Herceptin Biosimilars Market Size, Share, Trends, Industry Analysis Report

: By Application (Breast Cancer, Colorectal Cancer, Leukemia, Lymphoma, and Others), Dosage, End-Users, Distribution Channel, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:May-2025

- Pages: 118

- Format: PDF

- Report ID: PM5647

- Base Year: 2024

- Historical Data: 2020-2023

Herceptin Biosimilars Market Overview:

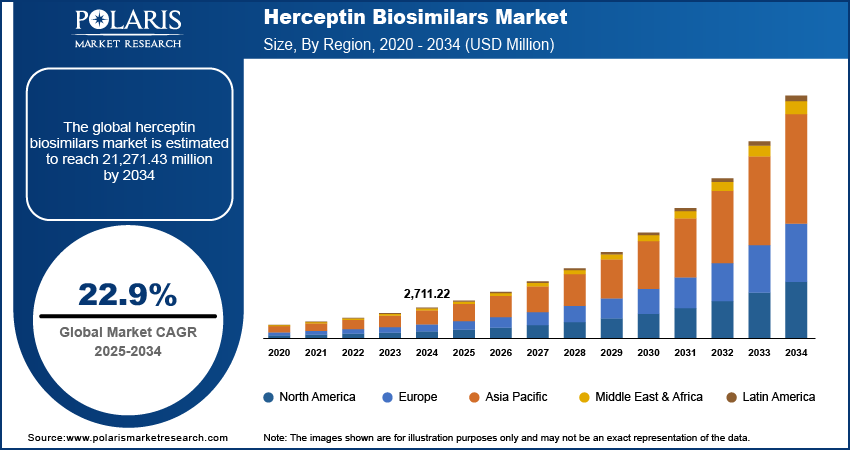

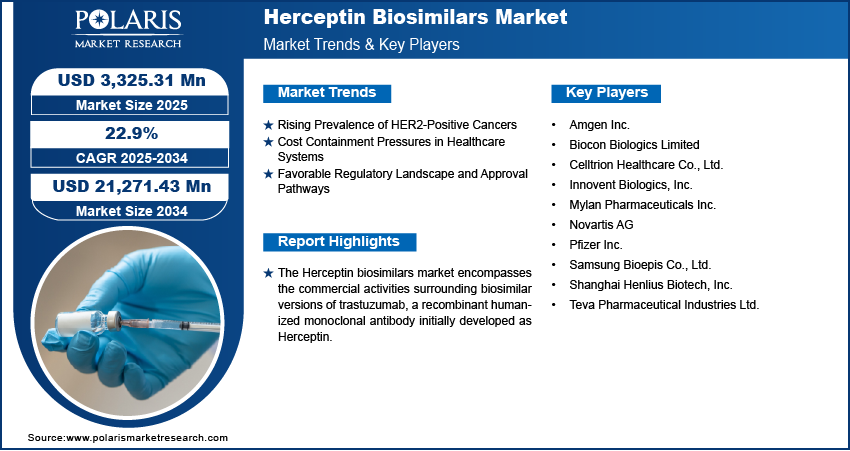

The Herceptin Biosimilars market size was valued at USD 2,711.22 million in 2024. The market is projected to grow from USD 3,325.31 million in 2025 to USD 21,271.43 million by 2034, exhibiting a CAGR of 22.9% during 2025–2034.

The Herceptin biosimilars market centers around biosimilar versions of trastuzumab, a monoclonal antibody crucial for treating HER2-positive breast and gastric cancers. These biosimilars are designed to exhibit comparable efficacy and safety to the original biologic drug, Herceptin. A primary market drive for the expansion of this market is the increasing global incidence of HER2-positive cancers, leading to a significant market demand for effective treatment options. Furthermore, the high cost associated with original biologic therapies creates a strong incentive for the adoption of more affordable biosimilars. This cost-effectiveness enhances market penetration, making these vital treatments more accessible to a broader patient population and easing the financial burden on healthcare systems. Regulatory support in various regions, encouraging the development and uptake of biosimilars through streamlined approval processes and favorable reimbursement policies, also acts as a significant market growth factor.

To Understand More About this Research: Request a Free Sample Report

Several factors contribute to the positive market outlook for Herceptin biosimilars. The expiration of patents for the reference product in key global markets has paved the way for numerous manufacturers to enter this space, intensifying market competition and further driving down prices. This increased competition not only improves affordability but also fosters market development through continuous innovation and the introduction of improved formulations.

Herceptin Biosimilars Market Dynamics:

Rising Prevalence of HER2-Positive Cancers

The increasing global incidence of HER2-positive breast and gastric cancers is a significant market drive for Herceptin biosimilars. According to research published on the National Institutes of Health (NIH) website in 2023, a study titled "Global Burden of Breast Cancer" highlighted a consistent rise in breast cancer therapies and diagnoses worldwide, with a notable proportion being HER2-positive. The study emphasized that advancements in diagnostic techniques have led to more accurate identification of HER2 status, consequently increasing the recognized pool of patients requiring HER2-targeted therapies like trastuzumab. This growing patient population inherently fuels the market demand for effective treatments.

Approximately 15-20% of breast cancers are HER2-positive, indicating an overexpression of the human epidermal growth factor receptor 2 (HER2) protein. Breast cancer is the most commonly diagnosed cancer in women worldwide. In 2020, there were an estimated 2.3 million new cases of breast cancer diagnosed globally. Assuming 15-20% are HER2-positive, this translates to a substantial patient population requiring HER2-targeted therapies like Herceptin. The persistent and increasing occurrence of these cancers across various demographics and geographical regions necessitates a greater availability of treatment options. This direct correlation between disease incidence and treatment necessity firmly establishes the rising prevalence of HER2-positive cancers as a key driver for the Herceptin biosimilars market.

Cost Containment Pressures in Healthcare Systems

The escalating costs of healthcare globally are exerting significant pressure on healthcare systems and payers, making cost containment a crucial market drive for the adoption of biosimilars, including Herceptin biosimilars. A publication on the World Health Organization (WHO) website in 2021, discussing "Sustainable access to medicines: addressing the challenges of high-priced medicines," underscored the growing concern over the financial sustainability of healthcare, particularly concerning expensive biologic therapies. The report highlighted the potential of biosimilars to alleviate this burden by offering comparable treatment options at a lower price point. Governments and healthcare providers are actively seeking strategies to reduce pharmaceutical expenditures without compromising patient outcomes. Herceptin (trastuzumab) is a high-cost biologic drug, placing a significant financial burden on healthcare systems, payers, and patients globally. The annual cost of Herceptin treatment can range from tens of thousands to over $100,000 depending on the region and treatment duration. For instance, the National Health Service (NHS) in the United Kingdom has actively promoted the use of biosimilars through tendering processes and prescribing guidelines, as detailed in their official publications on biosimilar adoption available on the NHS website. This economic imperative firmly establishes cost containment pressures in healthcare systems as a significant driver for the Herceptin biosimilars market.

Favorable Regulatory Landscape and Approval Pathways

The establishment of clear and favorable regulatory pathways for biosimilar approval in various regions is a critical market drive propelling the growth of the Herceptin biosimilars market. Regulatory bodies such as the European Medicines Agency (EMA) and the U.S. Food and Drug Administration (FDA) have implemented specific guidelines and frameworks to streamline the approval process for biosimilars, ensuring their safety and efficacy while facilitating their timely market entry. Research published on PubMed Central in 2021, titled "Regulatory landscape of biosimilars: challenges and opportunities," highlighted how these established regulatory frameworks reduce the time and cost associated with bringing biosimilars to market compared to novel biologics. This enabling regulatory landscape firmly establishes favorable regulatory landscape and approval pathways as a key driver for the Herceptin biosimilars market.

Herceptin Biosimilars Market Segment Insights:

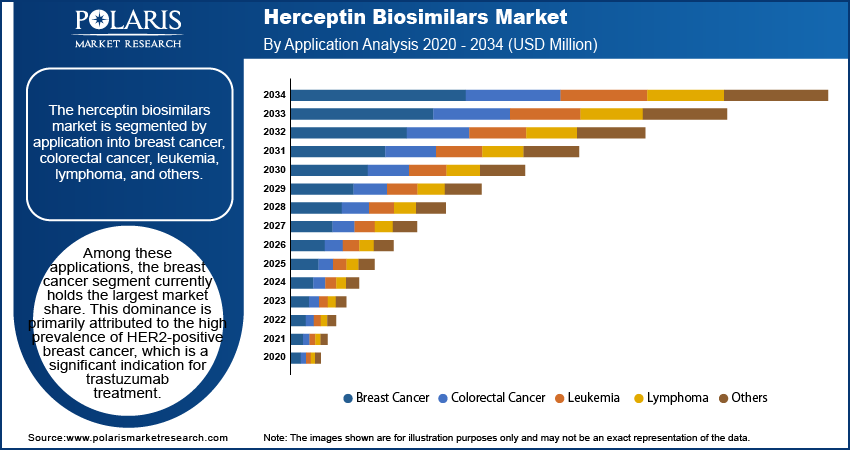

Herceptin Biosimilars Market Assessment – By Application

The Herceptin biosimilars market is segmented by application into breast cancer, colorectal cancer, leukemia, lymphoma, and others. Among these applications, the breast cancer segment currently holds the largest market share. This dominance is primarily attributed to the high prevalence of HER2-positive breast cancer, which is a significant indication for trastuzumab treatment. The established clinical utility of trastuzumab in various stages of breast cancer, including adjuvant and metastatic settings, contributes substantially to the consistent and substantial demand for its biosimilar versions.

The "others" segment is anticipated to exhibit the highest growth rate within the Herceptin biosimilars market. This growth is driven by the expanding research and oncology clinical trials exploring the efficacy of trastuzumab in treating other HER2-positive malignancies beyond breast cancer. While currently representing a smaller patient pool compared to breast cancer, the potential applications of trastuzumab in indications such as gastric cancer and other less common HER2-overexpressing tumors are gaining increasing recognition.

Herceptin Biosimilars Market Evaluation– By Dosage

The Herceptin biosimilars market is segmented by dosage into 150mg/single-dose vial and 420mg/multidose vial. Currently, the 150mg/single-dose vial segment accounts for the larger share of the market. This dominance can be attributed to several factors, including established prescribing practices and the flexibility offered by single-dose vials in tailoring dosages to individual patient needs based on body weight and treatment protocols. The single-dose vial format minimizes the risk of contamination and wastage for patients requiring less than the full multidose vial, aligning with stringent hospital pharmacy guidelines and practices.

Conversely, the 420mg/multidose vial segment is anticipated to experience the higher growth rate in the Herceptin biosimilars market over the coming years. This increased growth is primarily driven by its cost-effectiveness for patients requiring the full or nearly full dose, as it reduces the per-milligram cost compared to multiple single-dose vials. The convenience of administering multiple doses from a single vial also streamlines the treatment process in healthcare settings with a high throughput of patients.

Herceptin Biosimilars Market Evaluation– By End Users

The Herceptin biosimilars market is segmented by end-users into specialty clinics, hospitals, oncology centers, and others. Among these end-user segments, hospitals currently command the largest market share. This significant share is primarily attributed to the central role hospitals play in cancer diagnosis such as breast cancer liquid biopsy and treatment, particularly for complex cases requiring intravenous administration of biologics like trastuzumab biosimilars. Hospitals serve as the primary point of care for a substantial number of patients undergoing Breast cancer therapy, offering comprehensive treatment facilities and a wide range of medical specialties.

Oncology centers are anticipated to exhibit the highest growth rate within the Herceptin biosimilars market among the listed end-user segments. These specialized centers are increasingly becoming the focal point for cancer care, offering integrated and multidisciplinary treatment approaches tailored specifically to oncology patients. The growing preference for specialized cancer care, driven by the expertise and focused resources available at oncology centers, is leading to a greater concentration of patients receiving trastuzumab biosimilar treatments in these settings. The streamlined processes and dedicated infrastructure within oncology centers for administering chemotherapy and targeted therapies, coupled with a growing emphasis on patient convenience and specialized expertise, are contributing to the increasing adoption of Herceptin biosimilars in this segment.

Herceptin Biosimilars Market Evaluation– By Distribution Channel

The Herceptin biosimilars market is segmented by distribution channel into direct tender, hospital pharmacy, retail pharmacy, online pharmacy, and others. Currently, the hospital pharmacy segment holds the largest share of the market. This substantial share is primarily due to the fact that Herceptin biosimilars, being primarily administered through intravenous infusion under medical supervision, are predominantly dispensed and administered within hospital settings. Hospital pharmacies serve as the primary point of access for these medications, managing their procurement, storage, and dispensing directly to patients undergoing treatment within the hospital premises or associated clinics.

The online pharmacy segment is anticipated to exhibit the highest growth rate within the Herceptin biosimilars market among the listed distribution channels. This projected rapid growth is driven by the increasing trend towards digital healthcare solutions and the growing convenience offered by online platforms for accessing medications. While the current distribution of injectable biologics like Herceptin biosimilars through online pharmacies may be limited due to the need for specialized handling and administration, the evolving regulatory landscape and advancements in pharmaceutical logistics are gradually paving the way for greater accessibility through online channels.

Herceptin Biosimilars Market – Regional Footprint

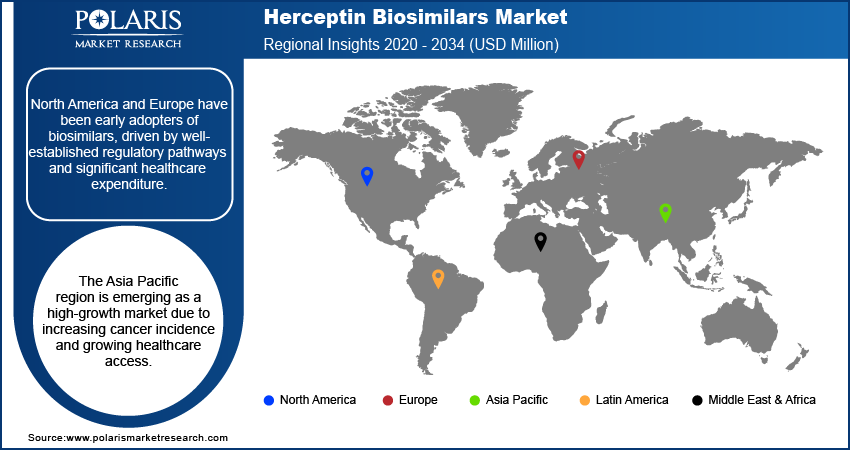

The Herceptin biosimilars market exhibits distinct regional dynamics shaped by factors such as healthcare infrastructure, regulatory landscapes, prevalence of HER2-positive cancers, and the degree of biosimilar adoption. North America and Europe have been early adopters of biosimilars, driven by well-established regulatory pathways and significant healthcare expenditure. The Asia Pacific region is emerging as a high-growth market due to increasing cancer incidence and growing healthcare access. Latin America and the Middle East & Africa are also witnessing increasing adoption, albeit at a relatively slower pace, influenced by economic factors and evolving regulatory frameworks. Overall, the global Herceptin biosimilars market presents a diverse landscape with varying levels of market penetration and growth potential across different regions.

Currently, North America accounts for the largest share of the Herceptin biosimilars market. This dominance is primarily attributed to the high prevalence of breast cancer in the region, coupled with a robust healthcare infrastructure and well-defined regulatory pathways for biosimilar approval and commercialization. The presence of a large patient population eligible for trastuzumab therapy, combined with a strong emphasis on advanced cancer care, contributes significantly to the substantial market size in North America. Furthermore, the early adoption of biosimilars in this region, driven by both cost-saving initiatives and increasing physician familiarity, has solidified North America's position as the leading market for Herceptin biosimilars. The presence of key market players and ongoing efforts to promote biosimilar uptake further reinforce the region's leading market share.

The Asia Pacific region is projected to exhibit the highest growth rate in the Herceptin biosimilars market over the forecast period. This rapid growth is fueled by a confluence of factors, including a growing incidence of HER2-positive cancers across various countries in the region, increasing healthcare expenditure, and improving access to advanced cancer therapies. Furthermore, the development of local manufacturing capabilities for biosimilars and the implementation of more streamlined regulatory pathways in several Asia Pacific countries are facilitating greater market penetration. The increasing awareness and acceptance of biosimilars among healthcare professionals and patients, coupled with the potential for significant cost savings in densely populated countries, positions the Asia Pacific region as the most dynamic and rapidly expanding market for Herceptin biosimilars in the coming years.

Herceptin Biosimilars Market – Key Players and Competitive Insights

The prominent participants actively involved in the Herceptin biosimilars market include Biocon Biologics Limited (Biocon Limited), Celltrion Healthcare Co., Ltd. (Celltrion, Inc.), Mylan Pharmaceuticals Inc. (Viatris Inc.), Amgen Inc., Novartis AG (Sandoz International GmbH), Pfizer Inc., Teva Pharmaceutical Industries Ltd., Samsung Bioepis Co., Ltd. (Samsung Group), Shanghai Henlius Biotech, Inc., and Innovent Biologics, Inc. These entities are engaged in the development, manufacturing, and commercialization of trastuzumab biosimilars across various regions, contributing significantly to the market landscape.

The competitive analysis of the Herceptin biosimilars market reveals a dynamic environment characterized by a growing number of players vying for market share. Key areas of competition include product pricing, geographical reach, product differentiation (such as formulation or delivery mechanisms), and the ability to secure favorable contracts with healthcare providers and payers. Companies are focusing on expanding their global presence through strategic partnerships and regulatory approvals in diverse markets. Furthermore, the speed of market entry following patent expiration in different regions plays a crucial role in gaining a competitive edge. Continuous innovation in manufacturing processes to enhance efficiency and reduce costs is also a significant factor influencing the competitive landscape.

Celltrion Healthcare Co., Ltd., a part of Celltrion, Inc., is headquartered in Incheon, South Korea. The company offers Herzuma, a biosimilar of trastuzumab, which is approved and marketed in several regions worldwide for the treatment of HER2-positive breast cancer and metastatic gastric cancer. Herzuma is a key offering in Celltrion Healthcare's portfolio of biosimilar products, demonstrating their commitment to providing cost-effective alternatives to original biologics in the oncology therapeutic area.

Amgen Inc. is located in Thousand Oaks, California, USA. The company markets Kanjinti, a biosimilar to trastuzumab, which has received regulatory approvals in multiple countries for the treatment of HER2-positive breast and gastric cancers. Kanjinti is one of Amgen's biosimilar products aimed at expanding patient access to essential medicines while offering potential cost savings to healthcare systems.

List of Key Companies in Herceptin Biosimilars Market:

- Amgen Inc.

- Biocon Biologics Limited

- Celltrion Healthcare Co., Ltd.

- Innovent Biologics, Inc.

- Mylan Pharmaceuticals Inc.

- Novartis AG

- Pfizer Inc.

- Samsung Bioepis Co., Ltd.

- Shanghai Henlius Biotech, Inc.

- Teva Pharmaceutical Industries Ltd.

Herceptin Biosimilars Industry Developments

- January 2025: Tanvex Biopharma Inc.'s U.S. subsidiary received an FDA rejection, a Complete Response Letter (CRL) dated January 3, for its TX-05 BLA, a biosimilar to Roche's Herceptin (trastuzumab). The FDA cited unresolved problems at the third-party responsible for manufacturing Tanvex U.S.'s drug product.

- September 2024: Accord BioPharma, Inc., the U.S. oncology-focused arm of Intas Pharmaceuticals, Ltd., announced that the FDA has approved a 420mg strength of HERCESSI (trastuzumab-strf), a biosimilar to Herceptin (trastuzumab), for the treatment of HER2-overexpressing breast and gastric cancers.

Herceptin Biosimilars Market Segmentation

By Application Outlook (Revenue-USD Million, 2020–2034)

- Breast Cancer

- Colorectal Cancer

- Leukemia

- Lymphoma

- Others

By Dosage Outlook (Revenue-USD Million, 2020–2034)

- 150mg/single-dose vial

- 420mg/multidose vial

By End-Users Outlook (Revenue-USD Million, 2020–2034)

- Specialty Clinics

- Hospitals

- Oncology Centers

- Others

By Distribution Channel Outlook (Revenue-USD Million, 2020–2034)

- Direct Tender

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

- Others

By Regional Outlook (Revenue-USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest of Latin America

Herceptin Biosimilars Market Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 2,711.22 million |

|

Market Size Value in 2025 |

USD 3,325.31 million |

|

Revenue Forecast by 2034 |

USD 21,271.43 million |

|

CAGR |

22.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy: The Herceptin Biosimilars market has been segmented into detailed segments of application, dosage, end users, and distribution channel. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Market Entry Strategies: The growth and marketing strategy within the Herceptin biosimilars market hinges on several key pillars. A primary focus is on demonstrating bioequivalence and cost-effectiveness to gain favor with healthcare providers and payers. Strategic partnerships with hospitals, oncology centers, and group purchasing organizations are crucial for market penetration. Educational initiatives targeting physicians to build confidence in biosimilar efficacy and safety are also vital. Furthermore, expanding geographical reach through regulatory approvals in emerging markets presents significant growth opportunities. Effective pricing strategies that offer substantial discounts compared to the reference product, coupled with strong distribution networks, are essential for capturing market share and driving adoption.

FAQ's

The Herceptin Biosimilars market size was valued at USD 2,711.22 million in 2024 and is projected to grow to USD 21,271.43 million by 2034.

The market is projected to register a CAGR of 22.9% during the forecast period, 2024-2034.

North America had the largest share of the market.

Key players in the Herceptin Biosimilars market include Biocon Biologics Limited (Biocon Limited), Celltrion Healthcare Co., Ltd. (Celltrion, Inc.), Mylan Pharmaceuticals Inc. (Viatris Inc.), Amgen Inc., Novartis AG (Sandoz International GmbH), Pfizer Inc., Teva Pharmaceutical Industries Ltd., Samsung Bioepis Co., Ltd. (Samsung Group), Shanghai Henlius Biotech, Inc., and Innovent Biologics, Inc.

The hospital pharmacy segment accounted for the larger share of the market in 2024.

Following are some of the Herceptin Biosimilars market trends: ? Increasing Adoption of Subcutaneous Formulations: Subcutaneous formulations are gaining preference due to their ease of administration, particularly in outpatient settings, offering convenience for both patients and healthcare providers. ? Expansion in Emerging Markets: The Asia Pacific, Latin America, and Middle East & Africa regions are witnessing increased adoption due to rising cancer prevalence, growing healthcare expenditure, and improving regulatory pathways. ? Focus on Cost-Effectiveness: The demand for more affordable treatment options continues to drive the market, as biosimilars offer significant cost savings compared to the originator product.

Herceptin biosimilars are versions of trastuzumab, a biologic medication originally marketed as Herceptin. Trastuzumab is a monoclonal antibody that targets the HER2 protein, which is overexpressed in certain types of cancer, particularly HER2-positive breast and gastric cancers. Biosimilars are biological products that are demonstrated to be highly similar to an already-approved biologic product (the reference product) in terms of safety, efficacy, and quality.