Oncology Clinical Trials Market Size, Share, Trends, & Industry Analysis Report

By Cancer Type (Lung cancer, Breast cancer, Thyroid cancer), By Phase, By Study Design, and By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 126

- Format: PDF

- Report ID: PM1895

- Base Year: 2024

- Historical Data: 2020-2023

Overview

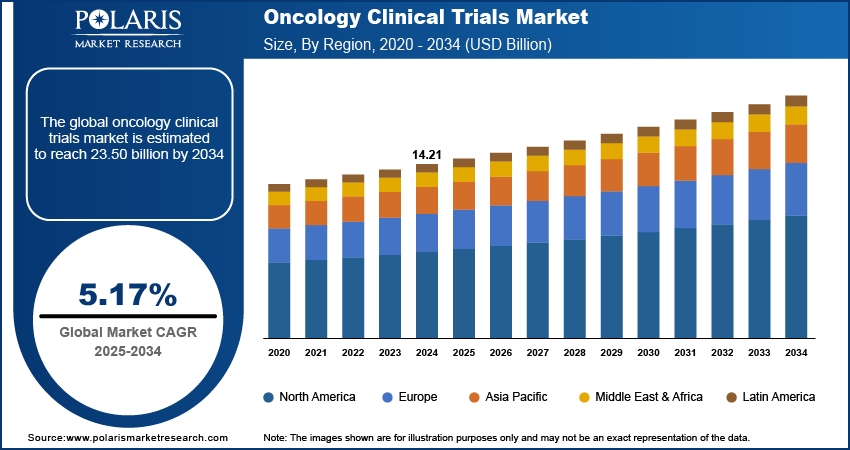

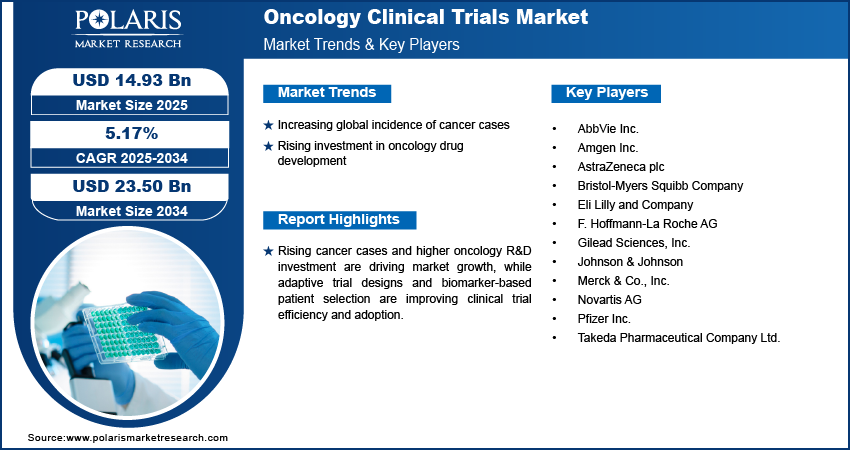

The oncology clinical trials market was valued at USD 14.21 billion in 2024 growing at a CAGR of 5.17% from 2025-2032. Rising global cancer cases and increasing investment in oncology drug development are driving growth in the clinical trials market.

Key Insights

- The segment of lung cancer led in 2024 with high prevalence and extensive clinical uptake of targeted and immunotherapy trials.

- The phase II segment growing at the highest CAGR, fueled by initial efficacy studies and adaptive trial designs.

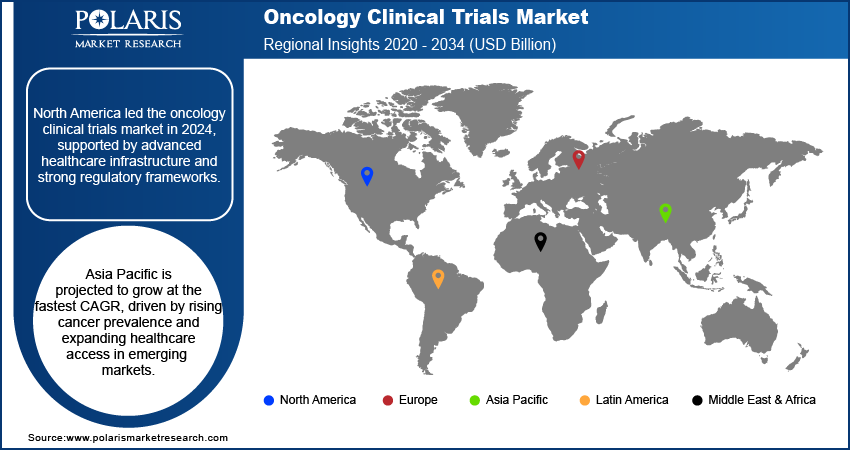

- North America dominated the market worldwide in 2024 due to advanced clinical research facilities and high rates of cancer occurrence.

- The U.S. dominated North America with extensive hospital networks and strong regulatory support for oncology trials.

- Asia Pacific is expected to grow at fastest rate, owing to by increasing cancer prevalence and growing healthcare accessibility in emerging markets.

- China is expanding rapidly due to increasing healthcare expenditure and government initiatives supporting oncology clinical research.

Industry Dynamics

- Rising global cancer incidence is increasing the demand for oncology clinical trials.

- Growing investment in oncology drug development and research is driving market growth.

- High price points and intricate regulatory needs continue to limit market adoption.

- Growing application of targeted therapies, immunotherapies and personalized medicine provide new potential for market expansion.

Market Statistics

- 2024 Market Size: USD 14.21 Billion

- 2034 Projected Market Size: USD 23.50 Billion

- CAGR (2025-2034): 5.17%

- North America: Largest Market Share

Oncology clinical trials entail the rigorous assessment of novel cancer treatments, such as targeted treatments, immunotherapies, and combination therapy, to identify safety and efficacy prior to market approval. Oncology clinical trials are at the forefront of promoting precision medicine and better patient outcomes.

Growing incidence of cancer worldwide and mounting investment in developing cancer drugs are propelling the expansion of clinical trials. Pharmaceutical firms are placing emphasis on novel trial design, biomarker-enabled patient selection, and adaptive protocols to speed up drug approval and enhance success rates.

Healthcare professionals and research institutions are incorporating oncology trials into multidisciplinary cancer care programs to augment treatment choices and access for patients. Merck presented more than 100 abstracts in October 2025 at ESMO 2025 with KEYTRUDA advancements for bladder, ovarian, and lung cancer and new information on investigational treatments such as R-DXd in platinum-resistant ovarian cancer. Market leaders are increasing partnerships with contract research organizations (CROs), hospitals, and academic institutions to create next-generation treatments and tap real-world evidence to deliver more efficient trial results.

Drivers & Opportunity

Increasing global incidence of cancer cases: The increasing global incidence of cancer is driving the demand for oncology clinical trials. The WHO's 2024 report estimates global cancer cases to rise from 20 million in 2022 to more than 35 million in 2050, with 9.7 million cancer deaths in 2022 and 53.5 million individuals surviving five years or fewer after diagnosis. Emerging patient populations with variegated cancer types are propelling the demand to create new treatments, conduct treatment efficacy tests, and assess safety across populations. The trend inspires pharmaceutical firms and research institutions to launch more trials and increase the overall market.

Rising investment in oncology drug development: Growing investment and funding in oncology pharmaceutical research are hastening the initiation of clinical trials. Drugmakers are investing in targeted treatments, immunotherapies, and precision medicine strategies, which involve substantial clinical testing. Greater availability of capital facilitates quicker trial opening, advanced study designs, and intensified partnerships with research institutions and contract research organizations, which enhance market growth.

Segmental Insights

Cancer Type Analysis

Based on cancer type, the segmentation includes lung cancer, breast cancer, thyroid cancer, leukemia, liver cancer, skin cancer, lymphoma, pancreatic cancer, prostate cancer, colon & rectal cancer, urinary system cancer, and other cancer. The lung cancer segment led the market in 2024 owing to the widespread incidence of lung cancer worldwide. The American Cancer Society estimates that in 2025, the U.S. was expected to have approximately 226,650 new lung cancer cases and approximately 124,730 fatalities. Additionally, increasing investments in targeted therapies and cancer immunotherapies have fueled accelerated clinical trials, driving sustained top-line growth.

The thyroid cancer segment is expected to expand at the highest CAGR over the forecast period, driven by heightened early detection programs and the emergence of new targeted therapies. Furthermore, research in uncommon cancers is increasing trial opportunities.

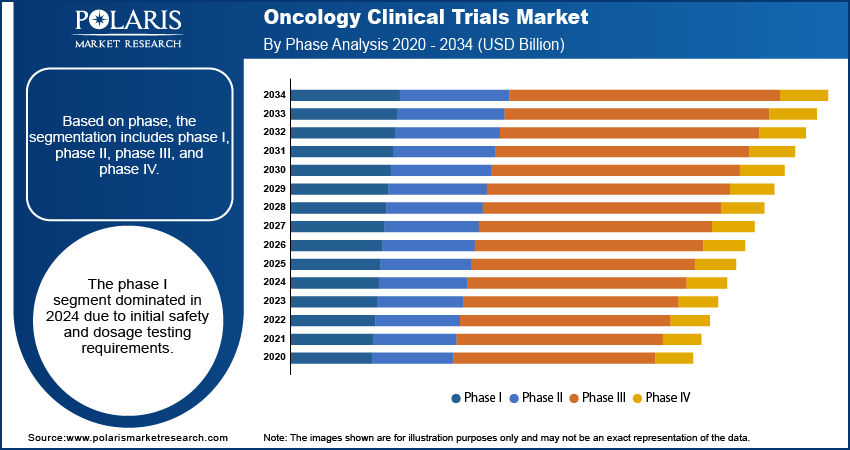

Phase Analysis

Based on phase, the segmentation includes phase I, phase II, phase III, and phase IV. The phase I segment was the market leader in 2024 due to the demand for initial dosage and safety testing of novel oncology treatments. In addition, robust investment in early-phase trials drove steady revenue expansion.

The phase II segment is also expected to expand at the highest CAGR through the forecast period owing to increasing demand for efficacy evaluation of new treatments. Further, adaptive study designs are shortening clinical development times.

Study Design Analysis

Based on study design, the segmentation includes interventional, observational, and expanded access. The interventional segment dominated the market in 2024 due to the high number of trials evaluating new oncology therapies. Additionally, government grants and financing of experimental treatment helped stimulate extensive study activity.

Observational segment is expected to register the highest CAGR over the forecast period owing to growing emphasis on real-world evidence and patient outcomes. Besides, digital health platform adoption is also easing longitudinal studies.

Regional Analysis

North America dominated the oncology clinical trials market in 2024 due to high cancer prevalence and advanced healthcare infrastructure. In addition, rising pharmaceutical R&D expenditure and regulatory support further boosted trial initiation and uptake. In addition, growing patient awareness supported efficient recruitment.

The U.S. Oncology Clinical Trials Market Insights

The U.S. led the oncology clinical trials market owing to extensive oncology research and strong clinical trial infrastructure. For example, in May 2025, OneOncology and START opened three new early-phase oncology trial sites in the U.S. to increase community access to cancer treatments. In addition, pharma-academic partnership and government funding programs boosted trial volume. In addition, advanced diagnostic facilities facilitated personalized medicine trials.

Europe Oncology Clinical Trials Market Insights

Europe holds the substantial share in the oncology clinical trials market due to strong regulatory frameworks and high adoption of targeted therapies. The European medicines network reported that from Jan 2022 to Jan 2025, an average of 200 clinical trials were submitted monthly under CTR, with about 80 multinationals. Additionally, well established pharmaceutical R&D facilities facilitated large-scale clinical trials. Besides, increasing cooperation between hospitals and CROs improved trial efficiency.

Asia Pacific Oncology Clinical Trials Market Insights

Asia Pacific projected highest growth rate of CAGR, driven by an increase in cancer cases and an increase in healthcare infrastructure. According to the Indian Council of Medical Research (ICMR), In India, about 100 people per 100,000 are diagnosed with cancer, with over 1.4 million new cases reported in 2023. Moreover, growing government initiatives supporting clinical research in emerging economies increasing trial activity. In addition, cost advantages attracted multinational pharma companies to the region.

China Oncology Clinical Trials Market Insights

China is expanding rapidly due to rising cancer cases and government-backed oncology research programs. Additionally, cooperation with international CROs enhanced trial efficiency. Furthermore, the increasing clinical research capability of India and cost-efficient patient recruitment led to swift market growth.

Key Players & Competitive Analysis Report

Oncology clinical trials market is moderately competitive, with organizations emphasizing the creation of new targeted therapies, immunotherapies, and combination therapy trials. In addition, investments in adaptive design studies, biomarker-based patient enrollment, and partnerships with hospitals and contract research organizations are enhancing trial efficiency, patient access, and global market access.

Major companies operating in the oncology clinical trials market are Pfizer Inc., Novartis AG, F. Hoffmann-La Roche AG, Bristol-Myers Squibb Company, Merck & Co., Inc., Johnson & Johnson, AstraZeneca plc, Eli Lilly and Company, Amgen Inc., AbbVie Inc., Gilead Sciences, Inc., and Takeda Pharmaceutical Company Ltd.

Key Players

- AbbVie Inc.

- Amgen Inc.

- AstraZeneca plc

- Bristol-Myers Squibb Company

- Eli Lilly and Company

- F. Hoffmann-La Roche AG

- Gilead Sciences, Inc.

- Johnson & Johnson

- Merck & Co., Inc.

- Novartis AG

- Pfizer Inc.

- Takeda Pharmaceutical Company Ltd.

Industry Development

- October 2025: Theriva Biologics announced to present updated data from the VIRAGE Phase 2b and SYN-004 trials at ESMO 2025 and IDWeek 2025, covering pancreatic cancer and transplant patient safety.

- September 2025: Olema Oncology partnered with Pfizer for a Phase 1b/2 trial testing palazestrant and atirmociclib in ER+/HER2- metastatic breast cancer.

- May 2025: Johnson & Johnson presented over 70 studies at ASCO and EHA 2025, highlighting advances in treatments for multiple myeloma, lung, prostate, and colorectal cancers.

Oncology Clinical Trials Market Segmentation

By Cancer Type (Revenue, USD Billion, 2020–2034)

- Lung cancer

- Breast cancer

- Thyroid cancer

- Leukemia

- Liver cancer

- Skin cancer

- Lymphoma

- Pancreatic cancer

- Prostate cancer

- Colon & rectal cancer

- Urinary system cancer

- Other cancer

By Phase (Revenue, USD Billion, 2020–2034)

- Phase I

- Phase II

- Phase III

- Phase IV

By Study Design (Revenue, USD Billion, 2020–2034)

- Interventional

- Observational

- Expanded Access

By Region (Revenue, USD Billion, 2020–2034)

- North America

- The U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherland

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

- Latin America

- Saudi Arabia

- UAE

- South Africa

- Israel

- Rest of South Africa

Oncology Clinical Trials Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 14.21 Billion |

|

Market Size in 2025 |

USD 14.93 Billion |

|

Revenue Forecast by 2034 |

USD 23.50 Billion |

|

CAGR |

5.17% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2025-2034 |

|

Forecast Period |

2025-2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Study Design |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions and segmentation. |

FAQ's

The global market size was valued at USD 14.21 billion in 2024 and is projected to grow to USD 23.50 billion by 2034.

The global market is projected to register a CAGR of 5.17% during the forecast period.

North America dominated the oncology clinical trials market in 2024 due to a high prevalence of cancer cases and advanced clinical research infrastructure.

A few of the key players in the market are Pfizer Inc., Novartis AG, F. Hoffmann-La Roche AG, Bristol-Myers Squibb Company, Merck & Co., Inc., Johnson & Johnson, AstraZeneca plc, Eli Lilly and Company, Amgen Inc., AbbVie Inc., Gilead Sciences, Inc., and Takeda Pharmaceutical Company Ltd.

The lung cancer segment dominated in 2024 owing to its high incidence and increasing adoption of targeted and immunotherapy trials.

The phase II segment is projected to grow fastest, driven by rising early efficacy studies and adaptive trial designs.