America Region Dominated the Global Market in 2023

North America region dominated the global market in 2023. The aging population, technology improvements, and growing awareness of hearing health have all contributed to the continuous expansion in the region. The aging population increases the probability of hearing loss, which raises the need for hearing aids. More people are seeking medical attention for hearing impairment and purchasing hearing aids because of the significant rise in knowledge of hearing health issues and the accessibility of remedies such as these.

In addition, changes to regulations, such as the United States' adoption of laws pertaining to over-the-counter (OTC) hearing aids, have made it simpler for customers to obtain hearing aids without a prescription. Because of this regulation change, a greater spectrum of people will be able to obtain hearing aids, and the market may expand.

Asia Pacific region is expected to grow at the highest CAGR over the forecast period. The growing elderly populations of many Asia-Pacific nations, including South Korea, China, & Japan, have led to significant growth in the market for hearing aid dispensers in the region. There is an increasing need for hearing aids due to the increasing incidence of hearing impairment that comes with aging in the general population. Furthermore, more people are looking for solutions like hearing aids as a result of a growing understanding of hearing health issues and the value of early intervention, which is propelling the market's rise.

Key Market Players & Competitive Insights

Strategic partnerships to drive the competition

The hearing aid dispensers’ market is characterized by intense competition. Companies in the market are competing on factors such as technical advancements, device miniaturization, low-cost models with advanced features, and longer battery turnout. Bigger companies are collaborating with smaller companies to scale-up manufacturing operations.

Some of the major players operating in the global market include:

- Audio Hearing Aid Service, LLC

- Costco Wholesale Corporation

- Davidson Hearing Aid Centres

- Echo Hearing Center

- Elite Hearing Centers of America

- Family Hearing Center

- Hear Well Be Well

- Hearing Unlimited

- HearUSA

- Independent Hearing Services

- LUCID HEARING HOLDING COMPANY, LLC

- Miracle-Ear

- SoundPoint Hearing Centers

Recent Developments in the Industry

- In February 2024, Starkey introduced Genesis AI hearing aids in India, to address the rising cases of people suffering with hearing loss.

- In June 2023, Stockton Hearing Aid Dispensing Center introduced AI-enabled hearing aids to transform the lives of many people, without securing any personal data.

Report Coverage

The hearing aid dispenser market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, ownership, gender, and their futuristic growth opportunities.

Hearing Aid Dispenser Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 8,947.00 million |

|

Revenue forecast in 2032 |

USD 14,406.08 million |

|

CAGR |

6.1% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

the key companies in Hearing Aid Dispenser Market are Audio Hearing Aid Service, Costco Wholesale, Davidson Hearing Aid Centres.

Hearing aid dispenser market exhibiting the CAGR of 6.1% during the forecast period.

Hearing Aid Dispenser Market report covering key segments are ownership, gender, and region.

the key driving factors in Hearing Aid Dispenser Market Technological advancements in hearing aid devices

Hearing Aid Dispenser Market Size Worth $ 14,406.08 Million By 2032